Answered step by step

Verified Expert Solution

Question

1 Approved Answer

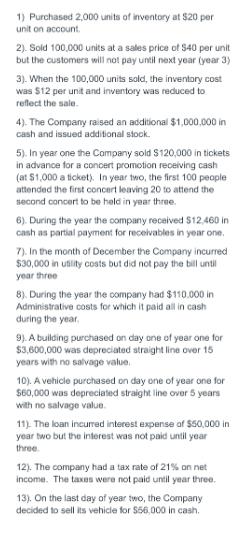

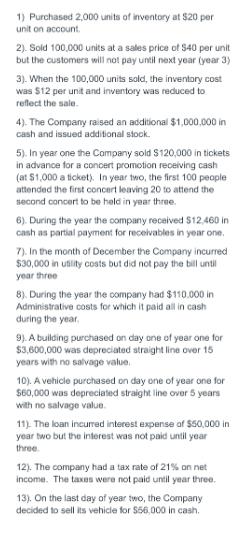

Prepare the Income statement for the following. 1) Purchased 2,000 units of inventory at $20 per unit on account. 2). Sold 100,000 units at a

Prepare the Income statement for the following.

1) Purchased 2,000 units of inventory at $20 per unit on account. 2). Sold 100,000 units at a sales price of $40 per unit but the customers will not pay until next year (year 3) 3). When the 100,000 units sold, the inventory cost was $12 per unit and inventory was reduced to reflect the sale. 4). The Company raised an additional $1,000,000 in cash and issued additional stock. 5). In year one the Company sold $120,000 in tickets in advance for a concert promotion receiving cash (at $1,000 a ticket). In year two, the first 100 people attended the first concert leaving 20 to attend the second concert to be held in year three. 6). During the year the company received $12.460 in cash as partial payment for receivables in year one. 7). In the month of December the Company incurred $30,000 in utility costs but did not pay the bill until year three 8). During the year the company had $110.000 in Administrative costs for which it paid all in cash during the year. 9). A building purchased on day one of year one for $3,600,000 was depreciated straight line over 15 years with no salvage value. 10). A vehicle purchased on day one of year one for $60,000 was depreciated straight line over 5 years with no salvage value. 11). The loan incurred interest expense of $50,000 in year two but the interest was not paid until year three 12). The company had a tax rate of 21% on net income. The taxes were not paid until year three. 13). On the last day of year two, the Company decided to sell its vehicle for $56,000 in cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started