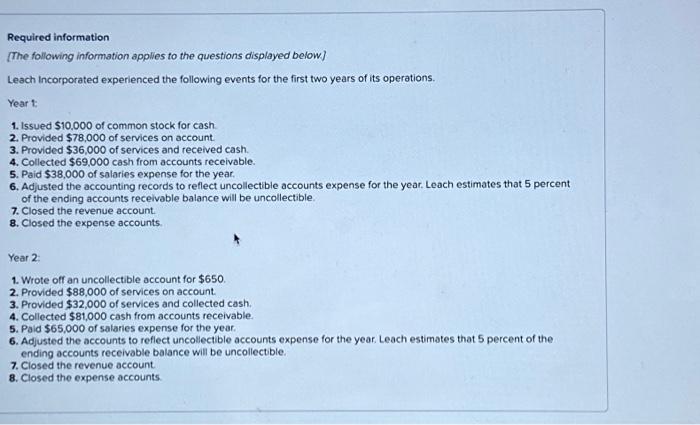

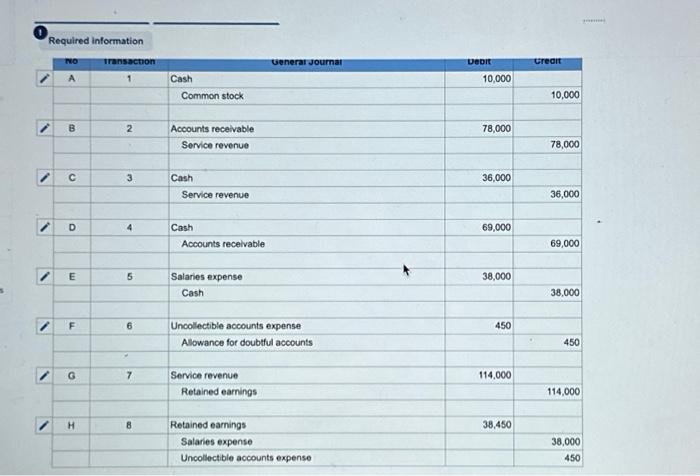

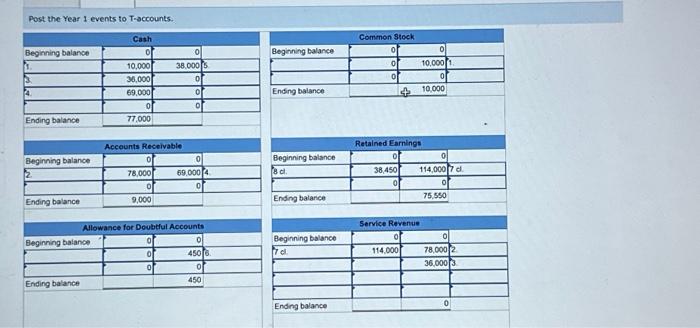

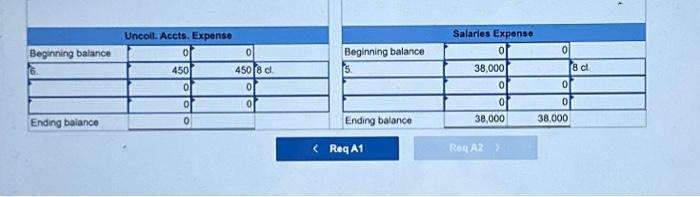

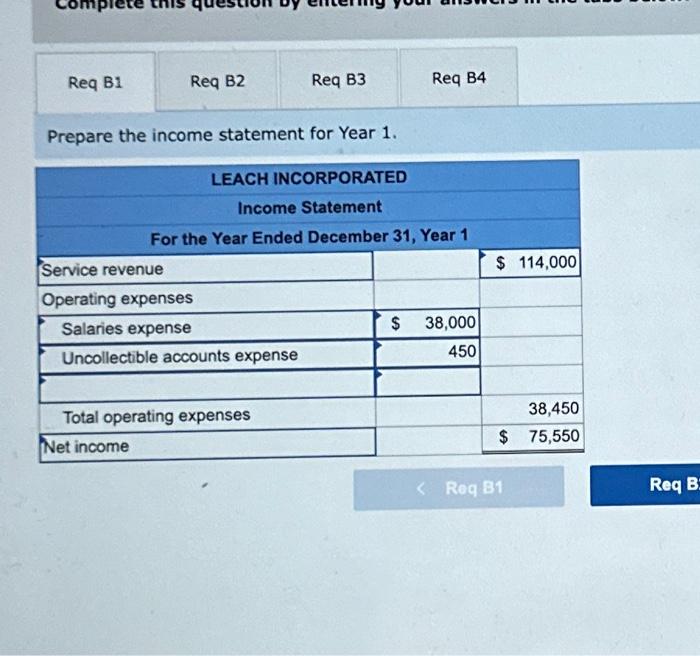

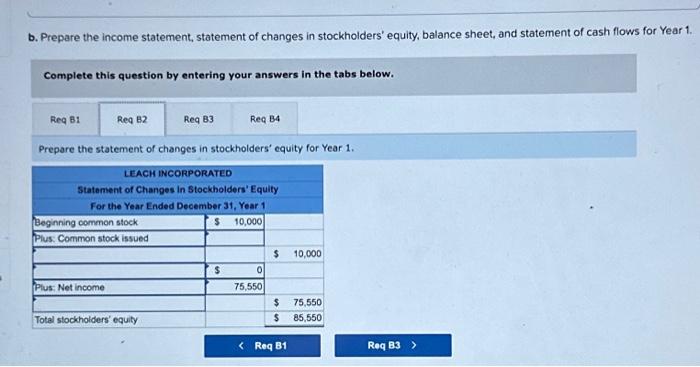

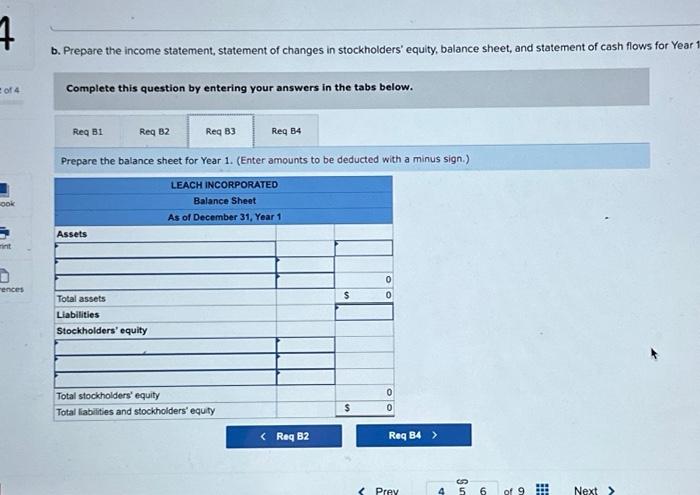

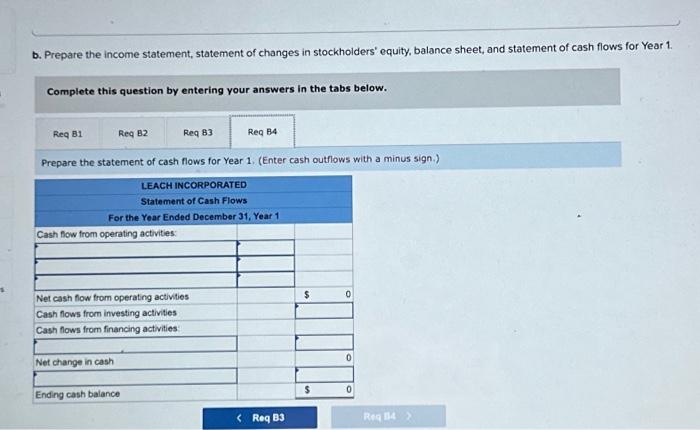

Prepare the income statement for Year 1. b. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year Complete this question by entering your answers in the tabs below. Prepare the statement of changes in stockholders' equity for Year 1. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Uncoll. Accts. Expense } \\ \hline Beginning balance & 0 & 0 & \\ \hline 6. & 450 & 450 & 8d \\ \hline & 0 & 0 & \\ \hline & 0 & 0 & \\ \hline Ending balance & 0 & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline & \multicolumn{3}{|c|}{ Salarles Expense } \\ \hline Beginning balance & 0 & & \\ \hline 5. & 38,000 & & 8cl \\ \hline & 0 & 0 & \\ \hline & 0 & 0 & \\ \hline Ending balance & 38,000 & 38,000 \\ \hline \end{tabular} ReqA1 Post the Year 1 events to T-accounts. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Complete this question by entering your answers in the tabs below. Prepare the balance sheet for Year 1. (Enter amounts to be deducted with a minus sign.) Required information [The following information applies to the questions displayed below] Leach incorporated experienced the following events for the first two years of its operations. Year 1: 1. Issued $10.000 of common stock for cash 2. Provided $78,000 of services on account. 3. Provided $36,000 of services and received cash. 4. Collected $69,000 cash from accounts receivable. 5. Paid $38,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts recelvable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Year 2 : 1. Wrote off an uncollectible account for $650. 2. Provided $88,000 of services on account. 3. Provided $32,000 of services and collected cash. 4. Collected $81,000 cash from accounts receivable. 5. Paid $65,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. c. What is the net realizable value of the accounts receivable at December 31 , Year 1 ? b. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for " Complete this question by entering your answers in the tabs below. Prepare the statement of cash flows for Year 1. (Enter cash outflows with a minus sign.) (1) Required information \begin{tabular}{|c|c|c|c|c|c|} \hline & no & Iransaction & Generat journar & veort & Greart \\ \hline & A & 1 & Cash & 10,000 & \\ \hline & & & Common stock & & 10,000 \\ \hline & B & 2 & Accounts receivable & 78,000 & \\ \hline & & 8 & Service revenue & & 78,000 \\ \hline \multirow[t]{2}{*}{} & c & 3 & Cash & 36,000 & \\ \hline & & & Service revenue & & 36,000 \\ \hline \multirow[t]{2}{*}{ l } & D & 4 & Cash & 69,000 & \\ \hline & & & Accounts receivable & & 69,000 \\ \hline \multirow[t]{2}{*}{/} & E & 5 & Salaries expense & 38,000 & \\ \hline & & & Cash & & 38,000 \\ \hline \multirow[t]{3}{*}{/} & F & 6 & Uncollectible accounts expense & 450 & \\ \hline & & & Allowance for doubtful accounts & & 450 \\ \hline & & ? & & & \\ \hline \multirow[t]{2}{*}{