Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the income tax accrual assuming the tax rate is 2 0 % . The differences between book and tax are as follows: Future deductible

Prepare the income tax accrual assuming the tax rate is The differences between book and tax are as follows:

Future deductible amounts: Warranty expense and vacation pay from parts b and cIgnore the other adjusting

entries for this accrual

Future taxable amount: Tax depreciation was $ whereas book depreciation was only $

Taxable income for is $

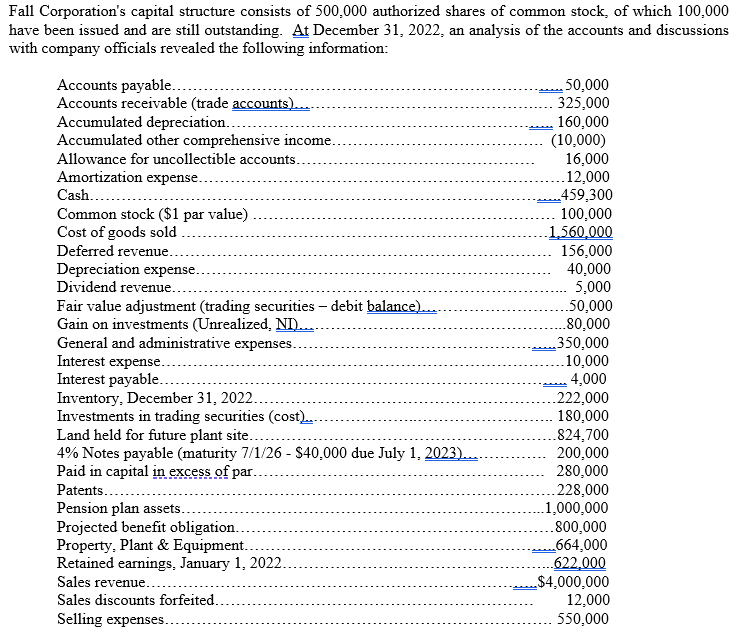

There were no previous balances in the Deferred Tax Asset or Deferred Tax Liability accounts.Fall Corporation's capital structure consists of authorized shares of common stock, of which

have been issued and are still outstanding. At December an analysis of the accounts and discussions

with company officials revealed the following information:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started