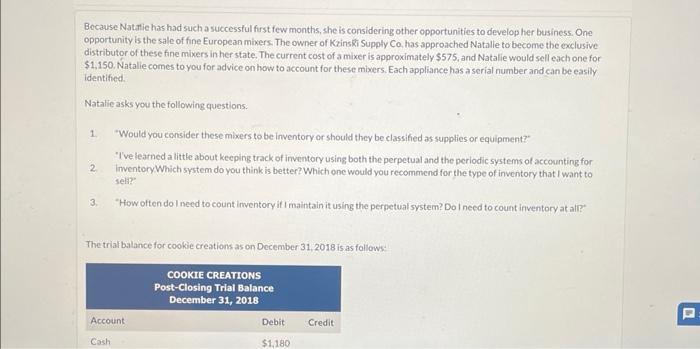

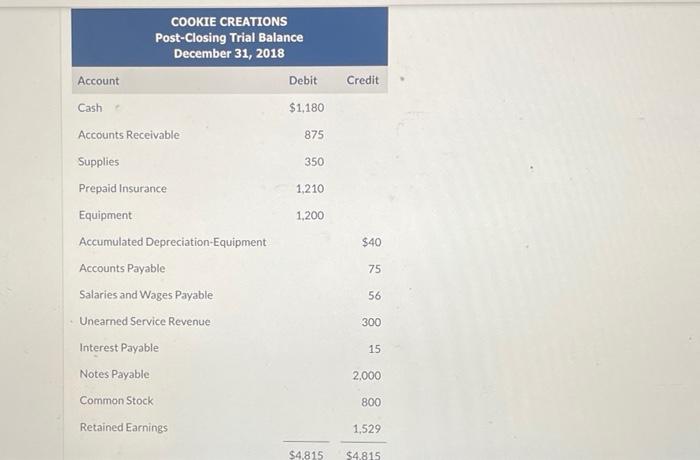

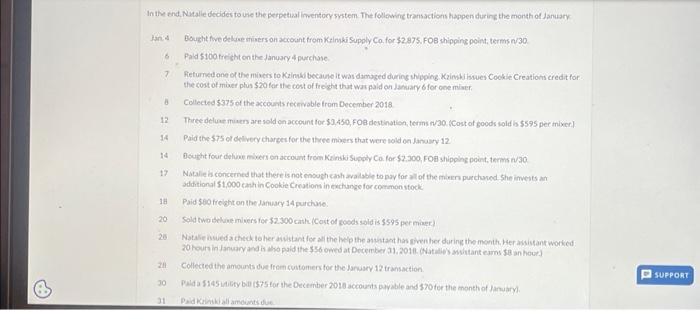

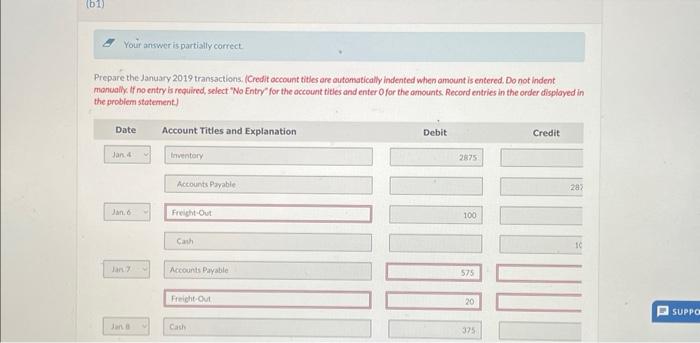

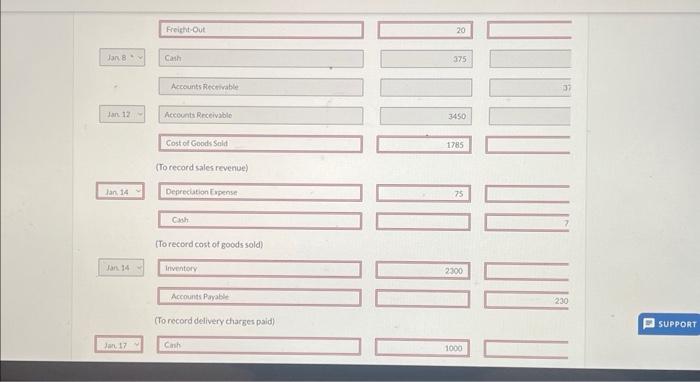

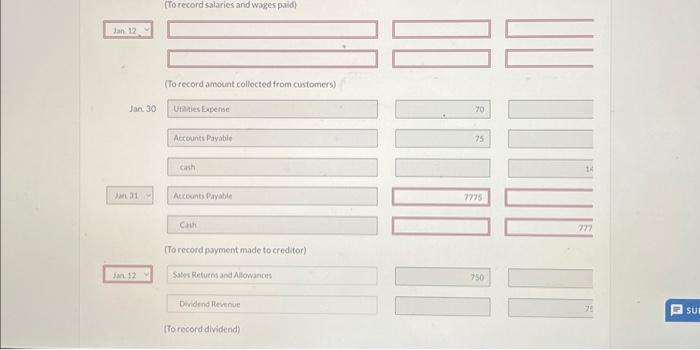

Prepare the January 2019 transactions. (Credit occount titles are outomstically indented when amount is entered. Do not indent monually, If no entry bi required, select "No Entry" for the occount titles and enter O for the amounts. Record entries in the arder disployed in the probiem statement) F Because Natritic has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is the sale of fine European mixers. The owner of Kzinski Supply Co, has approached Natalle to become the exclusive distributor of these fine mixers in her state. The current cost of a mixer is approximately $575, and Natalie would sell each one for $1,150. Natalie comes to you for advice on how to account for these mixers. Each appliance has a serial number and can be easily identified. Natalie asks you the following questions. 1. Would you consider these mixers to be inventory or should they be classified as supplies or equipment? T've learned a little about keeping track of inventory using both the perpetual and the periodic systems of actounting for 2. inventory Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell? 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all? The triaf balance for cookie creations as on December 31,2018 is as follows: In the end, Nutale decides to uhe the perpetial imentory swstem The folowine transactions happen during the month of January the cost of miat plus $20 for ife cost of freight that was paid on lamary 6 for coe miace. a) Collected 5375 of the accounts recewable from December 2018 14 Paid the 575 of delivecy charges for the there moen that were sold on lanuary i2 adtitional 51,000 cath in Cookie Creations in exchange for comenen stock: 18 Paid 560 frolati on the January 14 purchie. 2il Colected the amounts due frem cuatomers for the Jaruary 12 transaction. 31 Paid Kahnibiall amounts due. (To record salaries and wages paid) tan12 (To record amount collected from customers) Jan30 Eitities tuense Accounts Payabie cash ln31 Accounti Payable cin (To record payment made to creditor) In12 Sarticturm and Arowances 750 Dindind Revenve (Torecorddividend) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{l} COOKIE CREATIONS \\ Post-Closing Trial Balance \\ December 31, 2018 \end{tabular}} \\ \hline Account & Debit & Credit \\ \hline Cash : & $1,180 & \\ \hline Accounts Receivable & 875 & \\ \hline Supplies & 350 & \\ \hline Prepaid Insurance & 1,210 & \\ \hline Equipment: & 1,200 & \\ \hline Accumulated Depreciation-Equipment & & $40 \\ \hline Accounts Payable & & 75 \\ \hline Salaries and Wages Payable & & 56 \\ \hline Unearned Service Revenue & & 300 \\ \hline Interest Payable & & 15 \\ \hline Notes Payable & & 2,000 \\ \hline Common Stock & & 800 \\ \hline Retained Earnings & & 1,529 \\ \hline & $4.815 & $4.81 \\ \hline \end{tabular}