Question

Prepare the journal entries to record the following transactions for Ivanhoe Company, which has a calendar year end and uses the straight-line method of depreciation.

Prepare the journal entries to record the following transactions for Ivanhoe Company, which has a calendar year end and uses the straight-line method of depreciation.

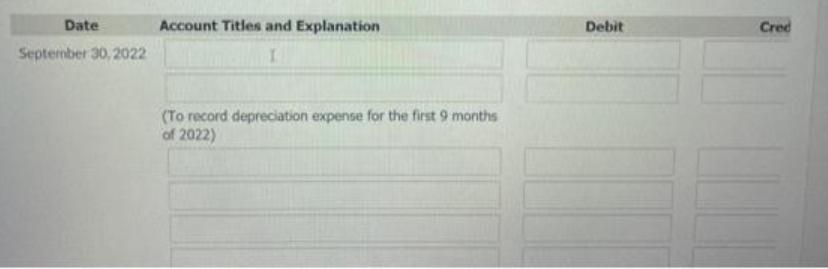

On September 30, 2022, the company sold old equipment for $87,400. The equipment was purchased on January 1, 2020, for $182,400 and was estimated to have a $30,400 salvage value at the end of its 5-year life. Depreciation on the equipment has been recorded through December 31, 2021. (Credit account titles are automatically indented.

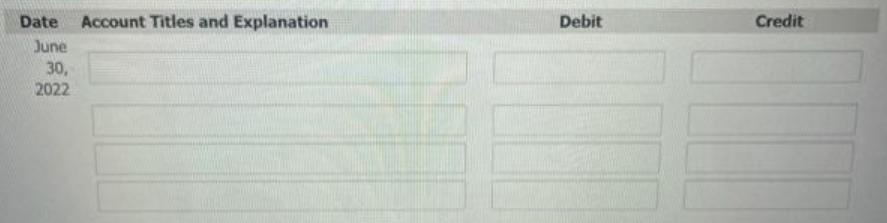

On June 30, 2022, the company sold old equipment for $45,600. The equipment originally cost $68,400 and had accumulated depreciation to the date of disposal of $28,500.

On June 30, 2022, the company sold old equipment for $45,600. The equipment originally cost $68,400 and had accumulated depreciation to the date of disposal of $28,500.

Date Account Titles and Explanation Debit Cred September 30, 2022 (To record depreciation expense for the first 9 months of 2022)

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1Cost 182400 Salvage value 30400 Life five years Annual depreciation usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started