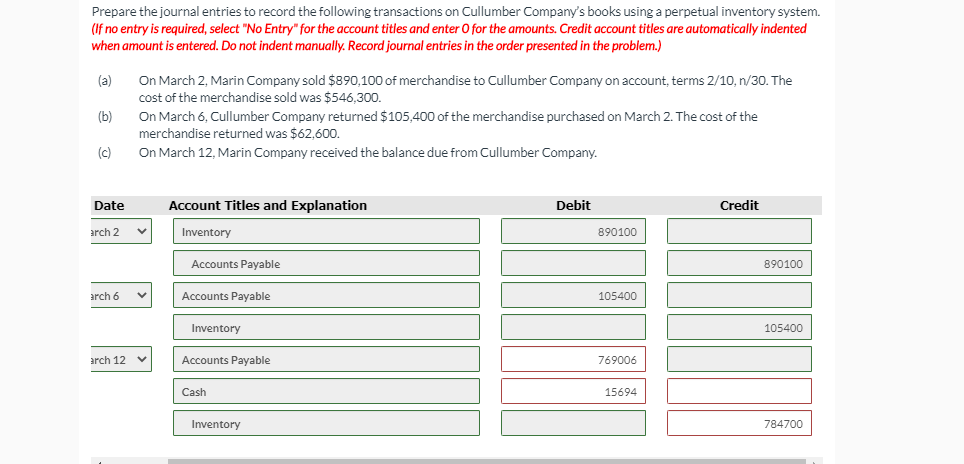

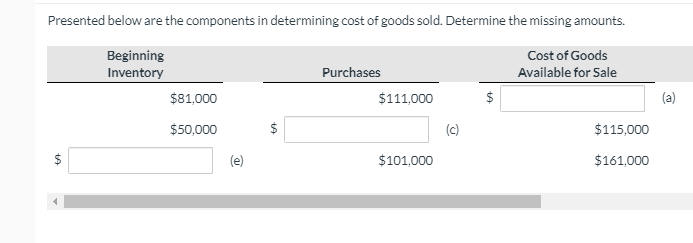

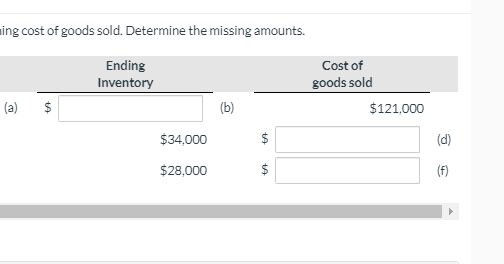

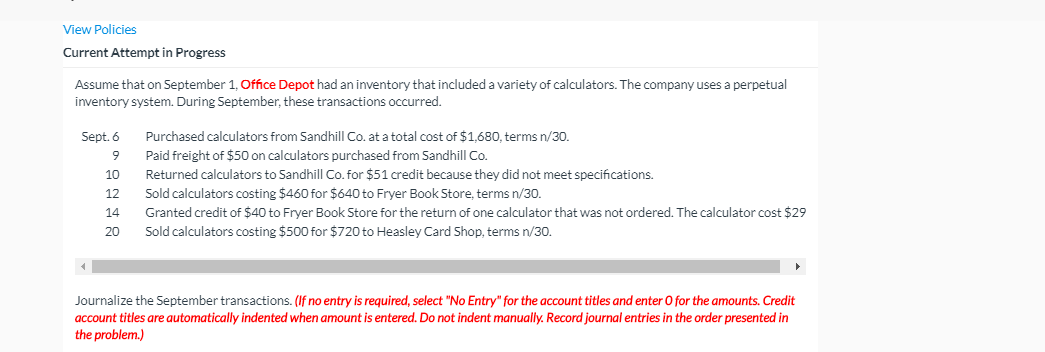

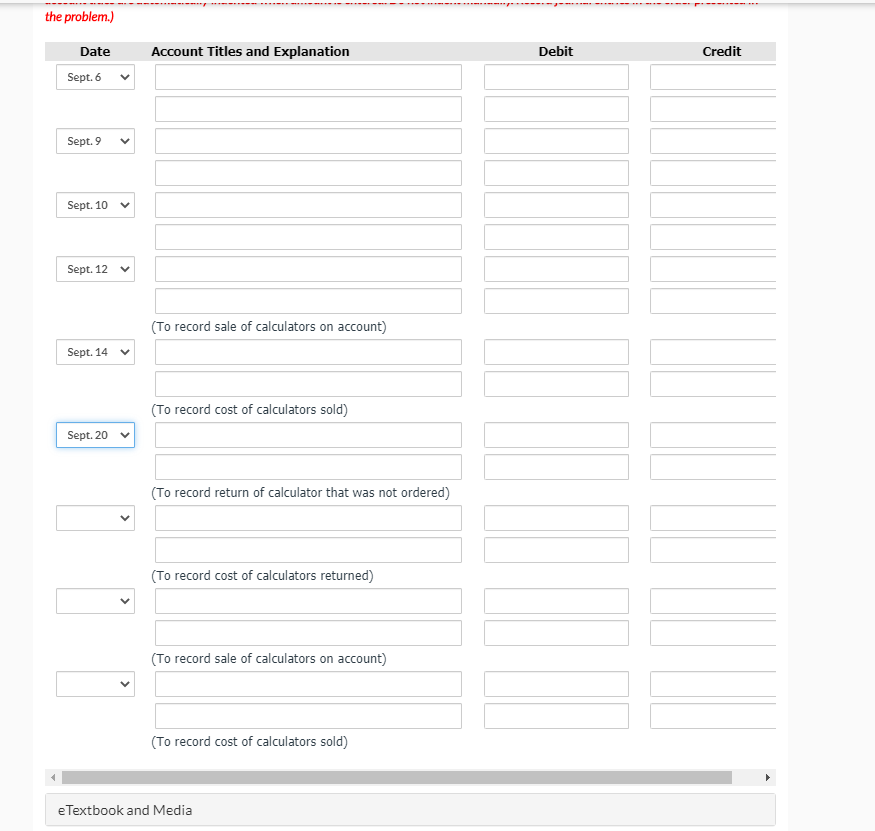

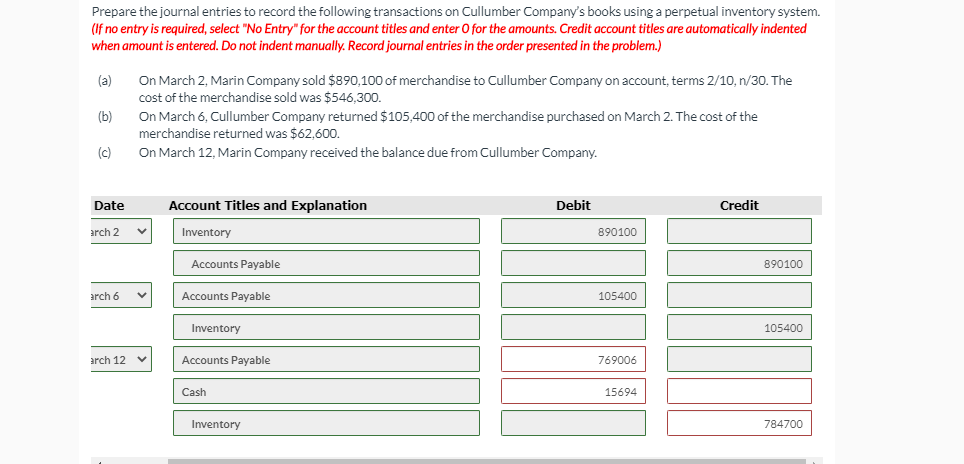

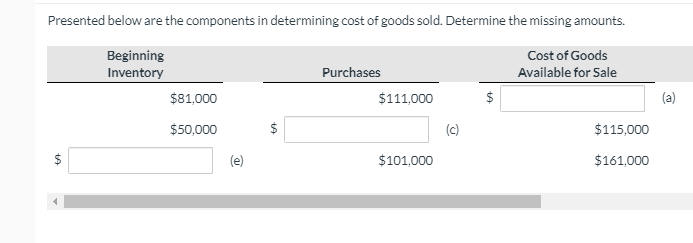

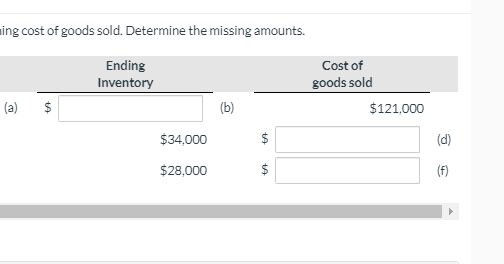

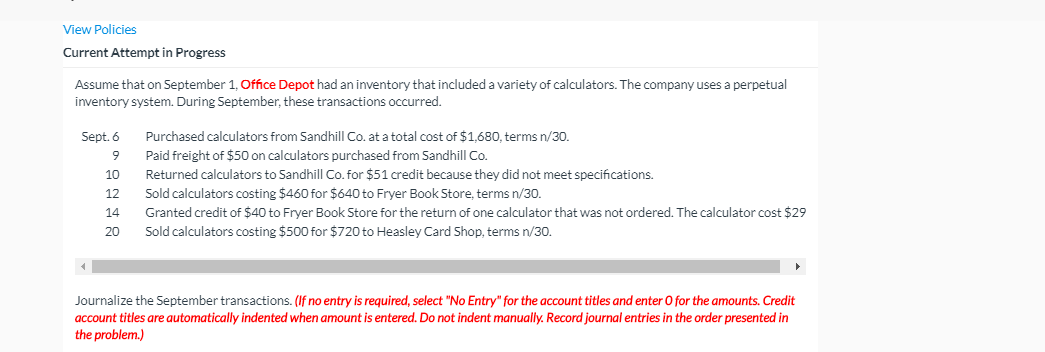

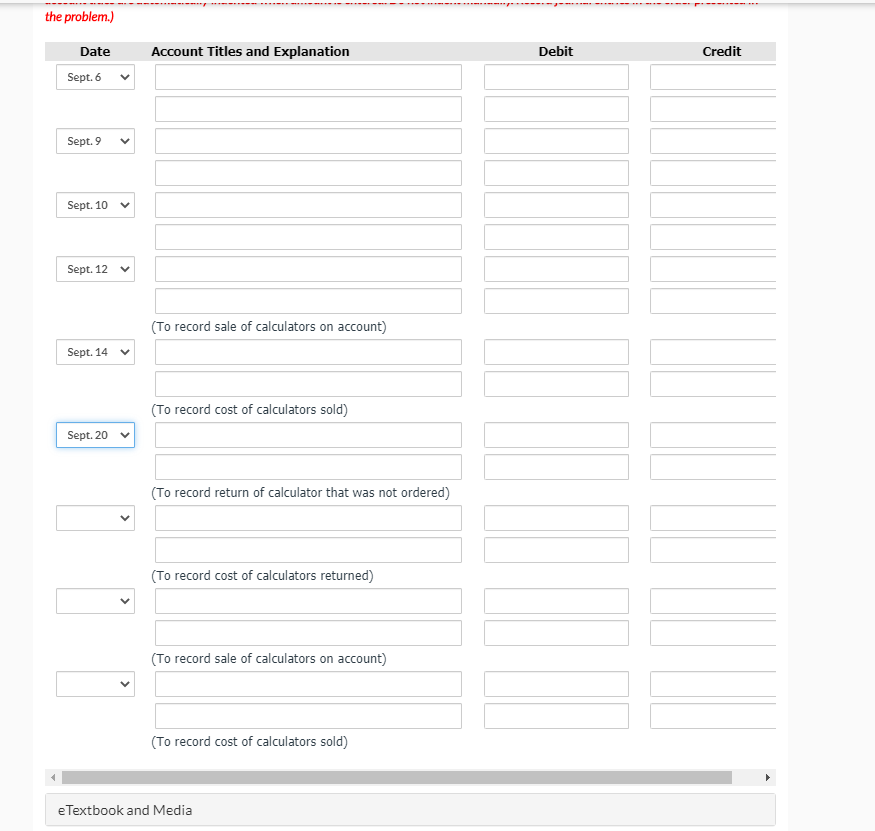

Prepare the journal entries to record the following transactions on Cullumber Company's books using a perpetual inventory system. (If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) (b) On March 2, Marin Company sold $890,100 of merchandise to Cullumber Company on account, terms 2/10,n/30. The cost of the merchandise sold was $546,300. On March 6, Cullumber Company returned $105,400 of the merchandise purchased on March 2. The cost of the merchandise returned was $62,600. On March 12, Marin Company received the balance due from Cullumber Company. (c) Date Account Titles and Explanation Debit Credit arch 2 V Inventory 890100 Accounts Payable 890100 arch 6 V Accounts Payable 105400 Inventory 105400 arch 12 Accounts Payable 769006 Cash 15694 Inventory 784700 Presented below are the components in determining cost of goods sold. Determine the missing amounts. Beginning Inventory $81,000 Cost of Goods Available for Sale Purchases $111,000 $ (a) $50,000 (c) $115.000 $ $ le) $101,000 $161,000 ing cost of goods sold. Determine the missing amounts. Ending Inventory Cost of goods sold $121,000 $ (b) $34,000 $ (d) $28,000 $ (f) View Policies Current Attempt in Progress Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September, these transactions occurred. Sept. 6 9 10 12 14 20 Purchased calculators from Sandhill Co. at a total cost of $1,680, terms n/30. Paid freight of $50 on calculators purchased from Sandhill Co. Returned calculators to Sandhill Co.for $51 credit because they did not meet specifications. Sold calculators costing $460 for $640 to Fryer Book Store, terms n/30. Granted credit of $40 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $29 Sold calculators costing $500 for $720 to Heasley Card Shop, terms n/30. Journalize the September transactions. (If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) the problem.) Account Titles and Explanation Debit Credit Date Sept. 6 Sept. 9 Sept. 10 Sept. 12 V (To record sale of calculators on account) Sept. 14 (To record cost of calculators sold) Sept. 20 (To record return of calculator that was not ordered) (To record cost of calculators returned) (To record sale of calculators on account) (To record cost of calculators sold) e Textbook and Media