Question

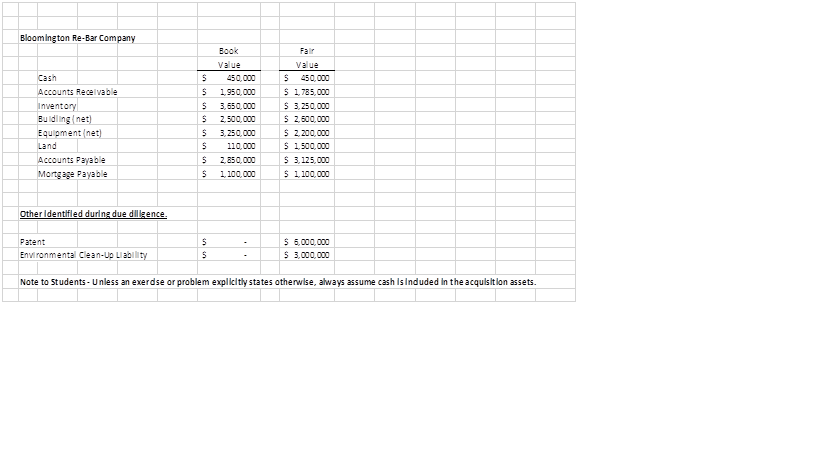

Prepare the journal entry assuming Minneapolis Manufacturing Inc. decided to purchase Bloomington Re-Bar Company for $13,000,000 in an Asset Acquisition . Prepare the journal entry

Prepare the journal entry assuming Minneapolis Manufacturing Inc. decided to purchase Bloomington Re-Bar Company for $13,000,000 in an Asset Acquisition.

Prepare the journal entry assuming Minneapolis Manufacturing Inc. decided to purchase 100% of Bloomington Re-Bar Company for $13,000,000 in a Stock Acquisition.

Prepare the journal entry assuming Minneapolis Manufacturing Inc. decided to purchase 75% of Bloomington Re-Bar Company for $9,000,000 in a Stock Acquisition.

For scenario C. (75% Stock Acquisition - above) prepare a CAD. In addition, prepare the necessary workpaper elimination entries necessary to complete a consolidated financial statement workpaper.

St. Paul Sewer Inc. purchased 70% of Pipestone Pipe Inc. in a Stock Acquisition.The CEO of St. Paul Sewer Inc. mentioned that there is an accounts receivable due from Pipestone Pipe Inc. in the amount of $12,000. How should St. Paul Sewer Inc. account for this inter-company (affiliated company) receivable?Provide the journal entry with your explanation.

Bloomington Re-Bar Company Fal Value 5 450,000 1785,000 3,250,000 5 2,600,000 5 2,200,000 1500,000 5 3,125,000 5 1100,000 Bock Value 5 450,000 1950, 000 3,550, 000 2,500,.000 3,250,000 counts Recelvae vento Buldl ing net] Equipment net 5 110,000 Accounts Payable Mangage Payable 2,850,000 1100,000 5 5,000,000 3,000,000 Patent Environmenta Clean-Up Liability Note to Students- Unless an exerdse or problem explltly states otherwise, always assume cash IsInduded in the acquisitlon assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started