Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the journal entry to record the sale of bonds on December 31, 20X1. The Corporation & Industry Financial Ratios Return on Equity Dividend Payout

Prepare the journal entry to record the sale of bonds on December 31, 20X1.

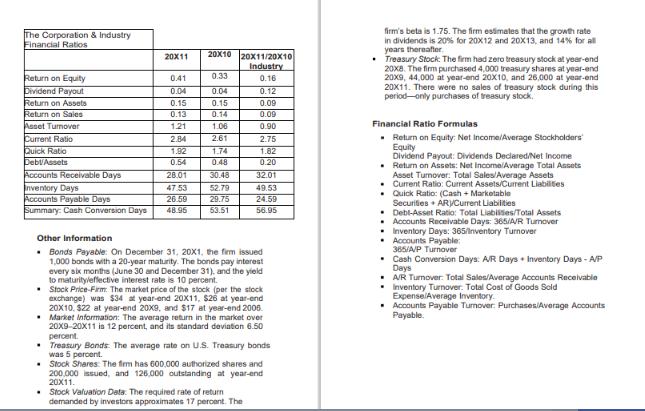

The Corporation & Industry Financial Ratios Return on Equity Dividend Payout Return on Assets Return on Sales Asset Tumover Current Ratio Quick Ratio DebAssets Accounts Receivable Days Inventory Days Accounts Payable Days Summary: Cash Conversion Days 20X11 0.41 0.04 0.15 0.13 1.21 2.84 1.82 0.54 28.01 47.53 26.59 48.95 20X10 0.33 0.04 0.15 0.14 1.06 2.61 1.74 0.48 30.48 52.79 29.75 53.51 20X11/20X10 Industry 0.16 0.12 0.09 0.09 0.90 Stock Valuation Data. The required rate of return demanded by investors approximates 17 percent. The 2.75 1.82 0.20 32.01 49.53 24.59 56.95 Other Information Bonds Payable: On December 31, 20x1, the firm issued 1,000 bonds with a 20-year maturity. The bonds pay interest every six months (June 30 and December 31), and the yield to maturity/effective interest rate is 10 percent. Stock Price-Firm: The market price of the stock (per the stock exchange) was $34 at year-end 20X11, $26 at year-end 20X10, $22 at year-end 20X9, and $17 at year-end 2006. Market Information: The average return in the market over 20X9-20X11 is 12 percent, and its standard deviation 6.50 percent. Treasury Bonds: The average rate on U.S. Treasury bonds was 5 percent. Stock Shares: The firm has 600,000 authorized shares and 200.000 issued, and 126,000 outstanding at year-end 20x11. firm's beta is 1.75. The firm estimates that the growth rate in dividends is 20% for 20X12 and 20X13, and 14% for all years thereafter. Treasury Stock: The firm had zero treasury stock at year-end 20X8. The firm purchased 4,000 treasury shares at year-end 20x9, 44,000 at year-end 20X10, and 26,000 at year-end 20X11. There were no sales of treasury stock during this period-only purchases of treasury stock. Financial Ratio Formulas . Return on Equity: Net Income/Average Stockholders Equity Dividend Payout: Dividends Declared/Net Income . Return on Assets: Net Income/Average Total Assets Asset Turnover: Total Sales/Average Assets Current Ratio: Current Assets/Current Liabilities Quick Ratio: (Cash+Marketable Securities + AR)/Current Liabilities Debt-Asset Ratio: Total Liabilities/Total Assets Accounts Receivable Days: 365/A/R Turnover Inventory Days: 365/Inventory Turnover Accounts Payable: 365/A/P Turnover Cash Conversion Days: A/R Days Inventory Days-A/P Days A/R Turnover: Total Sales/Average Accounts Receivable Inventory Turnover. Total Cost of Goods Sold Expense/Average Inventory. Accounts Payable Turnover: Purchases/Average Accounts Payable

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided financial ratios and information heres a summary Return on Equity 20X11 041 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started