Question

Prepare the monthly budget for 2025 for a company . The following estimates and information are available. Selling and Administration expenses are $ 1 2

Prepare the monthly budget for 2025 for a company The following estimates and information are available.

Selling and Administration expenses are $ ?per unit and $ ?per month. There is no depreciation included in this figure.

Dividends of $ ?will be declared in December.

Due to payroll processing times, half of the wages earned by workers is paid in the month of production, and the other half is paid in the following month.

A Company has a very flexible work force that allows them to scale up or down without cost each month.

The selling price per unit is $ ?except during May to August, inclusive, where increased competition requires a $ ?price reduction.

Overhead is $ ?per month plus $ ?per direct labour hour. Overhead costs are all paid in the month they occur, and there is $ ?per month in depreciation included.

Each unit requires ?hours of direct labour and ?pounds of metal to make.

Customer collections are received ?in the month of sale, ?in the next month, and ?in the second month following the sale. No further collections are received.

The company uses the absorption method of costing to calculate the finished goods inventory and cost of goods sold. They allocate manufacturing overhead on the basis of direct labour hours.

They have ?pounds of metal already in inventory. To prepare for supply disruptions of metal, the company likes to keep monthly ending inventory of metal high enough to meet the next two month's production requirements. In practice, their attempts at this might not always work out, but they were successful to end December

Direct labour costs $ ?per hour.

Accounts payable are paid ?in the month of purchase and ?in the following month.

Each pound of metal costs $

In December ?pounds of metal were purchased and ?hours of Direct Labour worked.

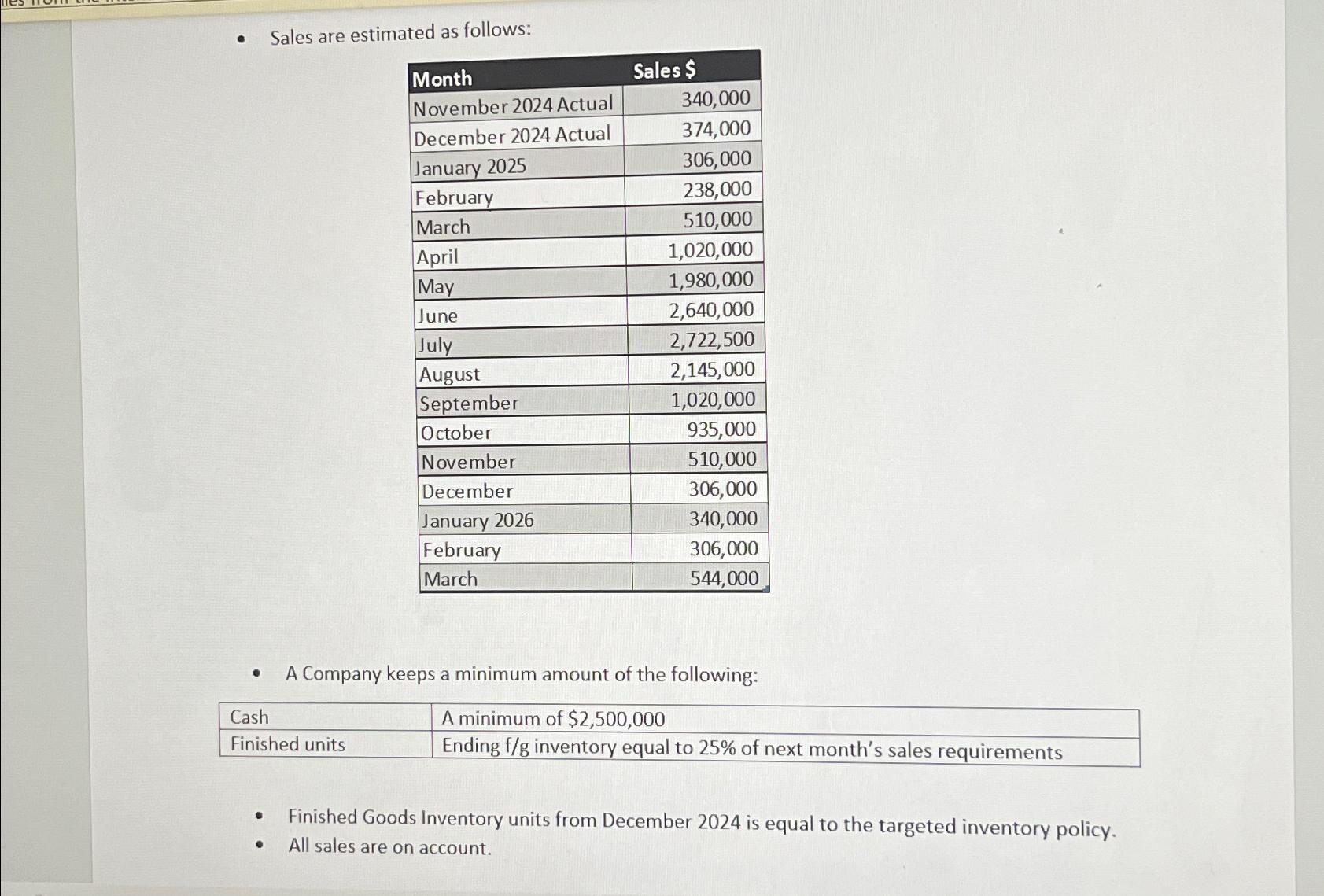

Sales are estimated as follows: Cash Finished units Month November 2024 Actual December 2024 Actual January 2025 February March April May June July August September October November December January 2026 February March Sales $ 340,000 374,000 306,000 238,000 510,000 1,020,000 1,980,000 2,640,000 2,722,500 2,145,000 1,020,000 935,000 510,000 306,000 340,000 306,000 544,000 A Company keeps a minimum amount of the following: A minimum of $2,500,000 Ending f/g inventory equal to 25% of next month's sales requirements Finished Goods Inventory units from December 2024 is equal to the targeted inventory policy. All sales are on account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare the monthly budget for 2025 for the given company we need to calculate the following 1 Cost of Goods Sold COGS 2 Selling and Adminis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started