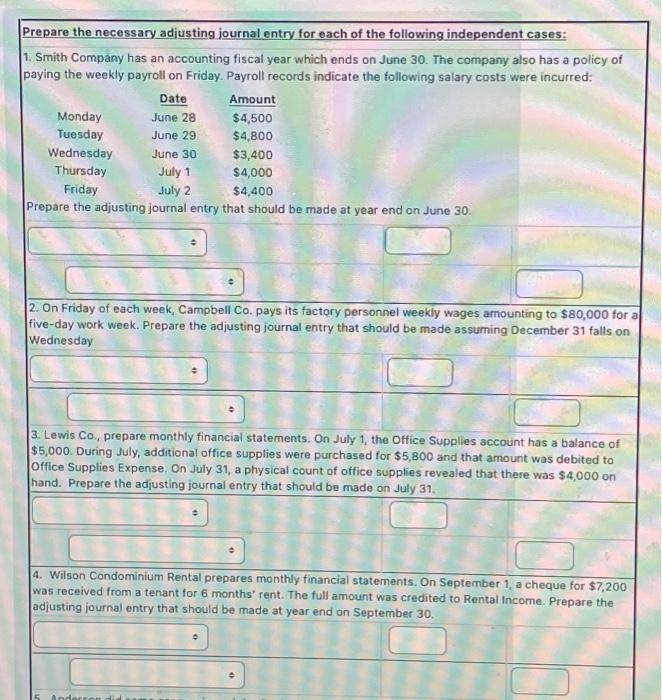

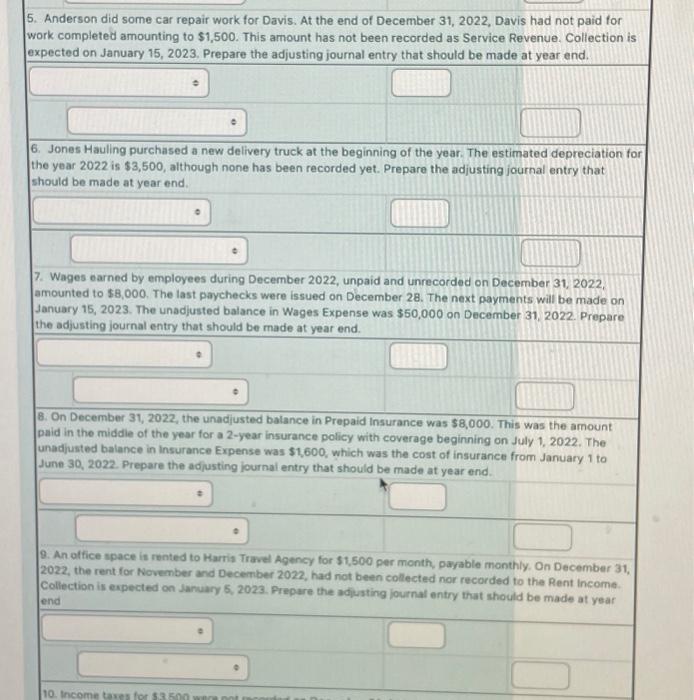

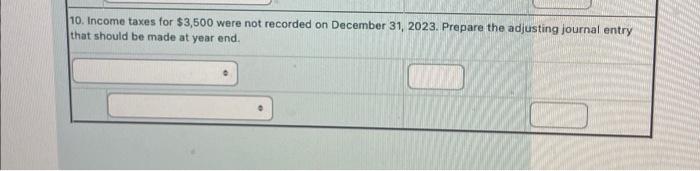

Prepare the necessary adjusting journal entry for each of the following independent cases: 1. Smith Company has an accounting fiscal year which ends on June 30. The company also has a policy of paying the weekly payroll on Friday. Payroll records indicate the following salary costs were incurred: Prepare the adjusting journal entry that should be made at year end on June 30 . 2. On Friday of each week, Campbell Co. pays its factory personnel weekly wages amounting to $80,000 for five-day work week. Prepare the adjusting journal entry that should be made assuming December 31 falls on Wednesday 3. Lewis Co., prepare monthly financial statements. On July 1, the Office Supplies account has a balance of $5,000. During July, additional office supplies were purchased for $5,800 and that amount was debited to Office Supplies Expense. On July 31 , a physical count of office supplies revealed that there was $4,000 on hand. Prepare the adjusting journal entry that should be made on July 31. 4. Wilson Condominium Rental prepares monthly financial statements. On September 1, a cheque for $7,200 was received from a tenant for 6 months' rent. The full amount was credited to Rental Income. Prepare the adjusting journal entry that should be made at year end on September 30. 5. Anderson did some car repair work for Davis. At the end of December 31, 2022, Davis had not paid for work completed amounting to $1,500. This amount has not been recorded as Service Revenue. Collection is expected on January 15, 2023. Prepare the adjusting journal entry that should be made at year end. 6. Jones Hauling purchased a new delivery truck at the beginning of the year. The estimated depreciation for the year 2022 is $3,500, although none has been recorded yet. Prepare the adjusting journal entry that should be made at year end. 7. Wages earned by employees during December 2022, unpaid and unrecorded on December 31, 2022, amounted to 58,000 . The last paychecks were issued on December 28 . The next payments will be made on January 15, 2023. The unadjusted balance in Wages Expense was $50,000 on December 31, 2022. Prepare the adjusting journal entry that should be made at year end. 8. On December 31, 2022, the unadjusted balance in Prepaid Insurance was \$8,000. This was the amount paid in the middle of the year for a 2-year insurance policy with coverage beginning on July 1, 2022. The unadjusted balance in insurance Expense was $1,600, which was the cost of insurance from January 1 to June 30, 2022. Prepare the adusting journal entry that should be made at year end. 9. An office space is rented to Harris Travel Agency for 51,500 per month, payable monthly. On December 31, 2022, the rent for November and December 2022, had not been collected nor recorded to the Rent income. Collection is expected on January 5, 2023. Prepare the adiusting journal entry that should be made at year end 10. Income taxes for $3,500 were not recorded on December 31,2023 . Prepare the adjusting journal entry that should be made at year end