Answered step by step

Verified Expert Solution

Question

1 Approved Answer

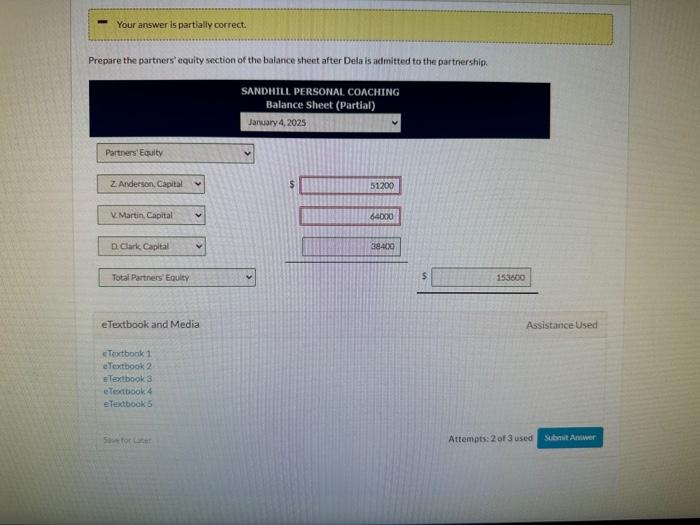

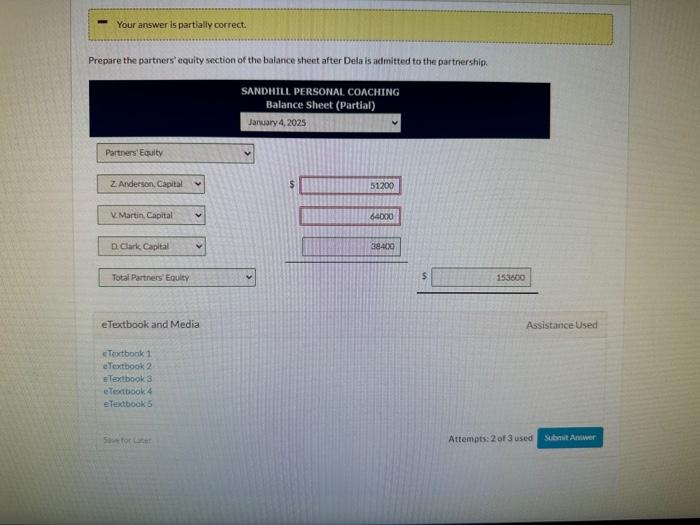

prepare the partners equity section of the balance sheet after dela is admitted to the partnership Prenare the dartners' eduity section of the balance sheet

prepare the partners equity section of the balance sheet after dela is admitted to the partnership

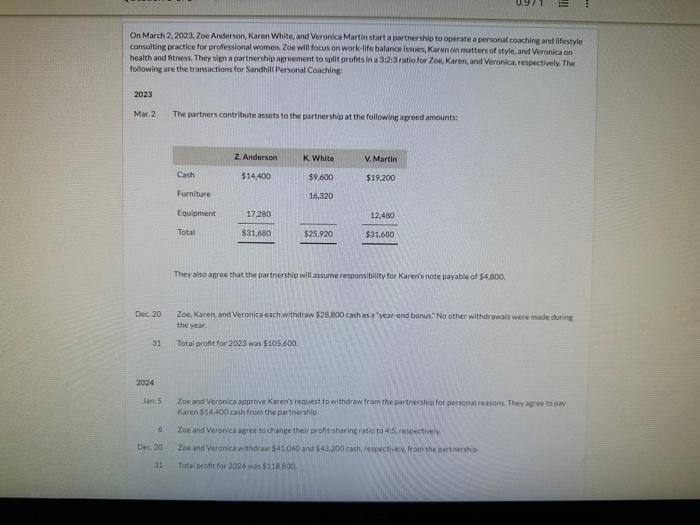

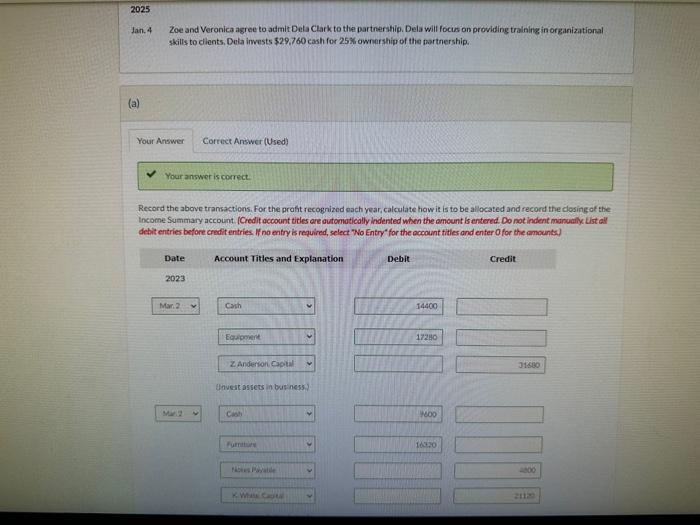

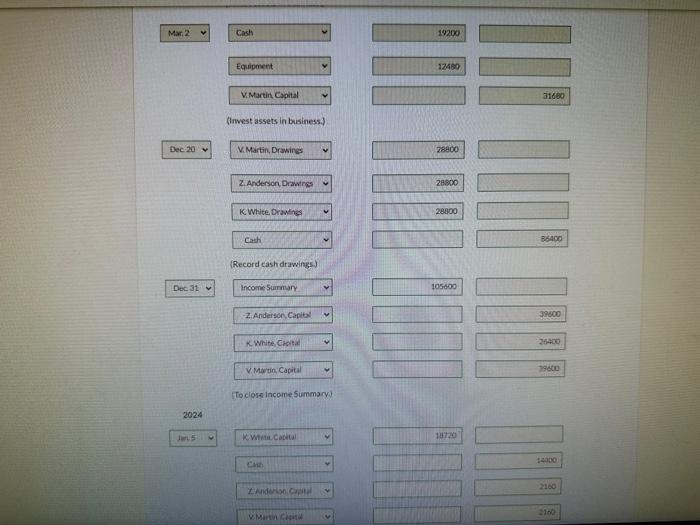

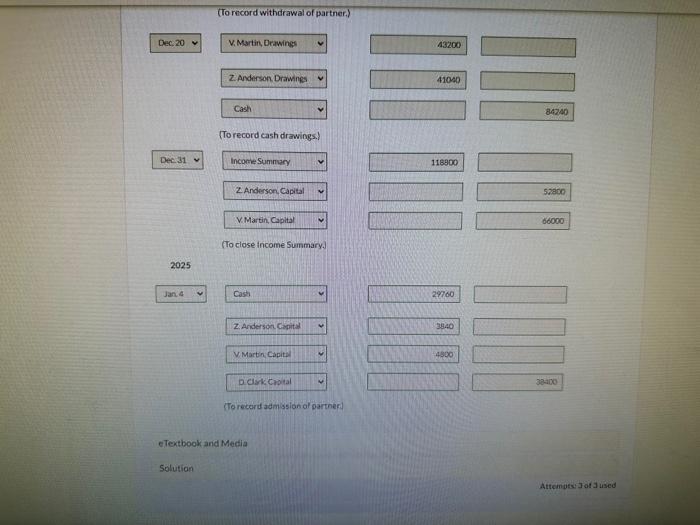

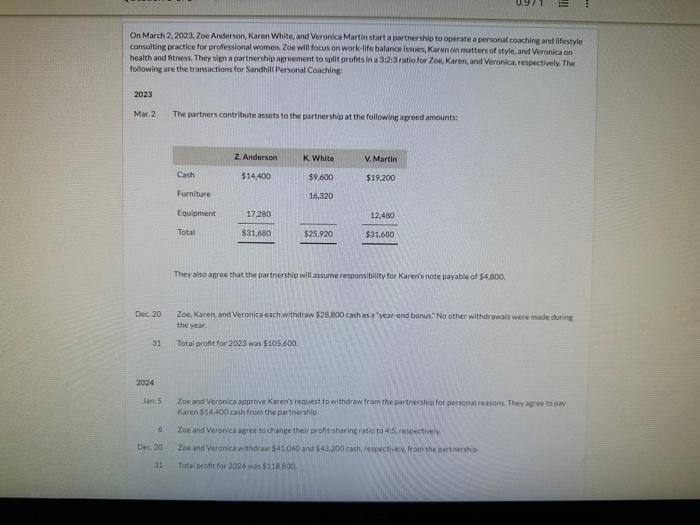

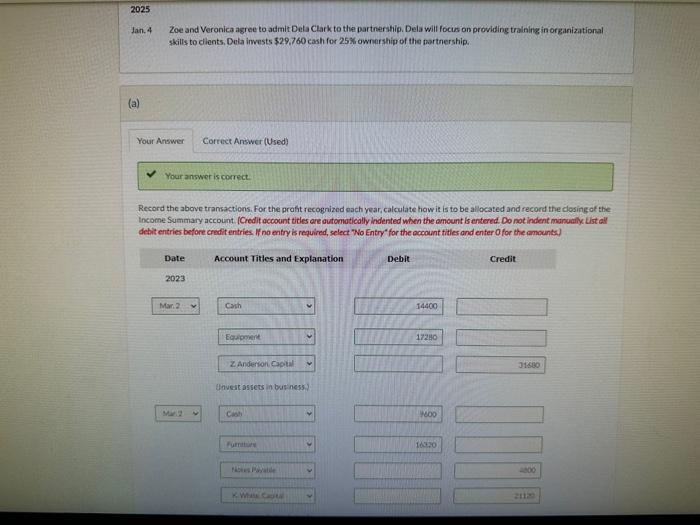

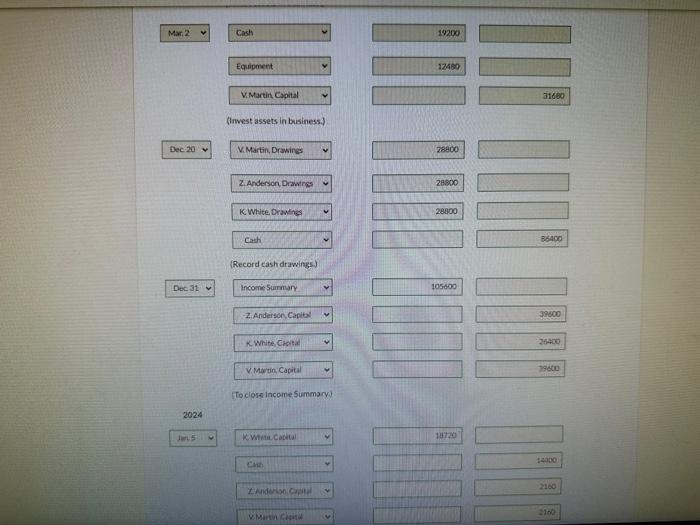

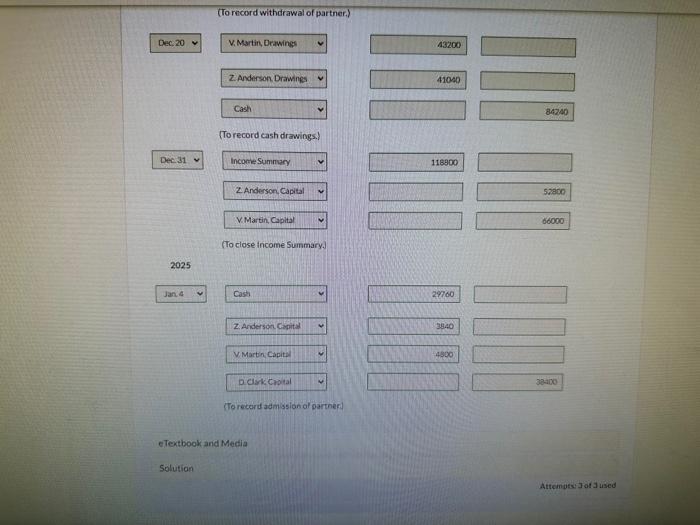

Prenare the dartners' eduity section of the balance sheet after Dela is admitted ta the nartnerchin. On March 2, 2023, Zos Anderion, Karen White, and Veronica Martinstart a parthership to operate a personal coaching and lifestyle consuiting practice for professional women. Zoe will fexas an work-ifet balance issues, Karenontmatters of style, and Veronica an health and fitness. They sign a partnerhip agreement to split profits in a 3.2:3 ratio for Zoe, Karen, arid Veronica, respectively. The followirg are the transactions for Sanuhili Personal Coaching: 2023 Mar.2. The partners contribute assets to the partnershlb at the following agreed amounts: They also agree that the partnershib will assume cerponsibility foc Karen's note payable of $4.800. Dec 20 Zoe, Karen, and Veronicaeach withdraw 526.800 emh as a "Year-end banct" No other withdrwwats were made cturing the year. 31 Total profit for 2023 was $105600 2024 Ian.5 Loe and Veronica approwe Karen'r repuert 10 withdraw from the pantrerstio foc aersonal reanans. They agree to bay: Kaien 514,400 castifrom the pactnerahip: 6. Toe and Veronica ap ee to change thelp proft aharieg ratio to 4.5 iriocctivily at. Tote prodit for 2024 wis 4118,600 Jan.4 Zoe and Veronica agree to admit Dela Clark to the partnership. Dela will focis on prowiding training in organizational skills to cilents, Dela invests $29.760 cash for 25% ownarship of the partnership. (a) Correct Answer (Used) Your answer is correct. Record the above transactions. For the prafit recogrized each year, calculate how it is to be allocated and record the closing of the Income Summary account. (Credit account tites are outomotically indented when the amcunt is entered. Do not indent manualily Uist all debit entries before credit entries. If no entry is required, select "No Entry" for the account fitles and enter O for the amounts) (To record withdrawal of partner.) (To record cash drawings.) (To close income summary.) 2025 STo record admission of parther! eTextbook and Media Solution Attemetsjot 3 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started