Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the relevant journal entries for 2021 E 14-3 Recording of accounts and notes receivable transactions The Dec. 31, 2020 statement of financial position of

Prepare the relevant journal entries for 2021

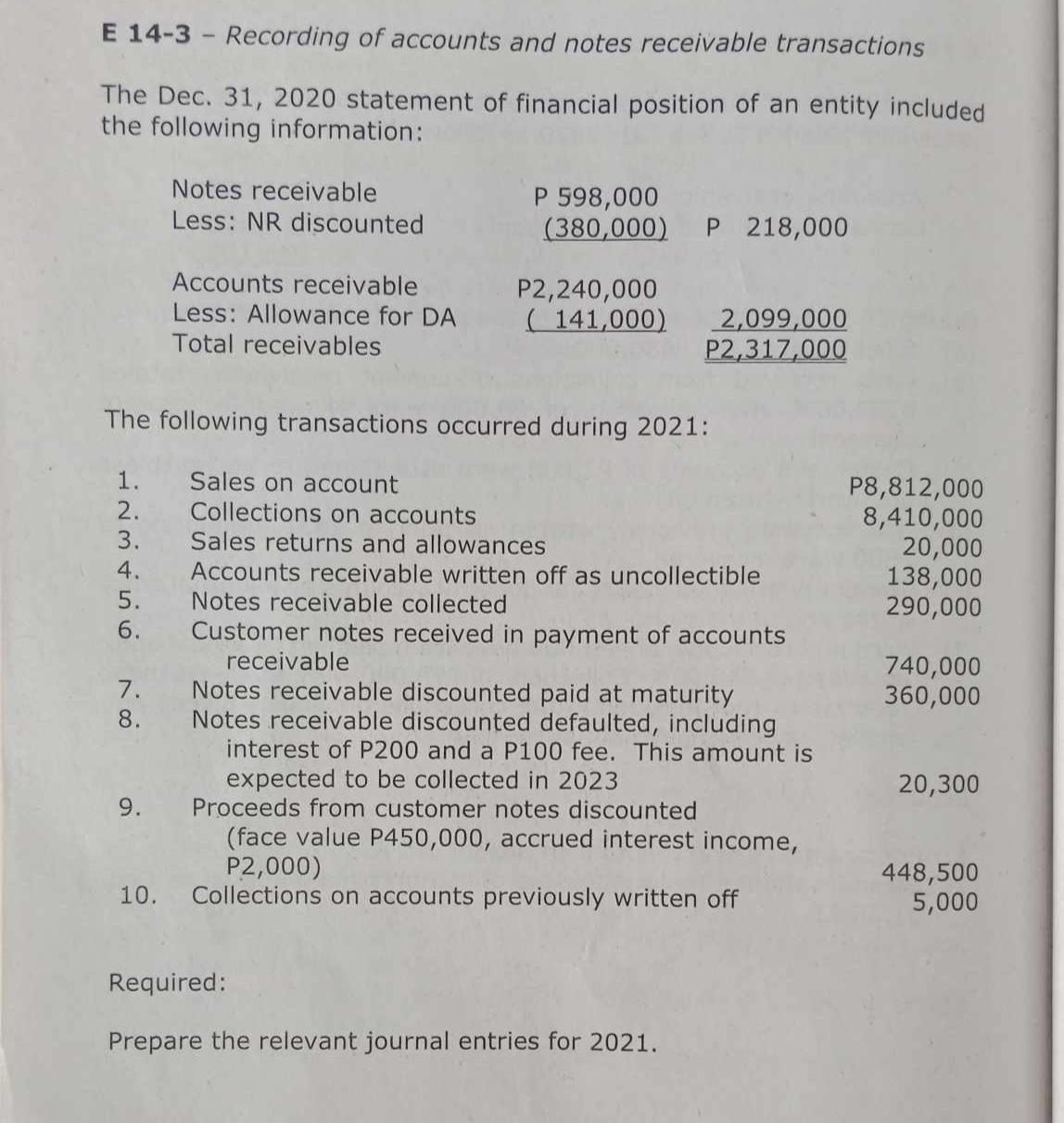

E 14-3 Recording of accounts and notes receivable transactions The Dec. 31, 2020 statement of financial position of an entity included the following information: 5. 6. 7. 8. 9. Notes receivable Less: NR discounted 10. Accounts receivable Less: Allowance for DA Total receivables The following transactions occurred during 2021: 1. Sales on account 2. 3. 4. P 598,000 (380,000) P 218,000 Collections on accounts P2,240,000 (141,000) 2,099,000 P2,317,000 Sales returns and allowances Accounts receivable written off as uncollectible Notes receivable collected Customer notes received in payment of accounts receivable Notes receivable discounted paid at maturity Notes receivable discounted defaulted, including interest of P200 and a P100 fee. This amount is expected to be collected in 2023 Proceeds from customer notes discounted (face value P450,000, accrued interest income, P2,000) Collections on accounts previously written off Required: Prepare the relevant journal entries for 2021. P8,812,000 8,410,000 20,000 138,000 290,000 740,000 360,000 20,300 448,500 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the relevant journal entries for the transactions that occurred during 2021 1 Sales on acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started