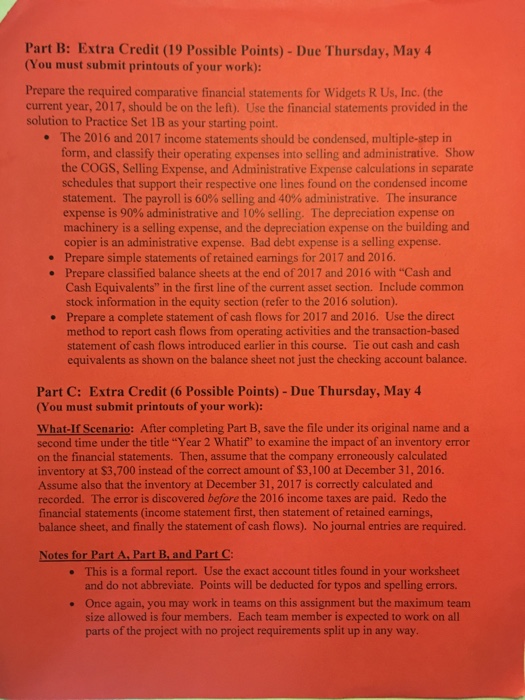

Prepare the required comparative financial statements for Widgets R Us, Inc. (the current year, 2017, should be on the left). Use the financial statements provided in the solution to Practice Set 1B as your starting point. The 2016 and 2017 income statements should be condensed, multiple-step in form, and classify their operating expenses into selling and administrative. Show the COGS, Selling Expense, and Administrative Expense calculations in separate schedules that support their respective one lines found on the condensed income statement. The payroll is 60% selling and 40% administrative. The insurance expense is 90% administrative and 10% selling. The depreciation expense on machinery is a selling expense, and the depreciation expense on the building and copier is an administrative expense. Bad debt expense is a selling expense. Prepare simple statements of retained earnings for 2017 and 2016. Prepare classified balance sheets at the end of 2017 and 2016 with "Cash and Cash Equivalents" in the first line of the current asset section. Include common stock information in the equity section (refer to the 2016 solution). Prepare a complete statement of cash flows for 2017 and 2016. Use the direct method to report cash flows from operating activities and the transaction-based statement of cash flows introduced earlier in this course. Tie out cash and cash equivalents as shown on the balance sheet not just the checking account balance. What If Scenario: After completing Part B, save the file under its original name and a second time under the title "Year 2 Whatif" to examine the impact of an inventory error on the financial statements. Then, assume that the company erroneously calculated inventory at $3,700 instead of the correct amount of $3,100 at December 31, 2016 Assume also that the inventory at December 31, 2017 is correctly calculated and recorded. The error is discovered before the 2016 income taxes are paid. Redo the financial statements (income statement first, then statement of retained earnings balance sheet, and finally the statement of cash flows). No journal entries are required. Prepare the required comparative financial statements for Widgets R Us, Inc. (the current year, 2017, should be on the left). Use the financial statements provided in the solution to Practice Set 1B as your starting point. The 2016 and 2017 income statements should be condensed, multiple-step in form, and classify their operating expenses into selling and administrative. Show the COGS, Selling Expense, and Administrative Expense calculations in separate schedules that support their respective one lines found on the condensed income statement. The payroll is 60% selling and 40% administrative. The insurance expense is 90% administrative and 10% selling. The depreciation expense on machinery is a selling expense, and the depreciation expense on the building and copier is an administrative expense. Bad debt expense is a selling expense. Prepare simple statements of retained earnings for 2017 and 2016. Prepare classified balance sheets at the end of 2017 and 2016 with "Cash and Cash Equivalents" in the first line of the current asset section. Include common stock information in the equity section (refer to the 2016 solution). Prepare a complete statement of cash flows for 2017 and 2016. Use the direct method to report cash flows from operating activities and the transaction-based statement of cash flows introduced earlier in this course. Tie out cash and cash equivalents as shown on the balance sheet not just the checking account balance. What If Scenario: After completing Part B, save the file under its original name and a second time under the title "Year 2 Whatif" to examine the impact of an inventory error on the financial statements. Then, assume that the company erroneously calculated inventory at $3,700 instead of the correct amount of $3,100 at December 31, 2016 Assume also that the inventory at December 31, 2017 is correctly calculated and recorded. The error is discovered before the 2016 income taxes are paid. Redo the financial statements (income statement first, then statement of retained earnings balance sheet, and finally the statement of cash flows). No journal entries are required