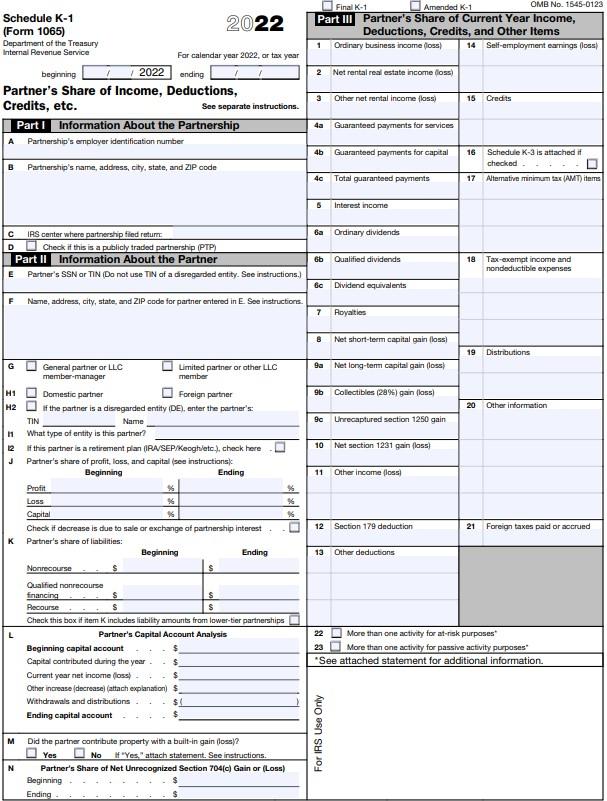

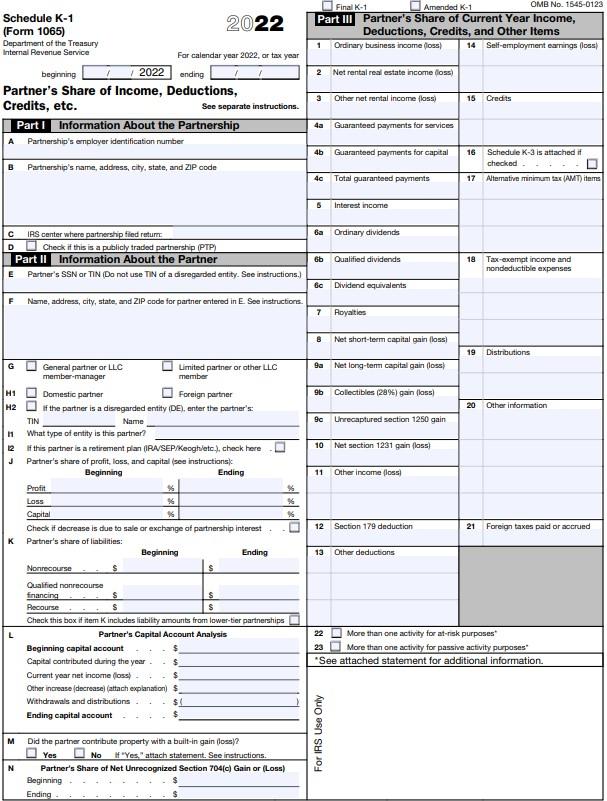

Prepare the Schedule K-1 for Ira, according to all information attach. Thank you.

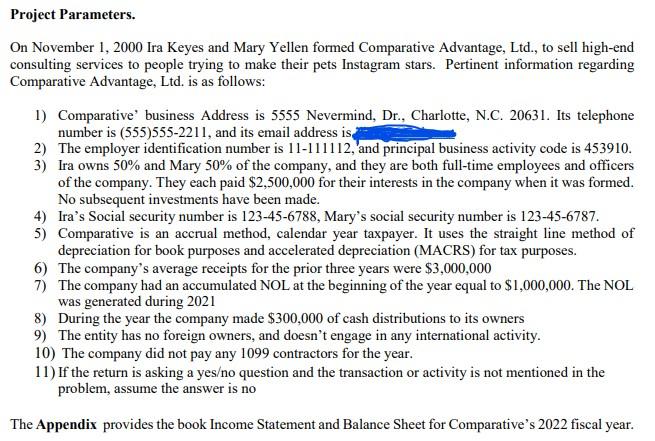

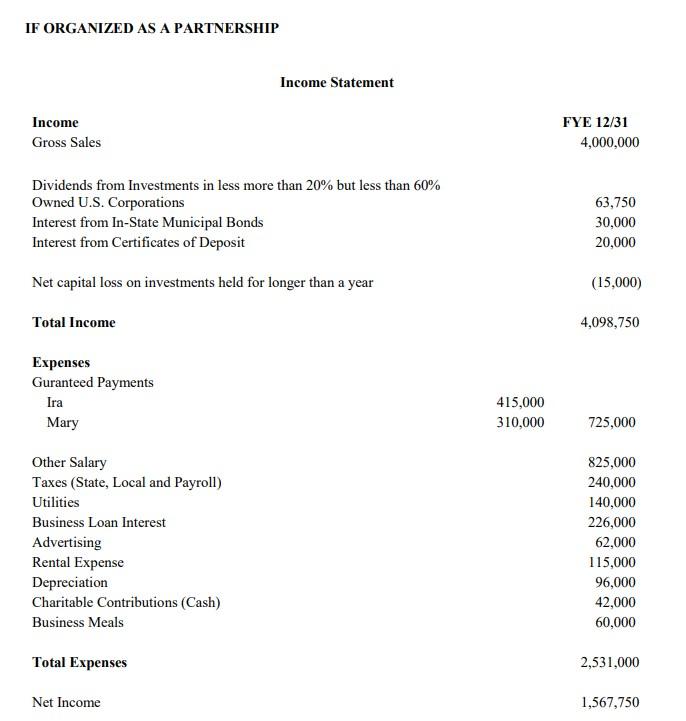

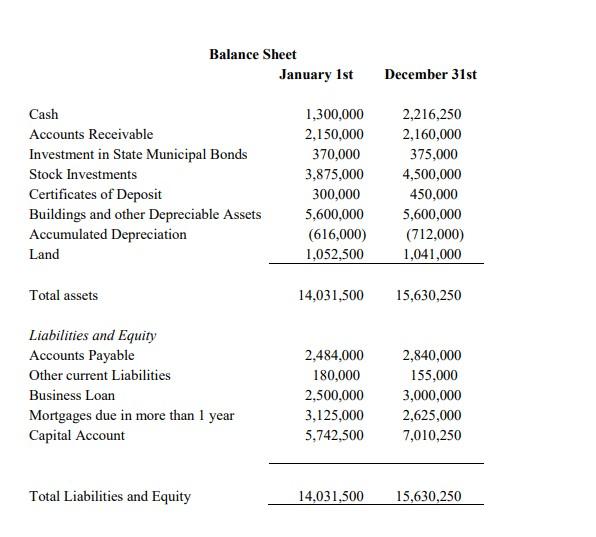

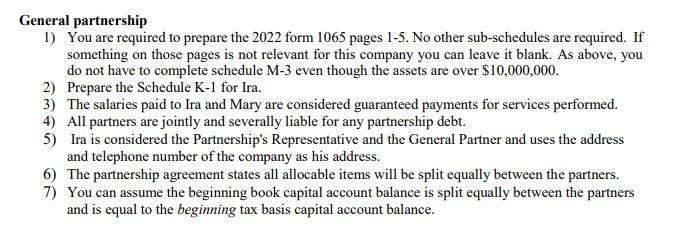

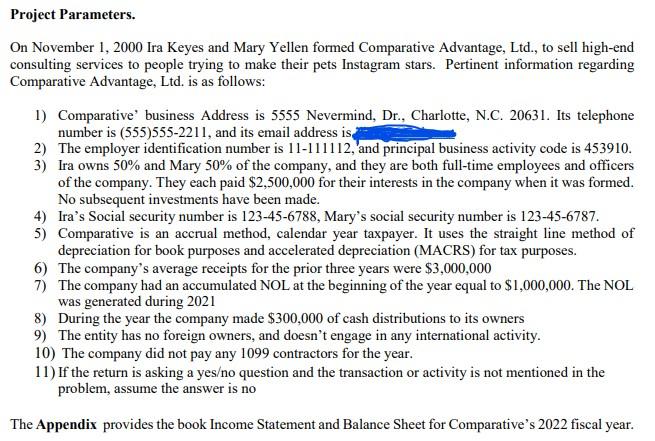

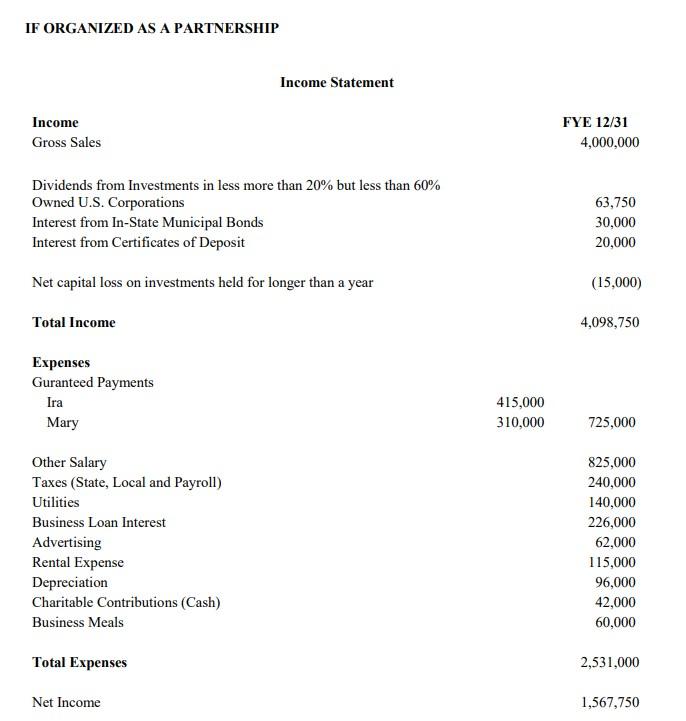

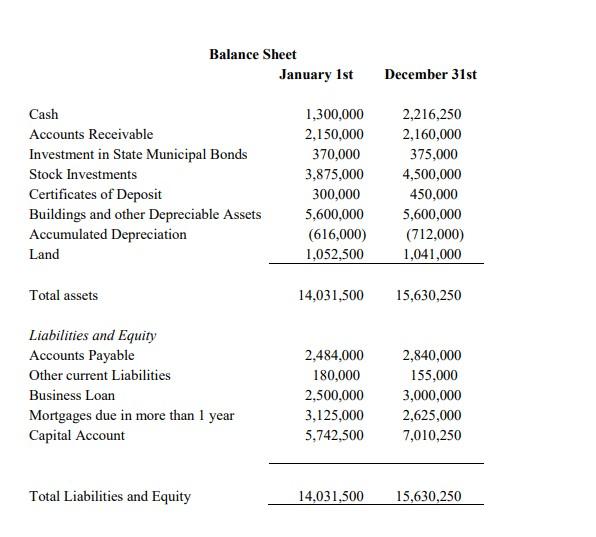

On November 1, 2000 Ira Keyes and Mary Yellen formed Comparative Advantage, Ltd., to sell high-end consulting services to people trying to make their pets Instagram stars. Pertinent information regarding Comparative Advantage, Ltd. is as follows: 1) Comparative' business Address is 5555 Nevermind, Dr., Charlotte, N.C. 20631. Its telephone number is (555)555-2211, and its email address is 2) The employer identification number is 11-111112, and principal business activity code is 453910 . 3) Ira owns 50% and Mary 50% of the company, and they are both full-time employees and officers of the company. They each paid $2,500,000 for their interests in the company when it was formed. No subsequent investments have been made. 4) Ira's Social security number is 123-45-6788, Mary's social security number is 123-45-6787. 5) Comparative is an accrual method, calendar year taxpayer. It uses the straight line method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes. 6) The company's average receipts for the prior three years were $3,000,000 7) The company had an accumulated NOL at the beginning of the year equal to $1,000,000. The NOL was generated during 2021 8) During the year the company made $300,000 of cash distributions to its owners 9) The entity has no foreign owners, and doesn't engage in any international activity. 10) The company did not pay any 1099 contractors for the year. 11) If the return is asking a yeso question and the transaction or activity is not mentioned in the problem, assume the answer is no The Appendix provides the book Income Statement and Balance Sheet for Comparative's 2022 fiscal year. IF ORGANIZED AS A PARTNERSHIP Balance Sheet January 1st December 31st \begin{tabular}{lcc} Cash & 1,300,000 & 2,216,250 \\ Accounts Receivable & 2,150,000 & 2,160,000 \\ Investment in State Municipal Bonds & 370,000 & 375,000 \\ Stock Investments & 3,875,000 & 4,500,000 \\ Certificates of Deposit & 300,000 & 450,000 \\ Buildings and other Depreciable Assets & 5,600,000 & 5,600,000 \\ Accumulated Depreciation & (616,000) & (712,000) \\ Land & 1,052,500 & 1,041,000 \\ \cline { 2 - 3 } & & \\ Total assets & 14,031,500 & 15,630,250 \\ & & \\ Liabilities and Equity & & \\ Accounts Payable & 2,484,000 & 2,840,000 \\ Other current Liabilities & 180,000 & 155,000 \\ Business Loan & 2,500,000 & 3,000,000 \\ Mortgages due in more than 1 year & 3,125,000 & 2,625,000 \\ Capital Account & 5,742,500 & 7,010,250 \\ & & \\ & & \\ Total Liabilities and Equity & 14,031,500 & 15,630,250 \\ \hline \end{tabular} General partnership 1) You are required to prepare the 2022 form 1065 pages 1-5. No other sub-schedules are required. If something on those pages is not relevant for this company you can leave it blank. As above, you do not have to complete schedule M3 even though the assets are over $10,000,000. 2) Prepare the Schedule K-1 for Ira. 3) The salaries paid to Ira and Mary are considered guaranteed payments for services performed. 4) All partners are jointly and severally liable for any partnership debt. 5) Ira is considered the Partnership's Representative and the General Partner and uses the address and telephone number of the company as his address. 6) The partnership agreement states all allocable items will be split equally between the partners. 7) You can assume the beginning book capital account balance is split equally between the partners and is equal to the beginning tax basis capital account balance. Final K1 Amended K-1 OMB No. 1545-0123 Schedule K-1 Part III Partner's Share of Current Year Income, (Form 1065) 2022 Deductions, Credits, and Other Items Department of the Treasury Internal Revenue Service 1. Ordinary business inoome (loss) 14 Self-employment earings (l0es) begining 4/2022 ending /1/1 2 Net rental real estate income flossi Partner's Share of Income, Deductions, 3 Other net rental income (loss) 15 Credts Credits, etc. See separate instructions. Part I Information About the Partnership A Partnership's emplaver identification number B Partnership's name, address, city, state, and ZIP oode On November 1, 2000 Ira Keyes and Mary Yellen formed Comparative Advantage, Ltd., to sell high-end consulting services to people trying to make their pets Instagram stars. Pertinent information regarding Comparative Advantage, Ltd. is as follows: 1) Comparative' business Address is 5555 Nevermind, Dr., Charlotte, N.C. 20631. Its telephone number is (555)555-2211, and its email address is 2) The employer identification number is 11-111112, and principal business activity code is 453910 . 3) Ira owns 50% and Mary 50% of the company, and they are both full-time employees and officers of the company. They each paid $2,500,000 for their interests in the company when it was formed. No subsequent investments have been made. 4) Ira's Social security number is 123-45-6788, Mary's social security number is 123-45-6787. 5) Comparative is an accrual method, calendar year taxpayer. It uses the straight line method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes. 6) The company's average receipts for the prior three years were $3,000,000 7) The company had an accumulated NOL at the beginning of the year equal to $1,000,000. The NOL was generated during 2021 8) During the year the company made $300,000 of cash distributions to its owners 9) The entity has no foreign owners, and doesn't engage in any international activity. 10) The company did not pay any 1099 contractors for the year. 11) If the return is asking a yeso question and the transaction or activity is not mentioned in the problem, assume the answer is no The Appendix provides the book Income Statement and Balance Sheet for Comparative's 2022 fiscal year. IF ORGANIZED AS A PARTNERSHIP Balance Sheet January 1st December 31st \begin{tabular}{lcc} Cash & 1,300,000 & 2,216,250 \\ Accounts Receivable & 2,150,000 & 2,160,000 \\ Investment in State Municipal Bonds & 370,000 & 375,000 \\ Stock Investments & 3,875,000 & 4,500,000 \\ Certificates of Deposit & 300,000 & 450,000 \\ Buildings and other Depreciable Assets & 5,600,000 & 5,600,000 \\ Accumulated Depreciation & (616,000) & (712,000) \\ Land & 1,052,500 & 1,041,000 \\ \cline { 2 - 3 } & & \\ Total assets & 14,031,500 & 15,630,250 \\ & & \\ Liabilities and Equity & & \\ Accounts Payable & 2,484,000 & 2,840,000 \\ Other current Liabilities & 180,000 & 155,000 \\ Business Loan & 2,500,000 & 3,000,000 \\ Mortgages due in more than 1 year & 3,125,000 & 2,625,000 \\ Capital Account & 5,742,500 & 7,010,250 \\ & & \\ & & \\ Total Liabilities and Equity & 14,031,500 & 15,630,250 \\ \hline \end{tabular} General partnership 1) You are required to prepare the 2022 form 1065 pages 1-5. No other sub-schedules are required. If something on those pages is not relevant for this company you can leave it blank. As above, you do not have to complete schedule M3 even though the assets are over $10,000,000. 2) Prepare the Schedule K-1 for Ira. 3) The salaries paid to Ira and Mary are considered guaranteed payments for services performed. 4) All partners are jointly and severally liable for any partnership debt. 5) Ira is considered the Partnership's Representative and the General Partner and uses the address and telephone number of the company as his address. 6) The partnership agreement states all allocable items will be split equally between the partners. 7) You can assume the beginning book capital account balance is split equally between the partners and is equal to the beginning tax basis capital account balance. Final K1 Amended K-1 OMB No. 1545-0123 Schedule K-1 Part III Partner's Share of Current Year Income, (Form 1065) 2022 Deductions, Credits, and Other Items Department of the Treasury Internal Revenue Service 1. Ordinary business inoome (loss) 14 Self-employment earings (l0es) begining 4/2022 ending /1/1 2 Net rental real estate income flossi Partner's Share of Income, Deductions, 3 Other net rental income (loss) 15 Credts Credits, etc. See separate instructions. Part I Information About the Partnership A Partnership's emplaver identification number B Partnership's name, address, city, state, and ZIP oode