Answered step by step

Verified Expert Solution

Question

1 Approved Answer

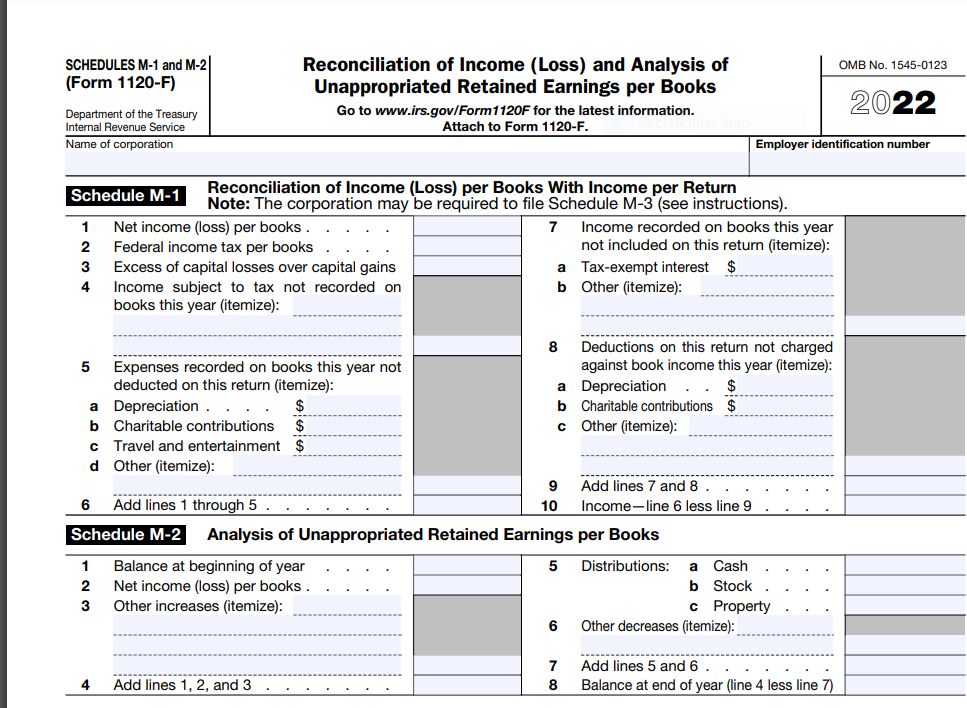

Prepare the Schedule M-1 using the following book-tax information. Begin with book income and make adjustments to book income to arrive at taxable income. Use

Prepare the Schedule M-1 using the following book-tax information. Begin with book income and make adjustments to book income to arrive at taxable income. Use the following data to complete the Schedule M-1 pictured below:

- Net income per books (after-tax): $181,230

- Federal income tax expense per books: $88,300

- Tax-exempt interest income: $9,000

- MACRS depreciation in excess of straight-line depreciation: $14,400

- Excess of capital loss over capital gains: $7,200

- Nondeductible meals and entertainment: $6,450

- Interest on loan to purchase tax-exempt bonds: $1,100

SCHEDULES M-1 and M-2 (Form 1120-F) Department of the Treasury Internal Revenue Service Name of corporation Schedule M-1 1 2 3 4 5 6 1 2 3 Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per Books Go to www.irs.gov/Form1120F for the latest information. Attach to Form 1120-F. 4 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). 7 Net income (loss) per books. Federal income tax per books Excess of capital losses over capital gains a Depreciation. b Charitable contributions c Travel and entertainment $ d Other (itemize): Income subject to tax not recorded on books this year (itemize): Expenses recorded on books this year not deducted on this return (itemize): Balance at beginning of year Net income (loss) per books. Other increases (itemize): Add lines 1, 2, and 3 Add lines 1 through 5 Schedule M-2 Analysis of Unappropriated Retained Earnings per Books Distributions: a b Other (itemize): 9 10 8 Deductions on this return not charged against book income this year (itemize): a Depreciation $ b Charitable contributions $ C Other (itemize): 5 Income recorded on books this year not included on this return (itemize): Tax-exempt interest $ 6 7 8 Add lines 7 and 8. Income-line 6 less line 9 Employer identification number a Cash b Stock c Property Other decreases (itemize): OMB No. 1545-0123 Add lines 5 and 6. Balance at end of year (line 4 less line 7) 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the Schedule M1 would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started