Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the Statement of Cash Flow of Loft Ltd for the year ended 31 March 2017. Note: Ignore VAT. Use indirect method QUESTION ONE (49

Prepare the Statement of Cash Flow of Loft Ltd for the year ended 31 March 2017. Note: Ignore VAT. Use indirect method

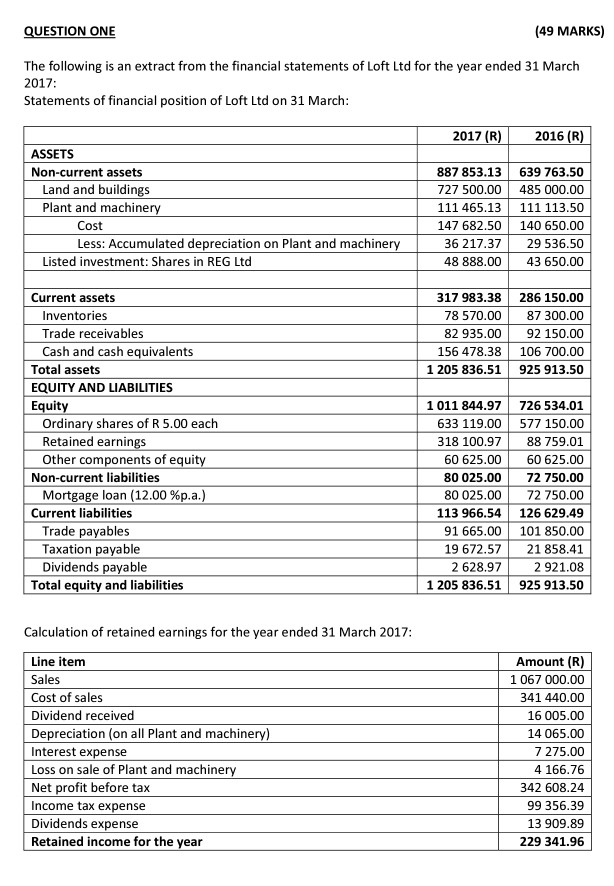

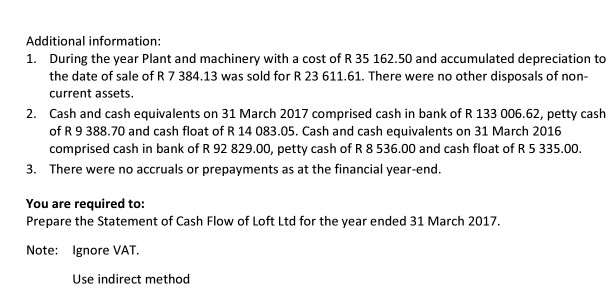

QUESTION ONE (49 MARKS) The following is an extract from the financial statements of Loft Ltd for the year ended 31 March 2017: Statements of financial position of Loft Ltd on 31 March: 2017 (R) 2016 (R) ASSETS Non-current assets Land and buildings Plant and machinery Cost Less: Accumulated depreciation on Plant and machinery Listed investment: Shares in REG Ltd 887 853.13 639 763.50 727 500.00 485 000.00 111 465.13 111 113.50 147 682.50 140 650.00 36 217.37 29 536.50 48 888.00 43 650.00 317 983.38 78 570.00 82 935.00 156 478.38 1 205 836.51 286 150.00 87 300.00 92 150.00 106 700.00 925 913.50 Current assets Inventories Trade receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Ordinary shares of R 5.00 each Retained earnings Other components of equity Non-current liabilities Mortgage loan (12.00 %p.a.) Current liabilities Trade payables Taxation payable Dividends payable Total equity and liabilities 1 011 844.97 633 119.00 318 100.97 60 625.00 80 025.00 80 025.00 113 966.54 91 665.00 19 672.57 2 628.97 1 205 836.51 726 534.01 577 150.00 88 759.01 60 625.00 72 750.00 72 750.00 126 629.49 101 850.00 21 858.41 2921.08 925 913.50 Calculation of retained earnings for the year ended 31 March 2017: Line item Sales Cost of sales Dividend received Depreciation (on all Plant and machinery) Interest expense Loss on sale of Plant and machinery Net profit before tax Income tax expense Dividends expense Retained income for the year Amount (R) 1 067 000.00 341 440.00 16 005.00 14 065.00 7 275.00 4 166.76 342 608.24 99 356.39 13 909.89 229 341.96 Additional information: 1. During the year Plant and machinery with a cost of R 35 162.50 and accumulated depreciation to the date of sale of R 7 384.13 was sold for R 23 611.61. There were no other disposals of non- current assets. 2. Cash and cash equivalents on 31 March 2017 comprised cash in bank of R 133 006.62, petty cash of R 9 388.70 and cash float of R 14 083.05. Cash and cash equivalents on 31 March 2016 comprised cash in bank of R 92 829.00, petty cash of R 8 536.00 and cash float of R 5 335.00. 3. There were no accruals or prepayments as at the financial year-end. You are required to: Prepare the Statement of Cash Flow of Loft Ltd for the year ended 31 March 2017 Note: Ignore VAT. Use indirect method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started