Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the statement of cash flows for Hooves and Boots Ltd for the year ended 31 December 2019. show all workings clearly and the reconciliation

Prepare the statement of cash flows for Hooves and Boots Ltd for the year ended 31 December 2019.

show all workings clearly and the reconciliation of profit befor tax and cash generated fem operations is not required.

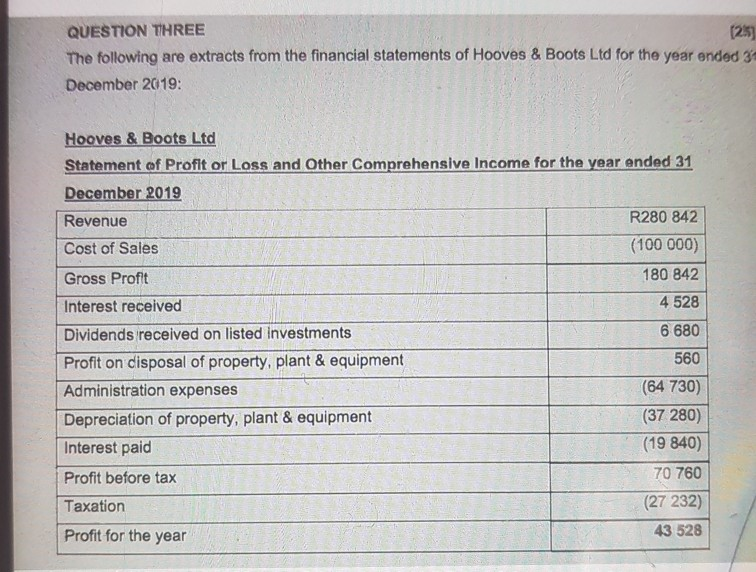

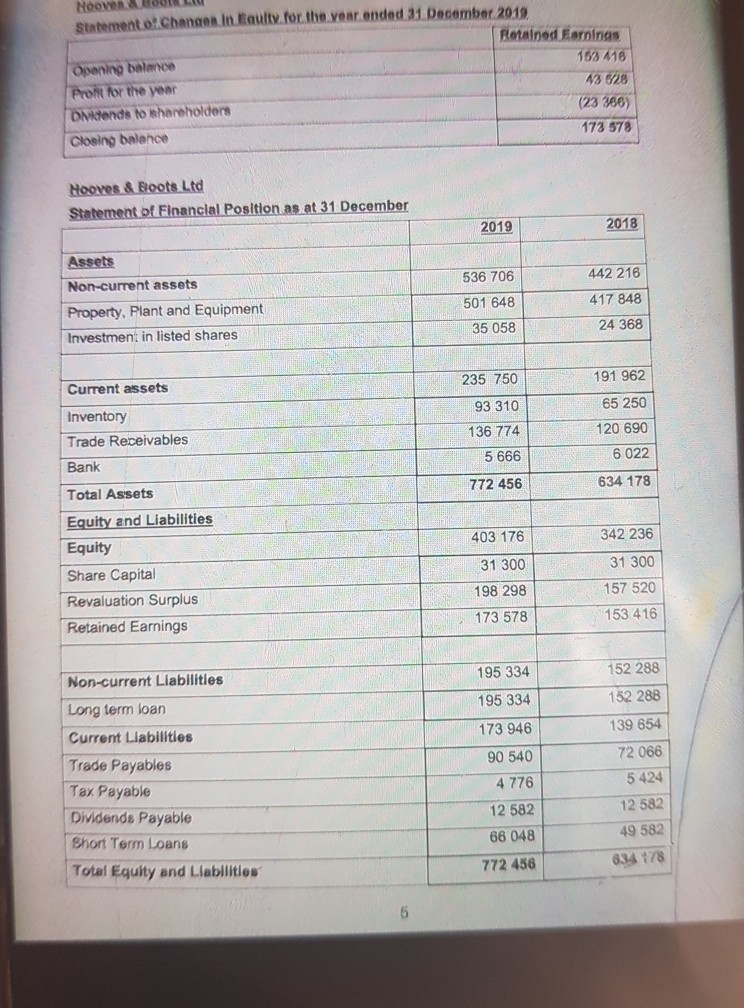

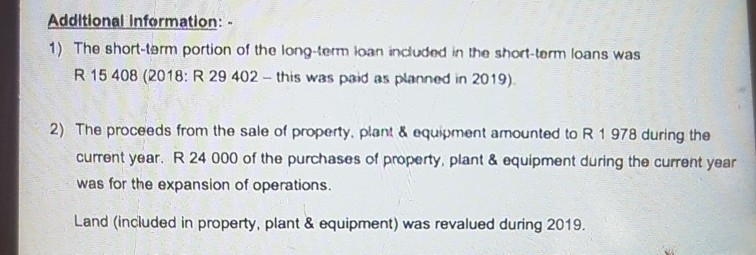

QUESTION THREE (25) The following are extracts from the financial statements of Hooves & Boots Ltd for the year ended 3 December 2019: Hooves & Boots Ltd Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019 Revenue R280 842 Cost of Sales (100 000) Gross Profit 180 842 Interest received 4 528 Dividends received on listed Investments 6 680 Profit on disposal of property, plant & equipment 560 Administration expenses (64 730) Depreciation of property, plant & equipment (37 280) Interest paid (19 840) Profit before tax 70 760 Taxation (27 232) Profit for the year 43 528 Hoover Statement of Changen in Eaulty for the year ended 31 December 2019 Ronalnod Earnings Opening balance 16/3 M8 Proint for the year 13 528 Ditends to shareholders (23366) Closing balance 173 578 Hooves & Boots Ltd Statement of Financial Position as at 31 December 2019 2018 Assets 536 706 442 216 Non-current assets 501 648 417 848 Property, Plant and Equipment Investment in listed shares 35 058 24 368 235 750 191 962 Current assets 93 310 65 250 136 774 120 690 Inventory Trade Receivables Bank 5 666 6 022 772 456 634 178 403 176 342 236 Total Assets Equity and Liabilities Equity Share Capital Revaluation Surplus Retained Earnings 31 300 31 300 198 298 157 520 173 578 153 416 195 334 195 334 Non-current Liabilities Long term loan Current Liabilities 152 288 152 288 139 654 173 946 90 540 4 776 Trade Payables Tax Payable Dividends Payable Short Term Loans Total Equity and Liabilities 72 066 5424 12 582 49 582 12 582 66 048 772 456 634 178 5 Additional Information: - 1) The short-term portion of the long-term loan included in the short-term loans was R 15 408 (2018: R 29 402 - this was paid as planned in 2019) 2) The proceeds from the sale of property, plant & equipment amounted to R 1 978 during the current year. R 24 000 of the purchases of property, plant & equipment during the current year was for the expansion of operations. Land (included in property, plant & equipment) was revalued during 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started