Prepare the statement of cash flows for TS plc for the year ended 30 September 2020 in accordance with IAS 7 Statement of Cash Flows using the indirect method.

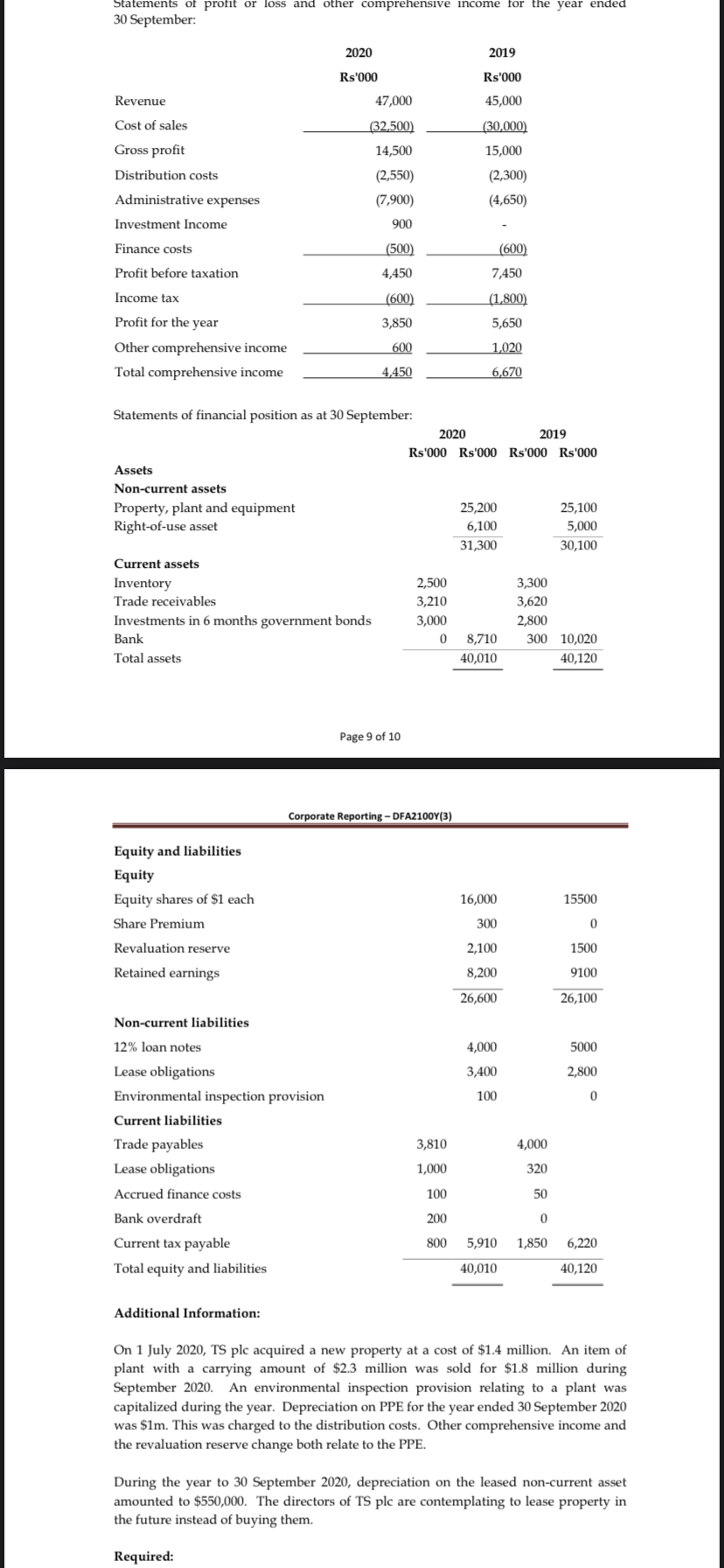

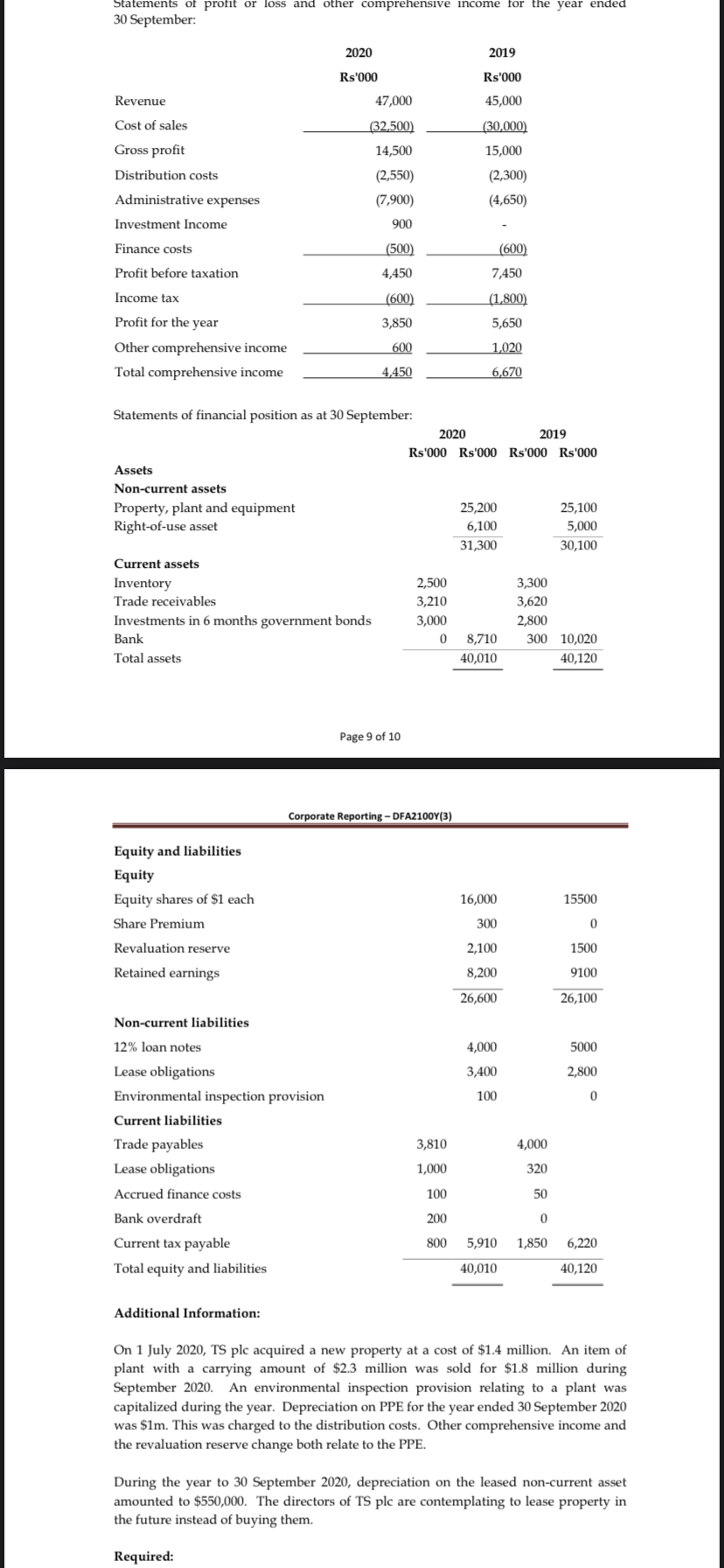

30 September: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment Income Finance costs Profit before taxation Income tax Profit for the year Other comprehensive income Total comprehensive income Statements of financial position as at 30 September: Assets Non-current assets Property, plant and equipment Right-of-use asset Current assets Inventory Trade receivables Investments in 6 months government bonds Bank Total assets \\begin{tabular}{rrrr} 2,500 & & 3,300 & \\\\ 3,210 & & 3,620 & \\\\ 3,000 & & 2,800 & \\\\ 0 & 8,710 & 300 & 10,020 \\\\ \\hline & 40,010 & & 40,120 \\\\ \\cline { 4 - 5 } & & & \\end{tabular} Page 9 of 10 Corporate Reporting - DFA2100Y(3) Equity and liabilities Equity Equity shares of \\$1 each Share Premium Revaluation reserve Retained earnings Non-current liabilities \12 loan notes Lease obligations Environmental inspection provision Current liabilities Trade payables Lease obligations Accrued finance costs Bank overdraft Current tax payable Total equity and liabilities \\begin{tabular}{rr} 16,000 & 15500 \\\\ 300 & 0 \\\\ 2,100 & 1500 \\\\ 8,200 & 9100 \\\\ \\hline 26,600 & 26,100 \\end{tabular} \\( \\begin{array}{rr}4,000 & 5000 \\\\ 3,400 & 2,800 \\\\ 100 & 0\\end{array} \\) \\begin{tabular}{rrrr} 3,810 & & 4,000 & \\\\ 1,000 & & 320 & \\\\ 100 & & 50 & \\\\ 200 & & 0 & \\\\ 800 & 5,910 & 1,850 & 6,220 \\\\ \\hline & 40,010 & & 40,120 \\\\ & & & \\end{tabular} Additional Information: On 1 July 2020, TS plc acquired a new property at a cost of \\( \\$ 1.4 \\) million. An item of plant with a carrying amount of \\( \\$ 2.3 \\) million was sold for \\( \\$ 1.8 \\) million during September 2020. An environmental inspection provision relating to a plant was capitalized during the year. Depreciation on PPE for the year ended 30 September 2020 was \\( \\$ 1 \\mathrm{~m} \\). This was charged to the distribution costs. Other comprehensive income and the revaluation reserve change both relate to the PPE. During the year to 30 September 2020, depreciation on the leased non-current asset amounted to \\( \\$ 550,000 \\). The directors of TS plc are contemplating to lease property in the future instead of buying them. Required: 30 September: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment Income Finance costs Profit before taxation Income tax Profit for the year Other comprehensive income Total comprehensive income Statements of financial position as at 30 September: Assets Non-current assets Property, plant and equipment Right-of-use asset Current assets Inventory Trade receivables Investments in 6 months government bonds Bank Total assets \\begin{tabular}{rrrr} 2,500 & & 3,300 & \\\\ 3,210 & & 3,620 & \\\\ 3,000 & & 2,800 & \\\\ 0 & 8,710 & 300 & 10,020 \\\\ \\hline & 40,010 & & 40,120 \\\\ \\cline { 4 - 5 } & & & \\end{tabular} Page 9 of 10 Corporate Reporting - DFA2100Y(3) Equity and liabilities Equity Equity shares of \\$1 each Share Premium Revaluation reserve Retained earnings Non-current liabilities \12 loan notes Lease obligations Environmental inspection provision Current liabilities Trade payables Lease obligations Accrued finance costs Bank overdraft Current tax payable Total equity and liabilities \\begin{tabular}{rr} 16,000 & 15500 \\\\ 300 & 0 \\\\ 2,100 & 1500 \\\\ 8,200 & 9100 \\\\ \\hline 26,600 & 26,100 \\end{tabular} \\( \\begin{array}{rr}4,000 & 5000 \\\\ 3,400 & 2,800 \\\\ 100 & 0\\end{array} \\) \\begin{tabular}{rrrr} 3,810 & & 4,000 & \\\\ 1,000 & & 320 & \\\\ 100 & & 50 & \\\\ 200 & & 0 & \\\\ 800 & 5,910 & 1,850 & 6,220 \\\\ \\hline & 40,010 & & 40,120 \\\\ & & & \\end{tabular} Additional Information: On 1 July 2020, TS plc acquired a new property at a cost of \\( \\$ 1.4 \\) million. An item of plant with a carrying amount of \\( \\$ 2.3 \\) million was sold for \\( \\$ 1.8 \\) million during September 2020. An environmental inspection provision relating to a plant was capitalized during the year. Depreciation on PPE for the year ended 30 September 2020 was \\( \\$ 1 \\mathrm{~m} \\). This was charged to the distribution costs. Other comprehensive income and the revaluation reserve change both relate to the PPE. During the year to 30 September 2020, depreciation on the leased non-current asset amounted to \\( \\$ 550,000 \\). The directors of TS plc are contemplating to lease property in the future instead of buying them. Required