Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the Statement of Changes in Equity for the year ended 28 February 2020 as per MFRS 101 Presentation of Financial Statements. The following information

| Prepare the Statement of Changes in Equity for the year ended 28 February 2020 |

| as per MFRS 101 Presentation of Financial Statements. |

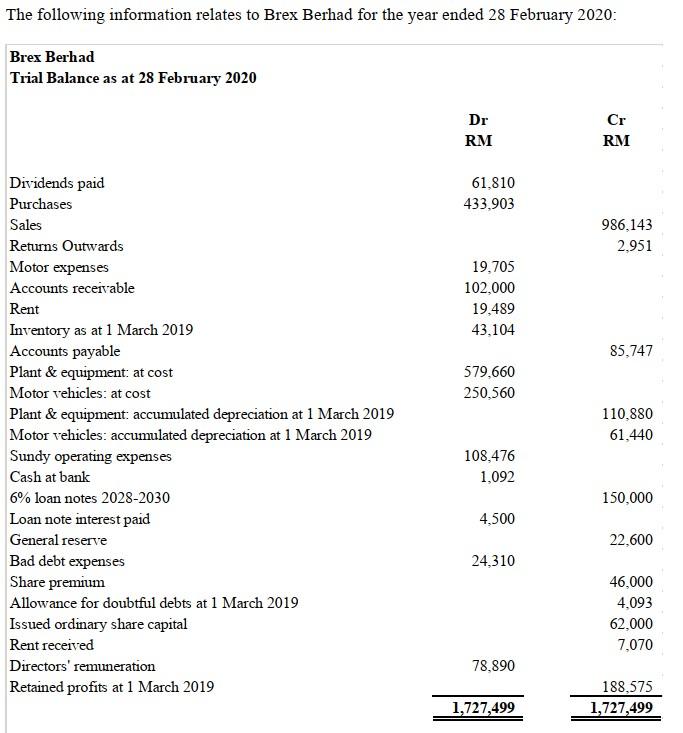

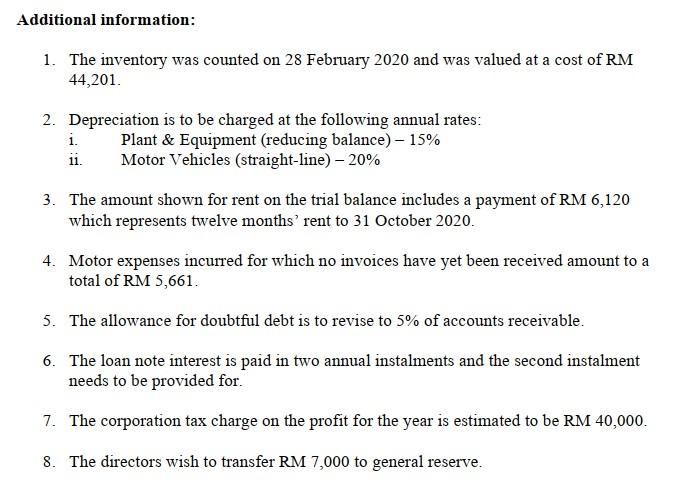

The following information relates to Brex Berhad for the year ended 28 February 2020: Brex Berhad Trial Balance as at 28 February 2020 Dr RM Cr RM Dividends paid Purchases Sales 986,143 Returns Outwards 2,951 Motor expenses Accounts receivable Rent Inventory as at 1 March 2019 Accounts payable 85,747 Plant & equipment: at cost Motor vehicles: at cost 110,880 Plant & equipment: accumulated depreciation at 1 March 2019 Motor vehicles: accumulated depreciation at 1 March 2019 Sundy operating expenses 61,440 Cash at bank 6% loan notes 2028-2030 150,000 Loan note interest paid General reserve 22,600 Bad debt expenses Share premium 46,000 Allowance for doubtful debts at 1 March 2019 4,093 Issued ordinary share capital 62,000 Rent received 7,070 Directors' remuneration Retained profits at 1 March 2019 188,575 1,727,499 61,810 433,903 19,705 102,000 19,489 43,104 579,660 250,560 108,476 1,092 4,500 24,310 78,890 1,727,499 Additional information: 1. The inventory was counted on 28 February 2020 and was valued at a cost of RM 44,201. 2. Depreciation is to be charged at the following annual rates: Plant & Equipment (reducing balance) - 15% i. 11. Motor Vehicles (straight-line) - 20% 3. The amount shown for rent on the trial balance includes a payment of RM 6,120 which represents twelve months' rent to 31 October 2020. 4. Motor expenses incurred for which no invoices have yet been received amount to a total of RM 5,661. 5. The allowance for doubtful debt is to revise to 5% of accounts receivable. 6. The loan note interest is paid in two annual instalments and the second instalment needs to be provided for. 7. The corporation tax charge on the profit for the year is estimated to be RM 40,000. 8. The directors wish to transfer RM 7,000 to general reserve

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started