Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the statement of financial position and determine the account of cash. 2. Prepare the supporting notes. 3. Prepare the statement of changes in

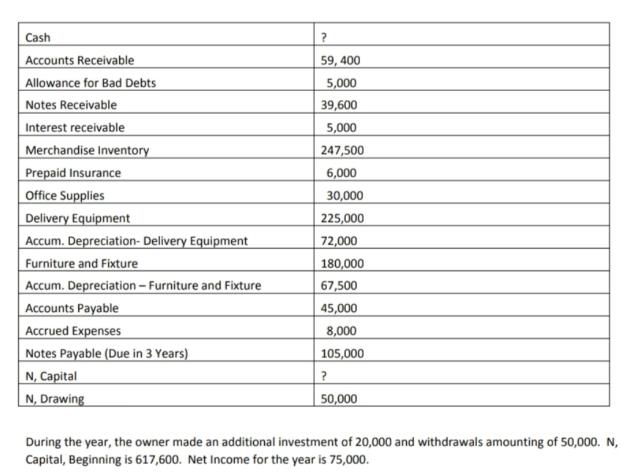

Prepare the statement of financial position and determine the account of cash. 2. Prepare the supporting notes. 3. Prepare the statement of changes in owner's equity. Cash Accounts Receivable Allowance for Bad Debts Notes Receivable Interest receivable Merchandise Inventory Prepaid Insurance Office Supplies Delivery Equipment Accum. Depreciation- Delivery Equipment Furniture and Fixture Accum. Depreciation - Furniture and Fixture Accounts Payable Accrued Expenses Notes Payable (Due in 3 Years) N, Capital N, Drawing ? 59, 400 5,000 39,600 5,000 247,500 6,000 30,000 225,000 72,000 180,000 67,500 45,000 8,000 105,000 ? 50,000 During the year, the owner made an additional investment of 20,000 and withdrawals amounting of 50,000. N, Capital, Beginning is 617,600. Net Income for the year is 75,000.

Step by Step Solution

★★★★★

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information lets complete the following tasks step by step 1 Prepare the statement of financial position and determine the account of cash 2 Prepare the supporting notes 3 Prepar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started