prepare the statemwnt of cash flows for this. thank you.

please do this by 2 hours for a thumbs up rating.

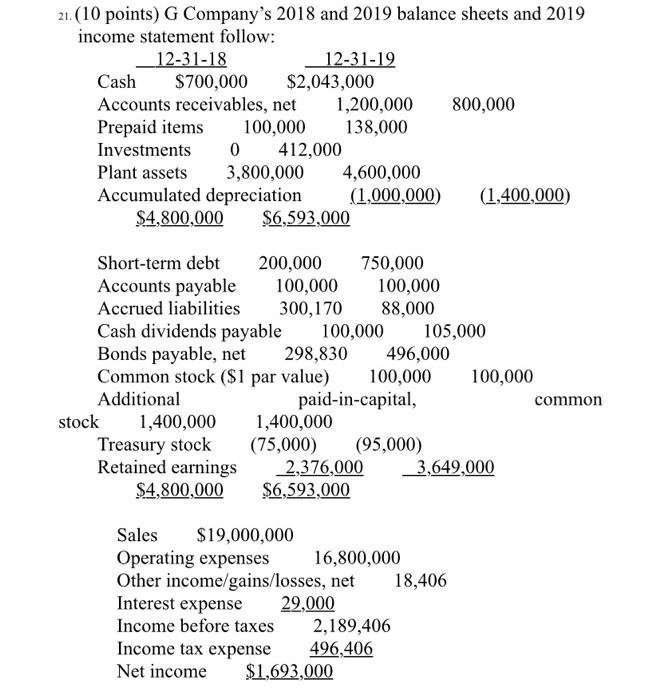

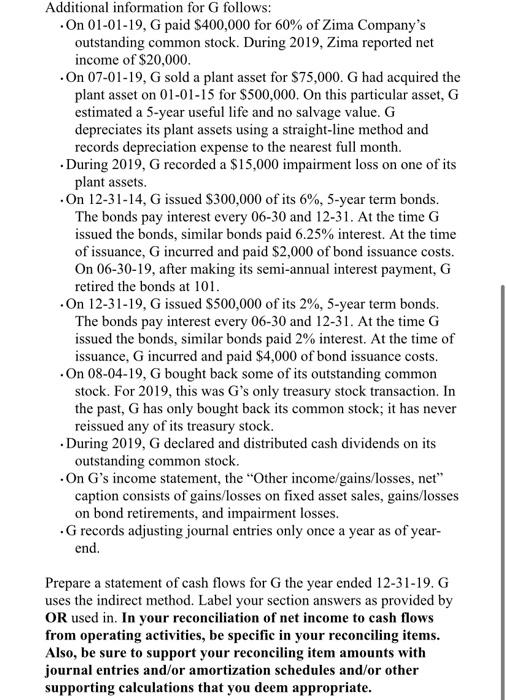

21 (10 points) G Company's 2018 and 2019 balance sheets and 2019 income statement follow: 12-31-18 12-31-19 Cash $700,000 $2,043,000 Accounts receivables, net 1,200,000 800,000 Prepaid items 100,000 138,000 Investments 0 412,000 Plant assets 3,800,000 4,600,000 Accumulated depreciation (1,000,000) (1,400,000) $4,800,000 $6,593,000 Short-term debt 200,000 750,000 Accounts payable 100,000 100,000 Accrued liabilities 300,170 88,000 Cash dividends payable 100,000 105,000 Bonds payable, net 298,830 496,000 Common stock ($1 par value) 100,000 100,000 Additional paid-in-capital, common stock 1,400,000 1,400,000 Treasury stock (75,000) (95,000) Retained earnings 2,376,000 3,649,000 $4,800,000 $6,593.000 Sales $19,000,000 Operating expenses 16,800,000 Other income/gains/losses, net 18,406 Interest expense 29,000 Income before taxes 2,189,406 Income tax expense 496,406 Net income $1,693,000 Additional information for G follows: On 01-01-19, G paid $400,000 for 60% of Zima Company's outstanding common stock. During 2019, Zima reported net income of $20,000. On 07-01-19, G sold a plant asset for $75,000. G had acquired the plant asset on 01-01-15 for $500,000. On this particular asset, G estimated a 5-year useful life and no salvage value. G depreciates its plant assets using a straight-line method and records depreciation expense to the nearest full month. . During 2019, G recorded a $15,000 impairment loss on one of its plant assets. On 12-31-14, G issued $300,000 of its 6%, 5-year term bonds. The bonds pay interest every 06-30 and 12-31. At the time G issued the bonds, similar bonds paid 6.25% interest. At the time of issuance, G incurred and paid $2,000 of bond issuance costs. On 06-30-19, after making its semi-annual interest payment, G retired the bonds at 101. On 12-31-19, G issued $500,000 of its 2%, 5-year term bonds. The bonds pay interest every 06-30 and 12-31. At the time G issued the bonds, similar bonds paid 2% interest. At the time of issuance, G incurred and paid $4,000 of bond issuance costs. On 08-04-19, G bought back some of its outstanding common stock. For 2019, this was G's only treasury stock transaction. In the past, G has only bought back its common stock; it has never reissued any of its treasury stock. During 2019, 6 declared and distributed cash dividends on its outstanding common stock On G's income statement, the "Other income/gains/losses, net" caption consists of gains/losses on fixed asset sales, gains/losses on bond retirements, and impairment losses. G records adjusting journal entries only once a year as of year- end. Prepare a statement of cash flows for the year ended 12-31-19. G uses the indirect method. Label your section answers as provided by OR used in. In your reconciliation of net income to cash flows from operating activities, be specific in your reconciling items. Also, be sure to support your reconciling item amounts with journal entries and/or amortization schedules and/or other supporting calculations that you deem appropriate