- Prepare the supplementary income statement for 2018 by applying CPP approach.

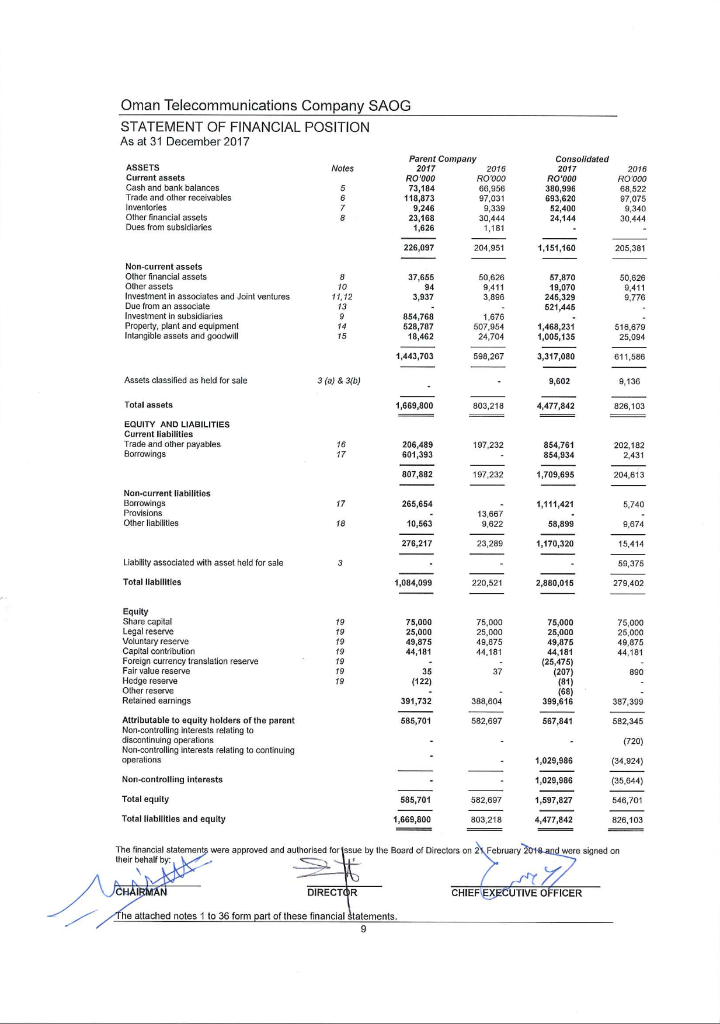

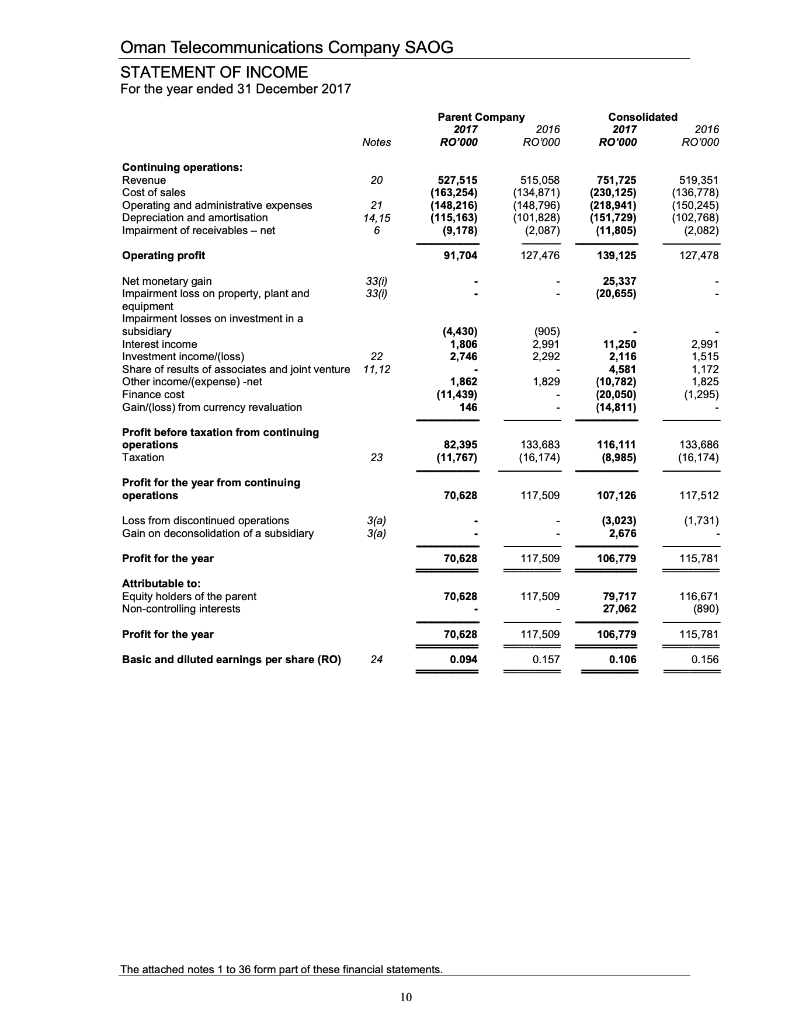

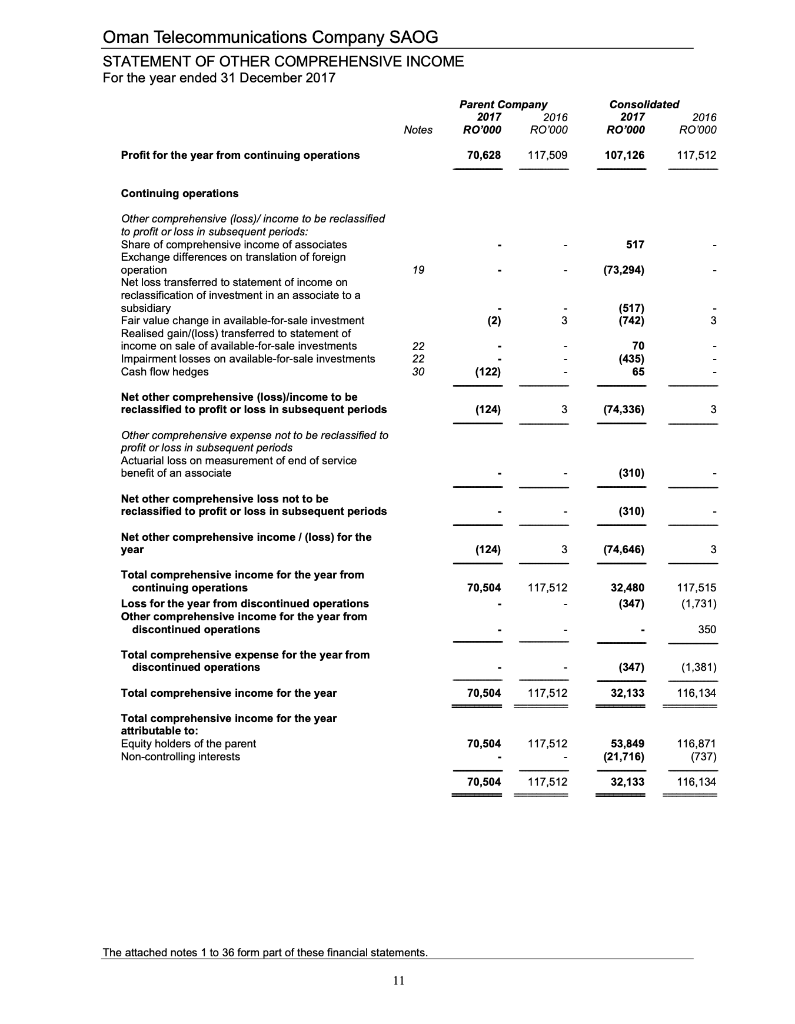

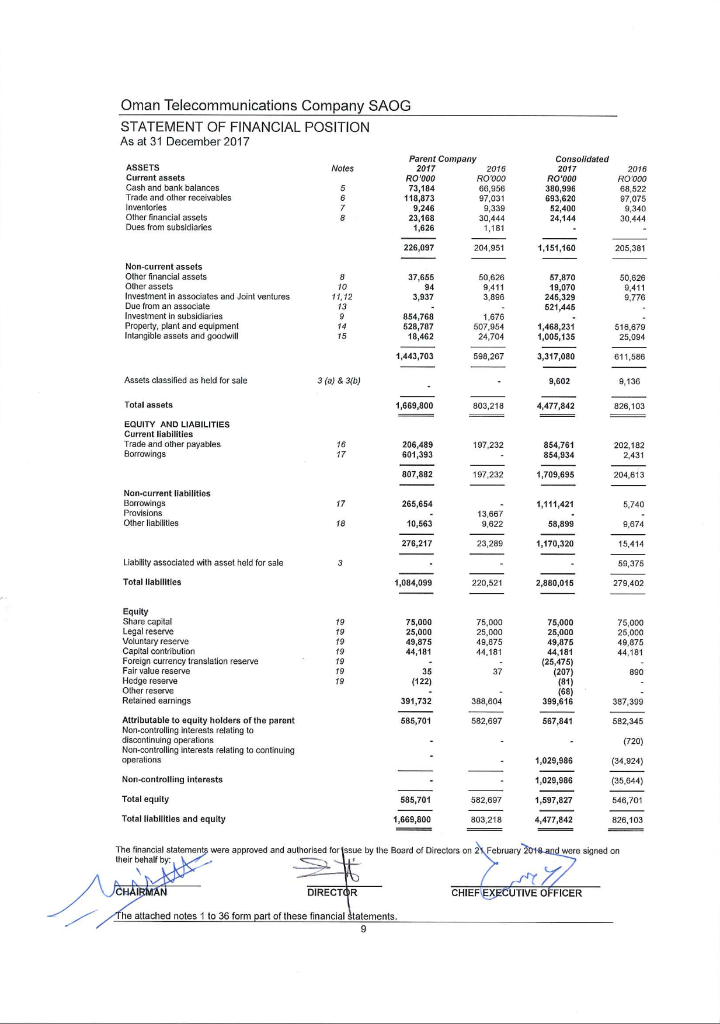

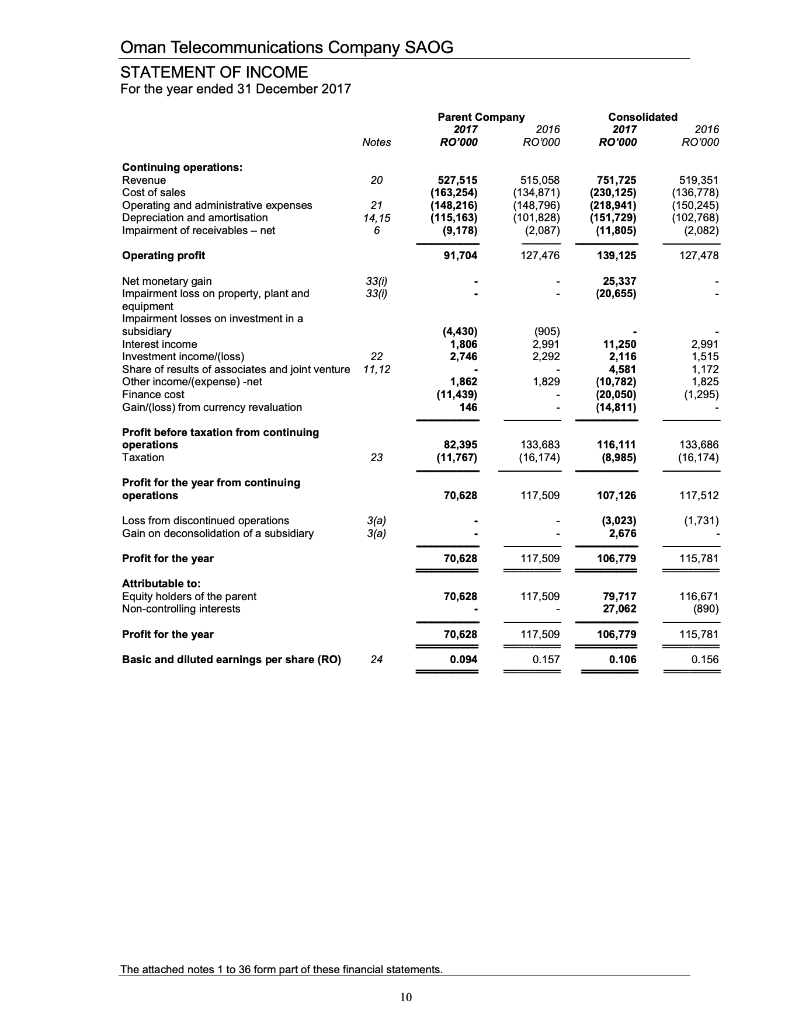

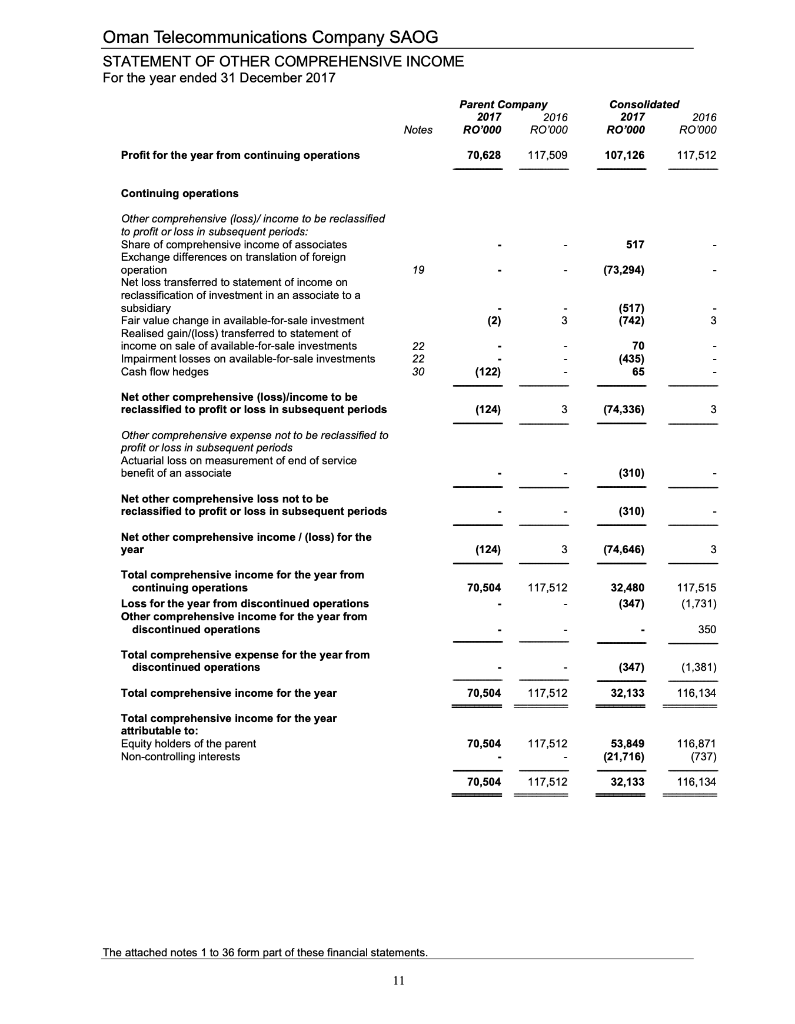

Oman Telecommunications Company SAOG STATEMENT OF FINANCIAL POSITION As at 31 December 2017 Parent Company ASSETS Notes 2017 2016 Current assets R0'000 R000 Cash and bank balances 73,184 66,956 Trade and other receivables 118,873 97,031 Inventories 9,246 9,339 Other financial assets 23,168 30,444 Dues from subsidiaries 1,626 1,181 Consolidated 2017 R0'000 380,996 693,620 2016 R000 68,522 87,075 9,340 30.444 52,400 24,144 226,097 204,951 1,151,160 205,381 Non-current assets Other financial assets Other assets Investment in associates and Joint ventures Due from an associate Investment in subsidiaries Property, plant and equipment Intangible assets and goodwill 37,655 94 3,937 50,626 9,411 3,896 8 10 11,12 13 9 14 15 57,870 19,070 245,329 521,446 50,626 9,411 9.770 854,768 528,787 18,462 1.676 507,954 24,704 1,468,231 1,005,135 518,870 25,094 1,443,703 598,267 3,317,080 611.586 Assets classified as held for sale 3 (a) & 3(b) 9,602 9,136 Total assets 1,669,800 803,218 4,477,842 826,103 EQUITY AND LIABILITIES Current liabilities Trade and other payables Borrowings 18 17 197,232 206,489 601,393 307,882 854,761 854,934 202,182 2,431 197 232 1,709,695 204,813 17 265,654 1,111,421 Non-current liabilities Borrowings Provisions Other liabilities 5,740 18 10,563 13,667 9,822 9,674 58,899 1,170,320 276,217 23,289 15,414 3 59,375 Liability associated with asset held for sale Total liabilities 1,084,099 220,521 2,880,015 279,402 19 19 19 19 19 19 19 75,000 25,000 49,875 44,181 75,000 25,000 49.875 44,181 75,000 25,000 49,875 44,181 75,000 25,000 49,875 44,181 (25,475) (207) (81) (68) 399,616 37 890 Equity Share capital Legal reserve Voluntary reserve Capital contribution Foreign currency translation reserve Fair value reserve Hodge reserve Other reserve Retained earnings Attributable to equity holders of the parent Non-controlling interests relating to discontinuing operations Non-controlling interests relating to continuing operations Non-controlling interests 35 (122) 391,732 388,604 387,399 585,701 582,697 567,841 562,345 (720) 1,029,986 (34,924) (35,644) 1,029,986 1,597,827 585,701 582.697 Total equity Total llabilities and equity 546,701 826,103 1,669,800 803,218 4,477,842 The financial statements were approved and authorised for issue by the Board of Directors on 21 February 2018 and were signed on their behalf by: LX u met CHARMAN DIRECTOR CHIEF EXECUTIVE OFFICER The attached notes 1 to 36 form part of these financial statements 9 Oman Telecommunications Company SAOG STATEMENT OF INCOME For the year ended 31 December 2017 Parent Company 2017 2016 RO'000 R0000 Consolidated 2017 2016 RO000 RO'000 Notes 20 Continuing operations: Revenue Cost of sales Operating and administrative expenses Depreciation and amortisation Impairment of receivables-net 21 14,15 6 6 527,515 (163,254) (148,216) (115,163) (9,178) 515,058 (134,871) (148,796) (101,828) (2,087) ( 751,725 (230,125) (218,941) (151,729) (11,805) 519,351 (136,778) (150,245) (102,768) (2,082) 91,704 127,476 139,125 127,478 33(0) 0 33(1) 25,337 (20,655) Operating profit Net monetary gain Impairment loss on property, plant and equipment Impairment losses on investment in a subsidiary Interest income Investment income/(loss) Share of results of associates and joint venture Other income/expense) -net Finance cost Gain (loss) from currency revaluation Profit before taxation from continuing operations (4,430) 1,806 2,746 (905) 2,991 2,292 22 11, 12 2.991 1,515 1,172 1,825 (1,295) 1,829 11,250 2,116 4,581 (10,782) (20,050) (14,811) 1,862 (11,439) 146 82,395 (11,767) 133,683 (16,174) 116,111 (8,985) Taxation 23 133,686 (16,174) Profit for the year from continuing operations 70,628 117,509 107,126 117,512 (1,731) Loss from discontinued operations Gain on deconsolidation of a subsidiary 3(a) 3(a) (3,023) 2,676 Profit for the year 70,628 117,509 106,779 115,781 Attributable to: Equity holders of the parent Non-controlling interests 70,628 117,509 79,717 27,062 116,671 (890) Profit for the year 70,628 117,509 106,779 115,781 Basic and diluted earnings per share (RO) 24 0.094 0.157 0.106 0.156 The attached notes 1 to 36 form part of these financial statements. 10 Oman Telecommunications Company SAOG STATEMENT OF OTHER COMPREHENSIVE INCOME For the year ended 31 December 2017 Parent Company 2017 2016 Notes RO'000 RO000 Consolidated 2017 2016 RO'000 RO000 Profit for the year from continuing operations 70,628 117,509 107,126 117,512 517 19 (73,294) Continuing operations Other comprehensive (loss) income to be reclassified to profit or loss in subsequent periods: Share of comprehensive income of associates Exchange differences on translation of foreign operation Net loss transferred to statement of income on reclassification of investment in an associate to a subsidiary Fair value change in available-for-sale investment Realised gain/(loss) transferred to statement of income on sale of available-for-sale investments Impairment losses on available-for-sale investments Cash flow hedges (2 (2) 3 (517) (742) 3 22 22 30 70 (435) 65 (122) Net other comprehensive (loss)/income to be reclassified to profit or loss in subsequent periods (124) 3 (74,336) Other comprehensive expense not to be reclassified to profit or loss in subsequent periods Actuarial loss on measurement of end of service benefit of an associate (310) (310) Net other comprehensive loss not to be reclassified to profit or loss in subsequent periods Net other comprehensive income / (loss) for the year (124) 3 (74,646) 70,504 117,512 Total comprehensive income for the year from continuing operations Loss for the year from discontinued operations Other comprehensive income for the year from discontinued operations 32,480 (347) | | | | 117,515 (1,731) Total comprehensive expense for the year from discontinued operations (347) (1,381) Total comprehensive income for the year 70,504 117,512 32,133 116,134 Total comprehensive income for the year attributable to: Equity holders of the parent Non-controlling interests 70,504 117,512 116,871 53,849 (21,716) 32,133 70,504 117,512 116,134 The attached notes 1 to 36 form part of these financial statements. 11 Oman Telecommunications Company SAOG STATEMENT OF FINANCIAL POSITION As at 31 December 2017 Parent Company ASSETS Notes 2017 2016 Current assets R0'000 R000 Cash and bank balances 73,184 66,956 Trade and other receivables 118,873 97,031 Inventories 9,246 9,339 Other financial assets 23,168 30,444 Dues from subsidiaries 1,626 1,181 Consolidated 2017 R0'000 380,996 693,620 2016 R000 68,522 87,075 9,340 30.444 52,400 24,144 226,097 204,951 1,151,160 205,381 Non-current assets Other financial assets Other assets Investment in associates and Joint ventures Due from an associate Investment in subsidiaries Property, plant and equipment Intangible assets and goodwill 37,655 94 3,937 50,626 9,411 3,896 8 10 11,12 13 9 14 15 57,870 19,070 245,329 521,446 50,626 9,411 9.770 854,768 528,787 18,462 1.676 507,954 24,704 1,468,231 1,005,135 518,870 25,094 1,443,703 598,267 3,317,080 611.586 Assets classified as held for sale 3 (a) & 3(b) 9,602 9,136 Total assets 1,669,800 803,218 4,477,842 826,103 EQUITY AND LIABILITIES Current liabilities Trade and other payables Borrowings 18 17 197,232 206,489 601,393 307,882 854,761 854,934 202,182 2,431 197 232 1,709,695 204,813 17 265,654 1,111,421 Non-current liabilities Borrowings Provisions Other liabilities 5,740 18 10,563 13,667 9,822 9,674 58,899 1,170,320 276,217 23,289 15,414 3 59,375 Liability associated with asset held for sale Total liabilities 1,084,099 220,521 2,880,015 279,402 19 19 19 19 19 19 19 75,000 25,000 49,875 44,181 75,000 25,000 49.875 44,181 75,000 25,000 49,875 44,181 75,000 25,000 49,875 44,181 (25,475) (207) (81) (68) 399,616 37 890 Equity Share capital Legal reserve Voluntary reserve Capital contribution Foreign currency translation reserve Fair value reserve Hodge reserve Other reserve Retained earnings Attributable to equity holders of the parent Non-controlling interests relating to discontinuing operations Non-controlling interests relating to continuing operations Non-controlling interests 35 (122) 391,732 388,604 387,399 585,701 582,697 567,841 562,345 (720) 1,029,986 (34,924) (35,644) 1,029,986 1,597,827 585,701 582.697 Total equity Total llabilities and equity 546,701 826,103 1,669,800 803,218 4,477,842 The financial statements were approved and authorised for issue by the Board of Directors on 21 February 2018 and were signed on their behalf by: LX u met CHARMAN DIRECTOR CHIEF EXECUTIVE OFFICER The attached notes 1 to 36 form part of these financial statements 9 Oman Telecommunications Company SAOG STATEMENT OF INCOME For the year ended 31 December 2017 Parent Company 2017 2016 RO'000 R0000 Consolidated 2017 2016 RO000 RO'000 Notes 20 Continuing operations: Revenue Cost of sales Operating and administrative expenses Depreciation and amortisation Impairment of receivables-net 21 14,15 6 6 527,515 (163,254) (148,216) (115,163) (9,178) 515,058 (134,871) (148,796) (101,828) (2,087) ( 751,725 (230,125) (218,941) (151,729) (11,805) 519,351 (136,778) (150,245) (102,768) (2,082) 91,704 127,476 139,125 127,478 33(0) 0 33(1) 25,337 (20,655) Operating profit Net monetary gain Impairment loss on property, plant and equipment Impairment losses on investment in a subsidiary Interest income Investment income/(loss) Share of results of associates and joint venture Other income/expense) -net Finance cost Gain (loss) from currency revaluation Profit before taxation from continuing operations (4,430) 1,806 2,746 (905) 2,991 2,292 22 11, 12 2.991 1,515 1,172 1,825 (1,295) 1,829 11,250 2,116 4,581 (10,782) (20,050) (14,811) 1,862 (11,439) 146 82,395 (11,767) 133,683 (16,174) 116,111 (8,985) Taxation 23 133,686 (16,174) Profit for the year from continuing operations 70,628 117,509 107,126 117,512 (1,731) Loss from discontinued operations Gain on deconsolidation of a subsidiary 3(a) 3(a) (3,023) 2,676 Profit for the year 70,628 117,509 106,779 115,781 Attributable to: Equity holders of the parent Non-controlling interests 70,628 117,509 79,717 27,062 116,671 (890) Profit for the year 70,628 117,509 106,779 115,781 Basic and diluted earnings per share (RO) 24 0.094 0.157 0.106 0.156 The attached notes 1 to 36 form part of these financial statements. 10 Oman Telecommunications Company SAOG STATEMENT OF OTHER COMPREHENSIVE INCOME For the year ended 31 December 2017 Parent Company 2017 2016 Notes RO'000 RO000 Consolidated 2017 2016 RO'000 RO000 Profit for the year from continuing operations 70,628 117,509 107,126 117,512 517 19 (73,294) Continuing operations Other comprehensive (loss) income to be reclassified to profit or loss in subsequent periods: Share of comprehensive income of associates Exchange differences on translation of foreign operation Net loss transferred to statement of income on reclassification of investment in an associate to a subsidiary Fair value change in available-for-sale investment Realised gain/(loss) transferred to statement of income on sale of available-for-sale investments Impairment losses on available-for-sale investments Cash flow hedges (2 (2) 3 (517) (742) 3 22 22 30 70 (435) 65 (122) Net other comprehensive (loss)/income to be reclassified to profit or loss in subsequent periods (124) 3 (74,336) Other comprehensive expense not to be reclassified to profit or loss in subsequent periods Actuarial loss on measurement of end of service benefit of an associate (310) (310) Net other comprehensive loss not to be reclassified to profit or loss in subsequent periods Net other comprehensive income / (loss) for the year (124) 3 (74,646) 70,504 117,512 Total comprehensive income for the year from continuing operations Loss for the year from discontinued operations Other comprehensive income for the year from discontinued operations 32,480 (347) | | | | 117,515 (1,731) Total comprehensive expense for the year from discontinued operations (347) (1,381) Total comprehensive income for the year 70,504 117,512 32,133 116,134 Total comprehensive income for the year attributable to: Equity holders of the parent Non-controlling interests 70,504 117,512 116,871 53,849 (21,716) 32,133 70,504 117,512 116,134 The attached notes 1 to 36 form part of these financial statements. 11