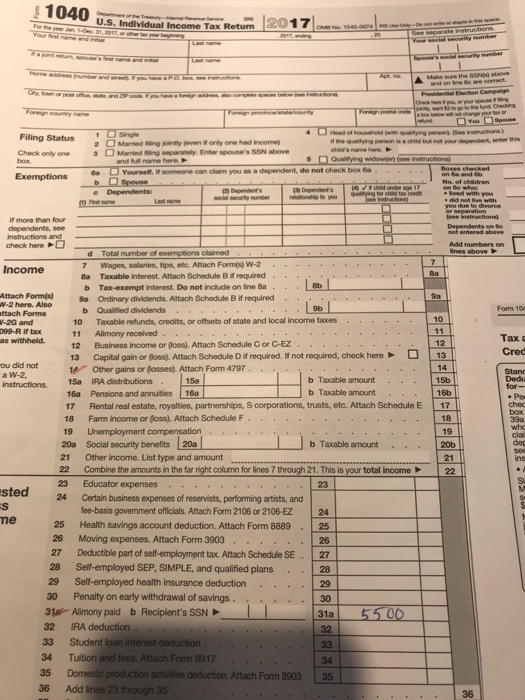

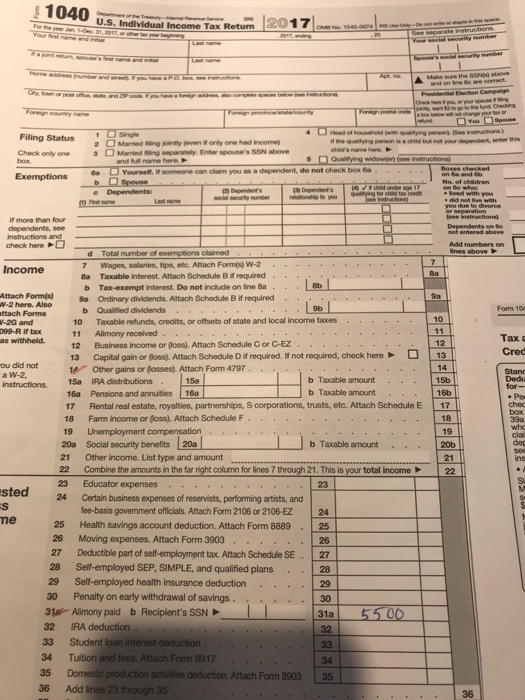

prepare the tax return for the year 2017

Please prepare the tax return in the form 1040( in the year 2017 )

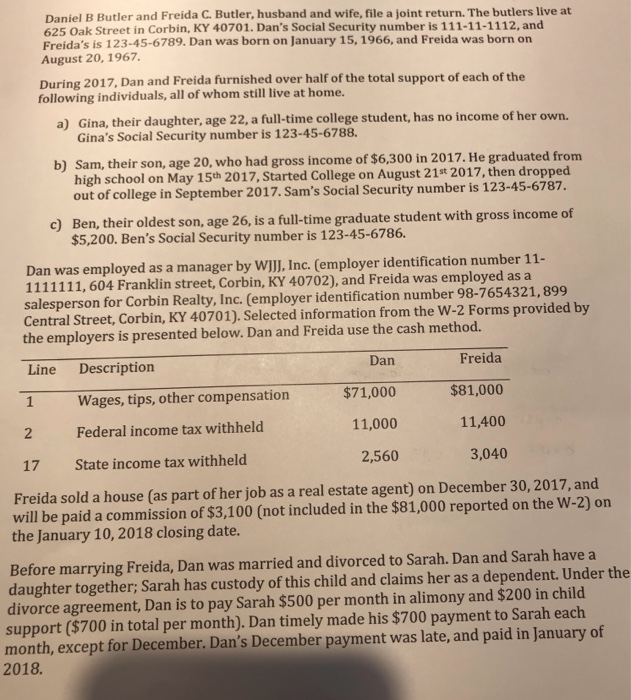

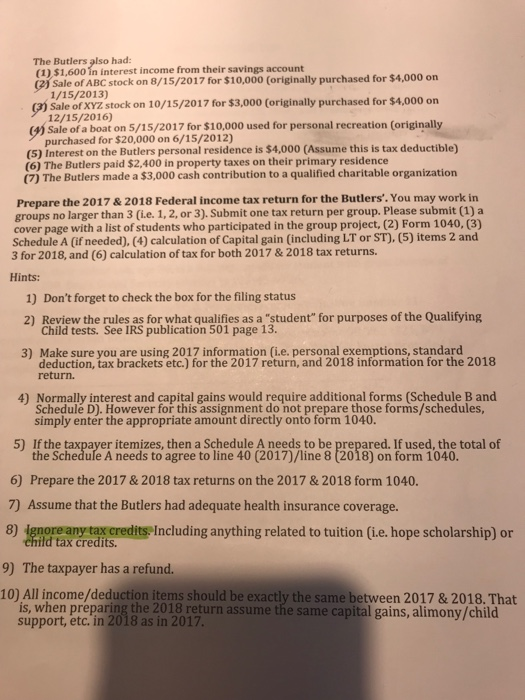

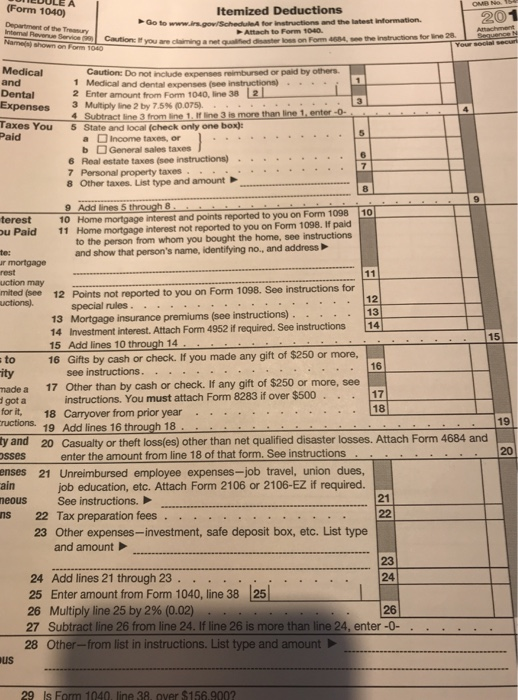

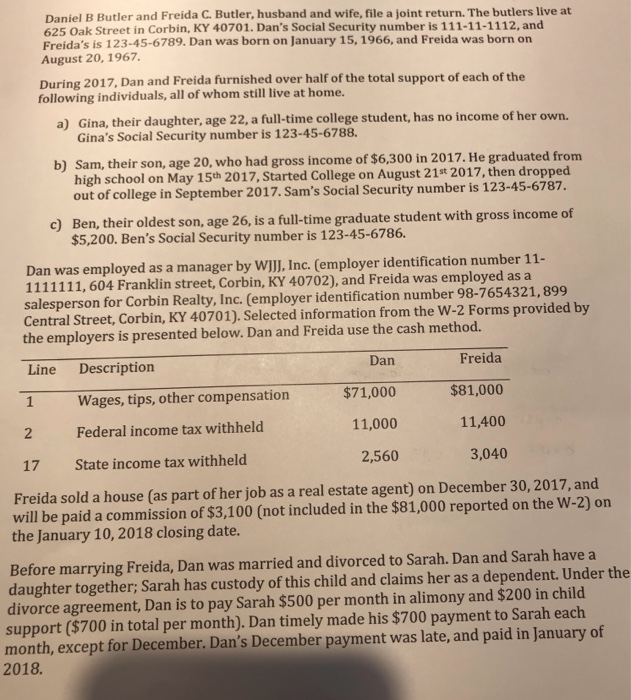

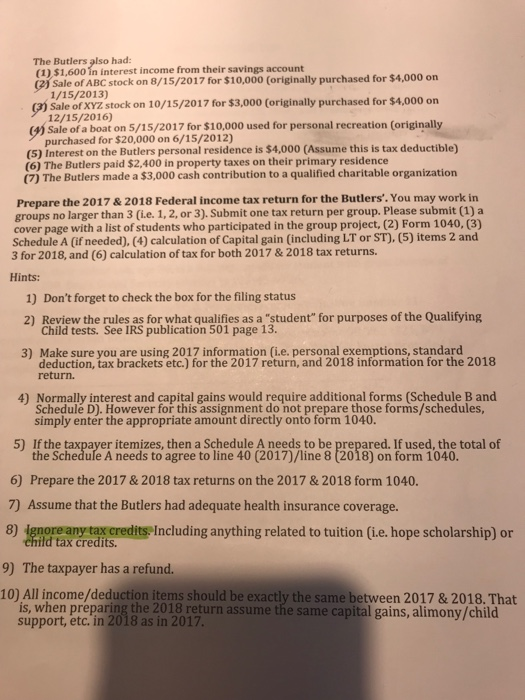

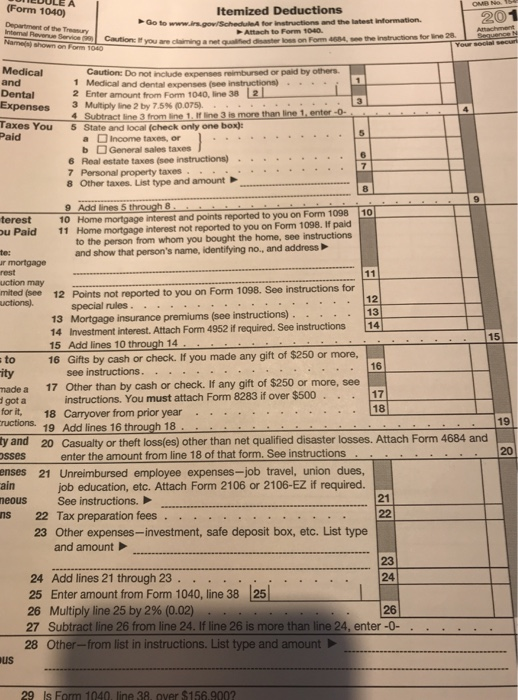

Daniel B Butler and Freida C. Butler, husband and wife, file a joint return. The butlers live at 625 Oak Street in Corbin, KY 40701. Dan's Social Security number is 111-11-1112, and Freida's is 123-45-6789. Dan was born on January 15, 1966, and Freida was born on August 20, 1967. 2017, Dan and Freida furnished over half of the total support of each of the During following individuals, all of whom still live at home. a) Gina, their daughter, age 22, a full-time college student, has no income of her own. Gina's Social Security number is 123-45-6788. b) Sam, their son, age 20, who had gross income of $6,300 in 2017. He graduat high school on May 15th 2017, Started College on August 21st 2017, then dropped out of college in September 2017. Sam's Social Security number is 123-45-6787. c) Ben, their oldest son, age 26, is a full-time graduate student with gross income of $5.200. Ben's Social Security number is 123-45-6786 Dan was employed as a manager by WI]I, Inc. (employer identification number 11- 1111111, 604 Franklin street, Corbin, KY 40702), and Freida was employed as a salesperson for Corbin Realty, Inc. (employer identification number 98-7654321,899 Central Street, Corbin, KY 40701). Selected information from the W-2 Forms provided by the employers is presented below. Dan and Freida use the cash method Freida $81,000 11,400 3,040 Line Description Dan $71,000 11,000 2,560 Wages, tips, other compensation 2 Federal income tax withheld 17 State income tax withhelod Freida sold a house (as part of her job as a real estate agent) on December 30, 2017, and will be paid a commission of $3,100 (not included in the $81,000 reported on the W-2) on the January 10, 2018 closing date. Before marrying Freida, Dan was married and divorced to Sarah. Dan and Sarah have a daughter together; Sarah has custody of this child and claims her as a dependent. Under the divorce agreement, Dan is to pay Sarah $500 per month in alimony and $200 in child support ($700 in total per month). Dan timely made his $700 payment to Sarah each month, except for December. Dan's December payment was late, and paid in January of 2018 (Form 1040) Itemized Deductions 201 Go to Intemal Revenue ServicCaution: # you are claiming a net oss on Form 4684, see the instructions for line 28 Caution: Do not include expenses reimbursed or paid by others Medical and dental expenses (see instructions) Enter amount from Form 1040, line 38 and Dental Expenses 3 Multiply ine 2 by 75% (0.075). axes You 5 State and local (check only one box) 1 2 4 Subtract line 3 from line 1. It line 3 is more than line 1 enter-O a Income taxes, or b General sales taxes 6 Real estate taxes (see instructions). 7 Personal property taxes 8 Other taxes. List type and amount Add lines 5 through 8 Home mortgage interest and points reported to you on Form 1098 10 Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 9 terest u Paid 10 11 te: r mortgage uction may mited (see 12 Point uctions). ts not reported to you on Form 1098. See instructions for 12 13 14 special rules 13 Mortgage insurance premiums (see instructions) 14 Investment interest. Attach Form 4952 if required. See instructions 15 Add lines 10 through 14 15 to 16 Gifts by cash or check. If you made any gift of $250 or more, ity made a 17 Other than by cash or check. If any gift of $250 or more, see dgot a for it, 18 Carryover from prior year.. 16 see instructions. .. - 17 instructions. You must attach Form 8283 if over $500 . . . nuctions. 19 Add lines 16 through 18 y and 20 Casualty or theft loss(es) other than net qualified disaster losses. Attach Form 4684 and enter the amount from line 18 of that form. See instructions enses 21 Unreimbursed employee expenses-job travel, union dues, ain job education, etc. Attach Form 2106 or 2106-EZ if required. See instructions. eous ns 22 Tax preparation fees . . . 23 Other expenses-investment, safe deposit box, etc. List type and amount 23 24 24 Add lines 21 through 23. . 25 Enter amount from Form 1040, line 38 25 26 Multiply line 25 by 2% (0.02) 27 Subtract line 26 from line 24. If line 26 is more than line 24, enter -0-... 28 Other-from list in instructions. List type and amount 26 us 29 Is Form 1040, line 38. over $156.9002