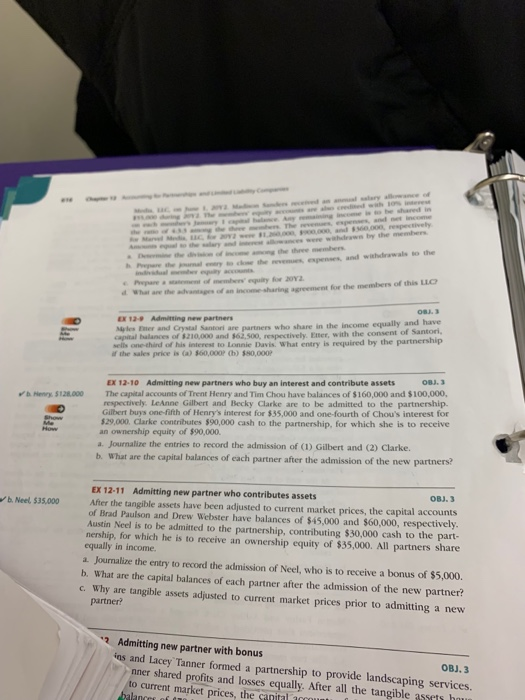

Prepare the umal nryoo the vexpenses, and withdirawals to the agreement for the members of this LLO d What ave the antages of an income- sharing a sgles Fuer and Crystal Santori are partners who share in the income equally a capital halances of $210,000 and s62,5oo, respectively. Eter, with the consent of Santori, sells one-thid of his interest to Lonnie Davis. What entry is required by the partnership arthe sales price is (a)0,000? a) sao,000, OB13 Ex 12-10 Admitting new partners who buy an interest and contribute assets .Henry $128.000 The capital accounts of Trent Henry and Tim Chou have balances of $160,000 and $100,000, respectively. LeAnne Gilbert and Becky Clarke are to be admitted to the partnership. Gilbert buys one-fifth of Henry's interest for $35,000 and one-fourth of Chou's interest for 29,000 Clarke contributes $90,000 cash to the partnership, for which she is to receive an ownership equity of $90,000. a. Journalize the entries to record the admission of (1) Gilbert and (2) Clarke. b. What are the capital balances of each partner after the admission of the new partners? EX 12-11 Admitting new partner who contributes assets OBJ.3 b.Neel $35,000 After the tangible assets have been adjusted to current market prices, the capital accounts of Brad Paulson and Drew Webster have balances of $45,000 and $60,000, respectively Austin Neel is to be admitted to the partnership, contributing $30,000 cash to the part- nership, for which he is to receive an ownership equity of $35,000. All partners share equally in income. a Journalize the entry to record the admission of Neel, who is to receive a bonus of $5,000. b. What are the capital balances of each partner after the admission of the new partner? c. Why are tangible assets adjusted to current market prices prior to admitting a new partner? Admitting new partner with bonus ins and Lacey Tanner formed a partnership to provide landscaping services. OBJ.3 nner shared profits and losses equally. After all the tangible assets h to current market prices, the canital Prepare the umal nryoo the vexpenses, and withdirawals to the agreement for the members of this LLO d What ave the antages of an income- sharing a sgles Fuer and Crystal Santori are partners who share in the income equally a capital halances of $210,000 and s62,5oo, respectively. Eter, with the consent of Santori, sells one-thid of his interest to Lonnie Davis. What entry is required by the partnership arthe sales price is (a)0,000? a) sao,000, OB13 Ex 12-10 Admitting new partners who buy an interest and contribute assets .Henry $128.000 The capital accounts of Trent Henry and Tim Chou have balances of $160,000 and $100,000, respectively. LeAnne Gilbert and Becky Clarke are to be admitted to the partnership. Gilbert buys one-fifth of Henry's interest for $35,000 and one-fourth of Chou's interest for 29,000 Clarke contributes $90,000 cash to the partnership, for which she is to receive an ownership equity of $90,000. a. Journalize the entries to record the admission of (1) Gilbert and (2) Clarke. b. What are the capital balances of each partner after the admission of the new partners? EX 12-11 Admitting new partner who contributes assets OBJ.3 b.Neel $35,000 After the tangible assets have been adjusted to current market prices, the capital accounts of Brad Paulson and Drew Webster have balances of $45,000 and $60,000, respectively Austin Neel is to be admitted to the partnership, contributing $30,000 cash to the part- nership, for which he is to receive an ownership equity of $35,000. All partners share equally in income. a Journalize the entry to record the admission of Neel, who is to receive a bonus of $5,000. b. What are the capital balances of each partner after the admission of the new partner? c. Why are tangible assets adjusted to current market prices prior to admitting a new partner? Admitting new partner with bonus ins and Lacey Tanner formed a partnership to provide landscaping services. OBJ.3 nner shared profits and losses equally. After all the tangible assets h to current market prices, the canital