Prepare this Assignment responding to the problems as a Excel or Microsoft Word, showing all necessary formulas and steps. List each question, followed by your answer.

Prepare this Assignment responding to the problems as a Excel or Microsoft Word, showing all necessary formulas and steps. List each question, followed by your answer.

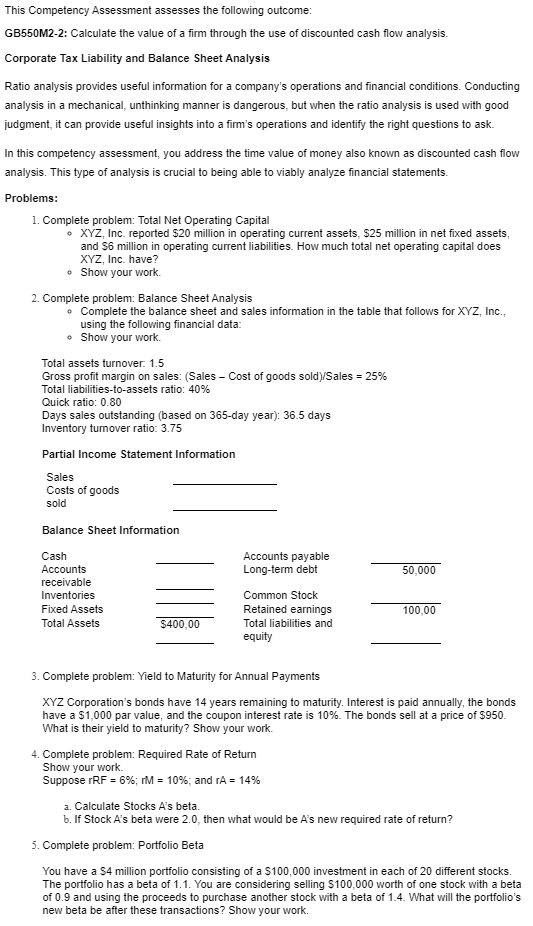

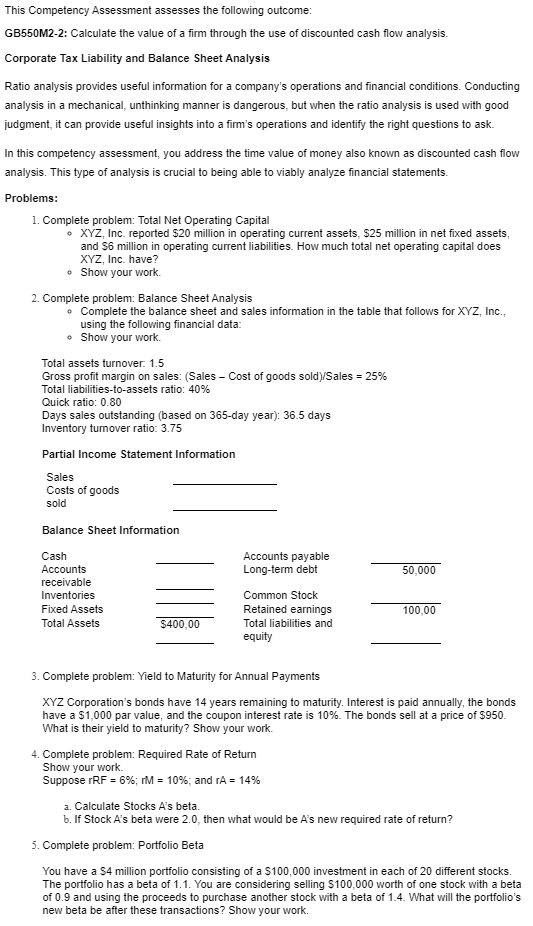

This Competency Assessment assesses the following outcome: GB550M2-2: Calculate the value of a firm through the use of discounted cash flow analysis. Corporate Tax Liability and Balance Sheet Analysis Ratio analysis provides useful information for a company's operations and financial conditions. Conducting analysis in a mechanical, unthinking manner is dangerous, but when the ratio analysis is used with good judgment, it can provide useful insights into a firm's operations and identify the right questions to ask. In this competency assessment, you address the time value of money also known as discounted cash flow analysis. This type of analysis is crucial to being able to viably analyze financial statements. Problems: 1. Complete problem: Total Net Operating Capital XYZ, Inc. reported $20 million in operating current assets, S25 million in net fixed assets, and S6 million in operating current liabilities. How much total net operating capital does XYZ, Inc. have? Show your work 2. Complete problem: Balance Sheet Analysis Complete the balance sheet and sales information in the table that follows for XYZ, Inc., using the following financial data: Show your work Total assets turnover 1.5 Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 25% Total liabilities-to-assets ratio: 40% Quick ratio: 0.80 Days sales outstanding (based on 365-day year): 36.5 days Inventory turnover ratio: 3.75 Partial Income Statement Information Sales Costs of goods sold Balance Sheet Information Accounts payable Long-term debt 50.000 Cash Accounts receivable Inventories Fixed Assets Total Assets 100,00 Common Stock Retained earnings Total liabilities and equity $400,00 3. Complete problem: Yield to Maturity for Annual Payments XYZ Corporation's bonds have 14 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 10%. The bonds sell at a price of $950. What is their yield to maturity? Show your work. 4. Complete problem: Required Rate of Return Show your work Suppose rRF = 6%; M = 10%, and rA = 14% a. Calculate Stocks A's beta. b. If Stock A's beta were 2.0, then what would be A's new required rate of return? 5. Complete problem: Portfolio Beta You have a S4 million portfolio consisting of a $100,000 investment in each of 20 different stocks. The portfolio has a beta of 1.1. You are considering selling $100,000 worth of one stock with a beta of 0.9 and using the proceeds to purchase another stock with a beta of 1.4. What will the portfolio's new beta be after these transactions? Show your work. This Competency Assessment assesses the following outcome: GB550M2-2: Calculate the value of a firm through the use of discounted cash flow analysis. Corporate Tax Liability and Balance Sheet Analysis Ratio analysis provides useful information for a company's operations and financial conditions. Conducting analysis in a mechanical, unthinking manner is dangerous, but when the ratio analysis is used with good judgment, it can provide useful insights into a firm's operations and identify the right questions to ask. In this competency assessment, you address the time value of money also known as discounted cash flow analysis. This type of analysis is crucial to being able to viably analyze financial statements. Problems: 1. Complete problem: Total Net Operating Capital XYZ, Inc. reported $20 million in operating current assets, S25 million in net fixed assets, and S6 million in operating current liabilities. How much total net operating capital does XYZ, Inc. have? Show your work 2. Complete problem: Balance Sheet Analysis Complete the balance sheet and sales information in the table that follows for XYZ, Inc., using the following financial data: Show your work Total assets turnover 1.5 Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 25% Total liabilities-to-assets ratio: 40% Quick ratio: 0.80 Days sales outstanding (based on 365-day year): 36.5 days Inventory turnover ratio: 3.75 Partial Income Statement Information Sales Costs of goods sold Balance Sheet Information Accounts payable Long-term debt 50.000 Cash Accounts receivable Inventories Fixed Assets Total Assets 100,00 Common Stock Retained earnings Total liabilities and equity $400,00 3. Complete problem: Yield to Maturity for Annual Payments XYZ Corporation's bonds have 14 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 10%. The bonds sell at a price of $950. What is their yield to maturity? Show your work. 4. Complete problem: Required Rate of Return Show your work Suppose rRF = 6%; M = 10%, and rA = 14% a. Calculate Stocks A's beta. b. If Stock A's beta were 2.0, then what would be A's new required rate of return? 5. Complete problem: Portfolio Beta You have a S4 million portfolio consisting of a $100,000 investment in each of 20 different stocks. The portfolio has a beta of 1.1. You are considering selling $100,000 worth of one stock with a beta of 0.9 and using the proceeds to purchase another stock with a beta of 1.4. What will the portfolio's new beta be after these transactions? Show your work

Prepare this Assignment responding to the problems as a Excel or Microsoft Word, showing all necessary formulas and steps. List each question, followed by your answer.

Prepare this Assignment responding to the problems as a Excel or Microsoft Word, showing all necessary formulas and steps. List each question, followed by your answer.