Answered step by step

Verified Expert Solution

Question

1 Approved Answer

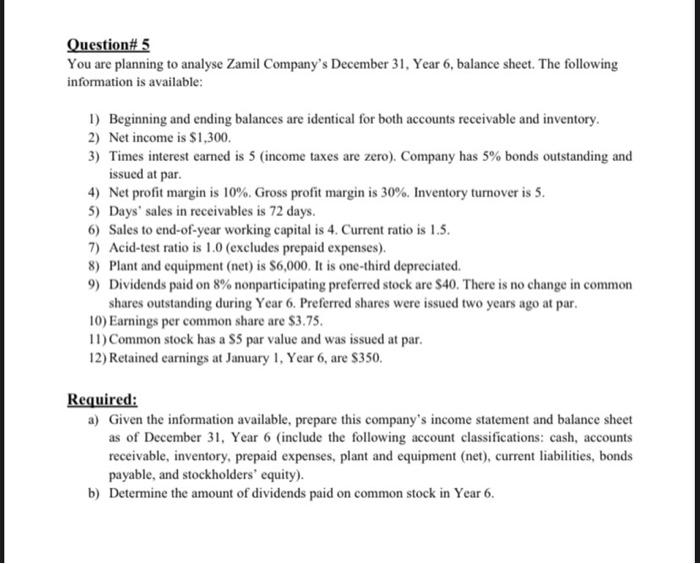

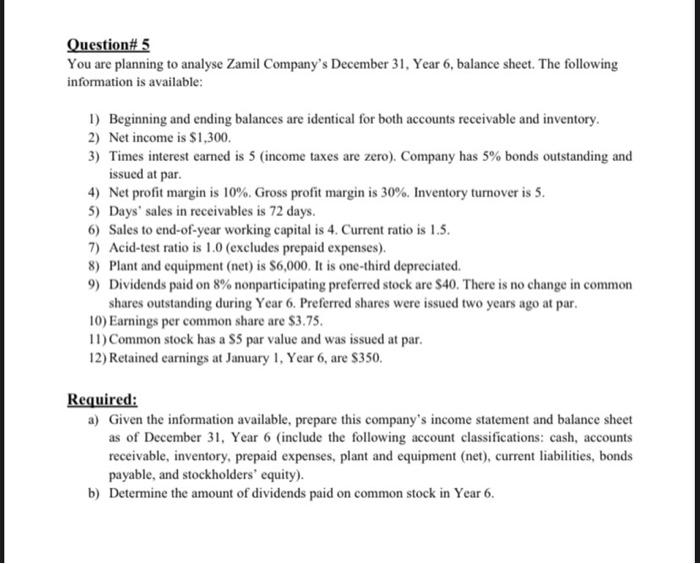

prepare this company's income statement and balance sheet Question# 5 You are planning to analyse Zamil Company's December 31, Year 6, balance sheet. The following

prepare this company's income statement and balance sheet

Question# 5 You are planning to analyse Zamil Company's December 31, Year 6, balance sheet. The following information is available: 1) Beginning and ending balances are identical for both accounts receivable and inventory. 2) Net income is $1,300. 3) Times interest earned is 5 (income taxes are zero). Company has 5% bonds outstanding and issued at par. 4) Net profit margin is 10%. Gross profit margin is 30%. Inventory turnover is 5. 5) Days' sales in receivables is 72 days. 6) Sales to end-of-year working capital is 4. Current ratio is 1.5. 7) Acid-test ratio is 1.0 (excludes prepaid expenses). 8) Plant and equipment (net) is $6,000. It is one-third depreciated. 9) Dividends paid on 8% nonparticipating preferred stock are $40. There is no change in common shares outstanding during Year 6. Preferred shares were issued two years ago at par. 10) Earnings per common share are $3.75. 11) Common stock has a S5 par value and was issued at par. 12) Retained earnings at January 1, Year 6, are $350. Required: a) Given the information available, prepare this company's income statement and balance sheet as of December 31, Year 6 (include the following account classifications: cash, accounts receivable, inventory, prepaid expenses, plant and equipment (net), current liabilities, bonds payable, and stockholders' equity). b) Determine the amount of dividends paid on common stock in Year 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started