Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare Tiker Company's journal entries to record the following transactions and the adjusting entry to record the fair value of the stock investments portfolio.

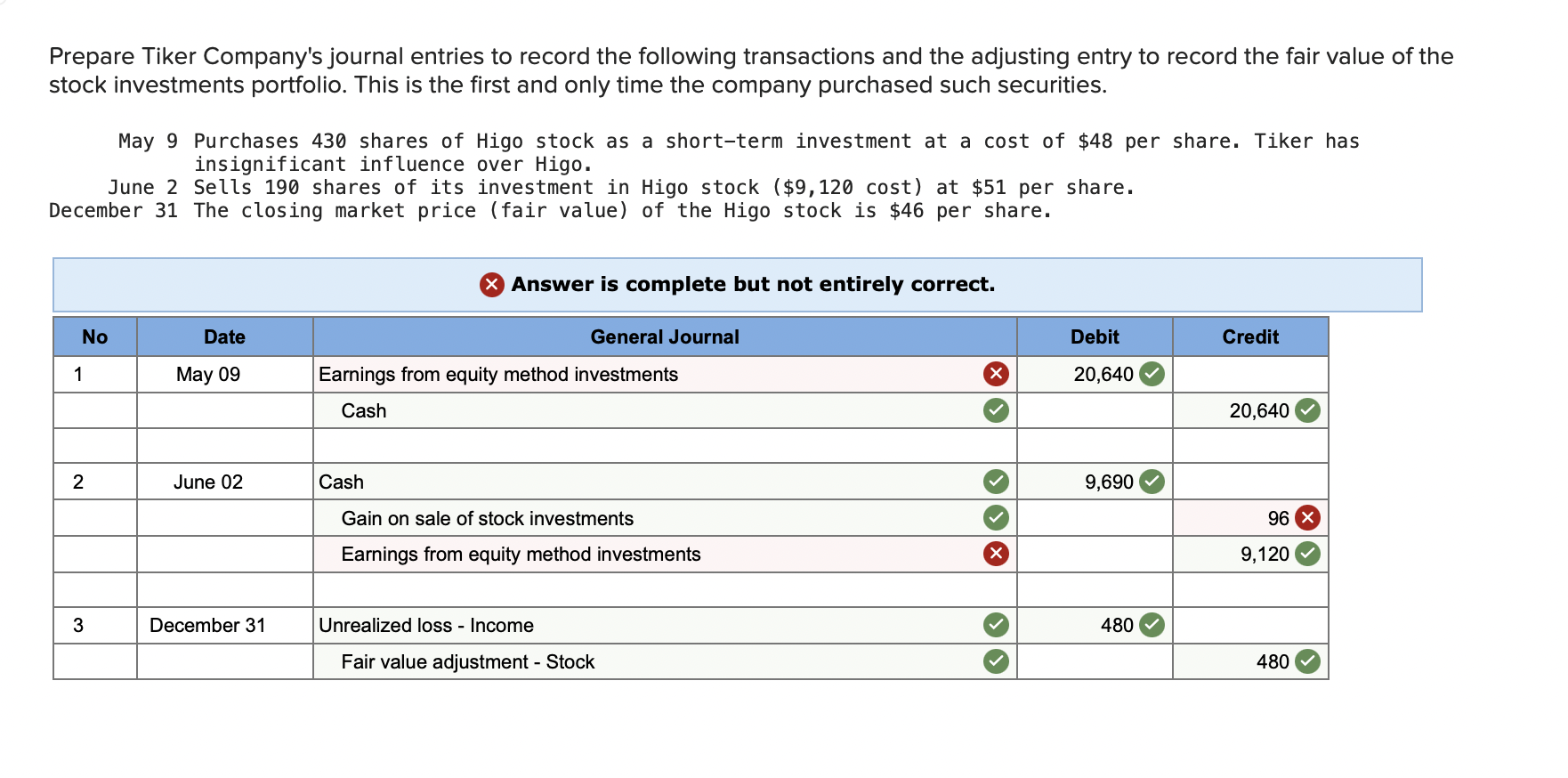

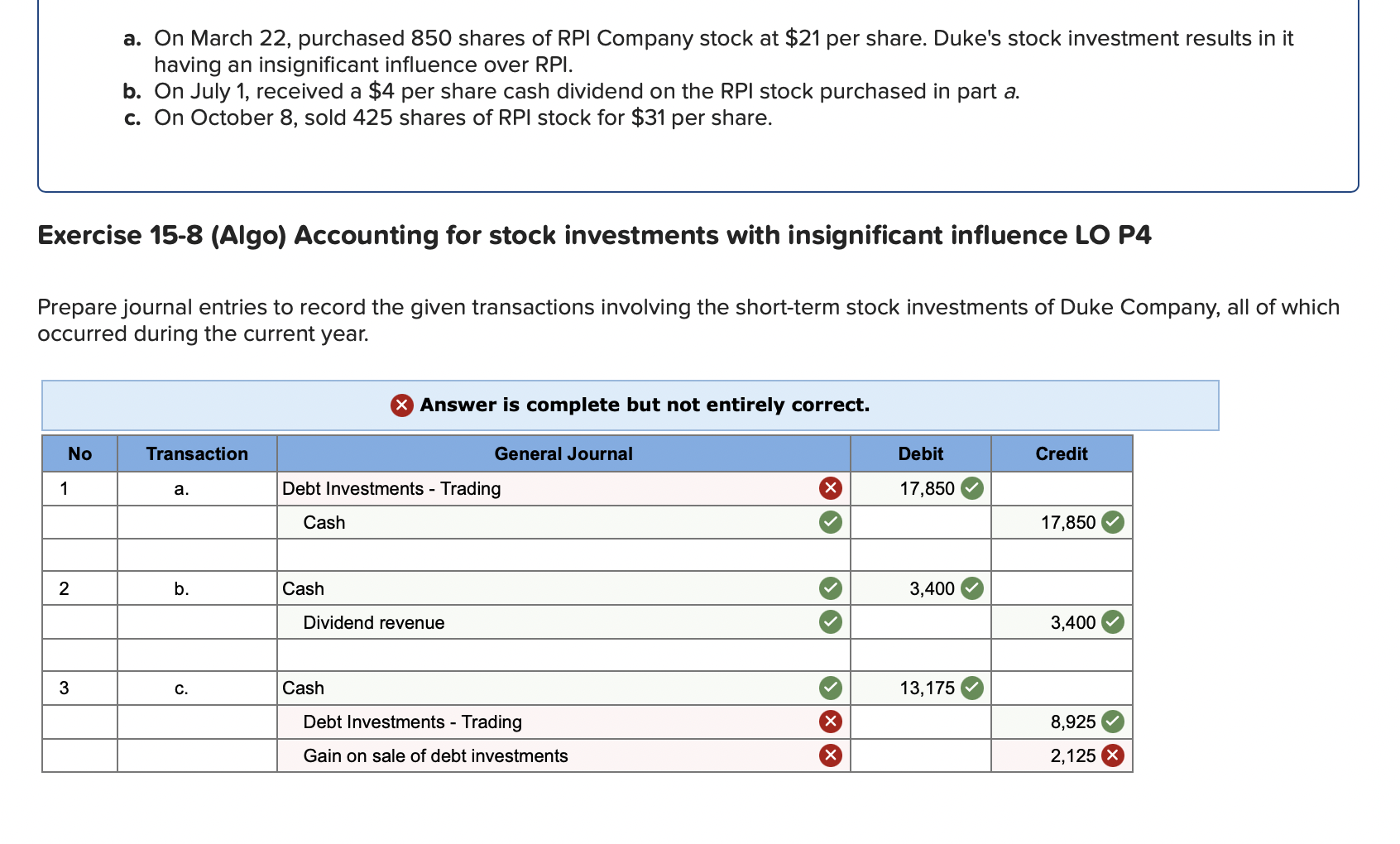

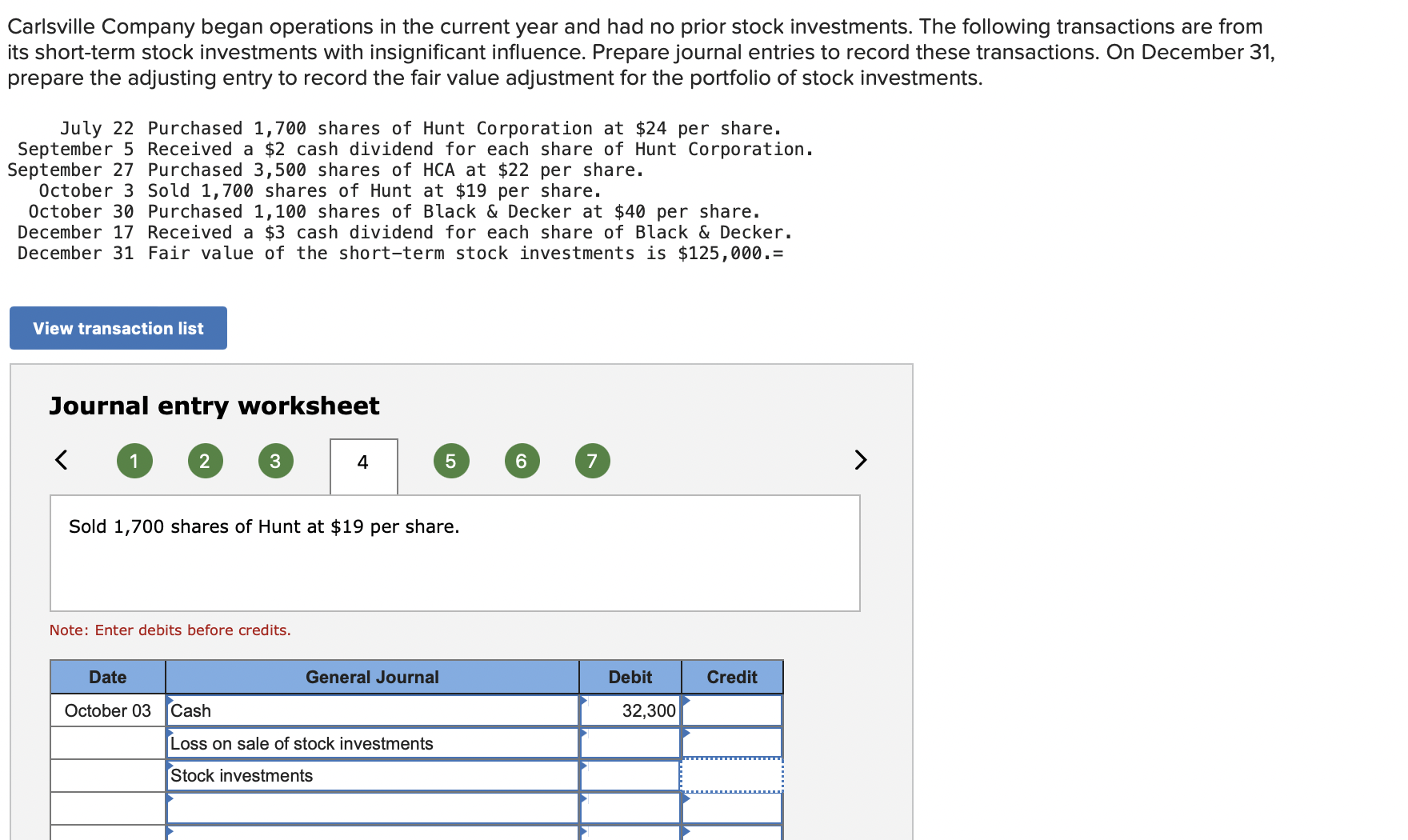

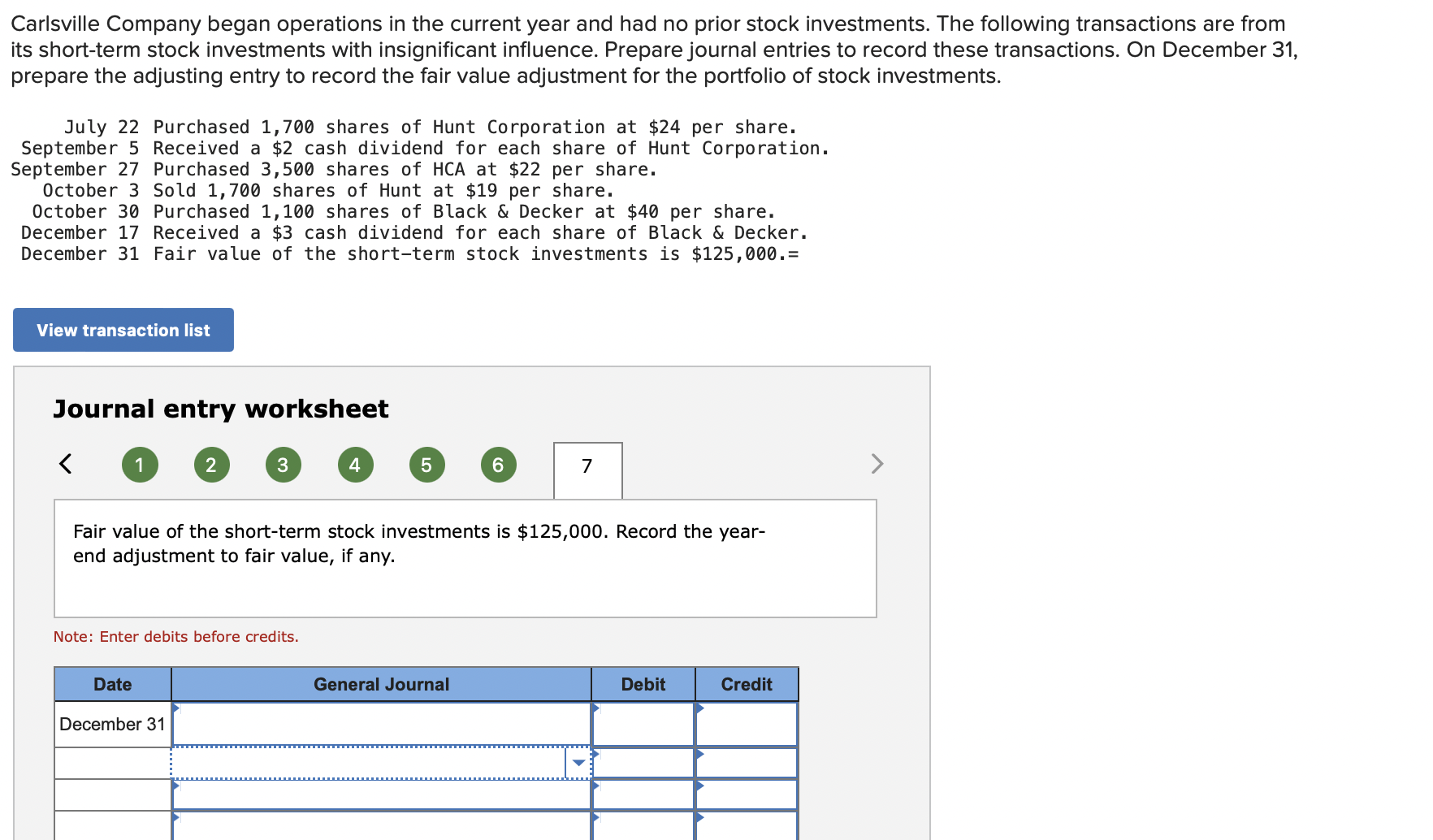

Prepare Tiker Company's journal entries to record the following transactions and the adjusting entry to record the fair value of the stock investments portfolio. This is the first and only time the company purchased such securities. May 9 Purchases 430 shares of Higo stock as a short-term investment at a cost of $48 per share. Tiker has insignificant influence over Higo. June 2 Sells 190 shares of its investment in Higo stock ($9,120 cost) at $51 per share. December 31 The closing market price (fair value) of the Higo stock is $46 per share. > Answer is complete but not entirely correct. No Date General Journal 1 May 09 Earnings from equity method investments Cash 2 June 02 Cash Gain on sale of stock investments Earnings from equity method investments 3 December 31 Unrealized loss - Income Fair value adjustment - Stock Debit Credit 20,640 20,640 9,690 96 9,120 480 480 a. On March 22, purchased 850 shares of RPI Company stock at $21 per share. Duke's stock investment results in it having an insignificant influence over RPI. b. On July 1, received a $4 per share cash dividend on the RPI stock purchased in part a. c. On October 8, sold 425 shares of RPI stock for $31 per share. Exercise 15-8 (Algo) Accounting for stock investments with insignificant influence LO P4 Prepare journal entries to record the given transactions involving the short-term stock investments of Duke Company, all of which occurred during the current year. Answer is complete but not entirely correct. 1 No a. Transaction General Journal Debt Investments - Trading Cash 2 b. Cash 3 C. Dividend revenue Debit Credit 17,850 17,850 3,400 3,400 Cash 13,175 Debt Investments - Trading 8,925 Gain on sale of debt investments 2,125 X Carlsville Company began operations in the current year and had no prior stock investments. The following transactions are from its short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31, prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. July 22 Purchased 1,700 shares of Hunt Corporation at $24 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3,500 shares of HCA at $22 per share. October 3 Sold 1,700 shares of Hunt at $19 per share. October 30 Purchased 1,100 shares of Black & Decker at $40 per share. December 17 Received a $3 cash dividend for each share of Black & Decker. December 31 Fair value of the short-term stock investments is $125,000.= View transaction list Journal entry worksheet 2 3 4 5 6 7 Sold 1,700 shares of Hunt at $19 per share. Note: Enter debits before credits. Date October 03 Cash General Journal Debit Credit 32,300 Loss on sale of stock investments Stock investments Carlsville Company began operations in the current year and had no prior stock investments. The following transactions are from its short-term stock investments with insignificant influence. Prepare journal entries to record these transactions. On December 31, prepare the adjusting entry to record the fair value adjustment for the portfolio of stock investments. July 22 Purchased 1,700 shares of Hunt Corporation at $24 per share. September 5 Received a $2 cash dividend for each share of Hunt Corporation. September 27 Purchased 3,500 shares of HCA at $22 per share. October 3 Sold 1,700 shares of Hunt at $19 per share. October 30 Purchased 1,100 shares of Black & Decker at $40 per share. December 17 Received a $3 cash dividend for each share of Black & Decker. December 31 Fair value of the short-term stock investments is $125,000.= View transaction list Journal entry worksheet 1 2 3 4 5 6 7 Fair value of the short-term stock investments is $125,000. Record the year- end adjustment to fair value, if any. Note: Enter debits before credits. Date December 31 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started