Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare using 2020 tax forms. vino a. 1. Prepare a MI 1040 CR and MI-1040 CR-7 for John and Johanna Powers, ages 66 and 68.

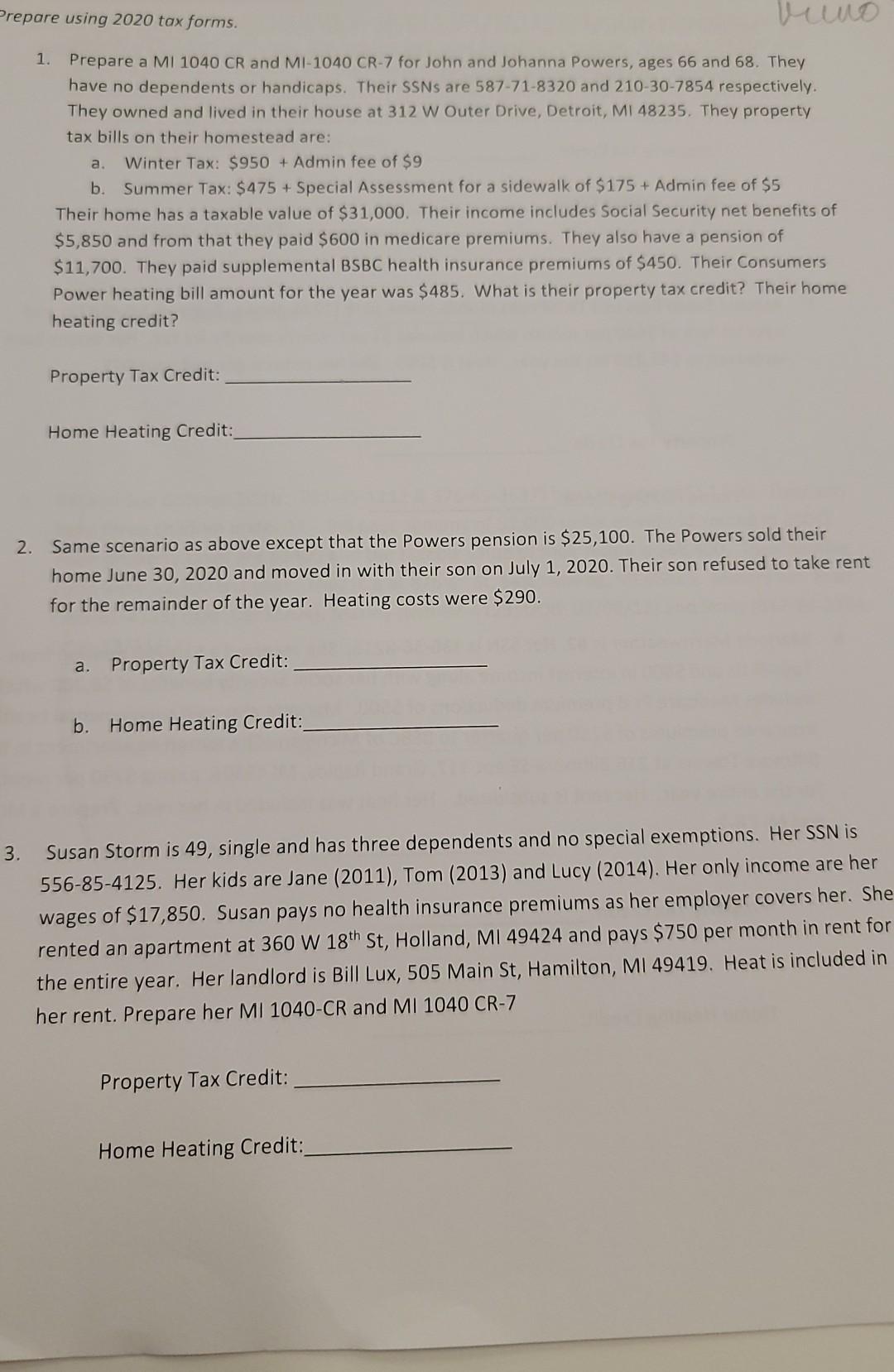

Prepare using 2020 tax forms. vino a. 1. Prepare a MI 1040 CR and MI-1040 CR-7 for John and Johanna Powers, ages 66 and 68. They have no dependents or handicaps. Their SSNs are 587-71-8320 and 210-30-7854 respectively. They owned and lived in their house at 312 W Outer Drive, Detroit, MI 48235. They property tax bills on their homestead are: Winter Tax: $950 + Admin fee of $9 b Summer Tax: $475 + Special Assessment for a sidewalk of $175 + Admin fee of $5 Their home has a taxable value of $31,000. Their income includes Social Security net benefits of $5,850 and from that they paid $600 in medicare premiums. They also have a pension of $11,700. They paid supplemental BSBC health insurance premiums of $450. Their Consumers Power heating bill amount for the year was $485. What is their property tax credit? Their home heating credit? Property Tax Credit: Home Heating Credit: 2. Same scenario as above except that the Powers pension is $25,100. The Powers sold their home June 30, 2020 and moved in with their son on July 1, 2020. Their son refused to take rent for the remainder of the year. Heating costs were $290. a. Property Tax Credit: b. Home Heating Credit: 3. Susan Storm is 49, single and has three dependents and no special exemptions. Her SSN is 556-85-4125. Her kids are Jane (2011), Tom (2013) and Lucy (2014). Her only income are her wages of $17,850. Susan pays no health insurance premiums as her employer covers her. She rented an apartment at 360 W 18th St, Holland, MI 49424 and pays $750 per month in rent for the entire year. Her landlord is Bill Lux, 505 Main St, Hamilton, MI 49419. Heat is included in her rent. Prepare her MI 1040-CR and MI 1040 CR-7 Property Tax Credit: Home Heating Credit: Prepare using 2020 tax forms. vino a. 1. Prepare a MI 1040 CR and MI-1040 CR-7 for John and Johanna Powers, ages 66 and 68. They have no dependents or handicaps. Their SSNs are 587-71-8320 and 210-30-7854 respectively. They owned and lived in their house at 312 W Outer Drive, Detroit, MI 48235. They property tax bills on their homestead are: Winter Tax: $950 + Admin fee of $9 b Summer Tax: $475 + Special Assessment for a sidewalk of $175 + Admin fee of $5 Their home has a taxable value of $31,000. Their income includes Social Security net benefits of $5,850 and from that they paid $600 in medicare premiums. They also have a pension of $11,700. They paid supplemental BSBC health insurance premiums of $450. Their Consumers Power heating bill amount for the year was $485. What is their property tax credit? Their home heating credit? Property Tax Credit: Home Heating Credit: 2. Same scenario as above except that the Powers pension is $25,100. The Powers sold their home June 30, 2020 and moved in with their son on July 1, 2020. Their son refused to take rent for the remainder of the year. Heating costs were $290. a. Property Tax Credit: b. Home Heating Credit: 3. Susan Storm is 49, single and has three dependents and no special exemptions. Her SSN is 556-85-4125. Her kids are Jane (2011), Tom (2013) and Lucy (2014). Her only income are her wages of $17,850. Susan pays no health insurance premiums as her employer covers her. She rented an apartment at 360 W 18th St, Holland, MI 49424 and pays $750 per month in rent for the entire year. Her landlord is Bill Lux, 505 Main St, Hamilton, MI 49419. Heat is included in her rent. Prepare her MI 1040-CR and MI 1040 CR-7 Property Tax Credit: Home Heating Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started