Answered step by step

Verified Expert Solution

Question

1 Approved Answer

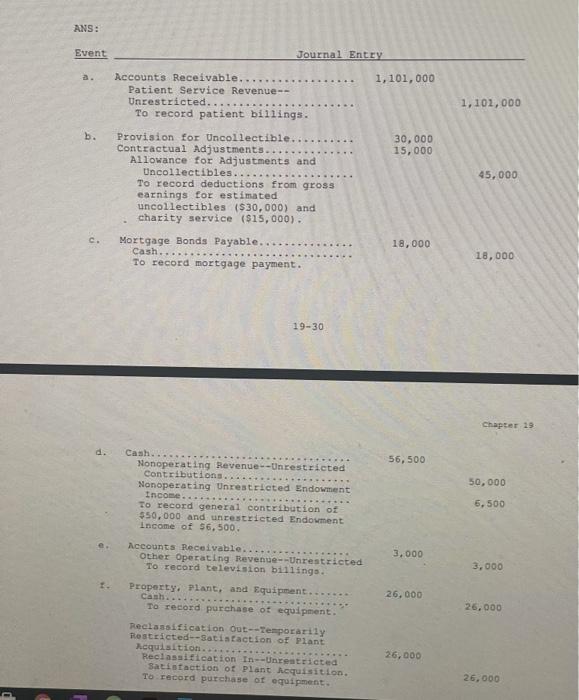

prepared financial of position ANS: Event Journal Entry 1,101,000 Accounts Receivable. Patient Service Revenue-- Unrestricted... To record patient billings. 1, 102,000 b. 30,000 15,000 Provision

prepared financial of position

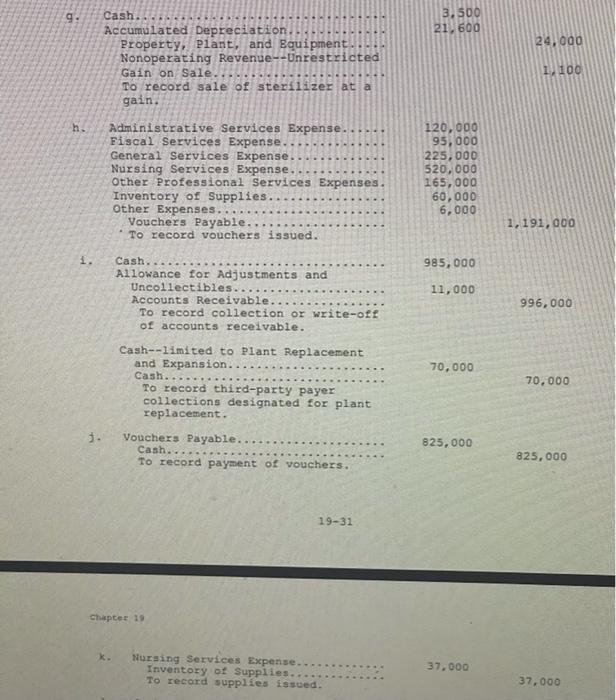

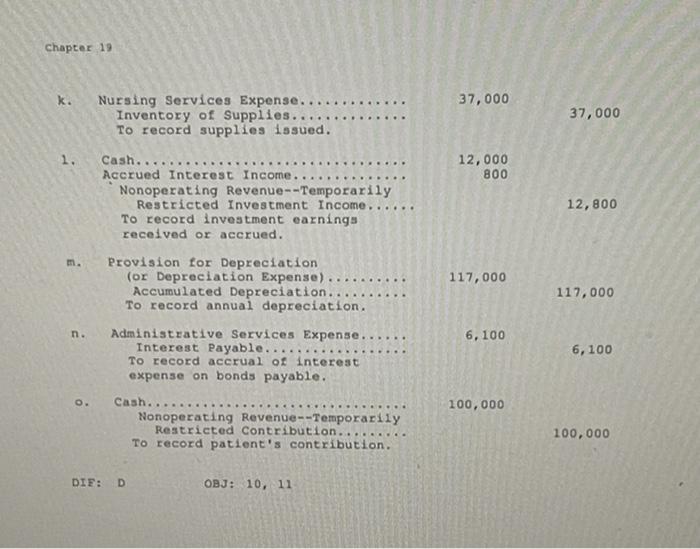

ANS: Event Journal Entry 1,101,000 Accounts Receivable. Patient Service Revenue-- Unrestricted... To record patient billings. 1, 102,000 b. 30,000 15,000 Provision for Uncollectible. Contractual Adjustments. Allowance for Adjustments and Uncollectibles. To record deductions from gross earnings for estimated uncollectibles ($30,000) and charity service ($15,000). 45,000 18,000 Mortgage Bonds Payable... Cash... To record mortgage payment. 18,000 19-30 Chapter 19 d. 56,500 50,000 Cash.... Nonoperating Revenue --Unrestricted Contributions.. Nonoperating Unrestricted Endowment Income To record general contribution of $50,000 and unrestricted Endowment Income of 56,500. 6.500 3.000 3,000 1 26.000 Accounts Receivable.. Other Operating Revenue--Unrestricted To record television billings. Property, plant, and Equipment... Cash... To record purchase of equipment. Reclassification Out-- Temporarily Restricted satisfaction of Plant Acquisition...... Reclassification In-Unrestricted Satisfaction of plant hcquisition. To record purchase of equipment. 26.000 26,000 26,000 9: 3,500 21,600 24,000 Cash. Accumulated Depreciation. Property, plant, and Equipment... Nonoperating Revenue --Unrestricted Gain on Sale To record sale of sterilizer at a gain. 1 100 h. Administrative Services Expense. Fiscal Services Expense....... General Services Expense.. Nursing Services Expense. Other Professional Services Expenses. Inventory of Supplies.. Other Expenses. Vouchers Payable.. To record vouchers issued. 120,000 95,000 225,000 520,000 165,000 60,000 6,000 1,191, 000 1. 985,000 Cash.. Allowance for Adjustments and Uncollectibles. Accounts Receivable. To record collection or write-ott of accounts receivable. 11,000 996,000 70,000 70,000 Cash--limited to plant Replacement and Expansion... Cash.. To record third-party payer collections designated for plant replacement. Vouchers Payable. Cash... To record payment of vouchers. 825,000 825,000 19-31 Chapter 19 K. Nursing Services Expense....... Inventory of Supplies. To record supplies issued. 37.000 37,000 Chapter 19 k. 37,000 Nursing Services Expense... Inventory of Supplies.. To record supplies issued. 37,000 1. 12,000 800 12,800 Cash. Accrued Interest Income.. Nonoperating Revenue--Temporarily Restricted Investment Income. To record investment earnings received or accrued. Provision for Depreciation (or Depreciation Expense) Accumulated Depreciation. To record annual depreciation. m. ......... 117,000 117,000 n. 6.100 6,100 Administrative Services Expense. Interest Payable.... To record accrual of interest expense on bonds payable. Cash.. Nonoperating Revenue--Temporarily Restricted Contribution. TO record patient's contribution. O. 100,000 100,000 DIE: D OBJ: 10, 11 ANS: Event Journal Entry 1,101,000 Accounts Receivable. Patient Service Revenue-- Unrestricted... To record patient billings. 1, 102,000 b. 30,000 15,000 Provision for Uncollectible. Contractual Adjustments. Allowance for Adjustments and Uncollectibles. To record deductions from gross earnings for estimated uncollectibles ($30,000) and charity service ($15,000). 45,000 18,000 Mortgage Bonds Payable... Cash... To record mortgage payment. 18,000 19-30 Chapter 19 d. 56,500 50,000 Cash.... Nonoperating Revenue --Unrestricted Contributions.. Nonoperating Unrestricted Endowment Income To record general contribution of $50,000 and unrestricted Endowment Income of 56,500. 6.500 3.000 3,000 1 26.000 Accounts Receivable.. Other Operating Revenue--Unrestricted To record television billings. Property, plant, and Equipment... Cash... To record purchase of equipment. Reclassification Out-- Temporarily Restricted satisfaction of Plant Acquisition...... Reclassification In-Unrestricted Satisfaction of plant hcquisition. To record purchase of equipment. 26.000 26,000 26,000 9: 3,500 21,600 24,000 Cash. Accumulated Depreciation. Property, plant, and Equipment... Nonoperating Revenue --Unrestricted Gain on Sale To record sale of sterilizer at a gain. 1 100 h. Administrative Services Expense. Fiscal Services Expense....... General Services Expense.. Nursing Services Expense. Other Professional Services Expenses. Inventory of Supplies.. Other Expenses. Vouchers Payable.. To record vouchers issued. 120,000 95,000 225,000 520,000 165,000 60,000 6,000 1,191, 000 1. 985,000 Cash.. Allowance for Adjustments and Uncollectibles. Accounts Receivable. To record collection or write-ott of accounts receivable. 11,000 996,000 70,000 70,000 Cash--limited to plant Replacement and Expansion... Cash.. To record third-party payer collections designated for plant replacement. Vouchers Payable. Cash... To record payment of vouchers. 825,000 825,000 19-31 Chapter 19 K. Nursing Services Expense....... Inventory of Supplies. To record supplies issued. 37.000 37,000 Chapter 19 k. 37,000 Nursing Services Expense... Inventory of Supplies.. To record supplies issued. 37,000 1. 12,000 800 12,800 Cash. Accrued Interest Income.. Nonoperating Revenue--Temporarily Restricted Investment Income. To record investment earnings received or accrued. Provision for Depreciation (or Depreciation Expense) Accumulated Depreciation. To record annual depreciation. m. ......... 117,000 117,000 n. 6.100 6,100 Administrative Services Expense. Interest Payable.... To record accrual of interest expense on bonds payable. Cash.. Nonoperating Revenue--Temporarily Restricted Contribution. TO record patient's contribution. O. 100,000 100,000 DIE: D OBJ: 10, 11 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started