Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The

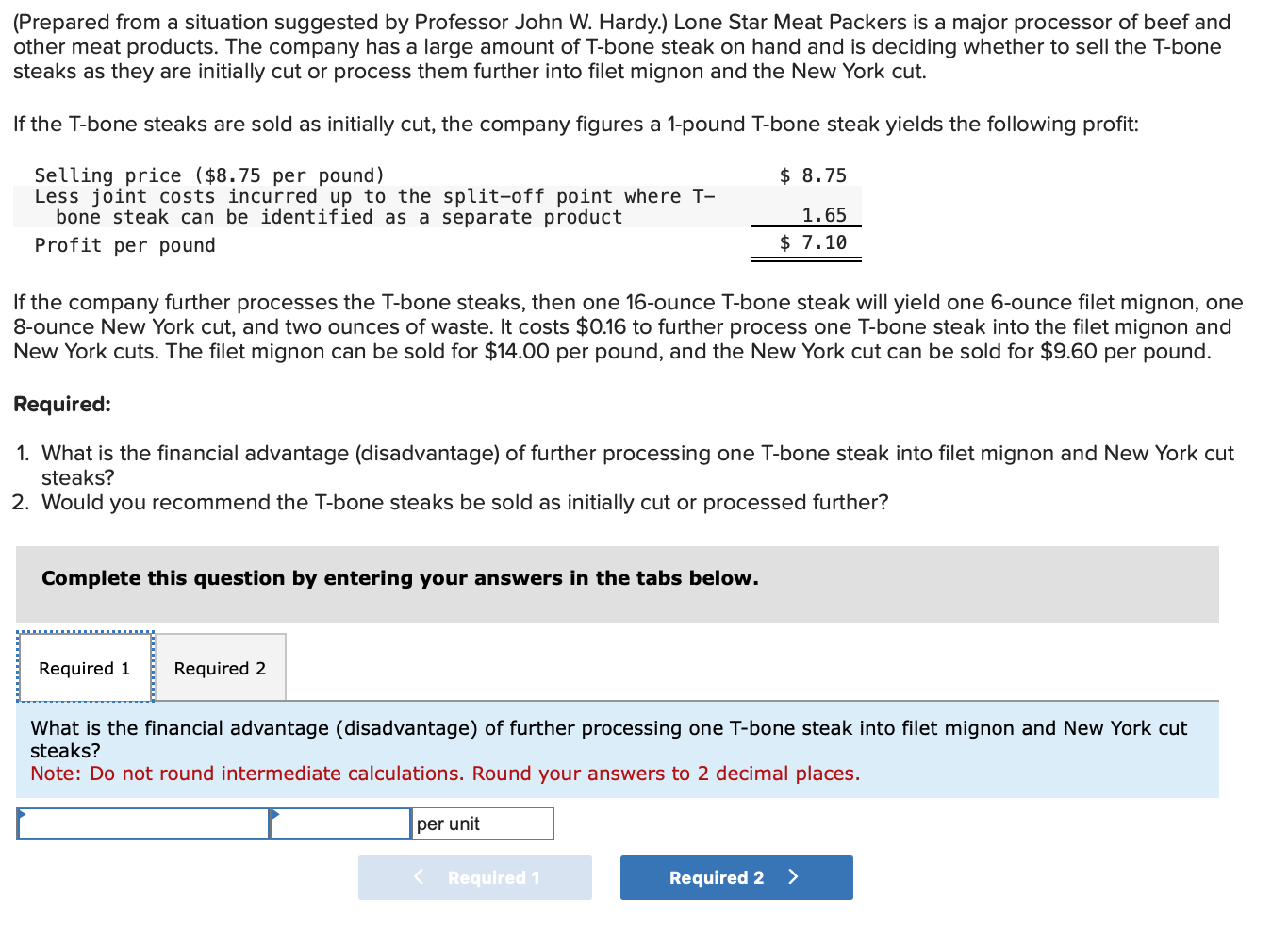

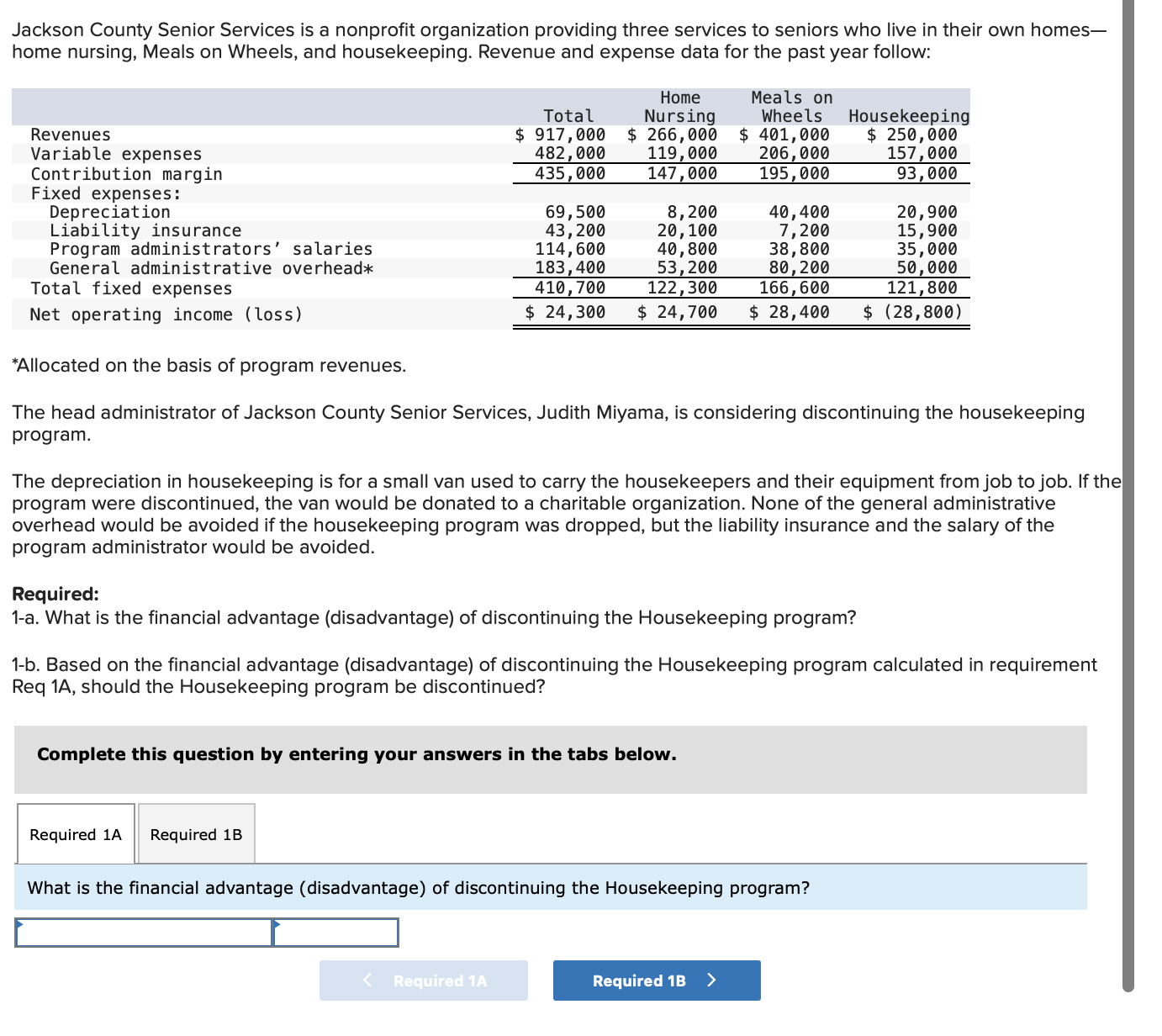

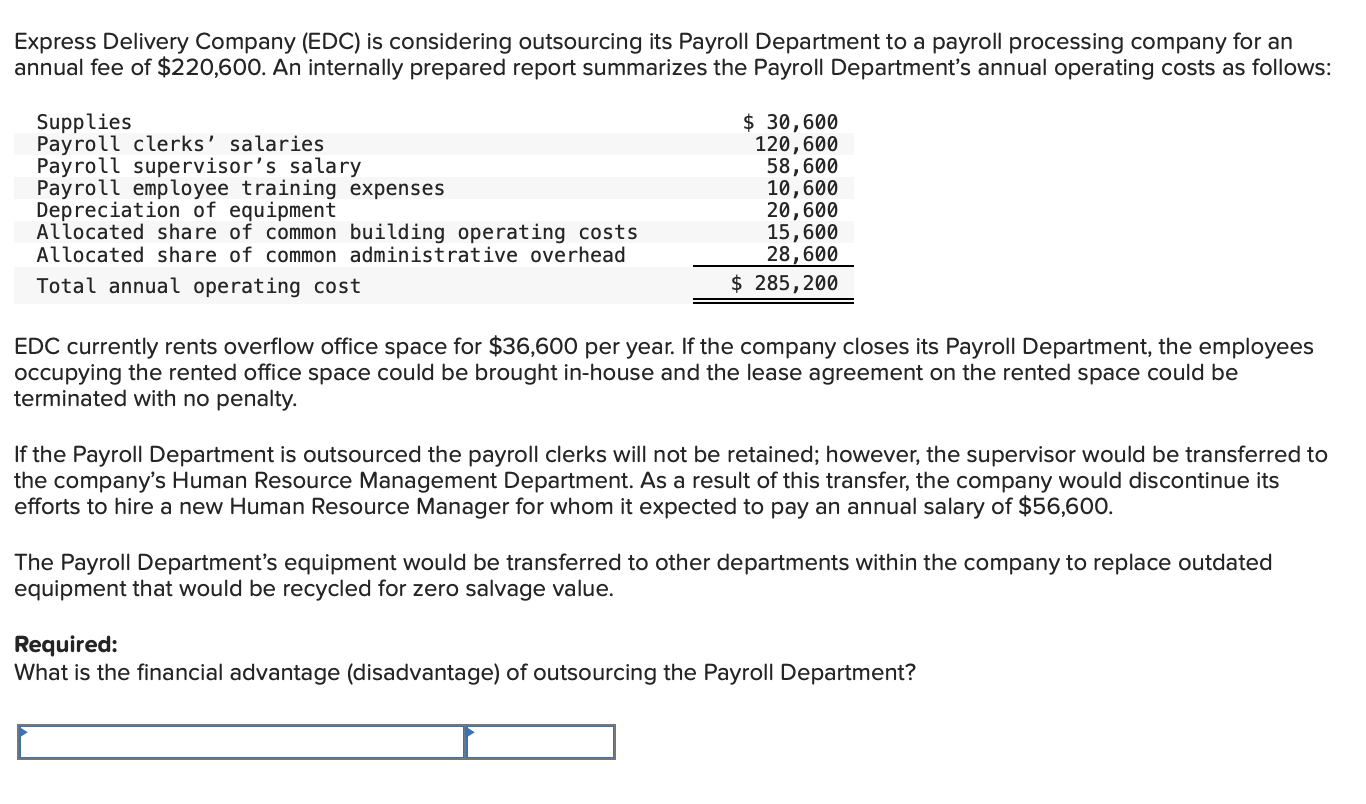

(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand and is deciding whether to sell the T-bone steaks as they are initially cut or process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures a 1-pound T-bone steak yields the following profit: If the company further processes the T-bone steaks, then one 16-ounce T-bone steak will yield one 6-ounce filet mignon, one 8 -ounce New York cut, and two ounces of waste. It costs $0.16 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $14.00 per pound, and the New York cut can be sold for $9.60 per pound. Required: 1. What is the financial advantage (disadvantage) of further processing one T-bone steak into filet mignon and New York cut steaks? 2. Would you recommend the T-bone steaks be sold as initially cut or processed further? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of further processing one T-bone steak into filet mignon and New York cut steaks? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Jackson County Senior Services is a nonprofit organization providing three services to seniors who live in their own homeshome nursing, Meals on Wheels, and housekeeping. Revenue and expense data for the past year follow: *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, is considering discontinuing the housekeeping program. The depreciation in housekeeping is for a small van used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead would be avoided if the housekeeping program was dropped, but the liability insurance and the salary of the program administrator would be avoided. Required: 1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? 1-b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A, should the Housekeeping program be discontinued? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? Express Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $220,600. An internally prepared report summarizes the Payroll Department's annual operating costs as follows: EDC currently rents overflow office space for $36,600 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company's Human Resource Management Department. As a result of this transfer, the company would discontinue its efforts to hire a new Human Resource Manager for whom it expected to pay an annual salary of $56,600. The Payroll Department's equipment would be transferred to other departments within the company to replace outdated equipment that would be recycled for zero salvage value. Required: What is the financial advantage (disadvantage) of outsourcing the Payroll Department

(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand and is deciding whether to sell the T-bone steaks as they are initially cut or process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures a 1-pound T-bone steak yields the following profit: If the company further processes the T-bone steaks, then one 16-ounce T-bone steak will yield one 6-ounce filet mignon, one 8 -ounce New York cut, and two ounces of waste. It costs $0.16 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $14.00 per pound, and the New York cut can be sold for $9.60 per pound. Required: 1. What is the financial advantage (disadvantage) of further processing one T-bone steak into filet mignon and New York cut steaks? 2. Would you recommend the T-bone steaks be sold as initially cut or processed further? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of further processing one T-bone steak into filet mignon and New York cut steaks? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Jackson County Senior Services is a nonprofit organization providing three services to seniors who live in their own homeshome nursing, Meals on Wheels, and housekeeping. Revenue and expense data for the past year follow: *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, is considering discontinuing the housekeeping program. The depreciation in housekeeping is for a small van used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead would be avoided if the housekeeping program was dropped, but the liability insurance and the salary of the program administrator would be avoided. Required: 1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? 1-b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A, should the Housekeeping program be discontinued? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? Express Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $220,600. An internally prepared report summarizes the Payroll Department's annual operating costs as follows: EDC currently rents overflow office space for $36,600 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company's Human Resource Management Department. As a result of this transfer, the company would discontinue its efforts to hire a new Human Resource Manager for whom it expected to pay an annual salary of $56,600. The Payroll Department's equipment would be transferred to other departments within the company to replace outdated equipment that would be recycled for zero salvage value. Required: What is the financial advantage (disadvantage) of outsourcing the Payroll Department Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started