Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepared the revised (and separate) budgeted profit and loss account for each of the different scenarios outlined by the ditterent members of the family in

Prepared the revised (and separate) budgeted profit and loss account for each of the different scenarios outlined by the ditterent members of the family in 1) to (3) above. Calculate the break-even-point in number of bottles for Approach (1) and (2)

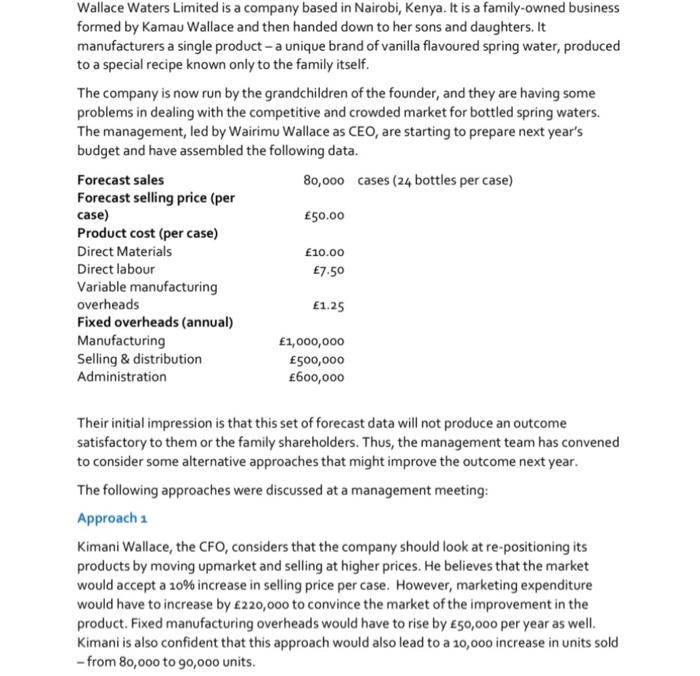

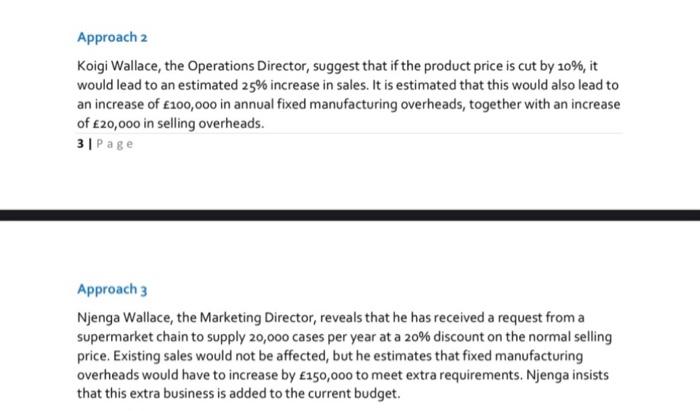

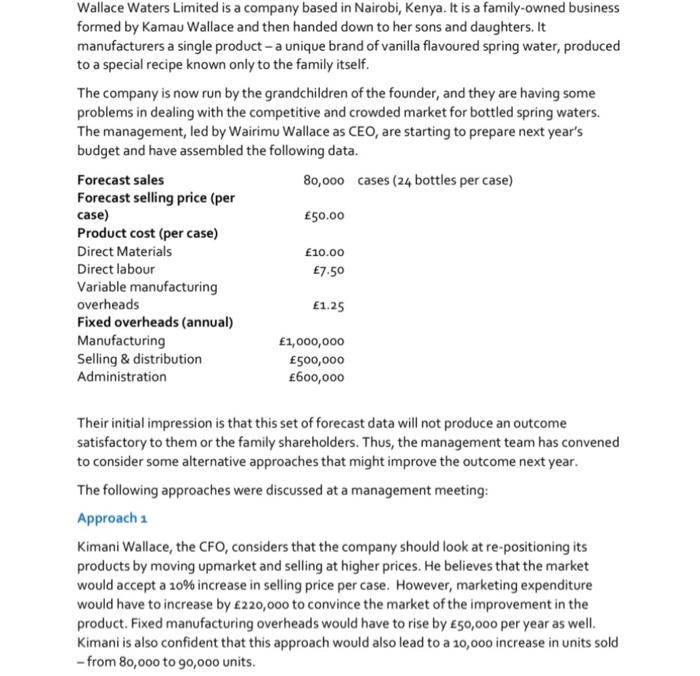

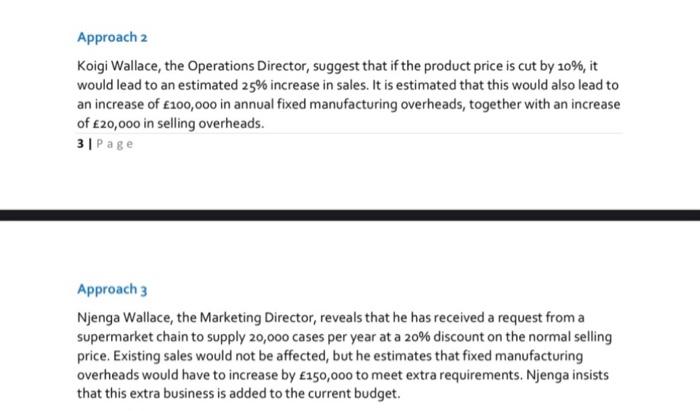

Wallace Waters Limited is a company based in Nairobi, Kenya. It is a family-owned business formed by Kamau Wallace and then handed down to her sons and daughters. It manufacturers a single product - a unique brand of vanilla flavoured spring water, produced to a special recipe known only to the family itself. The company is now run by the grandchildren of the founder, and they are having some problems in dealing with the competitive and crowded market for bottled spring waters. The management, led by Wairimu Wallace as CEO, are starting to prepare next year's budget and have assembled the following data. Their initial impression is that this set of forecast data will not produce an outcome satisfactory to them or the family shareholders. Thus, the management team has convened to consider some alternative approaches that might improve the outcome next year. The following approaches were discussed at a management meeting: Approach 1 Kimani Wallace, the CFO, considers that the company should look at re-positioning its products by moving upmarket and selling at higher prices. He believes that the market would accept a 10% increase in selling price per case. However, marketing expenditure would have to increase by 220,000 to convince the market of the improvement in the product. Fixed manufacturing overheads would have to rise by 50,000 per year as well. Kimani is also confident that this approach would also lead to a 10,000 increase in units sold - from 80,000 to 90,000 units. Approach 2 Koigi Wallace, the Operations Director, suggest that if the product price is cut by 10%, it would lead to an estimated 25% increase in sales. It is estimated that this would also lead to an increase of 100,000 in annual fixed manufacturing overheads, together with an increase of 20,000 in selling overheads. 3 | P a e Approach 3 Njenga Wallace, the Marketing Director, reveals that he has received a request from a supermarket chain to supply 20,000 cases per year at a 20% discount on the normal selling price. Existing sales would not be affected, but he estimates that fixed manufacturing overheads would have to increase by 150,000 to meet extra requirements. Njenga insists that this extra business is added to the current budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started