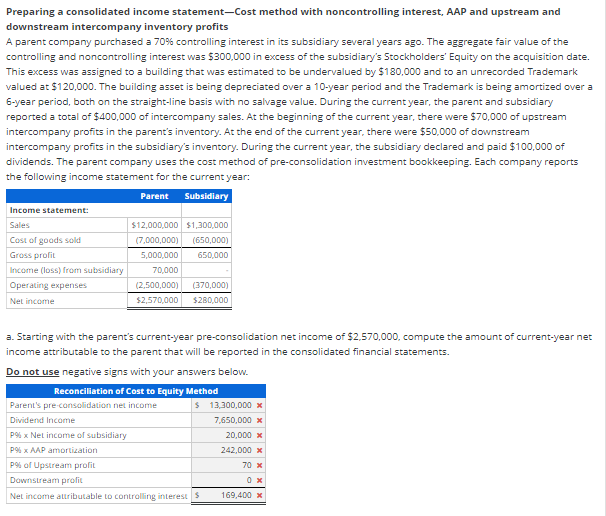

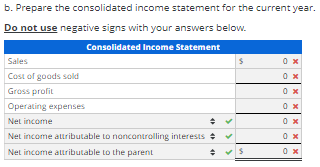

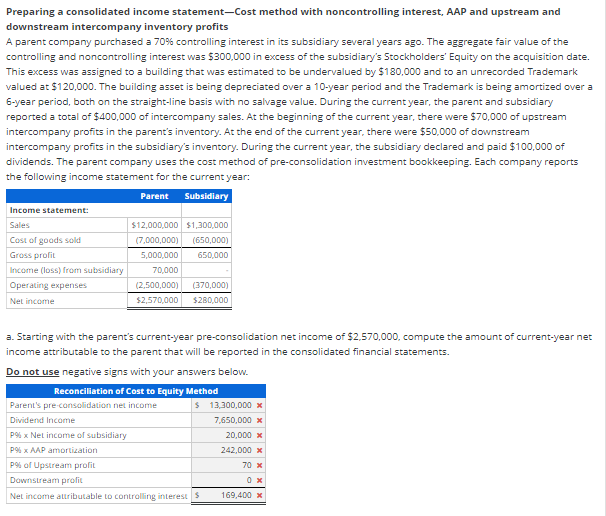

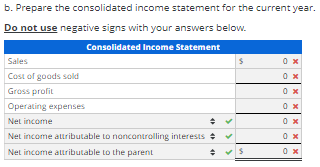

Preparing a consolidated income statement-Cost method with noncontrolling interest, AAP and upstream and downstream intercompany inventory profits A parent company purchased a 70% controlling interest in its subsidiary several years ago. The aggregate fair value of the controlling and noncontrolling interest was $300,000 in excess of the subsidiary's Stockholders' Equity on the acquisition date. This excess was assigned to a building that was estimated to be undervalued by $180,000 and to an unrecorded Trademark valued at $120,000. The building asset is being depreciated over a 10-year period and the Trademark is being amortized over a 6-year period, both on the straight-line basis with no salvage value. During the current year, the parent and subsidiary reported a total of $400,000 of intercompany sales. At the beginning of the current year, there were $70,000 of upstream intercompany profits in the parent's inventory. At the end of the current year, there were $50,000 of downstream intercompany profits in the subsidiary's inventory. During the current year, the subsidiary declared and paid $100,000 of dividends. The parent company uses the cost method of pre-consolidation investment bookkeeping. Each company reports the following income statement for the current year: Parent Subsidiary Income statement: Sales Cost of goods sold Gross profit Income (oss) from subsidiary Operating expenses Nel income $12,000,000 $1,300,000 (7,000,000) (650,000) 5,000,000 650.000 70,000 (2,500,000) (370,000) $2,570,000 $280,000 a. Starting with the parent's current-year pre-consolidation net income of $2,570,000, compute the amount of current-year net income attributable to the parent that will be reported in the consolidated financial statements. Do not use negative signs with your answers below. Reconciliation of Cost to Equity Method Parent's pre-consolidation net income 13,300,000 X Dividend Income 7,650,000 x p9x Nel income of subsidiary 20,000 X P9 x AAP amortization 242,000 x P% of Upstream profil Downstream profit Net income attributable to controlling interests 169,400 X 70 X b. Prepare the consolidated income statement for the current year. Do not use negative signs with your answers below. Consolidated Income Statement Sales $ Cost of goods sold Gross profit Operating expenses Net income Net income attributable to noncontrolling interests Net income attributable to the parent > 4 > $