preparing a master budget practice

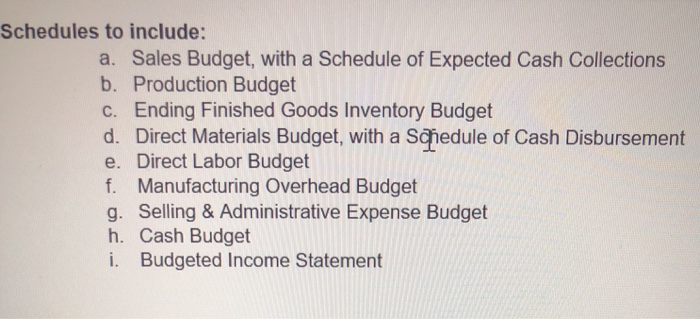

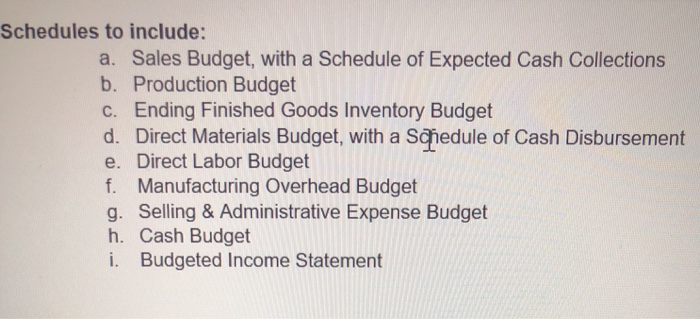

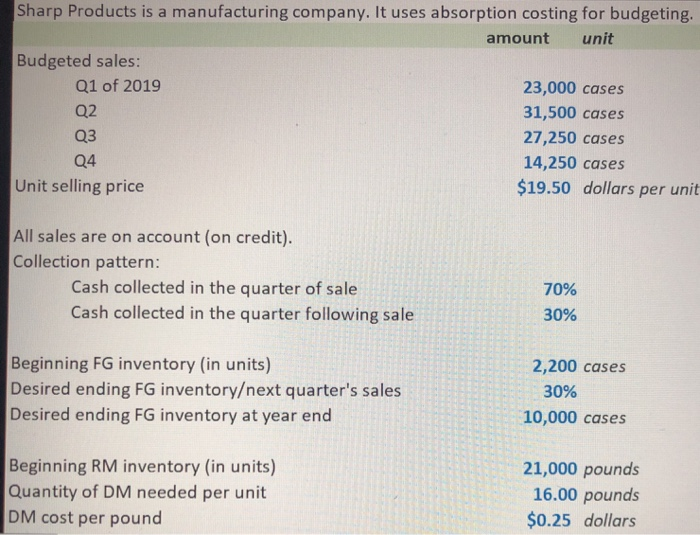

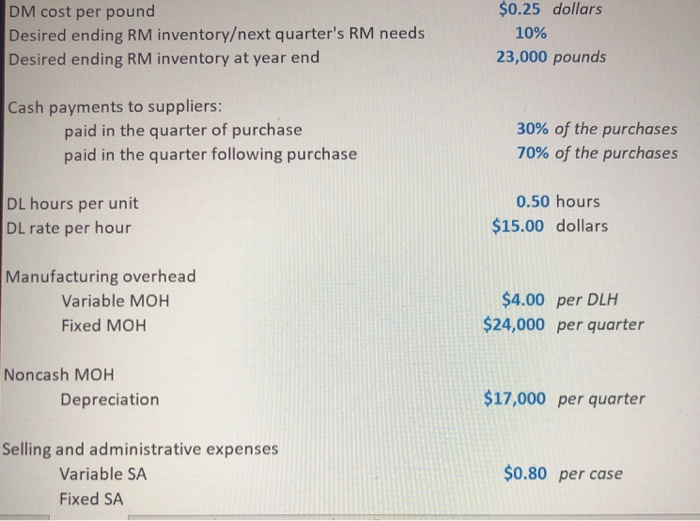

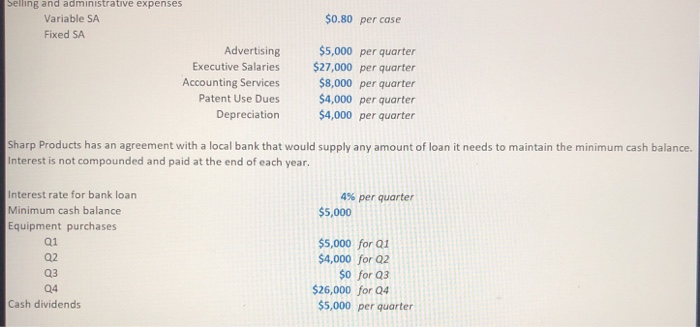

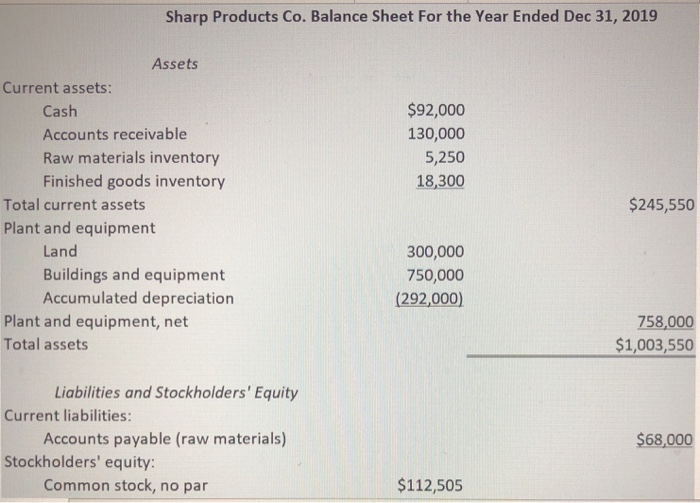

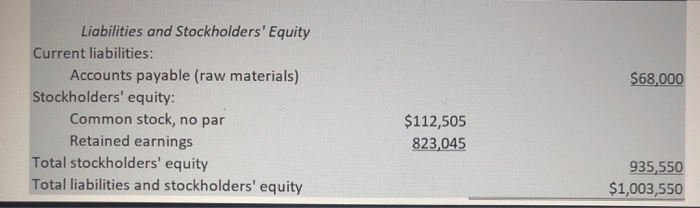

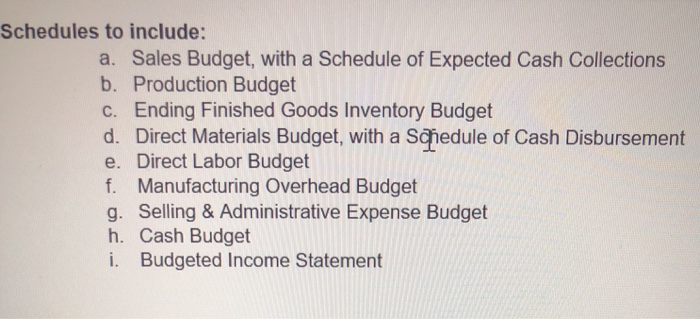

Schedules to include: a. Sales Budget, with a Schedule of Expected Cash Collections b. Production Budget C. Ending Finished Goods Inventory Budget d. Direct Materials Budget, with a Schedule of Cash Disbursement e. Direct Labor Budget f. Manufacturing Overhead Budget g. Selling & Administrative Expense Budget h. Cash Budget i. Budgeted Income Statement Sharp Products is a manufacturing company. It uses absorption costing for budgeting. amount unit Budgeted sales: Q1 of 2019 23,000 cases Q2 31,500 cases Q3 27,250 cases Q4 14,250 cases Unit selling price $19.50 dollars per unit All sales are on account (on credit). Collection pattern: Cash collected in the quarter of sale Cash collected in the quarter following sale 70% 30% Beginning FG inventory (in units) Desired ending FG inventoryext quarter's sales Desired ending FG inventory at year end 2,200 cases 30% 10,000 cases Beginning RM inventory (in units) Quantity of DM needed per unit DM cost per pound 21,000 pounds 16.00 pounds $0.25 dollars DM cost per pound Desired ending RM inventoryext quarter's RM needs Desired ending RM inventory at year end $0.25 dollars 10% 23,000 pounds Cash payments to suppliers: paid in the quarter of purchase paid in the quarter following purchase 30% of the purchases 70% of the purchases DL hours per unit DL rate per hour 0.50 hours $15.00 dollars Manufacturing overhead Variable MOH Fixed MOH $4.00 per DLH $24,000 per quarter Noncash MOH Depreciation $17,000 per quarter Selling and administrative expenses Variable SA Fixed SA $0.80 per case $0.80 per case semng and administrative expenses Variable SA Fixed SA Advertising Executive Salaries Accounting Services Patent Use Dues Depreciation $5,000 per quarter $27,000 per quarter $8,000 per quarter $4,000 per quarter $4,000 per quarter Sharp Products has an agreement with a local bank that would supply any amount of loan it needs to maintain the minimum cash balance. Interest is not compounded and paid at the end of each year, 4% per quarter $5,000 Interest rate for bank loan Minimum cash balance Equipment purchases Q1 02 03 $5,000 for 01 $4,000 for Q2 $0 for Q3 $26,000 for 24 $5,000 per quarter Q4 Cash dividends Sharp Products Co. Balance Sheet for the Year Ended Dec 31, 2019 $92,000 130,000 5,250 18,300 Assets Current assets: Cash Accounts receivable Raw materials inventory Finished goods inventory Total current assets Plant and equipment Land Buildings and equipment Accumulated depreciation Plant and equipment, net Total assets $245,550 300,000 750,000 (292,000) 758,000 $1,003,550 Liabilities and Stockholders' Equity Current liabilities: Accounts payable (raw materials) Stockholders' equity: Common stock, no par $68,000 $112,505 $68,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable (raw materials) Stockholders' equity: Common stock, no par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $112,505 823,045 935,550 $1,003,550