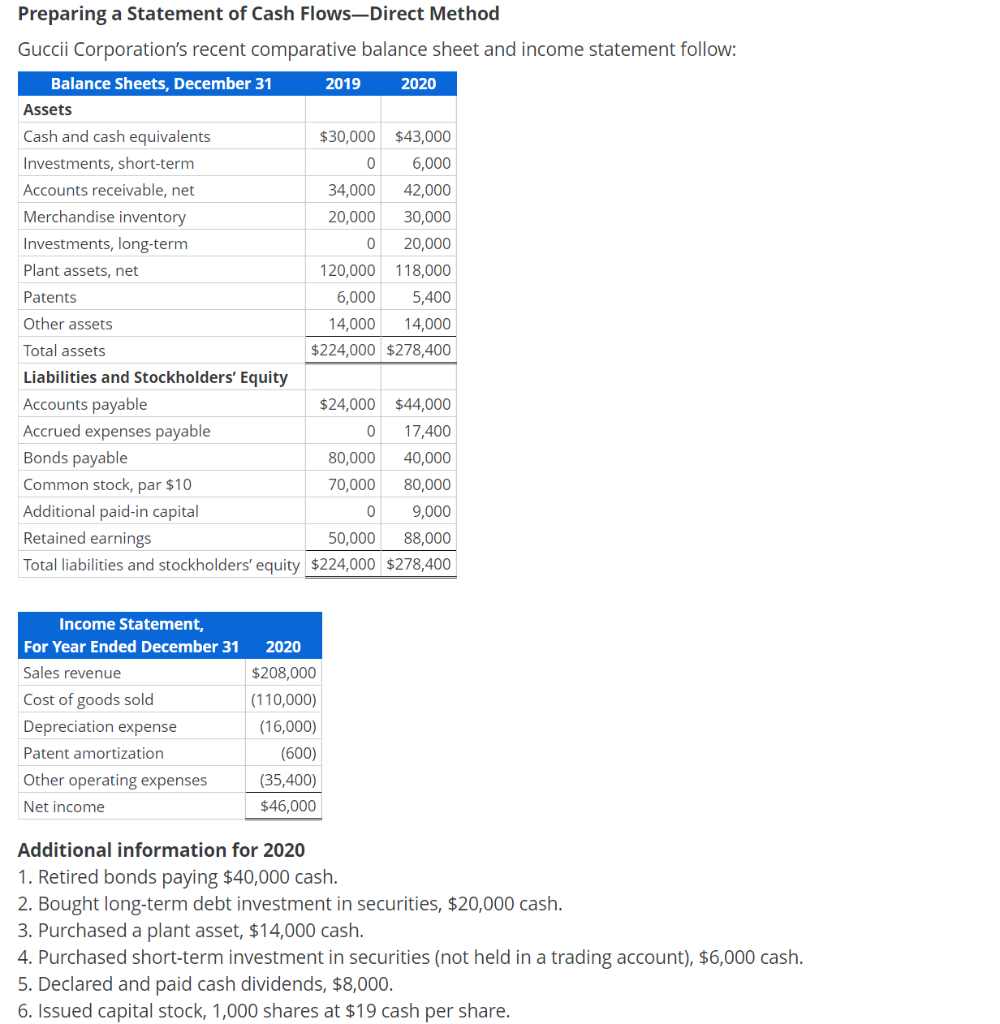

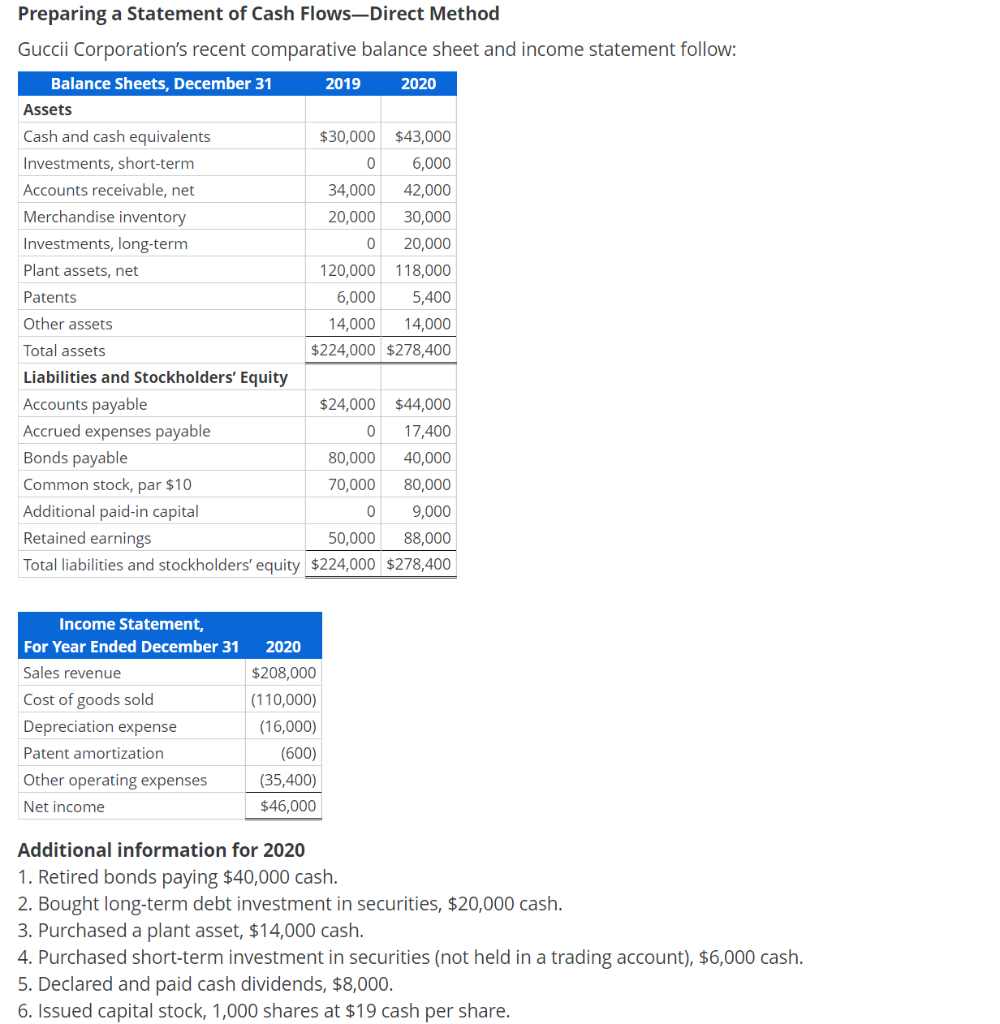

Preparing a Statement of Cash Flows-Direct Method Guccii Corporation's recent comparative balance sheet and income statement follow: Balance Sheets, December 31 2019 2020 Assets Cash and cash equivalents $30,000 $43,000 Investments, short-term 0 6,000 Accounts receivable, net 34,000 42,000 Merchandise inventory 20,000 30,000 Investments, long-term 0 20,000 Plant assets, net 120,000 118,000 Patents 6,000 5,400 Other assets 14,000 14,000 Total assets $224,000 $278,400 Liabilities and Stockholders' Equity Accounts payable $24,000 $44,000 Accrued expenses payable 0 17,400 Bonds payable 80,000 40,000 Common stock, par $10 70,000 80,000 Additional paid-in capital 0 9,000 Retained earnings 50,000 88,000 Total liabilities and stockholders' equity $224,000 $278,400 2020 Income Statement, For Year Ended December 31 Sales revenue Cost of goods sold Depreciation expense Patent amortization Other operating expenses Net income $208,000 (110,000) (16,000) (600) (35,400) $46,000 Additional information for 2020 1. Retired bonds paying $40,000 cash. 2. Bought long-term debt investment in securities, $20,000 cash. 3. Purchased a plant asset, $14,000 cash. 4. Purchased short-term investment in securities (not held in a trading account), $6,000 cash. 5. Declared and paid cash dividends, $8,000. 6. Issued capital stock, 1,000 shares at $19 cash per share. Oo oo Prepare a statement of cash flows assuming the direct method in presenting cash flows from operating activities. Assume there is no bad debt expense. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities Collections from customers $ Payments to suppliers Payments for other operating expenses Net cash provided (used) by operating activities Cash flows from investing activities Purchase of long-term investments Purchase of plant assets Purchase of short-term investments Net cash provided (used) by investing activities Cash flows from financing activities Retirement of bonds payable Issuance of common stock Cash paid for dividends Net cash provided (used) by financing activities Net increase in cash and cash equivalents during 2020 Cash and cash equivalents, January 1, 2020 Cash and cash equivalents, December 31, 2020 Oo oo 0 0 0 0 0 0 $ 0