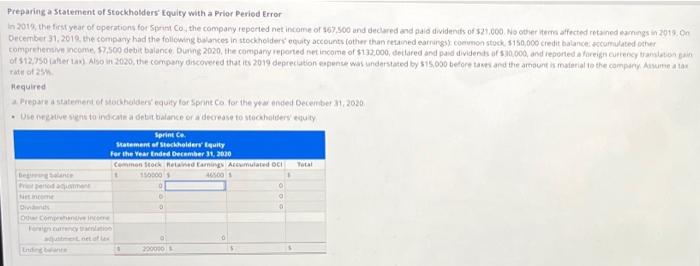

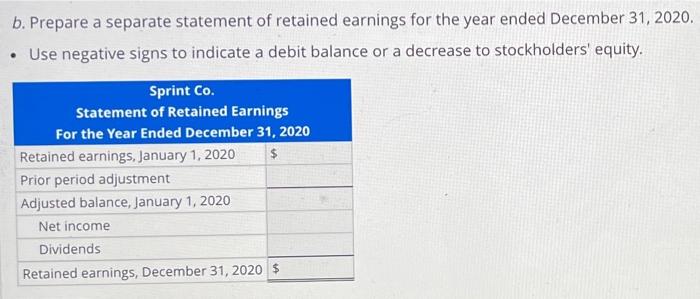

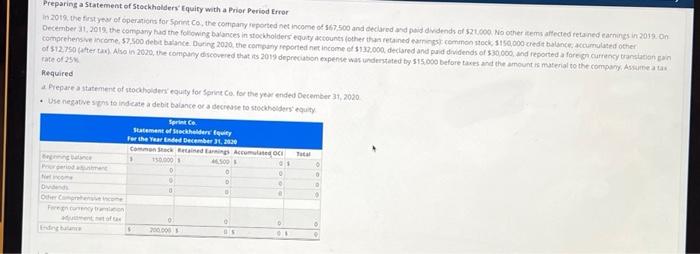

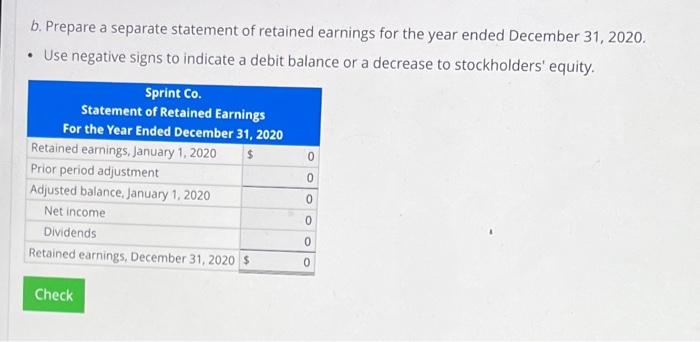

Preparing a statement of Stockholders' Equity with a Prior Period Error In 2013 the first year of operations for Sprinto the company reported net income of $67.500 and declared and paid dividents of $21.000 Nethem affected retained earning in 2013. On December 31, 2019. the company had the following balances in stockholders equity accounts other than retained earrings.common stock 5150,000 credit balance cumulated other comprehensive income, 7.500 debit balance. During 2020, the company reported net income of 132.000, declared and paid dividends of $10,000, and reported a foreign currency translation an of 512,70 her). Also in 2020, the company covered that its 2019 deprecation punt was understated by 515,000 before tants and the amount is material to the companiet rate of 2 Required Prepare a statement of stockholders equity for Sprint for the yow ended December 1, 2020 Dove su to indicata de un balance or decrease to stockholders guilty Sprint ce Statement of Stockholders Equity For the Year Ended December 31, 2000 Common stock Metal Earnings Accumulated DCI 150000 000 Ondants Com Loto End 200 5 b. Prepare a separate statement of retained earnings for the year ended December 31, 2020. Use negative signs to indicate a debit balance or a decrease to stockholders' equity. Sprint Co. Statement of Retained Earnings For the Year Ended December 31, 2020 Retained earnings, January 1, 2020 $ Prior period adjustment Adjusted balance, January 1, 2020 Net income Dividends Retained earnings, December 31, 2020 $ Preparing a statement of Stockholders' Equity with a Prior Period Error In 2018 the first year of operations for Sonnt Co, the company reported net income of 567.500 and declared and paid dividends of 21000 No other items affected retained earnings in 2019.On December 31, 2019, the company had the following Dances in stockholders equity accounts (other than retained angst common stock 5150,000 credit balance accumulated other comprehensive Income 57.500 debt balance. During 2030, the company reported net income of 532.000, declared and paid dividends of 530.000 and reported a foreign currency translation an of512.750 afterta). Also in 2020, the company discovered that its 2019 depreciation expense was understated by $15.000 before taxes and the amount is material to the company Assure rate of 25 Required Prepare statement of stockholders equity for Sort for the year ended December 31, 2020 Use negative to incre debit balance or decrease to stockholders Sprint Batement of Sockholders Iquity For the Year Ended December , 2020 Commons Recon Room 150000 14.500 Total NO D 0 5 200.000 b. Prepare a separate statement of retained earnings for the year ended December 31, 2020. Use negative signs to indicate a debit balance or a decrease to stockholders' equity. Sprint Co. Statement of Retained Earnings For the Year Ended December 31, 2020 Retained earnings, January 1, 2020 $ 0 Prior period adjustment Adjusted balance, January 1, 2020 Net income Dividends Retained earnings, December 31, 2020 $ 0 0 0 0 0 Check