Question

Preparing Adjusting Entries, Financial Statements, and Closing Entries Fischer Card Shop is a small retail shop. Fischer's balance sheet at year-end 2018 is as follows.

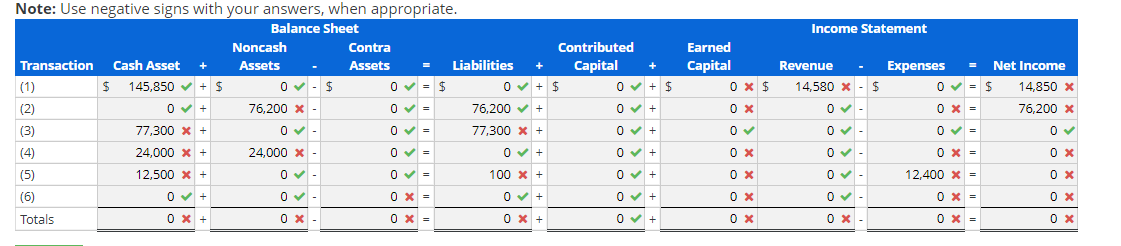

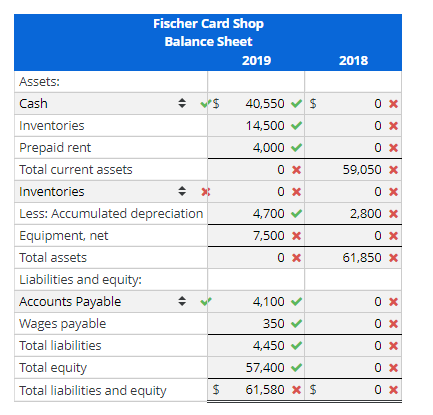

Preparing Adjusting Entries, Financial Statements, and Closing Entries Fischer Card Shop is a small retail shop. Fischer's balance sheet at year-end 2018 is as follows. The following information details transactions and adjustments that occurred during 2019. 1. Sales total $145,850 in 2019; all sales were cash sales. 2. Inventory purchases total $76,200 in 2019; at December 31, 2019, inventory totals $14,500. Assume all purchases are made on account. 3. Accounts payable totals $4,100 at December 31, 2019. 4. Annual store rent for $24,000 and was paid on March 1, 2019, covering the next 12 months. The balance in prepaid rent at December 31, 2018, was the balance remaining from the advance rent payment in 2018. 5. Wages are paid every other week on Friday; during 2019, Fischer paid $12,500 cash for wages. At December 31, 2019, Fischer owed employees unpaid and unrecorded wages of $350. 6. Depreciation on equipment totals $1,700 in 2019.

| Fischer Card Shop Balance Sheet December 31, 2018 | ||||

|---|---|---|---|---|

| Cash | $8,500 | Accounts payable | $5,200 | |

| Inventories | 12,000 | Wages payable | 100 | |

| Prepaid rent | 3,800 | Total current liabilities | 5,300 | |

| Total current assets | 24,300 | Total equity (includes retained earnings) | 23,500 | |

| Equipment | $7,500 | Total liabilities and equity | $28,800 | |

| Less Accumulated depreciation | 3,000 | |||

| Equipment, net | 4,500 | |||

| Total assets | $28,800 | |||

(a) Prepare any necessary transaction entries for 2019 and adjusting entries at December 31, 2019, using the financial statement effects template. (b) Prepare any necessary transaction entries for 2019 and adjusting entries at December 31, 2019, in journal entry form. (c) Set up T-accounts, including beginning balances, and post the journal entries to those T-accounts on the appropriate line. After all transactions are recorded, compute the balance for each account in the appropriate column. (d) Prepare its income statement for 2019, and its balance sheet at December 31, 2019. (e) Prepare entries to close its temporary accounts in journal entry form and post the closing entries to the T-accounts above in part (c).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started