Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparing Adjusting Journal Entries Adjusting Journal Entries Part One Adjusting Journal Entries Part Two Equipment used in operations cost $ 1 , 1 7 6

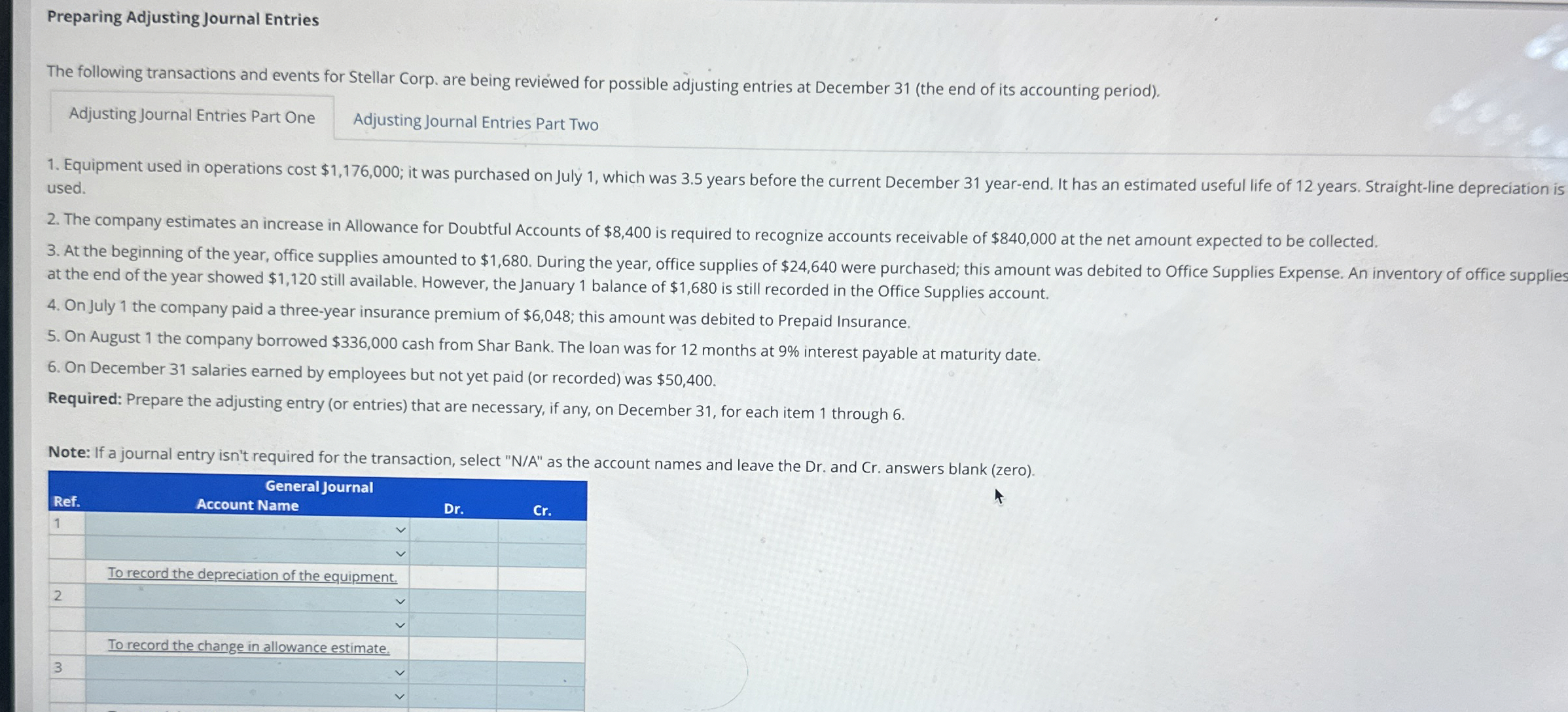

Preparing Adjusting Journal Entries

Adjusting Journal Entries Part One

Adjusting Journal Entries Part Two

Equipment used in operations cost $; it was purchased on July which was years before the current December yearend. It has an estimated useful life of years. Straightline depreciation is

used.

The company estimates an increase in Allowance for Doubtful Accounts of $ is required to recognize accounts receivable of $ at the net amount expected to be collected.

At the beginning of the year, office supplies amounted to $ During the year, office supplies of $ were purchased; this amount was debited to Office Supplies Expense. An inventory of office supplies

at the end of the year showed $ still available. However, the January balance of $ is still recorded in the Office Supplies account.

On July the company paid a threeyear insurance premium of $; this amount was debited to Prepaid Insurance.

On August the company borrowed $ cash from Shar Bank. The loan was for months at interest payable at maturity date.

On December salaries earned by employees but not yet paid or recorded was $

Required: Prepare the adjusting entry or entries that are necessary, if any, on December for each item through

Note: If a journal entry isn't required for the transaction, select NA as the account names and leave the Dr and Cr answers blank zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started