Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparing an Adjusted Trial Balance Walker Corp. provides the following information relating to adjusting entries required at the end of its fiscal year, December 31.

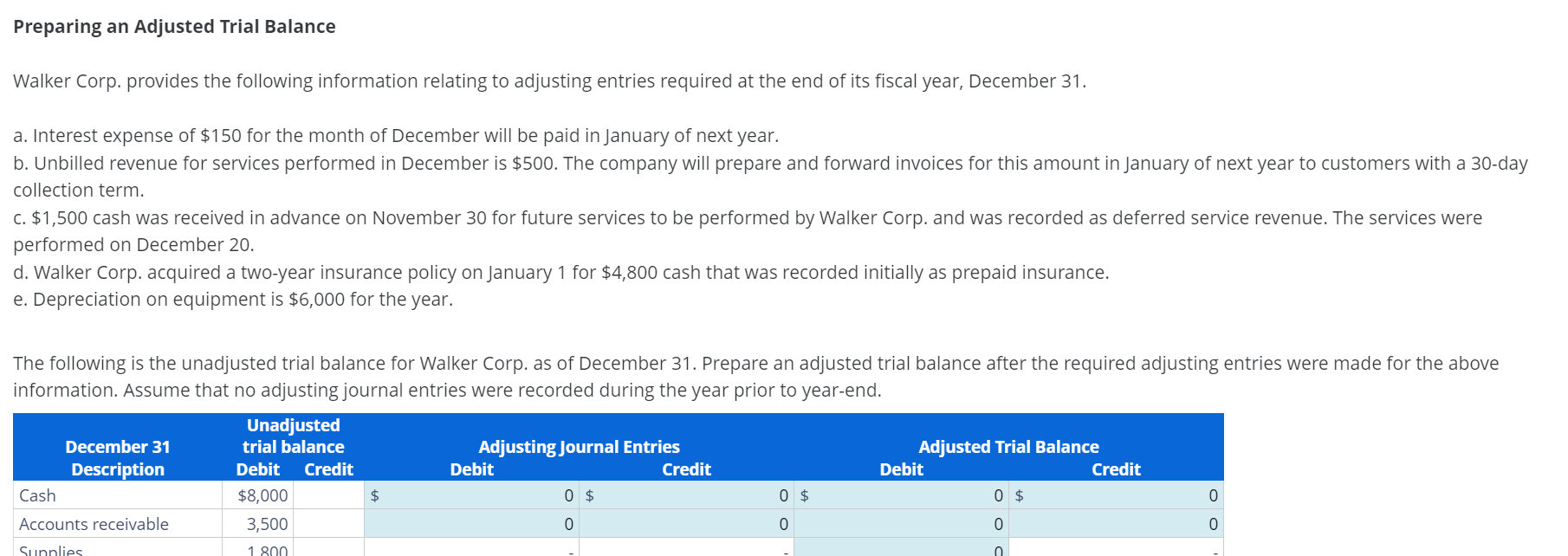

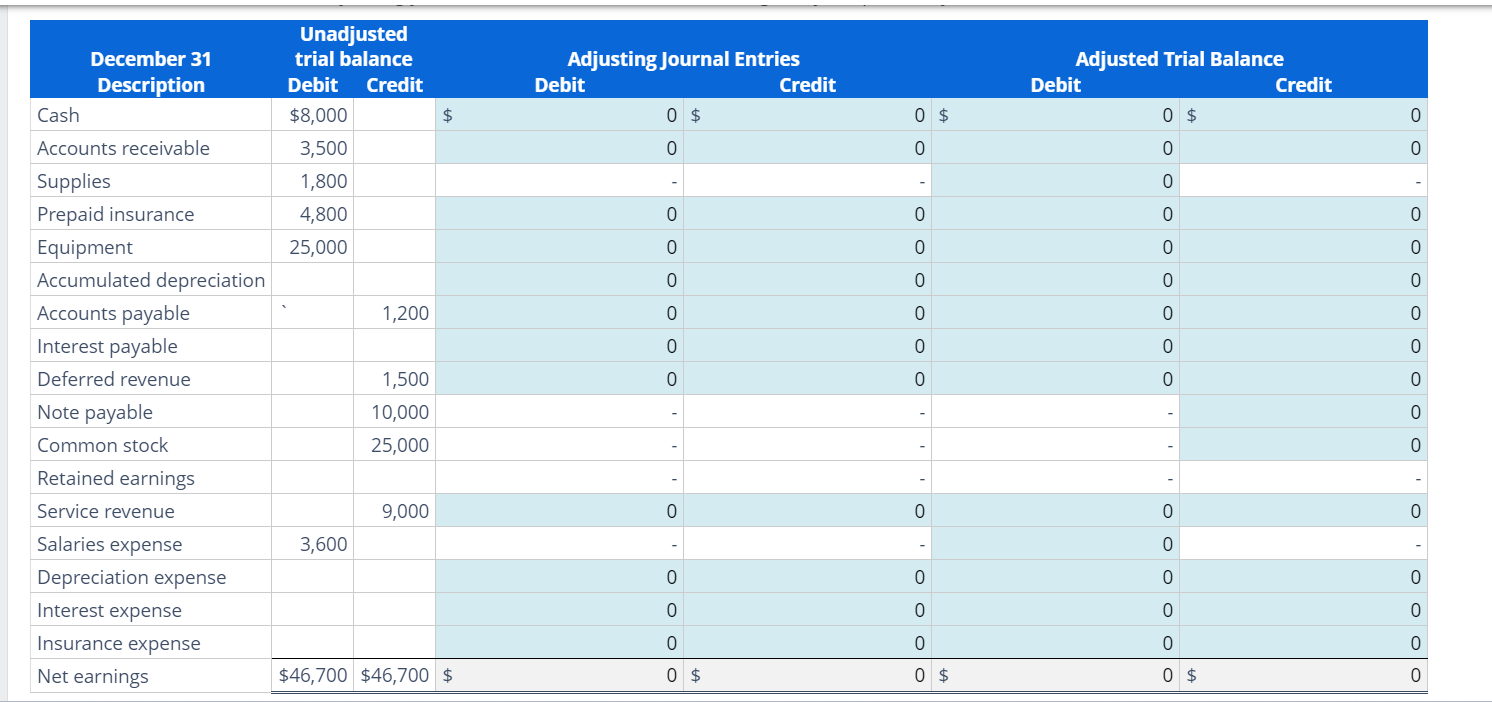

Preparing an Adjusted Trial Balance Walker Corp. provides the following information relating to adjusting entries required at the end of its fiscal year, December 31. a. Interest expense of $150 for the month of December will be paid in January of next year. b. Unbilled revenue for services performed in December is $500. The company will prepare and forward invoices for this amount in January of next year to customers with a 30 -day collection term. c. $1,500 cash was received in advance on November 30 for future services to be performed by Walker Corp. and was recorded as deferred service revenue. The services were performed on December 20. d. Walker Corp. acquired a two-year insurance policy on January 1 for $4,800 cash that was recorded initially as prepaid insurance. e. Depreciation on equipment is $6,000 for the year. The following is the unadjusted trial balance for Walker Corp. as of December 31. Prepare an adjusted trial balance after the required adjusting entries were made for the above information. Assume that no adjusting journal entries were recorded during the year prior to year-end. Preparing an Adjusted Trial Balance Walker Corp. provides the following information relating to adjusting entries required at the end of its fiscal year, December 31. a. Interest expense of $150 for the month of December will be paid in January of next year. b. Unbilled revenue for services performed in December is $500. The company will prepare and forward invoices for this amount in January of next year to customers with a 30 -day collection term. c. $1,500 cash was received in advance on November 30 for future services to be performed by Walker Corp. and was recorded as deferred service revenue. The services were performed on December 20. d. Walker Corp. acquired a two-year insurance policy on January 1 for $4,800 cash that was recorded initially as prepaid insurance. e. Depreciation on equipment is $6,000 for the year. The following is the unadjusted trial balance for Walker Corp. as of December 31. Prepare an adjusted trial balance after the required adjusting entries were made for the above information. Assume that no adjusting journal entries were recorded during the year prior to year-end

Preparing an Adjusted Trial Balance Walker Corp. provides the following information relating to adjusting entries required at the end of its fiscal year, December 31. a. Interest expense of $150 for the month of December will be paid in January of next year. b. Unbilled revenue for services performed in December is $500. The company will prepare and forward invoices for this amount in January of next year to customers with a 30 -day collection term. c. $1,500 cash was received in advance on November 30 for future services to be performed by Walker Corp. and was recorded as deferred service revenue. The services were performed on December 20. d. Walker Corp. acquired a two-year insurance policy on January 1 for $4,800 cash that was recorded initially as prepaid insurance. e. Depreciation on equipment is $6,000 for the year. The following is the unadjusted trial balance for Walker Corp. as of December 31. Prepare an adjusted trial balance after the required adjusting entries were made for the above information. Assume that no adjusting journal entries were recorded during the year prior to year-end. Preparing an Adjusted Trial Balance Walker Corp. provides the following information relating to adjusting entries required at the end of its fiscal year, December 31. a. Interest expense of $150 for the month of December will be paid in January of next year. b. Unbilled revenue for services performed in December is $500. The company will prepare and forward invoices for this amount in January of next year to customers with a 30 -day collection term. c. $1,500 cash was received in advance on November 30 for future services to be performed by Walker Corp. and was recorded as deferred service revenue. The services were performed on December 20. d. Walker Corp. acquired a two-year insurance policy on January 1 for $4,800 cash that was recorded initially as prepaid insurance. e. Depreciation on equipment is $6,000 for the year. The following is the unadjusted trial balance for Walker Corp. as of December 31. Prepare an adjusted trial balance after the required adjusting entries were made for the above information. Assume that no adjusting journal entries were recorded during the year prior to year-end Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started