Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparing Partial Financial Statements and Closing Entries The partnership of Robo and Swing, CPAs, reported revenues of $ 2 1 5 , 0 0 0

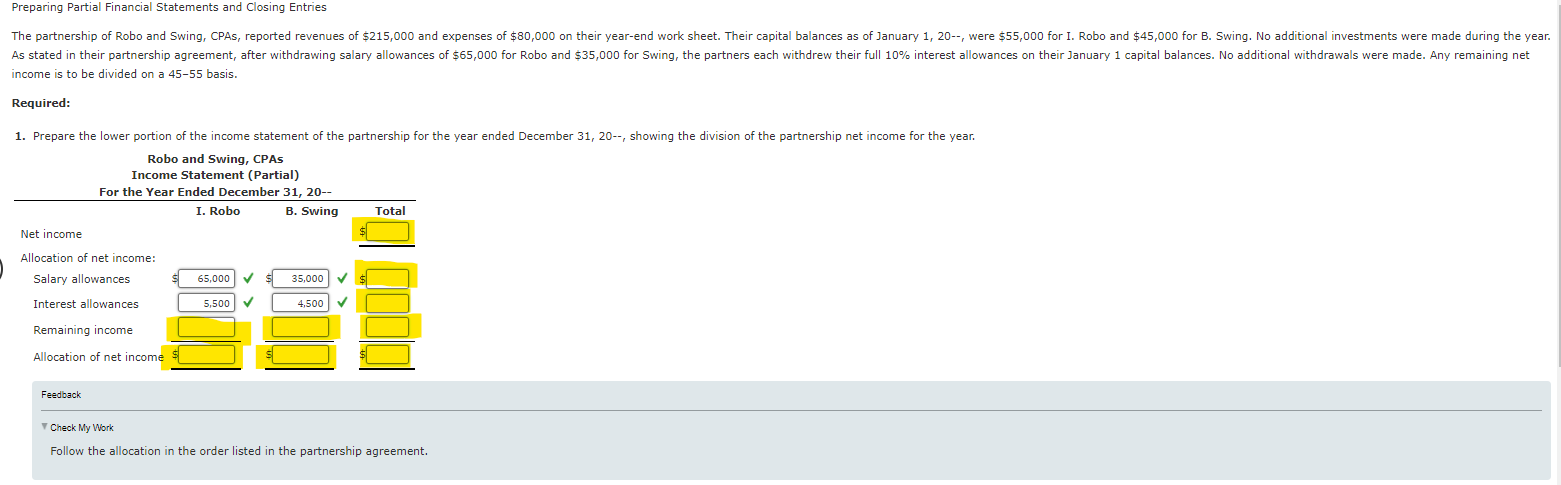

Preparing Partial Financial Statements and Closing Entries

The partnership of Robo and Swing, CPAs, reported revenues of $ and expenses of $ on their yearend work sheet. Their capital balances as of January were $ for I. Robo and $ for B Swing. No additional investments were made during the year. As stated in their partnership agreement, after withdrawing salary allowances of $ for Robo and $ for Swing, the partners each withdrew their full interest allowances on their January capital balances. No additional withdrawals were made. Any remaining net income is to be divided on a basis.

Required:

Question Content Area

Prepare the lower portion of the income statement of the partnership for the year ended December showing the division of the partnership net income for the year.

a Prepare a statement of partners' equity for the year ended December

b Prepare the partners' equity section of the balance sheet as on December

Prepare closing entries for the partnership as of December : a Close Revenue, b Close Expenses, c Close Net IncomeNet Loss, d Close Drawing accounts. For simplicity, use the account titles "Revenues" for all revenues and "Expenses" for all expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started