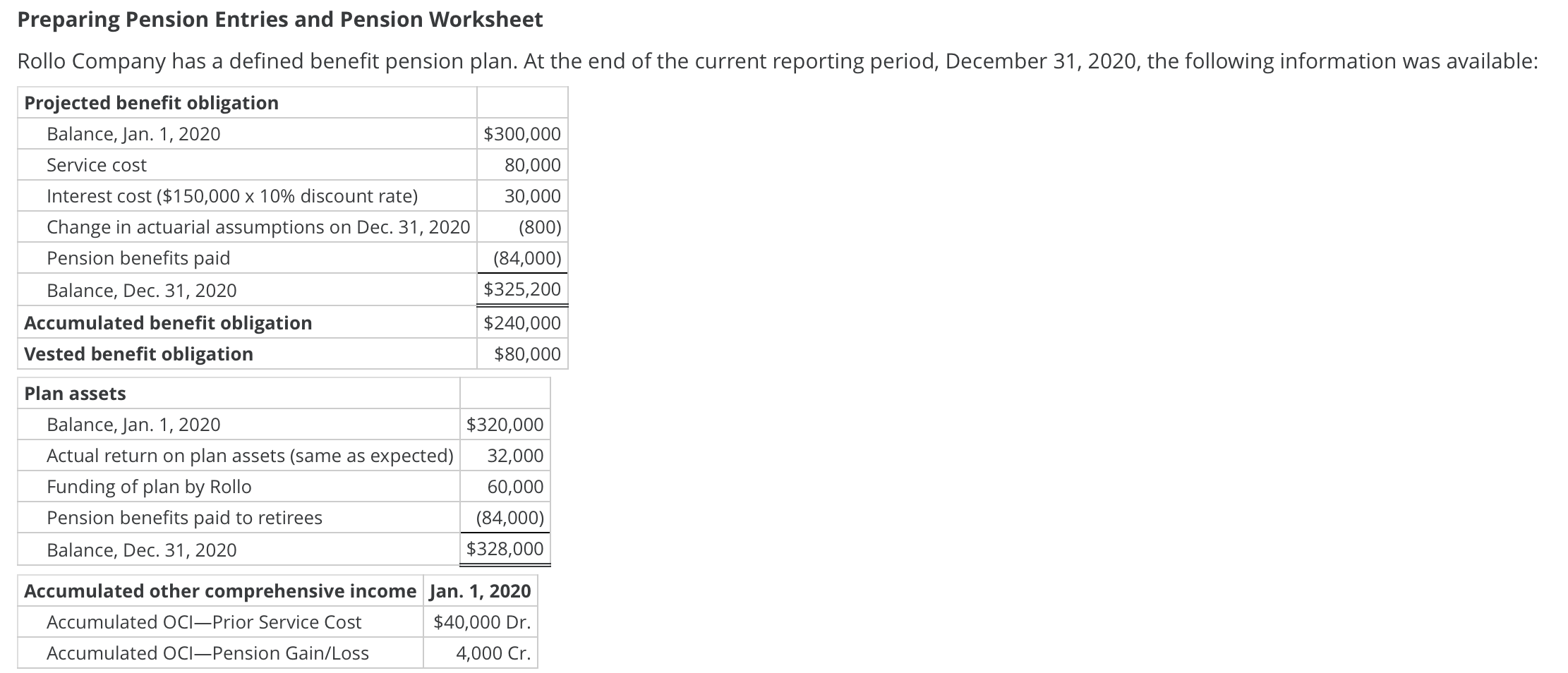

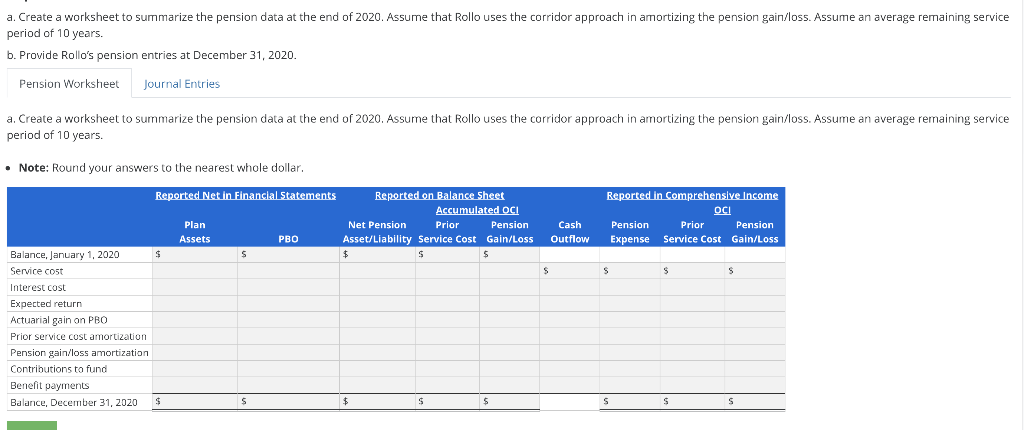

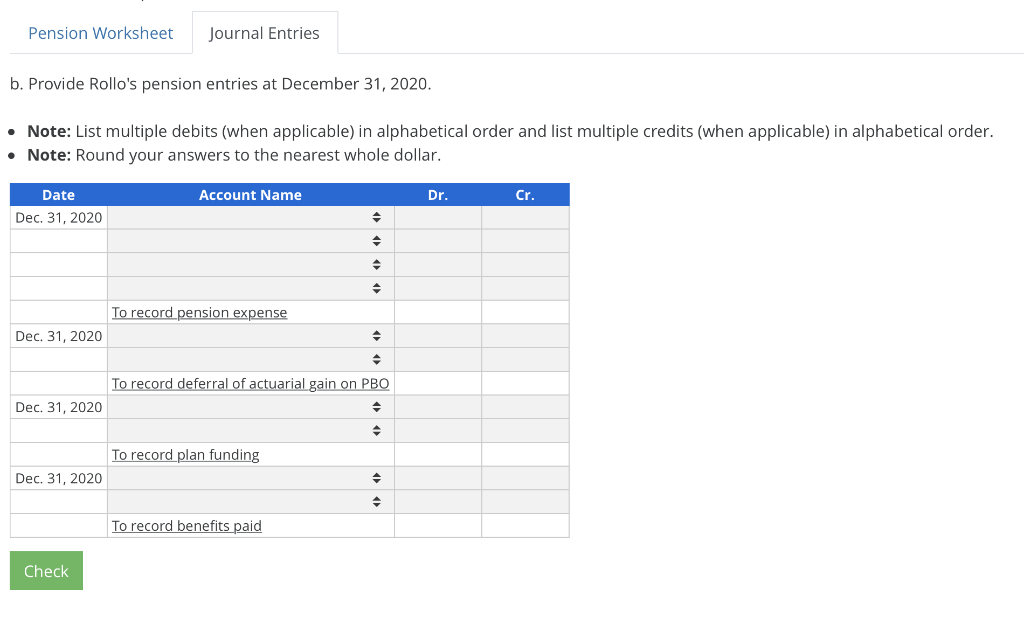

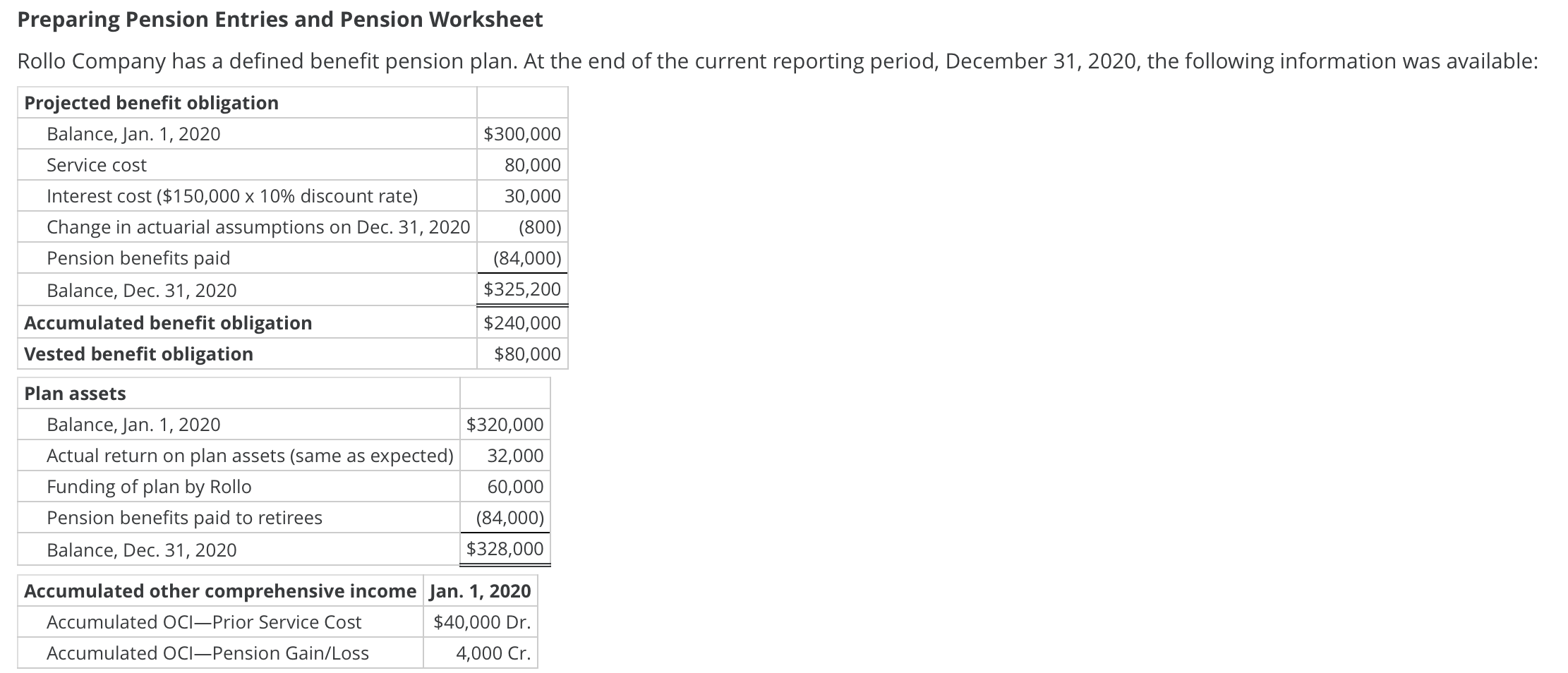

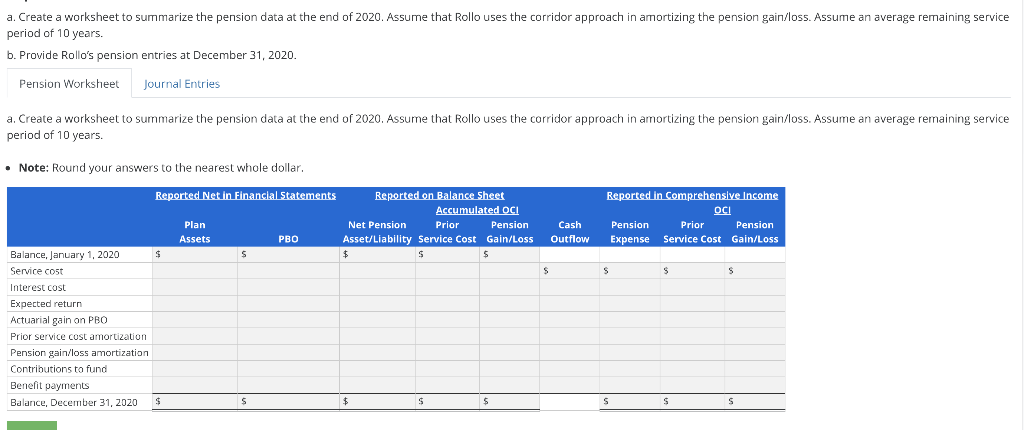

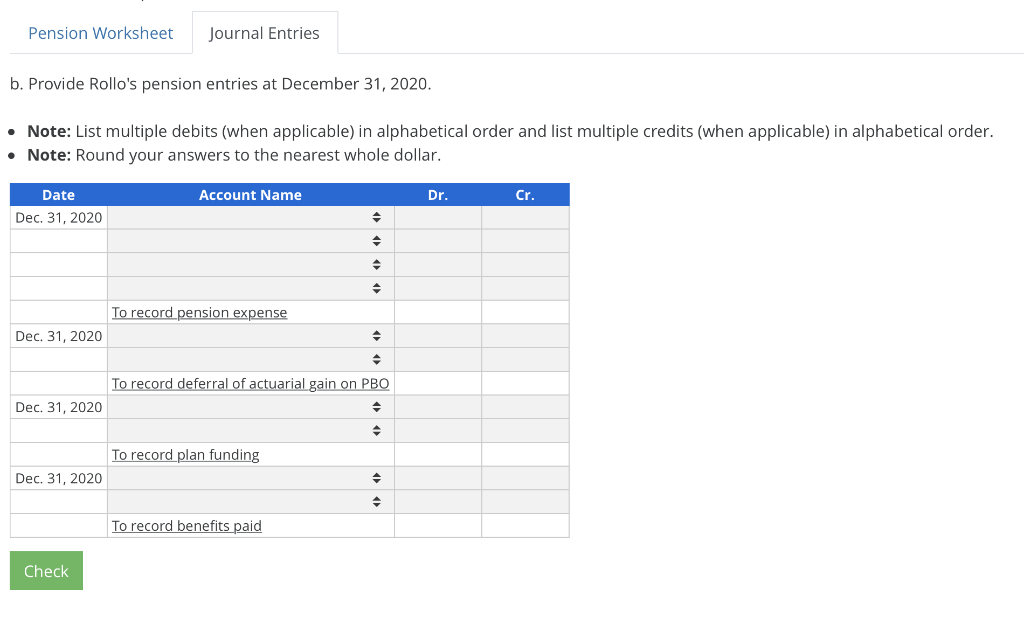

Preparing Pension Entries and Pension Worksheet Rollo Company has a defined benefit pension plan. At the end of the current reporting period, December 31, 2020, the following information was available: Projected benefit obligation Balance, Jan. 1, 2020 $300,000 Service cost 80,000 Interest cost ($150,000 x 10% discount rate) 30,000 Change in actuarial assumptions on Dec. 31, 2020 (800) Pension benefits paid (84,000) Balance, Dec. 31, 2020 $325,200 Accumulated benefit obligation $240,000 Vested benefit obligation $80,000 Plan assets Balance, Jan. 1, 2020 Actual return on plan assets (same as expected) Funding of plan by Rollo Pension benefits paid to retirees Balance, Dec. 31, 2020 $320,000 32,000 60,000 (84,000) $328,000 Accumulated other comprehensive income Jan. 1, 2020 Accumulated OCIPrior Service Cost $40,000 Dr. Accumulated OCI-Pension Gain/Loss 4,000 Cr. a. Create a worksheet to summarize the pension data at the end of 2020. Assume that Rollo uses the corridor approach in amortizing the pension gain/loss. Assume an average remaining service period of 10 years. b. Provide Rollo's pension entries at December 31, 2020. Pension Worksheet Journal Entries a. Create a worksheet to summarize the pension data at the end of 2020. Assume that Rollo uses the corridor approach in amortizing the pension gain/loss. Assume an average remaining service period of 10 years. Note: Round your answers to the nearest whole dollar. Reported Net in Financial Statements Reported on Balance Sheet Accumulated OCI Plan Net Pension Prior Pension Assets PBO Asset/Liability Service Cost Gain/Loss $ Reported in Comprehensive Income OCI Pension Prior Pension Expense Service Cost Gain/Loss Cash Outflow Balance, January 1, 2020 Service cost Interest cost Expected return Actuarial gain on PBO Prior service cost amortization Pension gain/loss amortization Contributions to fund Benefit payments Balance, December 31, 2020 $ Pension Worksheet Journal Entries b. Provide Rollo's pension entries at December 31, 2020. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: Round your answers to the nearest whole dollar. Account Name Dr. Date Dec. 31, 2020 To record pension expense Dec. 31, 2020 To record deferral of actuarial gain on PBO Dec. 31, 2020 To record plan funding Dec 31, 2020 To record benefits paid Check