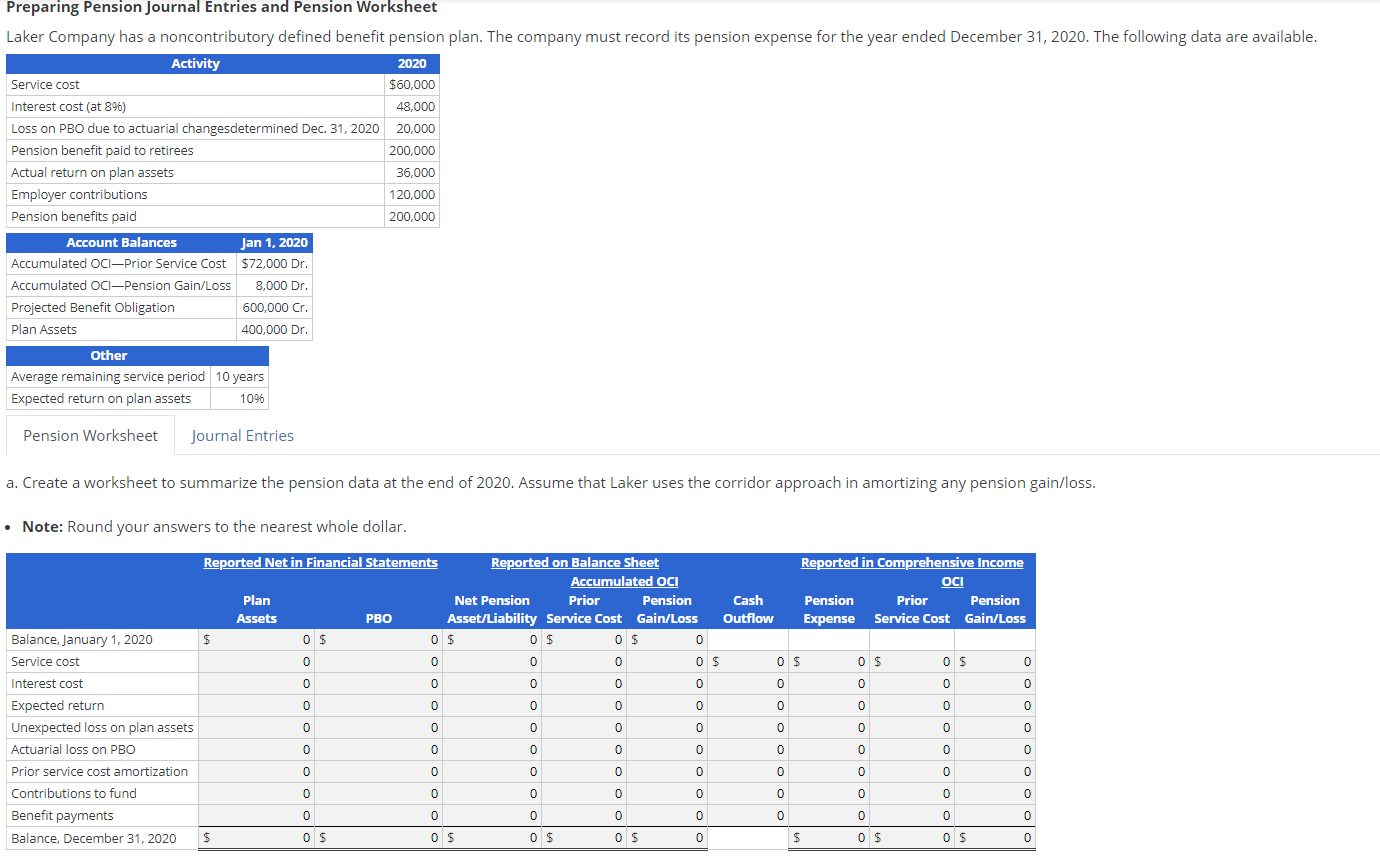

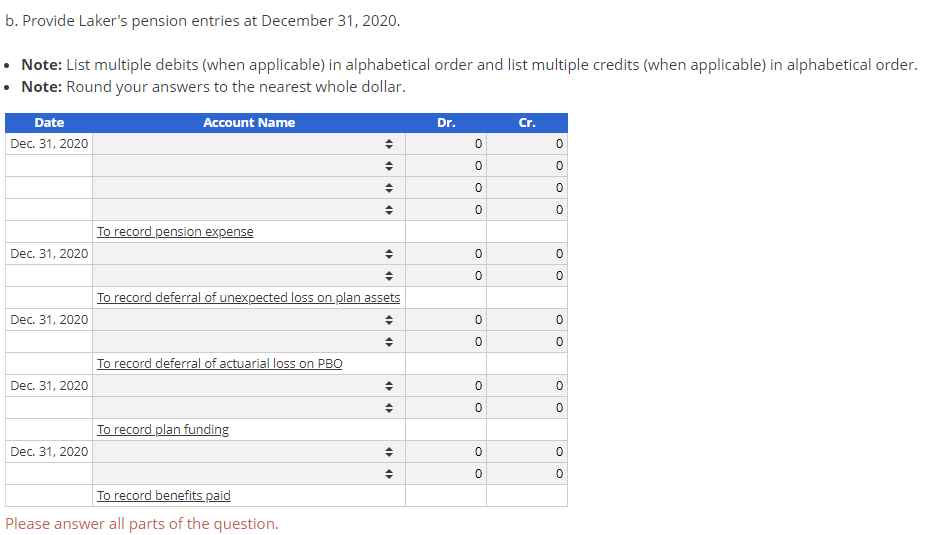

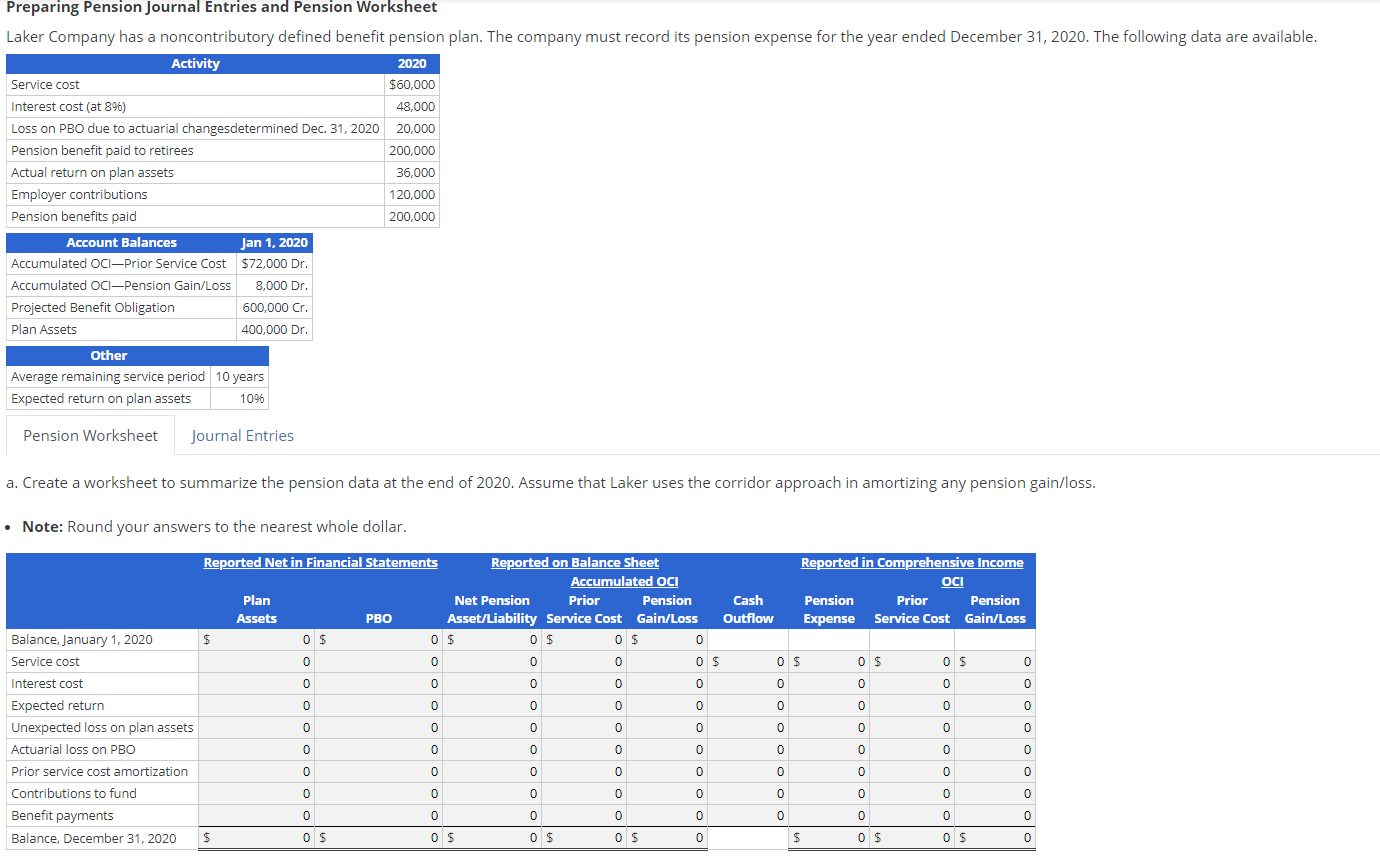

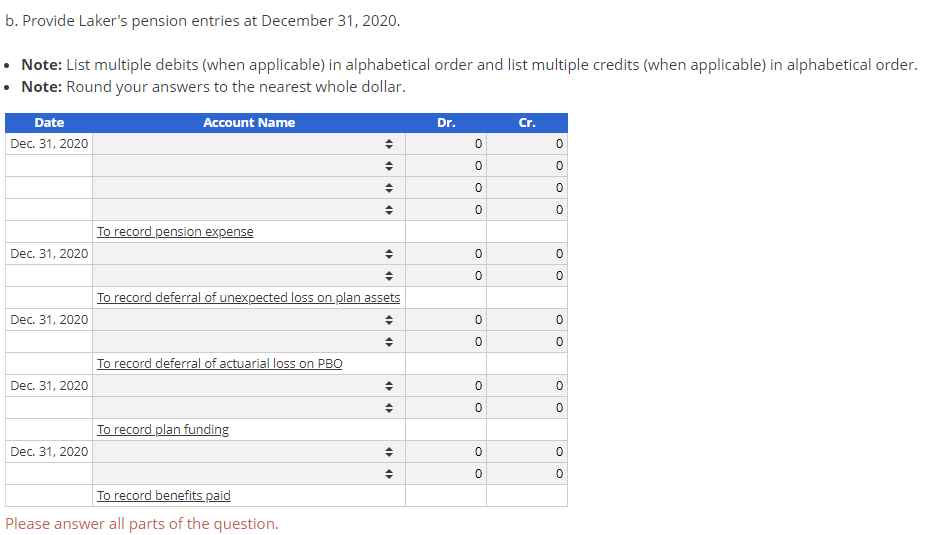

Preparing Pension Journal Entries and Pension Worksheet Laker Company has a noncontributory defined benefit pension plan. The company must record its pension expense for the year ended December 31, 2020. The following data are available. Activity 2020 Service cost $60,000 Interest cost (at 896) 48,000 Loss on PBO due to actuarial changesdetermined Dec 31, 2020 20,000 Pension benefit paid to retirees 200,000 Actual return on plan assets 36,000 Employer contributions 120,000 Pension benefits paid 200,000 Account Balances Jan 1, 2020 Accumulated OCIPrior Service Cost $72,000 Dr. Accumulated OCI-Pension Gain/Loss 8,000 Dr. Projected Benefit Obligation 600,000 Cr. Plan Assets 400,000 Dr. Other Average remaining service period 10 years Expected return on plan assets 1096 Pension Worksheet Journal Entries a. Create a worksheet to summarize the pension data at the end of 2020. Assume that Laker uses the corridor approach in amortizing any pension gain/loss. Note: Round your answers to the nearest whole dollar. Reported Net in Financial Statements Reported on Balance Sheet Reported in Comprehensive Income Accumulated OCI Plan Net Pension Prior Pension Cash Pension Prior Pension Assets PBO Asset/Liability Service Cost Gain/Loss Outflow Expense Service Cost Gain/Loss $ 0 $ 0 $ 0 $ 0 $ 0 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Balance, January 1, 2020 Service cost Interest cost Expected return Unexpected loss on plan assets Actuarial loss on PBO Prior service cost amortization Contributions to fund Benefit payments Balance, December 31, 2020 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ $ 0 $ 0 $ 0 $ 0 b. Provide Laker's pension entries at December 31, 2020. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: Round your answers to the nearest whole dollar. Account Name Dr. Cr. Date Dec 31, 2020 0 0 0 0 0 0 0 0 To record pension expense Dec. 31, 2020 . 0 0 > 0 0 To record deferral of unexpected loss on plan assets > Dec 31, 2020 0 0 0 0 To record deferral of actuarial loss on PBO Dec 31, 2020 0 0 0 0 To record plan funding Dec. 31, 2020 0 0 . 0 0 To record benefits paid Please answer all parts of the