Answered step by step

Verified Expert Solution

Question

1 Approved Answer

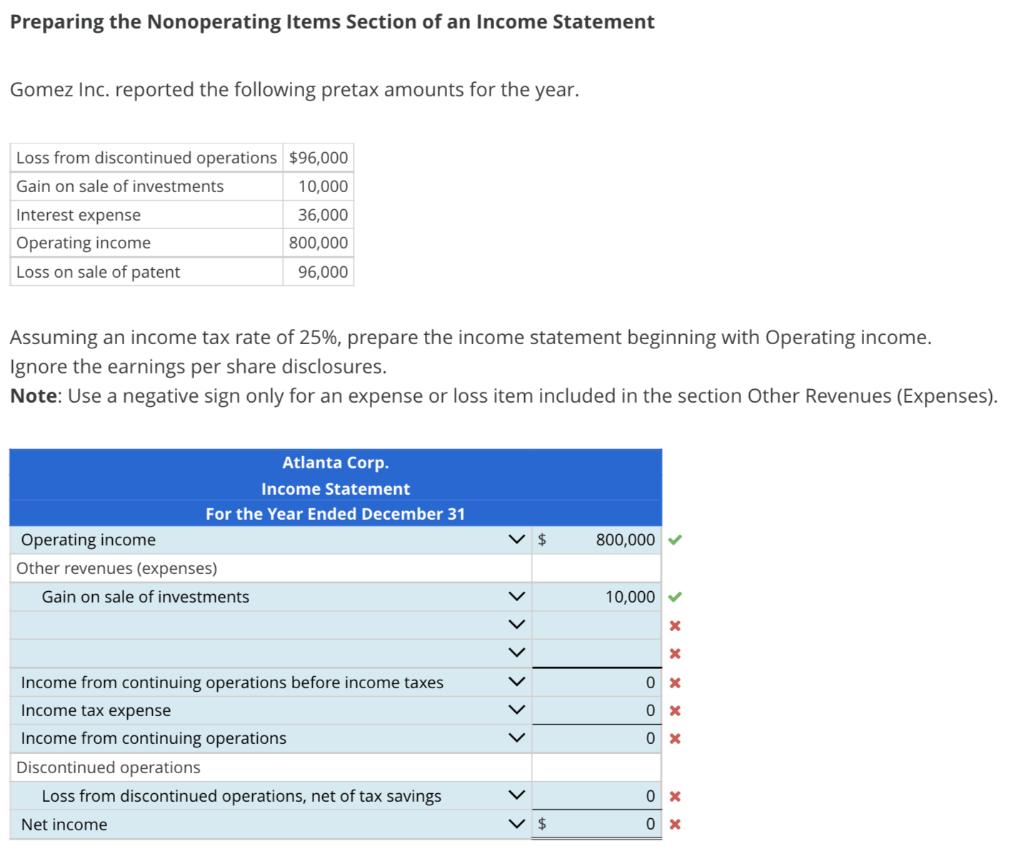

Preparing the Nonoperating Items Section of an Income Statement Gomez Inc. reported the following pretax amounts for the year. Loss from discontinued operations $96,000

Preparing the Nonoperating Items Section of an Income Statement Gomez Inc. reported the following pretax amounts for the year. Loss from discontinued operations $96,000 Gain on sale of investments 10,000 36,000 800,000 96,000 Interest expense Operating income Loss on sale of patent Assuming an income tax rate of 25%, prepare the income statement beginning with Operating income. Ignore the earnings per share disclosures. Note: Use a negative sign only for an expense or loss item included in the section Other Revenues (Expenses). Corp. Income Statement For the Year Ended December 31 Operating income Other revenues (expenses) Gain on sale of investments Income from continuing operations before income taxes Income tax expense Income from continuing operations Discontinued operations Loss from discontinued operations, net of tax savings Net income V $ >> V $ 800,000 10,000 X X 0 X 0 x 0 x 0 x 0 x

Step by Step Solution

★★★★★

3.23 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Atlanta Corp Income Statement For the Year Ended December 31 2020 Operating income 800000 Ot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started