Answered step by step

Verified Expert Solution

Question

1 Approved Answer

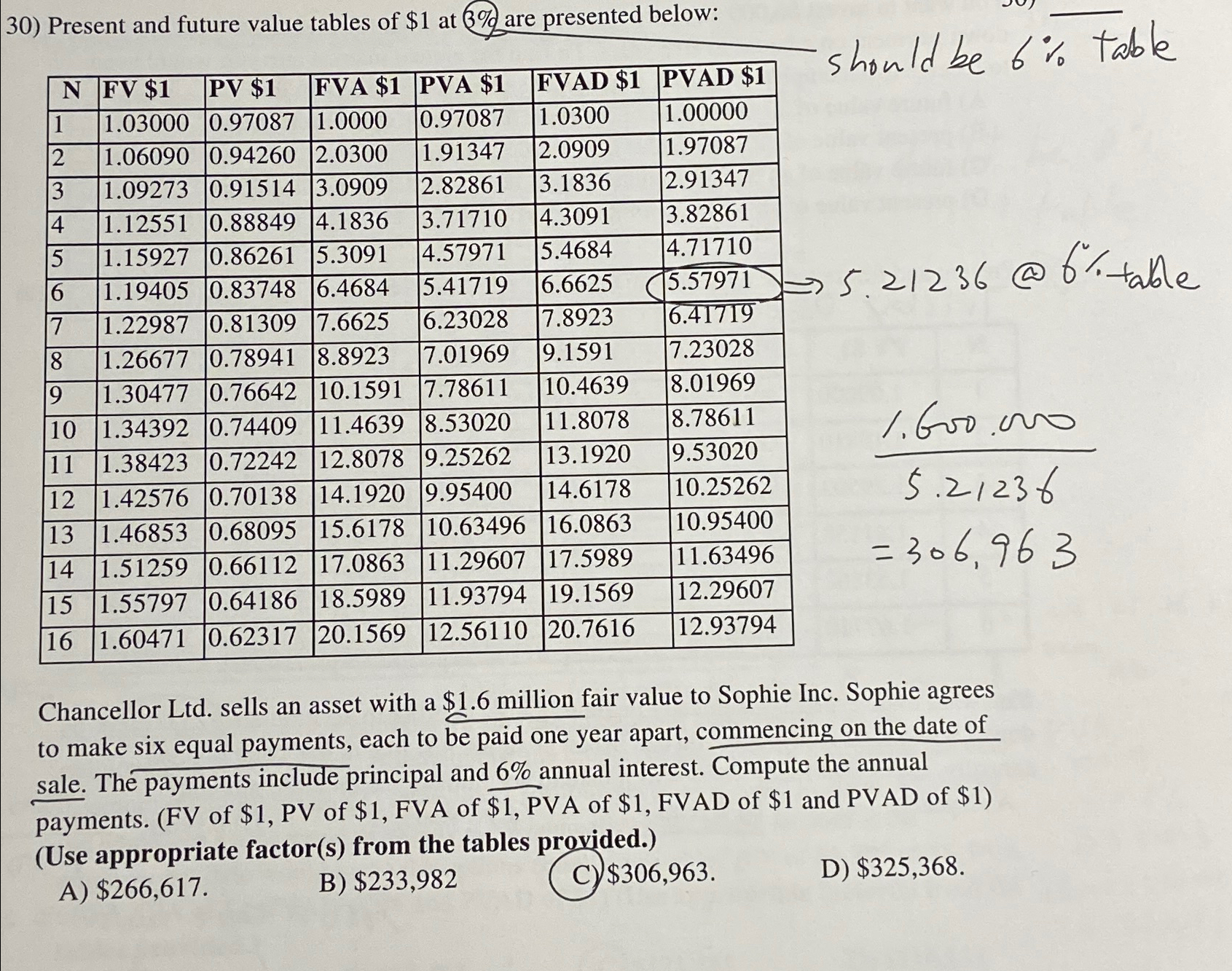

Present and future value tables of $ 1 at ( 3 % ) are presented below: table [ [ N , FV $ 1

Present and future value tables of $ at are presented below:

tableFV $PV $FVA $PVA $FVAD $PVAD $

Chancellor Ltd sells an asset with a $ million fair value to Sophie Inc. Sophie agrees to make six equal payments, each to be paid one year apart, commencing on the date of sale. The payments include principal and annual interest. Compute the annual payments. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $Use appropriate factors from the tables provided.

A $

B $

C $

D $ please explain in detail why this ansanswer is given, referring to the explaexplanations and answer written around it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started