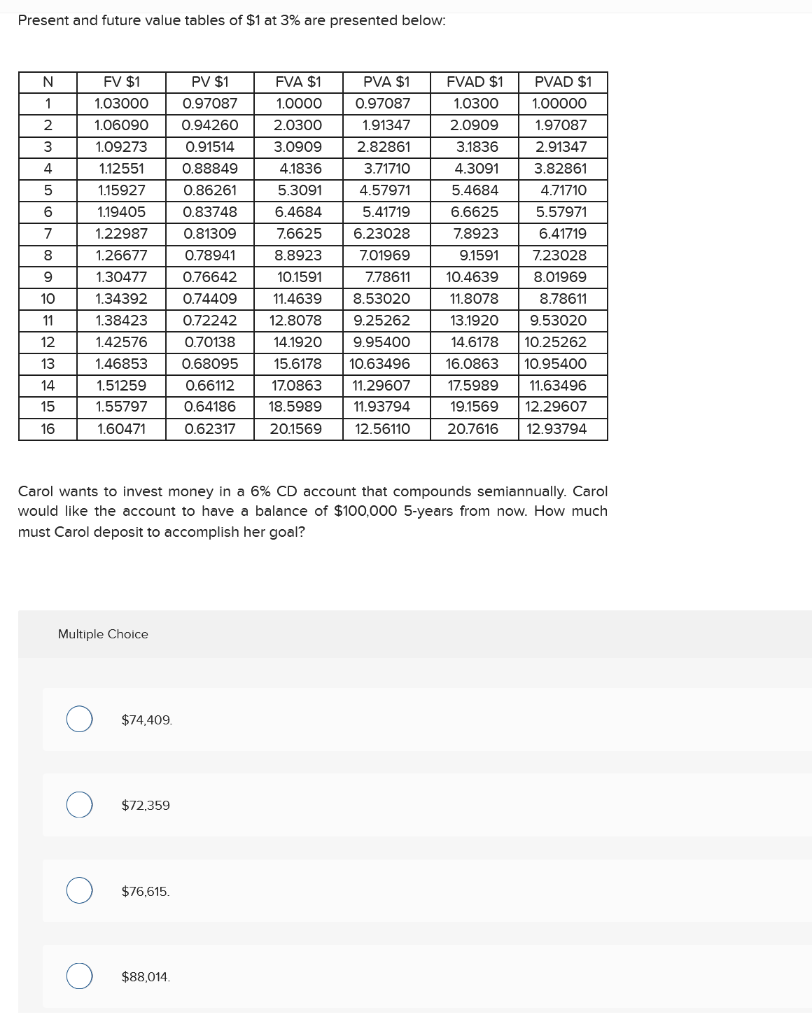

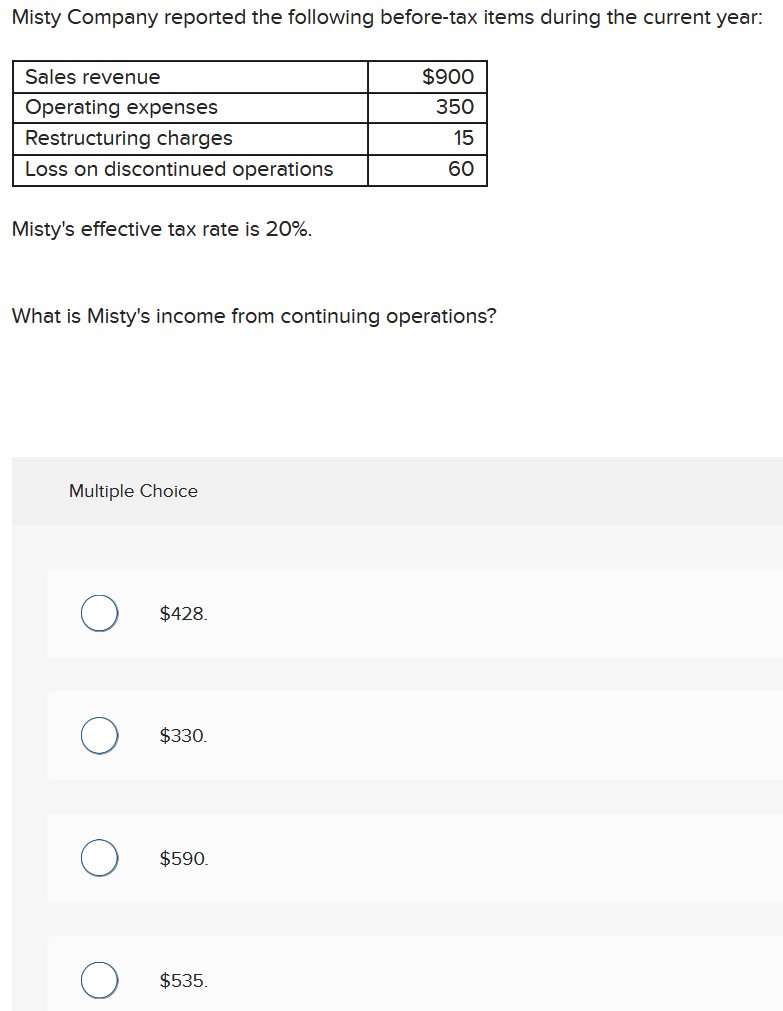

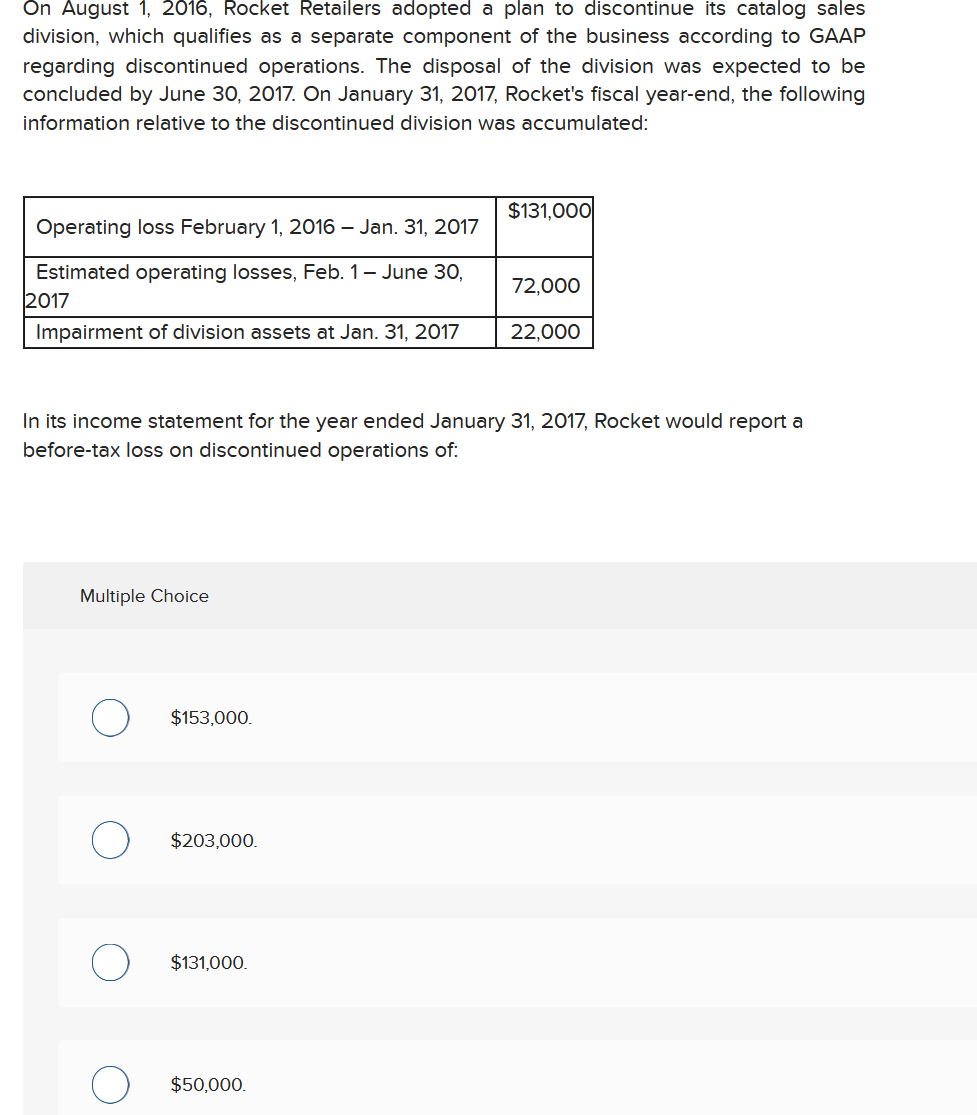

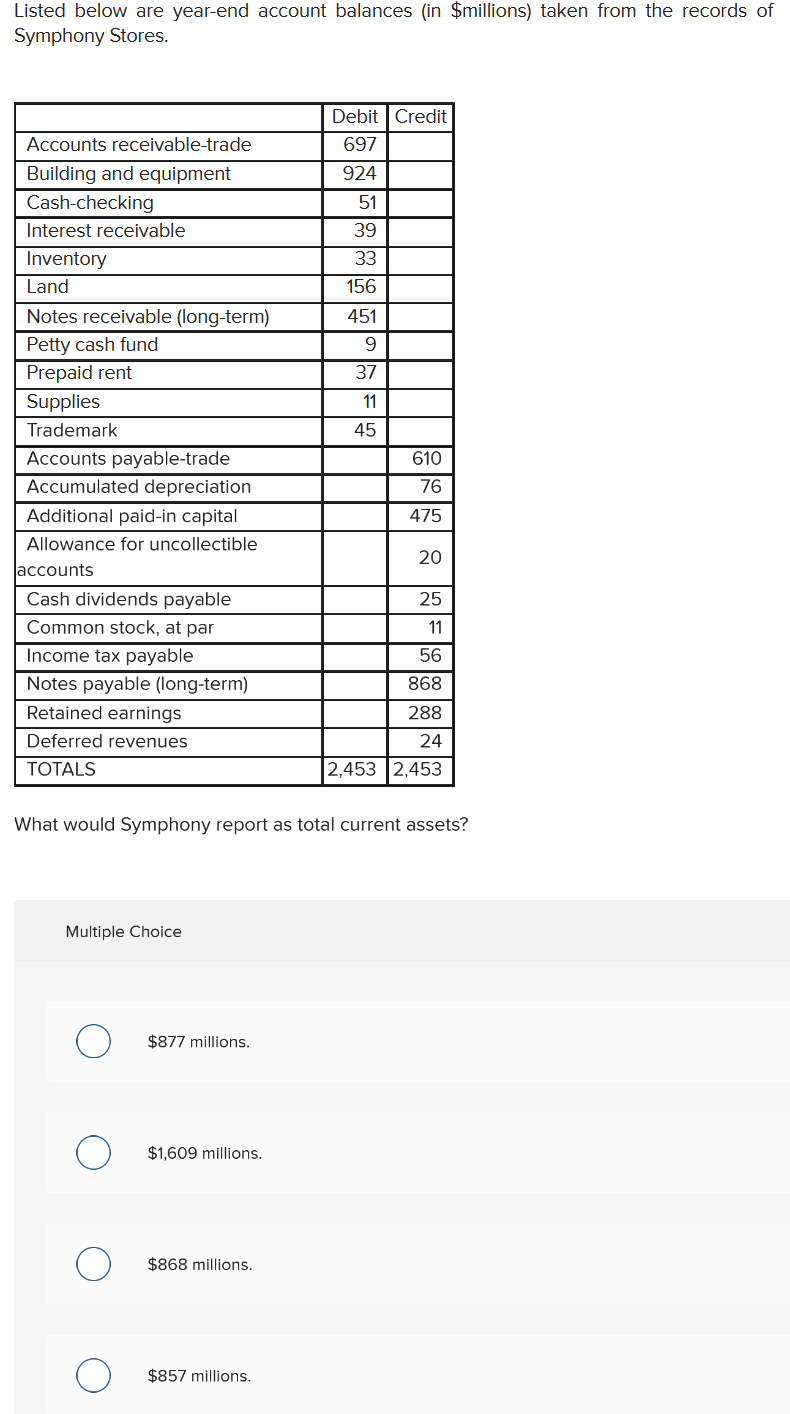

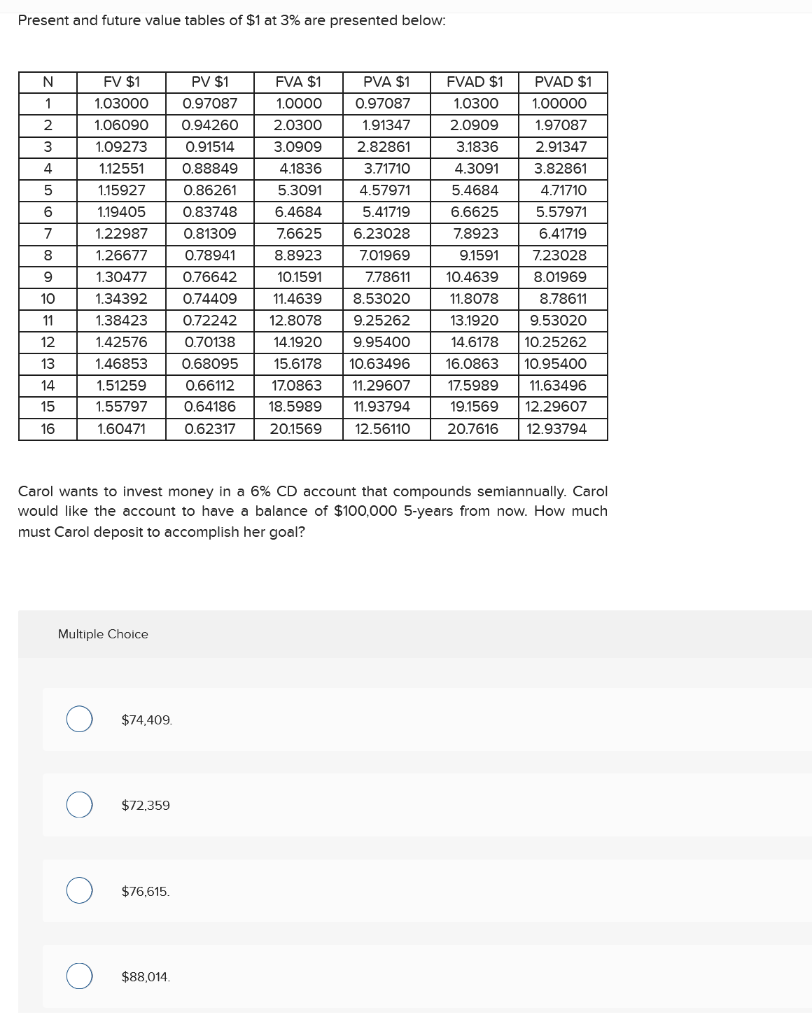

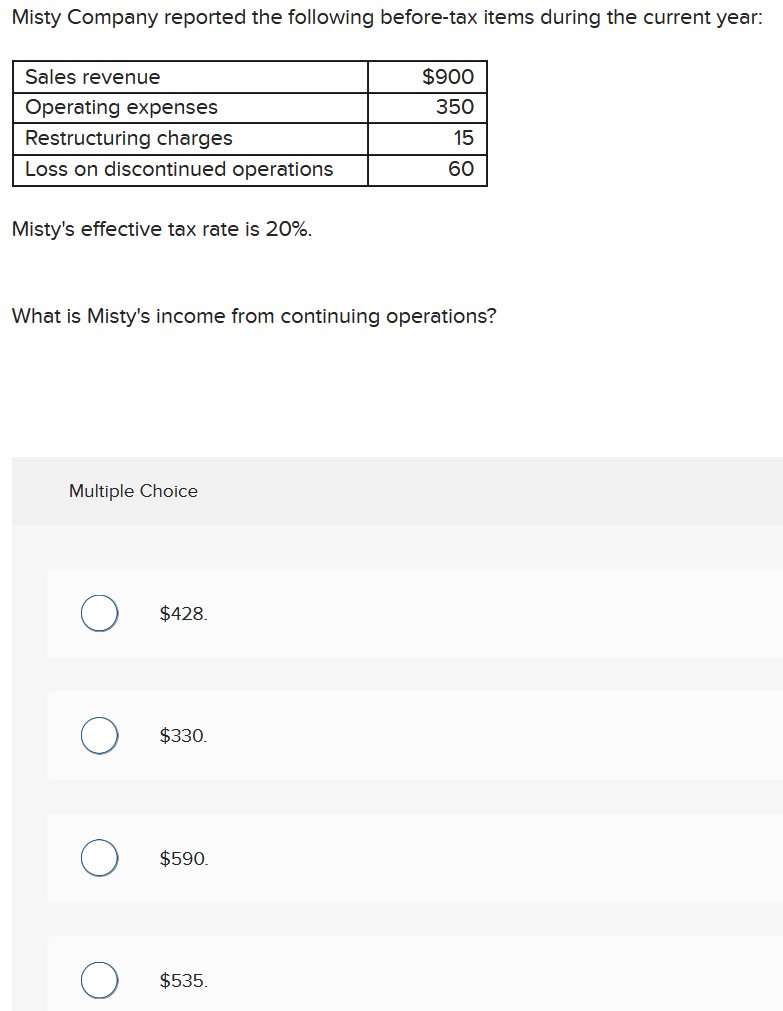

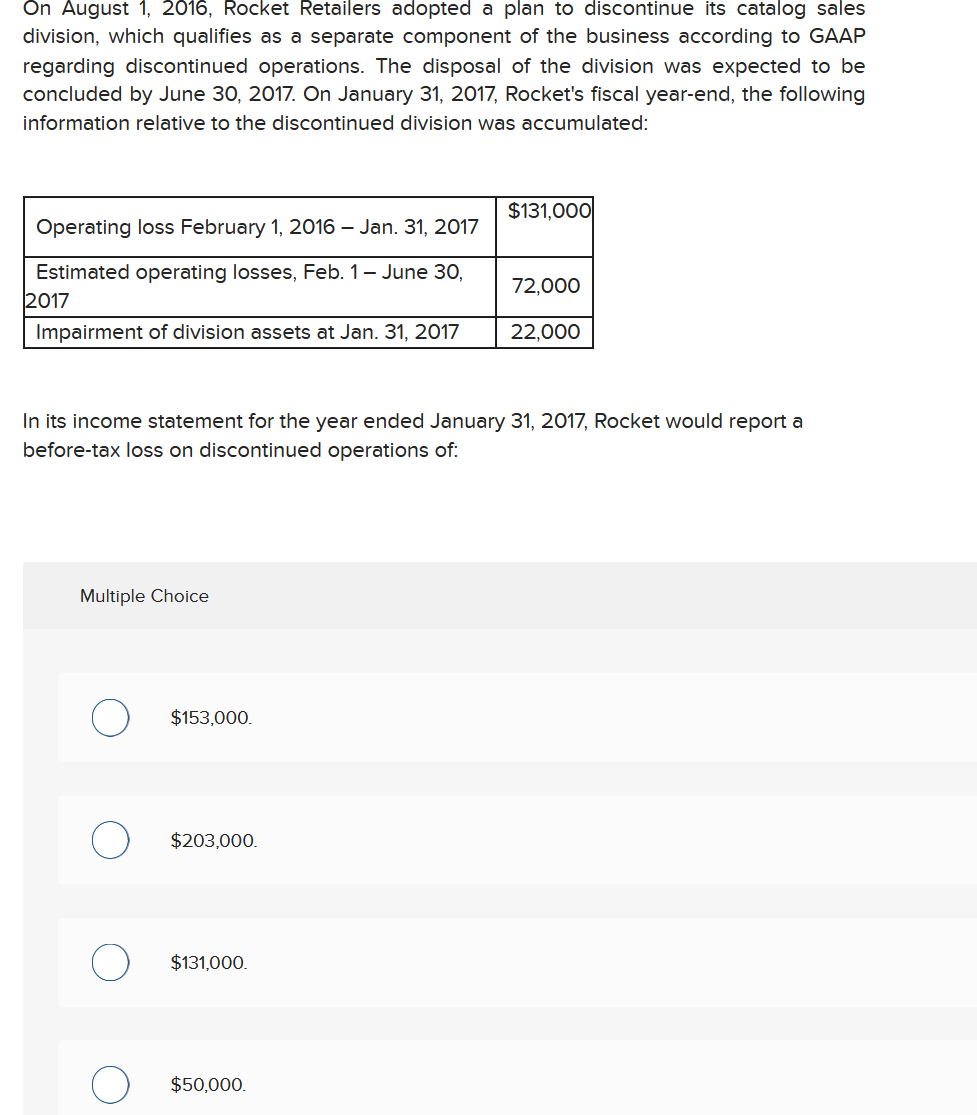

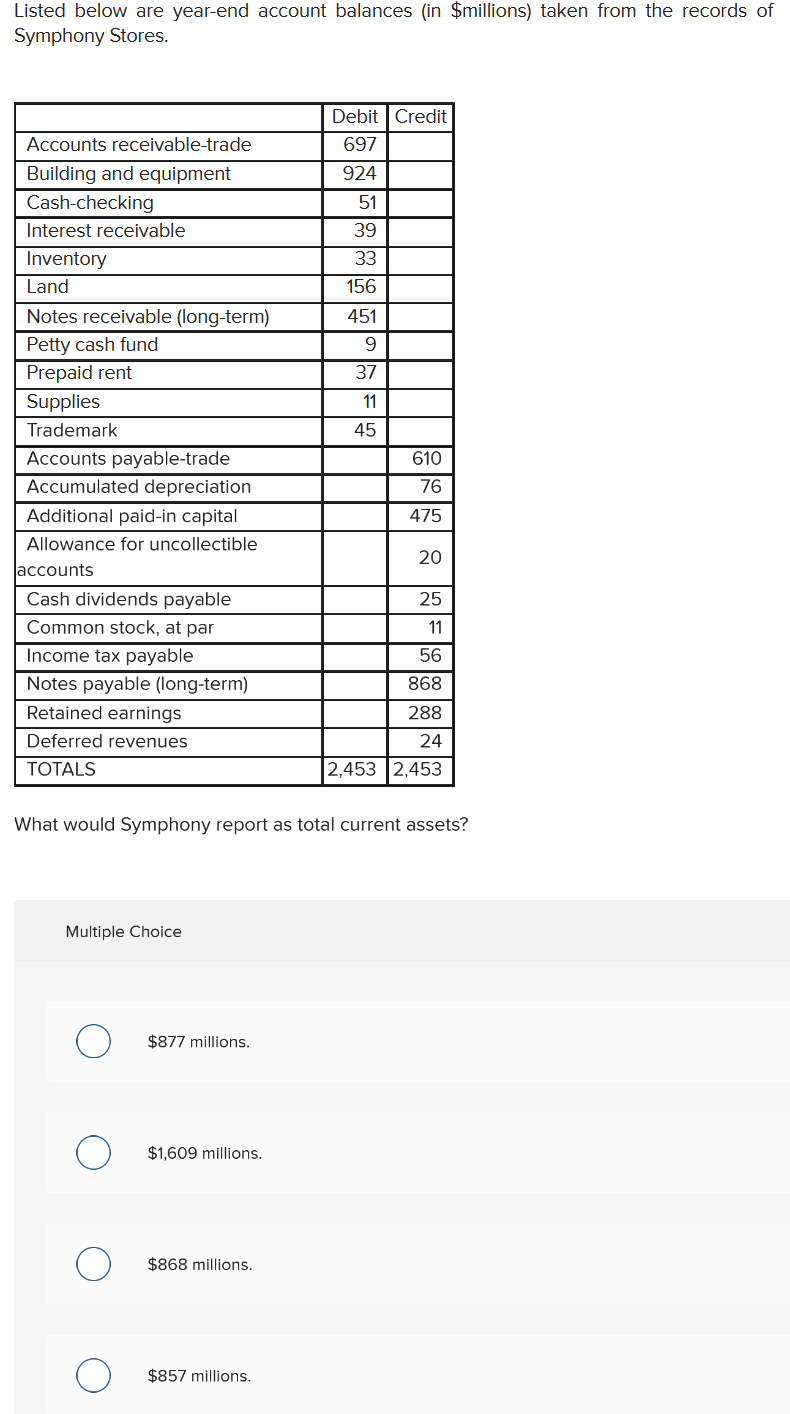

Present and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 Halalalalala 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Carol wants to invest money in a 6% CD account that compounds semiannually. Carol would like the account to have a balance of $100,000 5-years from now. How much must Carol deposit to accomplish her goal? Multiple Choice $74,409 $72.359 O O O $76,615. O O $88,014 Misty Company reported the following before-tax items during the current year: Sales revenue $900 350 Operating expenses Restructuring charges Loss on discontinued operations 15 60 Misty's effective tax rate is 20%. What is Misty's income from continuing operations? Multiple Choice $428 $330. $590. $535. On August 1, 2016, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by June 30, 2017. On January 31, 2017, Rocket's fiscal year-end, the following information relative to the discontinued division was accumulated: $131,000 Operating loss February 1, 2016 - Jan. 31, 2017 72,000 Estimated operating losses, Feb. 1 June 30, 2017 Impairment of division assets at Jan. 31, 2017 22,000 In its income statement for the year ended January 31, 2017, Rocket would report a before-tax loss on discontinued operations of: Multiple Choice $153,000 $203,000. $131,000. $50,000. Listed below are year-end account balances (in $millions) taken from the records of Symphony Stores. Debit Credit Accounts receivable-trade 697 924 Building and equipment Cash-checking 51 Interest receivable 39 33 Inventory Land 156 451 9 Notes receivable (long-term) Petty cash fund Prepaid rent Supplies 37 11 Trademark 45 610 Accounts payable-trade Accumulated depreciation Additional paid-in capital 76 475 Allowance for uncollectible 20 Jaccounts 25 Cash dividends payable Common stock, at par 11 56 Income tax payable Notes payable (long-term) Retained earnings 868 288 Deferred revenues 24 TOTALS 2,453 2,453 What would Symphony report as total current assets? Multiple Choice $877 millions. $1,609 millions. $868 millions. $857 millions