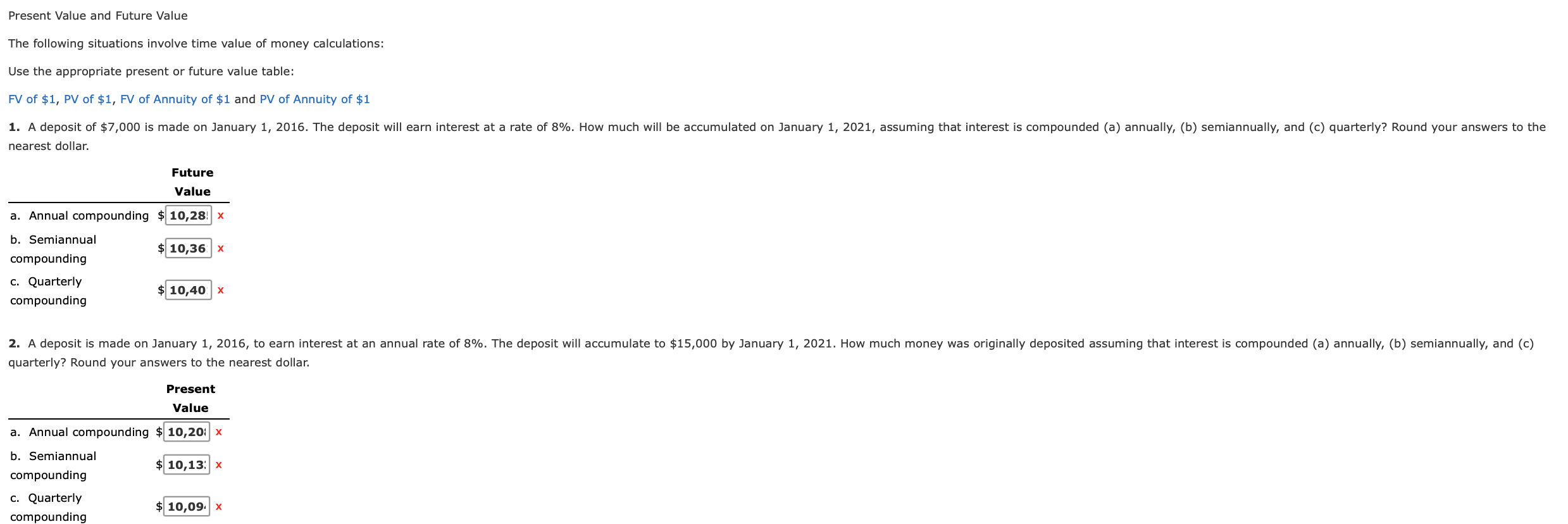

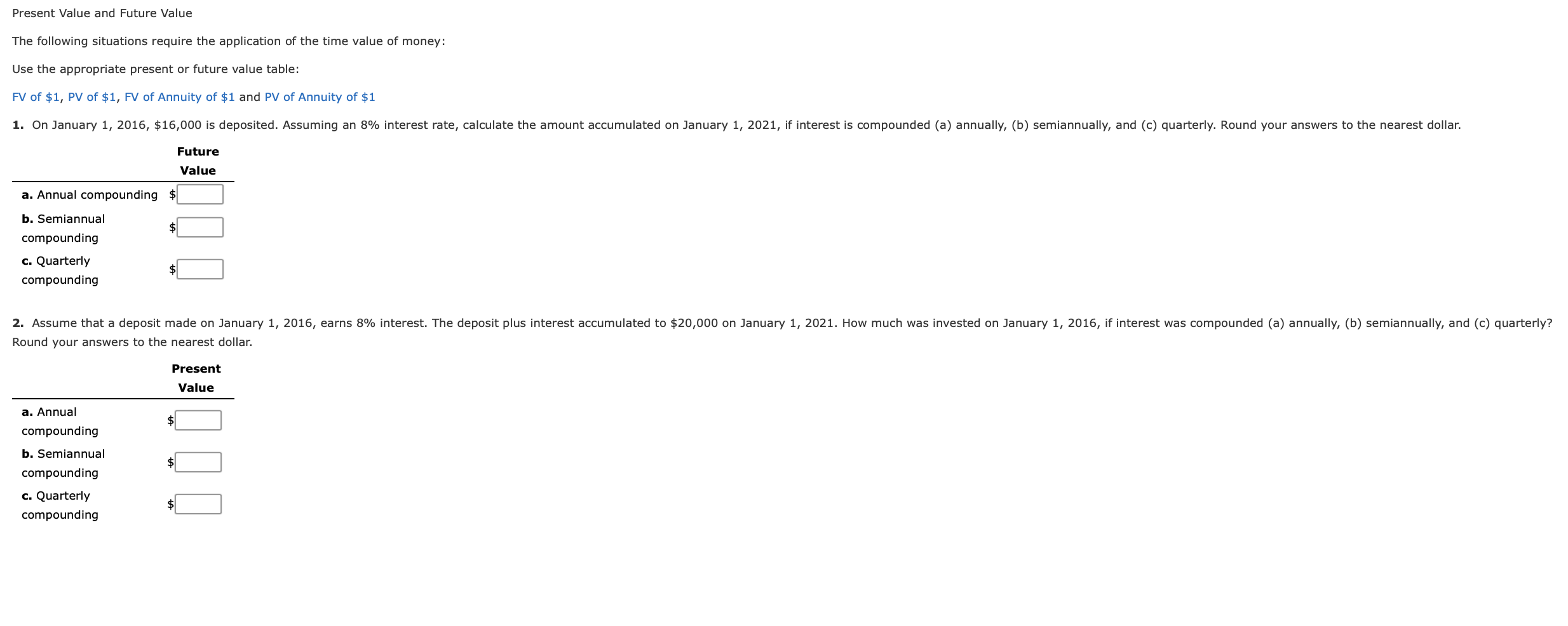

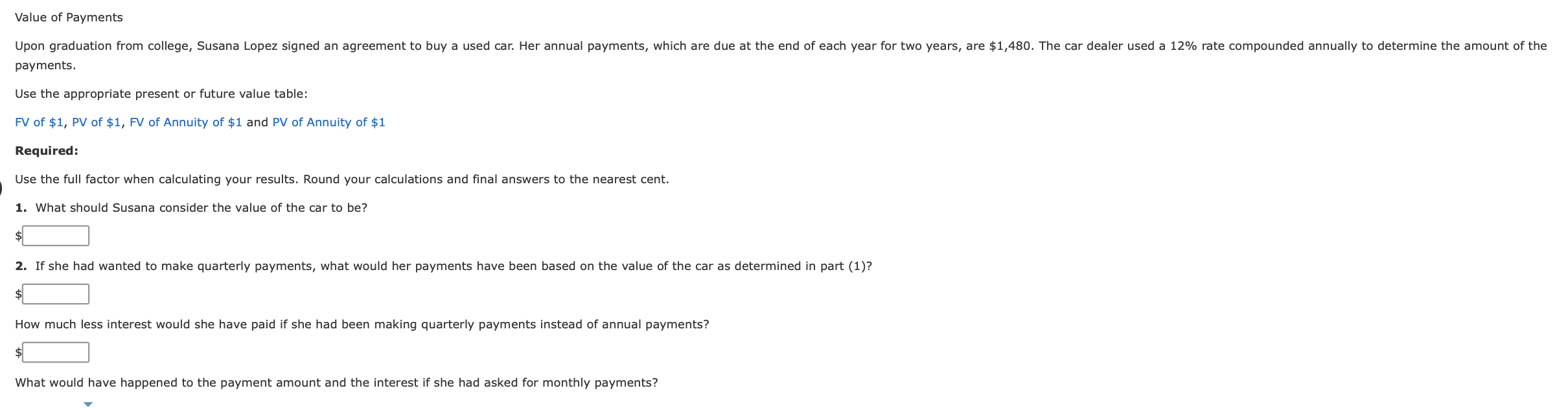

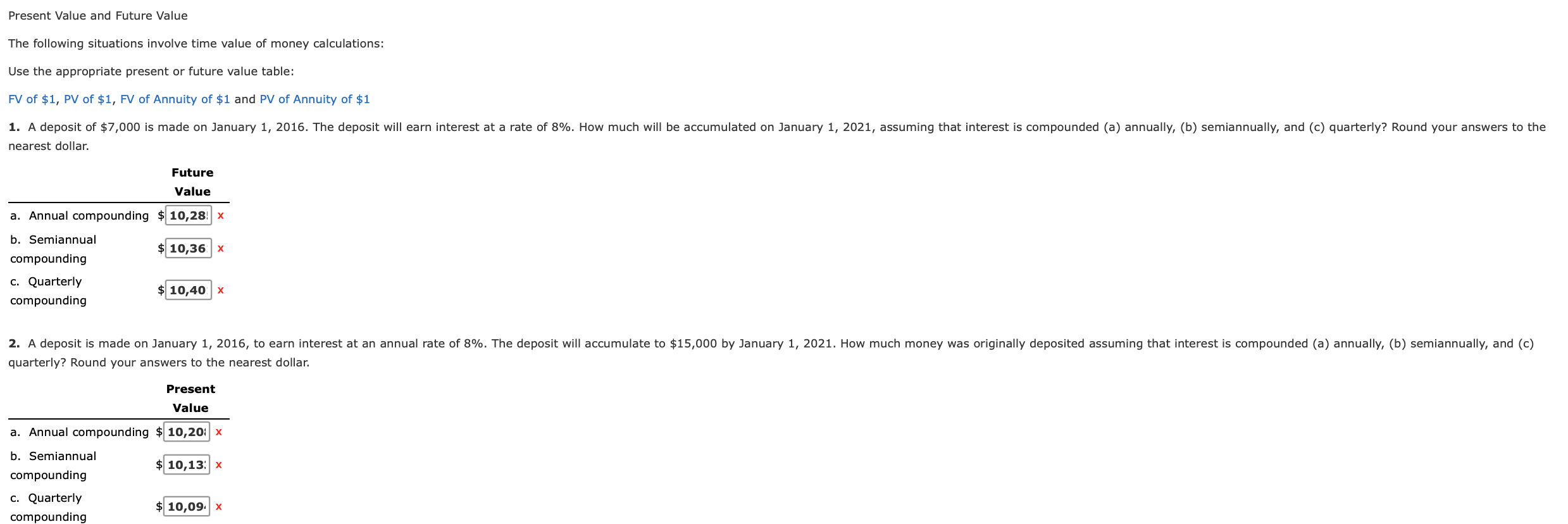

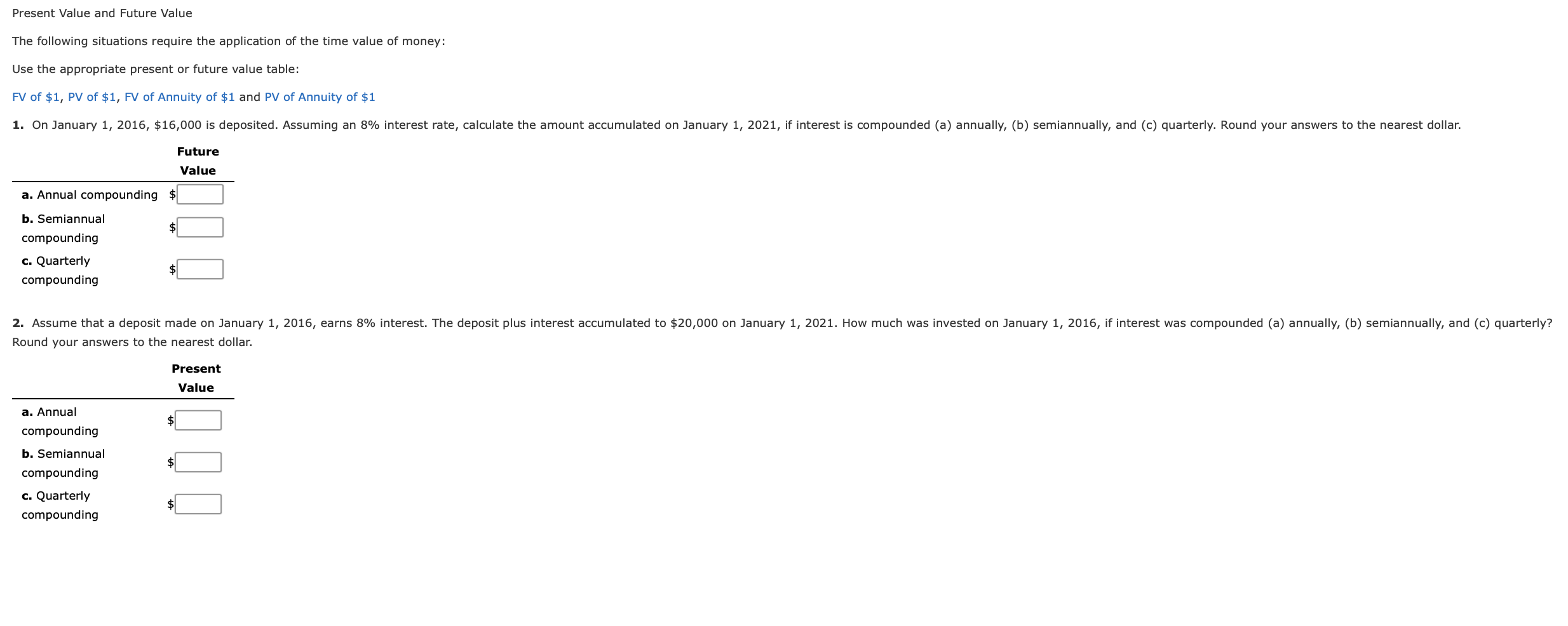

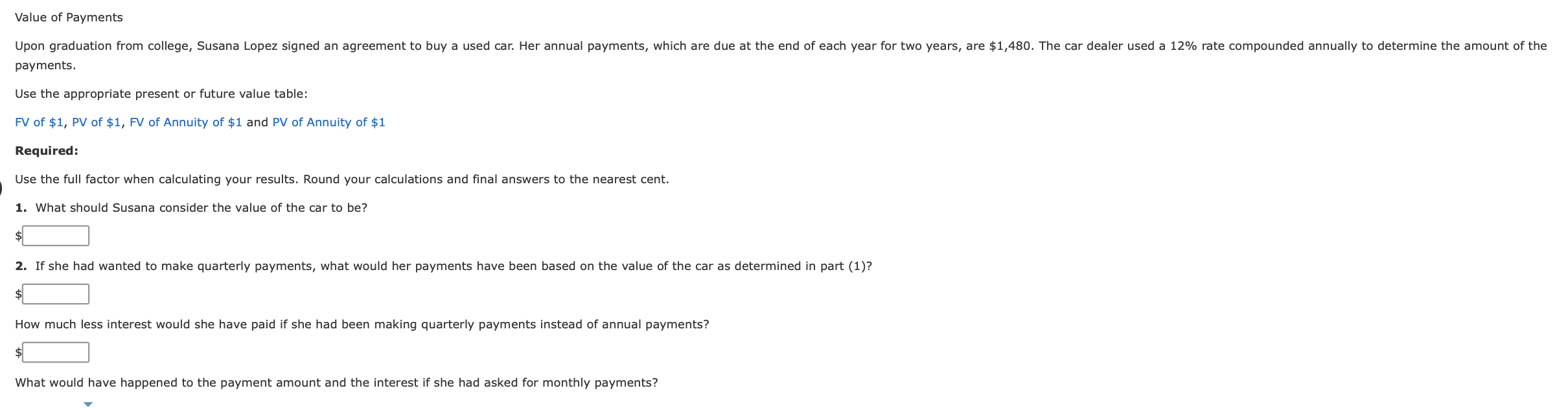

Present Value and Future Value The following situations involve time value of money calculations: Use the appropriate present or future value table: FV of $1, PV of $1, FV of Annuity of $1 and PV of Annuity of $1 1. A deposit of $7,000 is made on January 1, 2016. The deposit will earn interest at a rate of 8%. How much will be accumulated on January 1, 2021, assuming that interest is compounded (a) annually, (b) semiannually, and (c) quarterly? Round your answers to the nearest dollar. Future Value a. Annual compounding $ 10,28 x 10,36 x b. Semiannual compounding C. Quarterly compounding $ 10,40 x 2. A deposit is made on January 1, 2016, to earn interest at an annual rate of 8%. The deposit will accumulate to $15,000 by January 1, 2021. How much money was originally deposited assuming that interest is compounded (a) annually, (b) semiannually, and (c) quarterly? Round your answers to the nearest dollar. Present Value a. Annual compounding $ 10,20 x b. Semiannual $ 10,13 x compounding c. Quarterly $ 10,09. x compounding Present Value and Future Value The following situations require the application of the time value of money: Use the appropriate present or future value table: FV of $1, PV of $1, FV of Annuity of $1 and PV of Annuity of $1 1. On January 1, 2016, $16,000 is deposited. Assuming an 8% interest rate, calculate the amount accumulated on January 1, 2021, if interest is compounded (a) annually, (b) semiannually, and (c) quarterly. Round your answers to the nearest dollar. Future Value a. Annual compounding b. Semiannual compounding c. Quarterly compounding 2. Assume that a deposit made on January 1, 2016, earns 8% interest. The deposit plus interest accumulated to $20,000 on January 1, 2021. How much was invested on January 1, 2016, if interest was compounded (a) annually, (b) semiannually, and (c) quarterly? Round your answers to the nearest dollar. Present Value a. Annual $ compounding b. Semiannual compounding $ c. Quarterly compounding Value of Payments Upon graduation from college, Susana Lopez signed an agreement to buy a used car. Her annual payments, which are due at the end of each year for two years, are $1,480. The car dealer used a 12% rate compounded annually to determine the amount of the payments. Use the appropriate present or future value table: FV of $1, PV of $1, FV of Annuity of $1 and PV of Annuity of $1 Required: Use the full factor when calculating your results. Round your calculations and final answers to the nearest cent. 1. What should Susana consider the value of the car to be? $ 2. If she had wanted to make quarterly payments, what would her payments have been based on the value of the car as determined in part (1)? How much less interest would she have paid if she had been making quarterly payments instead of annual payments? $ What would have happened to the payment amount and the interest if she had asked for monthly payments