Question

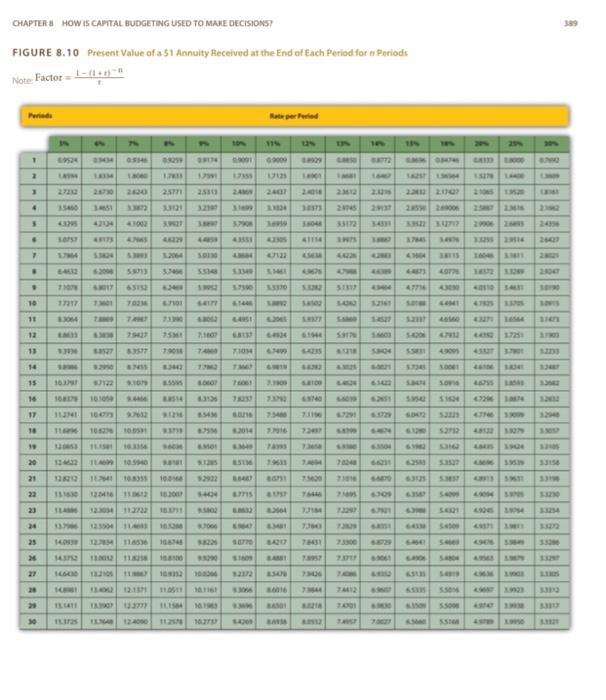

Present Value Calculations (Annuities). For each of the following independent scenarios, use Figure 8.10 in the appendix to calculate the present value of the cash

Present Value Calculations (Annuities). For each of the following independent scenarios, use Figure 8.10 in the appendix to calculate the present value of the cash flow described. Round to the nearest dollar.

1. $20,000 will be received at the end of each year for 6 years. The rate is 12 percent.

2. $20,000 will be received at the end of each year for 6 years. The rate is 15 percent.

3. $20,000 will be received at the end of each year for 6 years. The rate is 7 percent.

4. $120,000 will be received at the end of each year for 4 years. The rate is 10 percent.

CHAPTER HOW Is CAPITAL BUDGETING USED TO MAKE DECISIONS? 389 FIGURE 8.10 Present Value of a 51 Annuity Received at the End of Each Period for n Periods Note Factor Periede Rate per Peried 11% 12% 17% 19% 20% 25% 69524 69009 GAIm 1ASM 17 17125 16257 14400 1.3000 27212 24730 26243 25771 24437 3.372 33121 32100 3873 2845 29137 25 2102 43295 42104 41002 5.7908 38048 33172 34531 33522 K 29006 246 49173 44229 445 4355] 41114 374 3.3255 2914 24427 5.2064 47122 300 62006 5.3340 4.47) 3.33 65152 624 S52 37590 53370 5.3.02 4.3404 4774 4.3000 34 10 2717 6.7101 64177 4.1446 SA 2161 sa 44941 4725 s .303 4.451 SA SA 43371 12 75427 75M 6434 S4 4.7913 3.725 13 83577 7.90M A09 S45 SH04 4.9005 453 14 .20 A.MOS 15 163 122 76001 46755 ans 16 100 43136 4.2 N 17 114 104773 9.7632 8.54 7340 7310 6.7291 53 4774 3294 18 11A06 1042 10.051 8.75M 2014 7.7016 7347 3.30 19 16. 20 122 11. 10.5940 SIM 19633 625 5.3527 33156 21 122 1141 10.835 10e 92922 7529 7301 63125 5.M 337 22 1330 12 1112 18.20 7715 764 540 33230 23 1149 12304 tatu 2229 SA21 24 123904 11.40 7000 SA Seo 3322 25 1403 32.734 114536 33226 78431 23300 54e 490 n 33 26 143752 13.002 93290 2.31 S4804 3320 27 11. 7306 20 13:40 12.1SH 9.00 7 712 332 29 11411 9.00 BA 7401 5300 30 1240 112 $4

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started