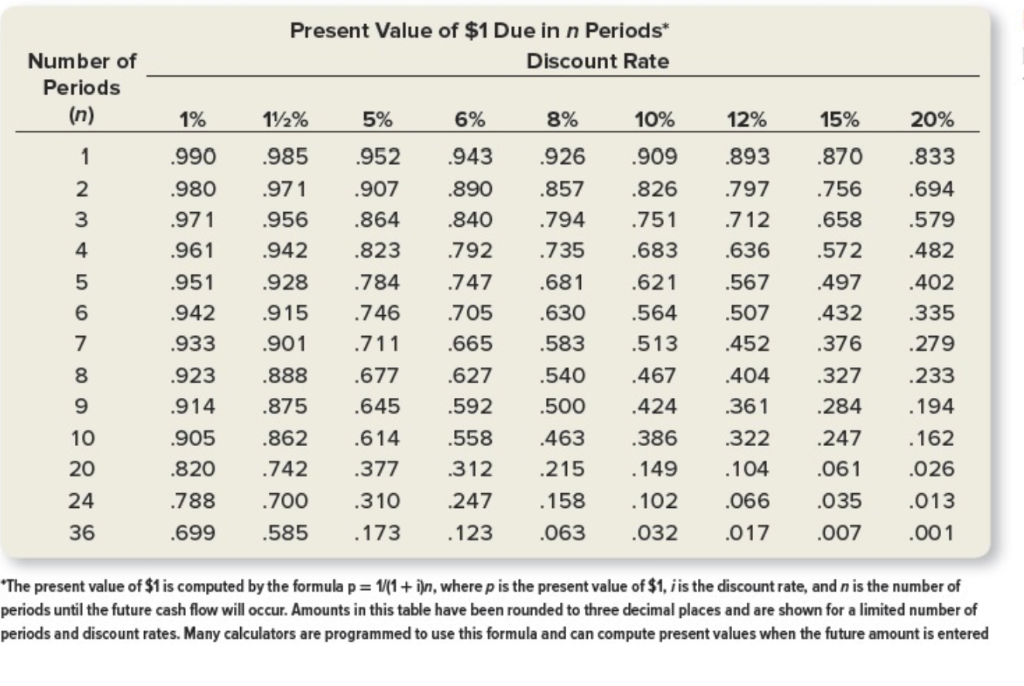

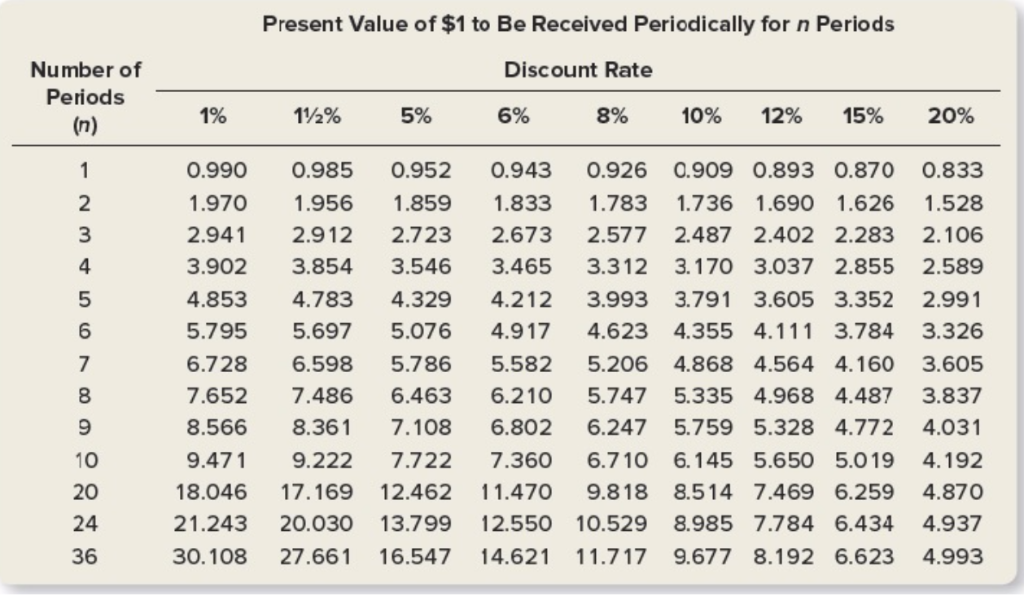

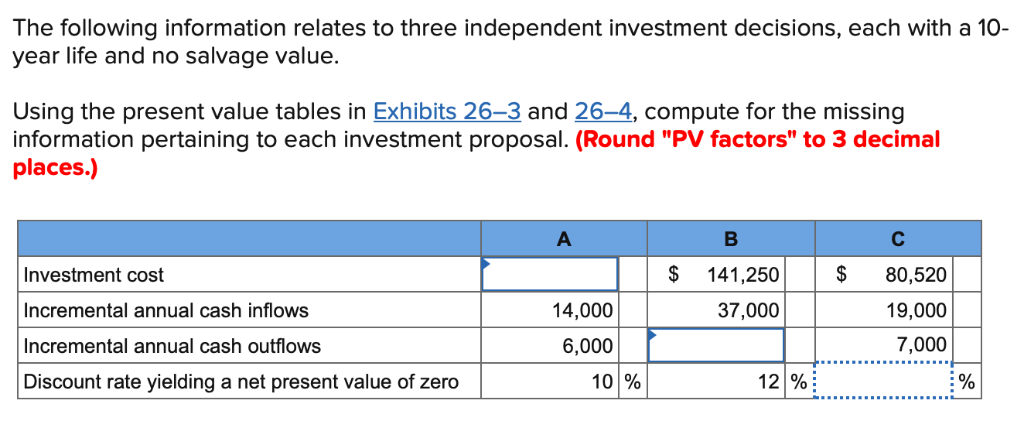

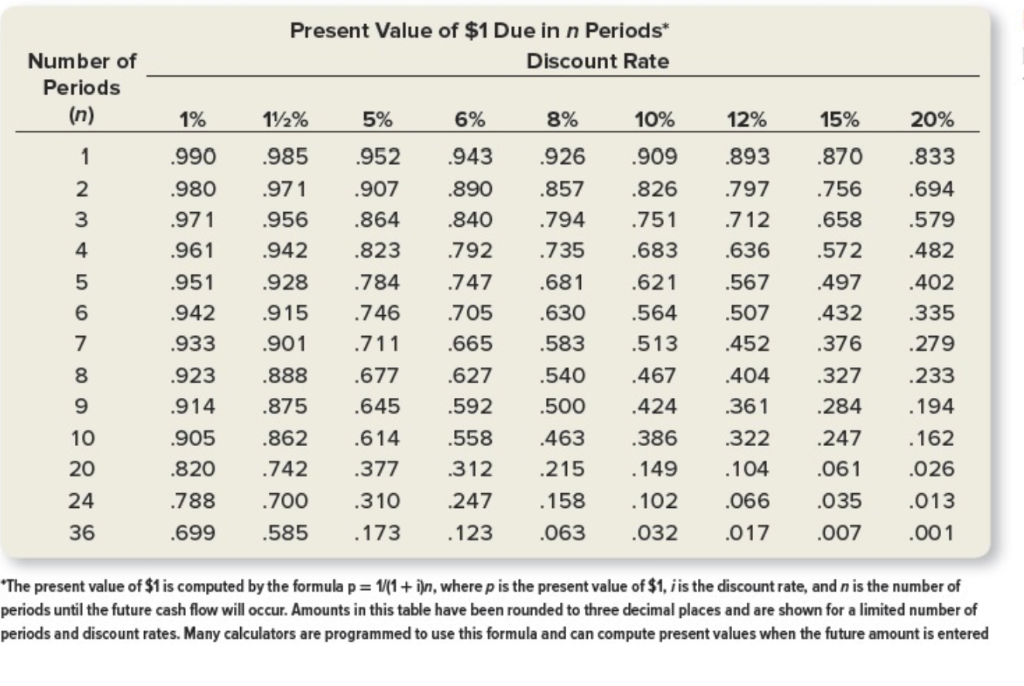

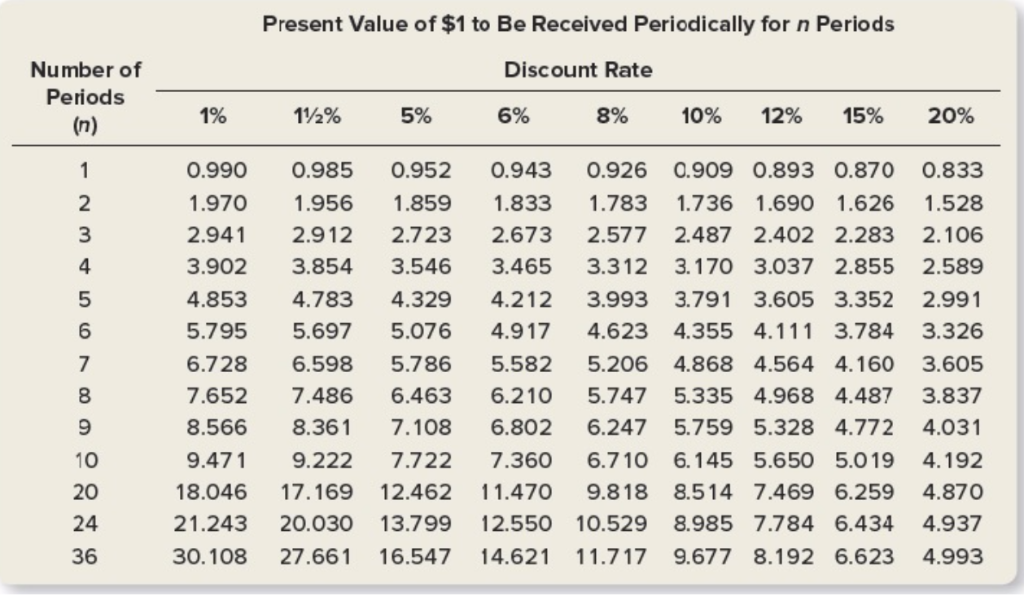

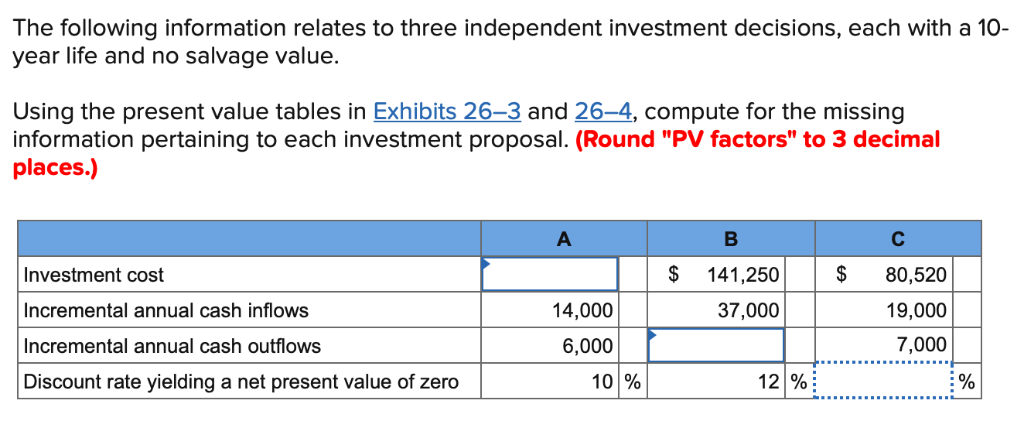

Present Value of $1 Due in n Periods* Discount Rate Number of Periods 1% 5% 6% 8% 10% 12% 15% 20% 990 985 952 943 926 909 893 .870 833 980971 971 956 864 840 .794 .751 712 .961 .890 857 826 .797 .756 .694 .579 636 .572 482 3 658 .942 .823 .792 735 .683 951 .928 784 747.681 .621 567 497 402 915 .746 705 942 933 .901 711 923 888 .677 914.875 645 592 .500424 36 905 862614 820 .742 .377 312 .788 .700 .310 247 .158 699 .585 1 .335 665 .583 .513 452 .376 279 404 .327 233 284.194 162 026 013 001 630 .564 507 432 8 9 10 20 24 36 627.540 4 .558 463386 322 247 .215 149 104.06 102 066 035 .032 017 173 123 063 007 'The present value of $1 is computed by the formula p periods until the future cash flow will occur. Amounts in this table have been rounded to three decimal places and are shown for a limited number of periods and discount rates. Many calculators are programmed to use this formula and can compute present values when the future amount is entered m1 + i)n, where p is the present value of $1, i is the discount rate, and n is the number of Present Value of $1 to Be Received Periodically for n Periods Discount Rate Number of Periods 1% 5% 6% 8% 10% 12% 15% 20% 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 .970 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 2.941 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855 2.589 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 5.795 5.697 5.076 4.9174.623 4.355 4.111 3.784 3.326 6.728 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3.605 7.652 7.486 6.463 6.210 5.747 5.335 4.968 4.487 3.837 8.566 8.361 7.108 6.802 6.247 5.759 5.328 4.772 4.031 9.471 9.222 7.722 7.360 6.7 10 6.145 5.650 5.019 4.192 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.870 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 30.108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993 5 6 10 20 24 36 The following information relates to three independent investment decisions, each with a 10 year life and no salvage value. Using the present value tables in Exhibits 26-3 and 26-4, compute for the missing information pertaining to each investment proposal. (Round "PV factors" to 3 decimal places.) Investment cost Incremental annual cash inflows Incremental annual cash outflows Discount rate yielding a net present value of zero s 141250S 80,520 19,000 7,000 14,000 6,000 37,000 101% 12%