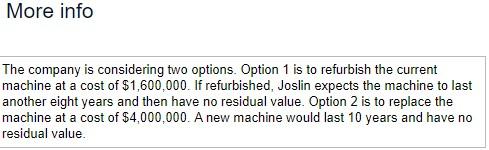

Question

_________________________________________________________ _____________________________________________________ ____________________________________________________________________________________________ Present Value of $1 table: _________________________________________________________________________________________________________________ Present Value of Ordinary Annuity of $1 table: ______________________________________________________________________________________________________________ Future Value of $1 table: ________________________________________________________________________________________________ Future

_________________________________________________________

_____________________________________________________

____________________________________________________________________________________________

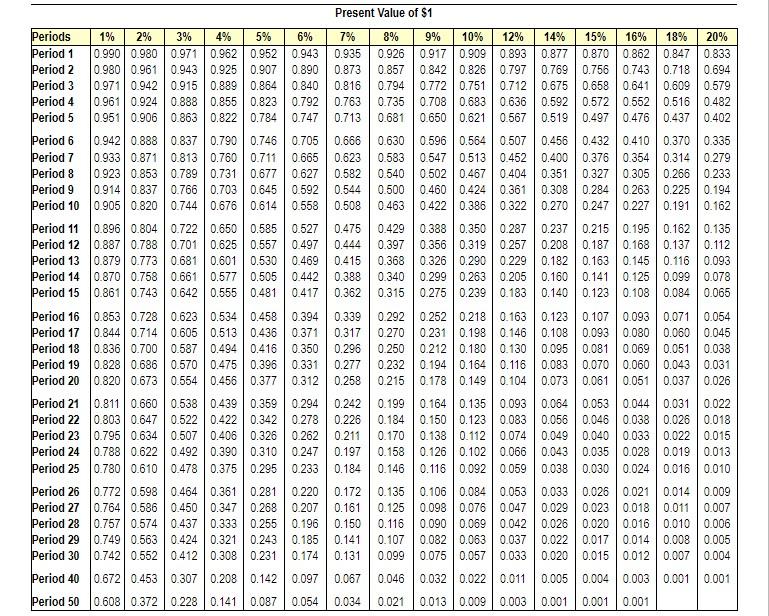

Present Value of $1 table:

_________________________________________________________________________________________________________________

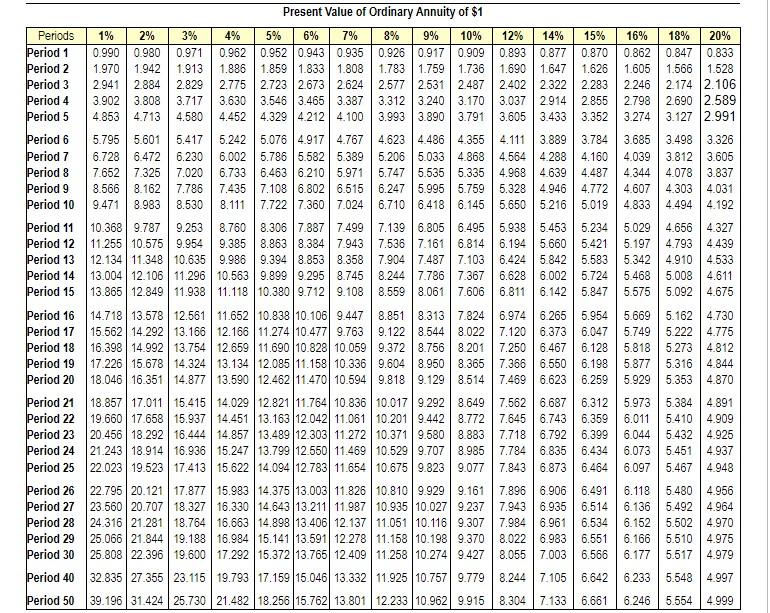

Present Value of Ordinary Annuity of $1 table:

______________________________________________________________________________________________________________

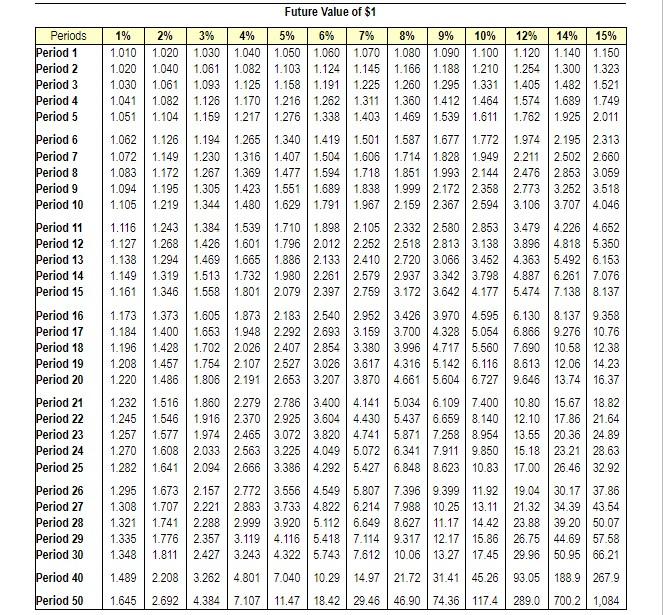

Future Value of $1 table:

________________________________________________________________________________________________

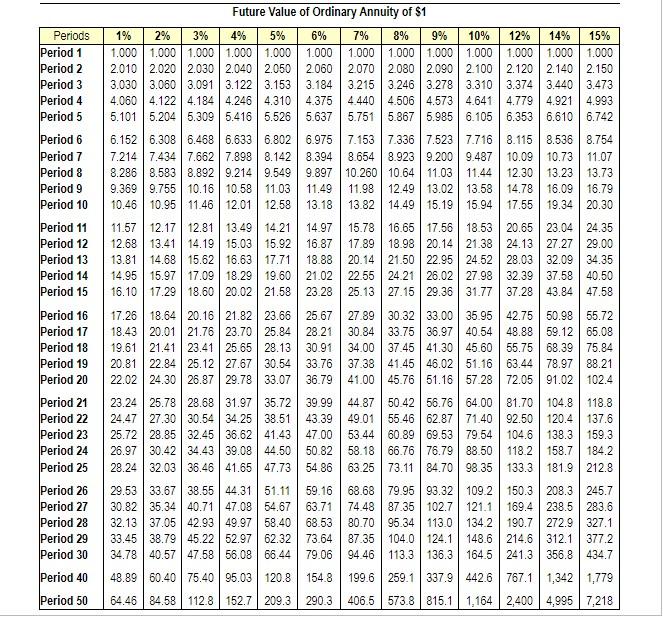

Future Value of Ordinary Annuity of $1 table:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started