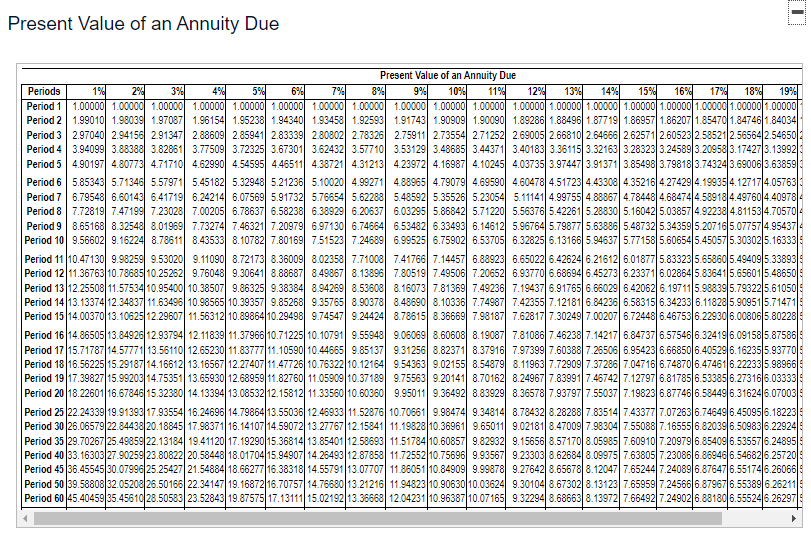

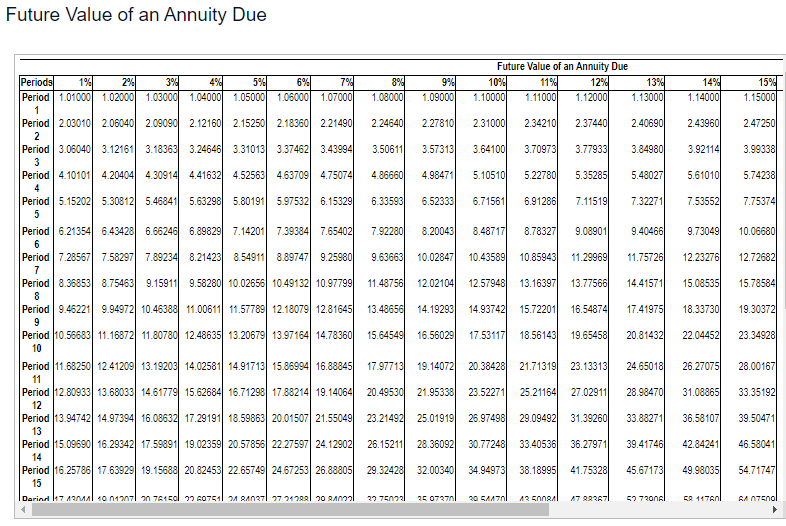

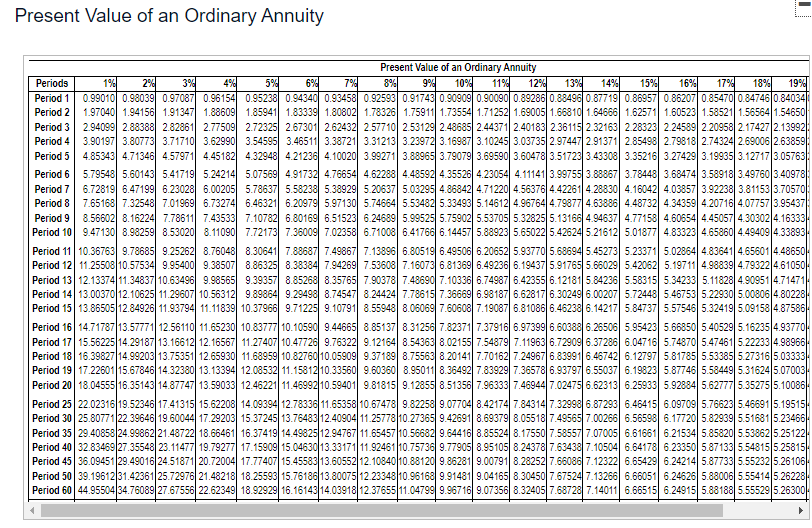

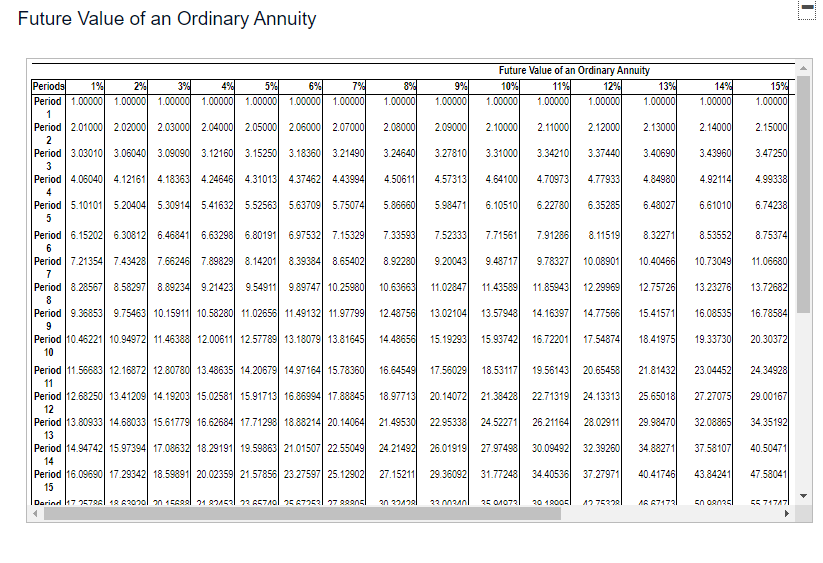

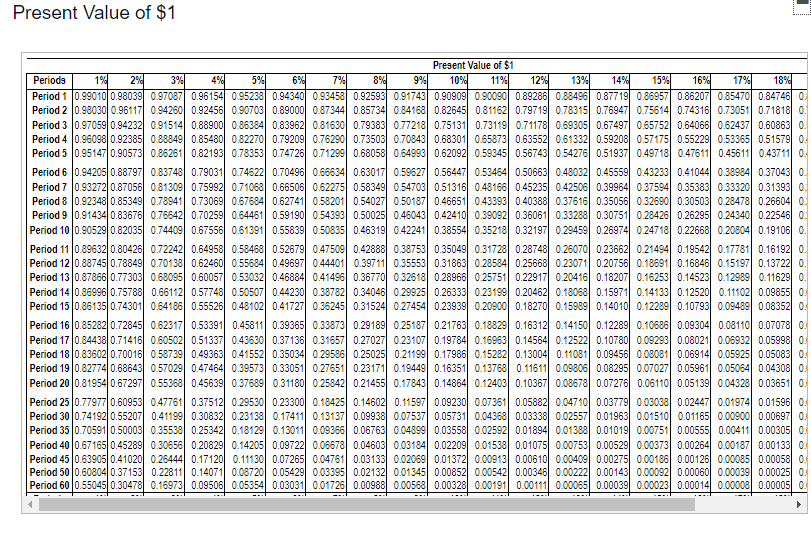

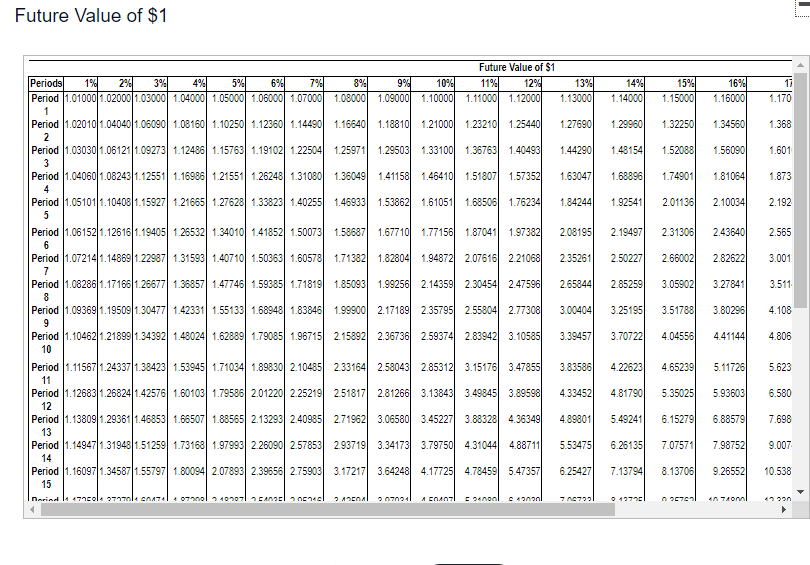

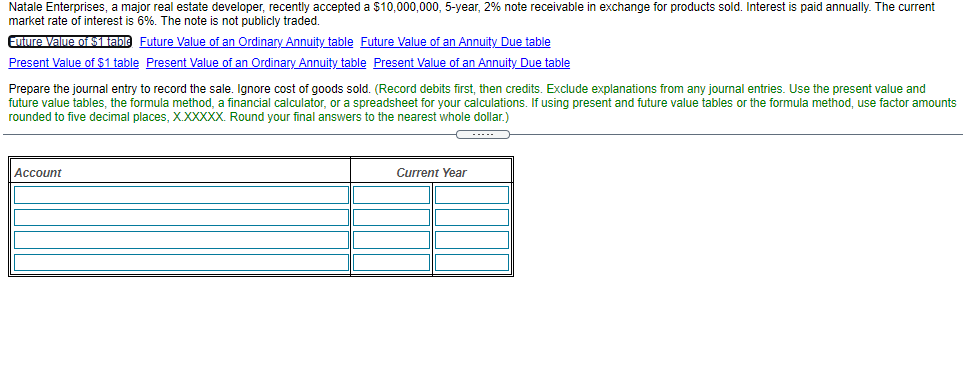

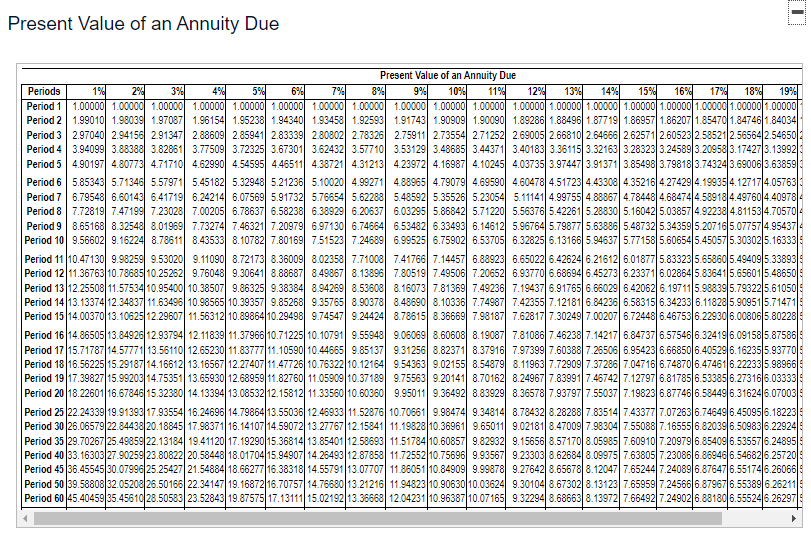

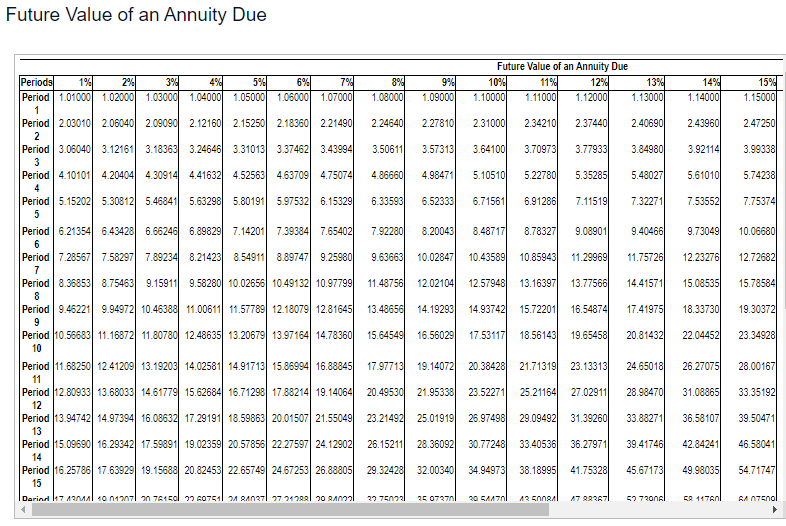

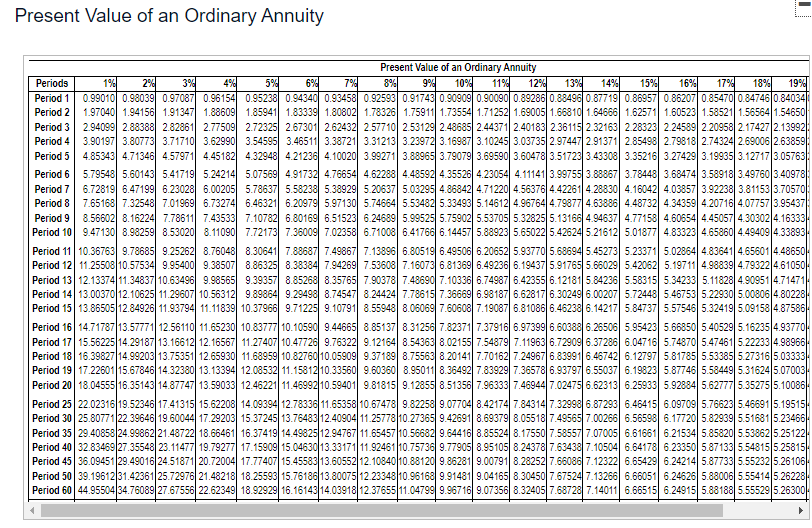

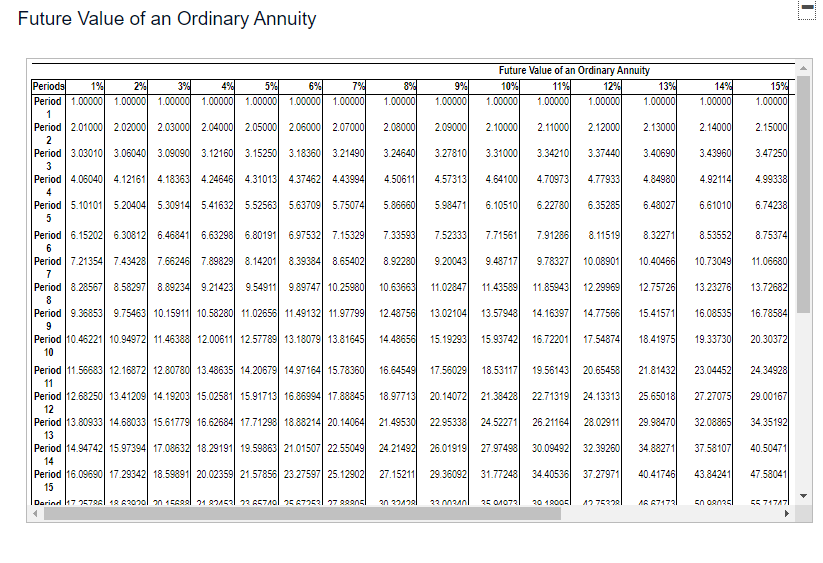

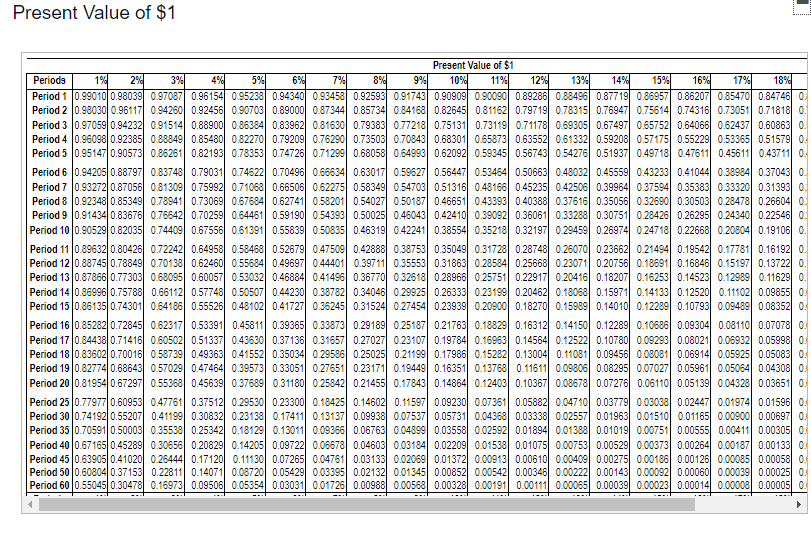

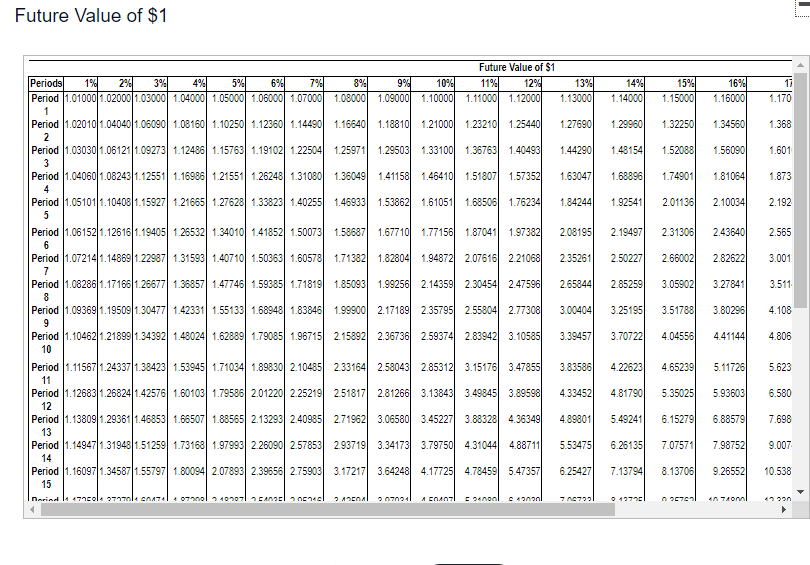

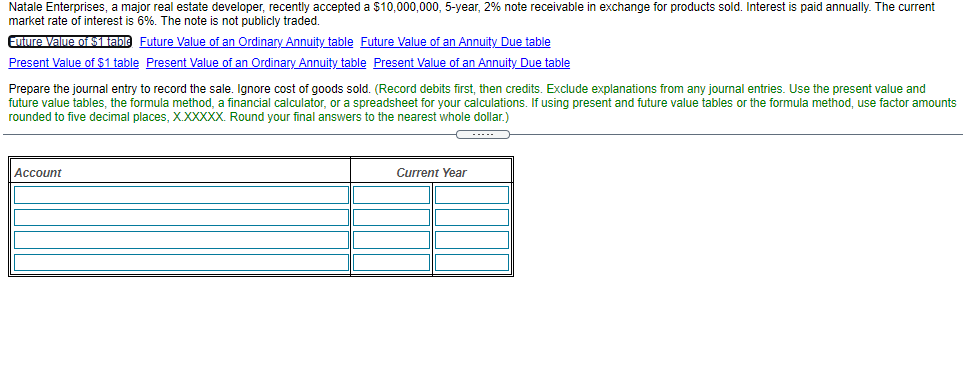

- Present Value of an Annuity Due % 9 % Present Value of an Annuity Due Periods 1% 29 3% 4% 5% 6% 7% 8% 9% 109 11% 12% 13% 14% 15% 16% 17% 18% 1992 Period 11.00000 1.00000 100000 1.00000 1.00000 100000 1.00000 100000 1.00000 1.00000 1.00000 1.00000 100000 100000 100000 100000 1.00000 1.00000 1.00000 Period 21.99010 1.98039 1.97087 1.96154 1.95238 1.94340 1.93458 1.92593 1.91743 1.90909 1.90090 1.89286 1.88496 1.87719 1.86957 1.86207 1.854701.847461.84034 Period 3 2.97040 2.94156 2.91347 2.88609 2.85941 2.83339 2.80802 2.78326 2.75911 2.73554 2.71252 2.69005 2.668102.64666 2.62571 2.60523 2.585212.565642.54650 Period 43.94099 3.88388 3.82861 3.77509 3.72325 3.67301 3.62432 3.57710 3.53129 3.48685 3.44371 3.40183 3.36115 3.32163 3.28323 3.24589 3.20958 3.17427 3.139923 Period 5 4.90197 4.80773 4.71710 4.62990 4.54595 4.46511 438721 4.31213| 4.23972 4.16987 4. 10245 4.03735 3.97447 3.91371 3.85498 3.79818 3.74324 3.69006|3.638593 Period 65.85343 5.71346 5.57971 5.45182 5.32948 5.21236 5.10020 4.99271 4.88965 4.79079469590 4.60478 4.51723 4.43308 4.35216 4.27429 4. 19935 4.12717 4.057633 Period 76.79548 6.60143 6.41719 6.24214 6.07569 5.91732 5.76654 5.62288 5.48592 5.35526 5.23054 5.11141| 4.99755 4.88867 4.78448 4.68474 4 58918 4.49760 4.409784 Period 87.72819 7.471997.23028 7.00205 6.78637 6.58238 6.38929 6.20637 6.03295 5.86842 5.71220 5.563765.42261 5.28830 5.160425.03857 4.92238 4.81153 4.705704 Period 9 | 8.65168 8.32548 8.01969 7.73274 7.46321 7.20979 6.97130 6.746646.53482 6.33493 6.14612 5.967645.798775.638865.48732 5.34359 5.207165.07757 4.954374 Period 10 9.56602 9.16224 8.78611 8.43533 8.10782 7.80169751523 7.24689 6.99525 6.75902 6.53705 6.32825 6.13166 5.94637 5.771585.606545.45057 5.30302 5.163336 Period 1110.471309.98259 9.53020 9.11090 8.72173 8.36009 8.02358 7.71008 7.41766 7.14457 6.88923 6.65022 6.42624 6.21612 6.01877 5.833235.65860 5.494095.338936 Period 12 11.36763|10.7868510.25262) 9.76048 9.30641 8.88687 8.49867 8.13896 7.80519 7.49506 7.20652 6.93770 6.68694 6.45273 6.23371 6.028645.836415.65601 5.486505 Period 1312.2550811.57534 10.95400 10.38507 9.86325 9.38384 8.94269 8.53608 8.16073 7.813697.49236 7.19437 6.91765 6.66029 6.42062 6.19711 5.98839 5.793225.610505 Period 1413.13374 12.34837 11.6349610.98565 10.39357 9.85268| 9.35765 8.90378 8.48690 8.10336 7.749877.42355 7.12181 6.84236 6.58315 6.34233 6.11828 5.90951 5.714715 Period 15 14.00370 13.1062512.29607 11.56312 10.89864 10.29498| 9.745479.24424 8.78615 8.366697.98187 7.62817 7.30249 7.00207 6.724486.46753 6.22930 6.008065.802285 Period 16 14.8650513.84926 12.93794 12.11839 11.3796610.71225 10.10791 9.55948 9.06069 860608 8.19087 7.81086 7.46238 7.142176.847376.575466.324196.091585.875865 Period 17 15.71787 14.5777113.56110 12.65230 11.83777 11.10590 10.44665 9.85137 9.31256 8.82371 8.37916 7.973997.60388 7.26506 6.95423 6.66850 6.405296.16235 5.937705 Period 1816.5622515.29187 14.1661213.16567 12.2740711.4772610.7632210.12164 9.54363 9.02155 8.54879 8.11963 7.729097.372867.047166.748706.474616.22233 5.98966 Period 1917.3982715.99203 14.7535113.65930 12.6895911.82760 11.05909 10.37189 9.75563 9.20141 8.70162 8.24967 7.83991 7.46742 7.12797 6.817856.533856.273166.033335 Period 20 18.2260116.6784615.323801413394 13.08532 12.15812 1133560 10.60360 9.95011 9.36492 8.83929 8.36578 7.93797 7.55037) 7.198236.87746 6.58449 6.316246.070035 Period 25 22.2433919.91393 17.93554 16.24696 14.7986413.5503612.4693311.52876 10.70661 9.98474 9.34814 8.78432 8.28288 7.83514 7.43377 7.07263 6.74649 6.450956.182235 Period 30 26.06579 22.84438|20.18845 17.98371 16.14107 14.59072 13.27767 12.15841 11.1982810.36961 9.65011 9.02181 8.470097.98304 7.55088 7.165556.82039 6.509836.229245 Period 35 29.70267 25.4985922.13184 19.4112017.1929015.36814 13.85401 12.58693 11.51784 10.60857 9.82932 9.15656 8.571708.059857.609107.209796.85409 6.53557 6.24895 Period 40 33.16303/27.9025923.80822 20.5844818.0170415.94907 14.26493 12.87858 11.72552 10.75696 9.93567 9.23303 8.62684 8.09975 7.63805 7.230866.869466.546826.2572015 Period 45 36.45545 30.07996 25.25427 21.5488418.6627716.3831814.5579113.07707 11.86051 10.84909 9.99878 9.27642 8.65678 8.12047 7.65244 7.240896.876476.551746.260665 Period 50 39.5880832.05208 26.50166 22.3414719.1687216.70757 14.76680 13.21216 11.94823 10.9063010.03624 9.30104 8.67302 8.131237.65959 7.245666.87967 6.553896.262115 Period 60 45.40459 35.45610 28.50583 23.5284319.87575 17.1311115.02192 13.36668 12.04231 10.96387 10.07165 9.32294 8.68663 8.13972 7.66492 7-24902 6.881806.555246.262975 Future Value of an Annuity Due 8% 1.08000 9% 1.09000 Future Value of an Annuity Due 10% 11% 12% 13% 1.10000 1.11000 1.120001 1.13000 14% 1.140001 15% 1.15000 2.24640 2.27810 2.310001 2.342101 2.37440 2.406901 2.43960 2.472501 3.506111 3.57313 3.64100 3.70973 3.77933 3.84980 3.92114 3.99338 4.86660 4.98471 5.105101 5.22780 5.35285 5.48027 5.610101 5.74238 6.33593 6.52333 6.71561 6.91286 7.11519 7.32271 7.53552 7.75374 7.92280 8.20043 8.487171 8.78327 9.08901 9.40466 9.73049 10.06680 Periods 1% 294 3% 4% 5% 6% 7% Period 1.01000 1.02000 1.03000 1.040001 1.05000 1.06000 1.07000 1 Period 2.03010 2.06040 2.09090 2.12160 2.15250 2.18360 2.21490 2 Period 3.06040 3.12161 3.18363 3.24646 3.31013 3.37462 3.43994 3 Period 4.10101 4.20404 430914 4.41632) 4.52563 4.63709 4.75074 4 Period 5.15202| 5.308125.46841 5.63298 5.80191 5.97532 6.15329 5 Period 6.21354 6.43428 6.66246 6.89829 7.14201 7.39384 7.65402) 6 Period 7.28567 7.58297 7.89234 8.21423 8.54911 8.89747] 9.25980 7 Period 8.36853 8.75463 9.15911 9.58280 10.02656 10.49132 10.97799 8 Period 9.46221] 9.94972 10.46388 11.00611 11.57789 12.18079| 12.81645) 9 Period 10.56683 11.16872 11.80780 12.48635 13.20679 13.97164 14.78360 10 Period 11.68250 12.41209 13.19203 14.02581 14.91713 15.86994 16.88845 11 Period 12.80933 13.68033 14.61779 15.62684 16.71298 17.88214 19.14064 12 Period 13.94742 14.97394 16.08632 17.29191 18.59863 20.01507 21.55049 9.636631 10.02847 10.435891 10.85943 11.29969 11.75726 12.23276 12.72682 11.48756 12.02104 12.57948 13.16397 13.77566 14.41571 15.08535 15.78584 13.48656 14.19293 14.937421 15.72201 16.54874 17.41975 18.33730 19.303721 15.64549 16.56029 17.531171 18.56143 19.65458 20.81432 22.04452 23.34928 17.97713 19.14072 20.38428' 21.71319 23.13313 24.65018 26.270751 28.00167 20.49530 21.95338 23.52271 25.21164 27.02911 28.98470 31.08865 33.35192 23.21492 25.01919 26.97498 29.09492 31.39260 33.88271 36.58107 39.50471 13 26.15211 28.36092 30.77248 33.40536 36.27971 39.41746 42.84241 46.58041 Period 15.09690 16.29342 17.59891 19.02359 20.57856 22.27597 24.12902 14 Period 16.25786 17.63929 19.15688 20.82453 22.65749 24.67253 26.88805 15 29.32428 32.003401 34.949731 38.189951 41.75328 45.67173 49.980350 54.71747 Darindi 147 421 10 013071 30 761 Col 77 107511 21 BAN371 77712920 90 Angol 29 751331 25 07370 20 SATI 42 song 47 992871 52 7200R CR 1176 A 075nol Present Value of an Ordinary Annuity Present Value of an Ordinary Annuity Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% Period 1 0.99010 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 0.85470 0.847460.84034 Period 2 1.97040 1.94156 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.668101.64666 1.62571 1.60523 1.58521 1.56564 1.54650|| Period 3 2.94099 2.88388 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 2.40183 2.36115 2.32163 2.28323 2.24589 2.209582. 17427 2.13992: Period 4 3.90197 3.80773 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735 2.97447 2.91371 2.85498 2.79818 2.74324 2.69006 2.63859 Period 5 4.85343 4.71346 4.57971 4.45182 4.32948 421236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.51723 3.43308 3.35216 3.274293.19935 3.12717 3.05763: Period 6 5.79548 5.60143 5.41719 5.242145.07569 491732 4.76654 4.62288 4.48592 4 35526 4.23054 4.111413.99755 3.88867 3.78448 3.68474 3.58918 3.49760 3.40978; Period 7 6.72819 6.47199 6.23028 6.00205 5.786375.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376442261 4.28830 4.16042 4.03857 3.92238 3.81153|3.70570; Period 87.651687.32548 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.534825.33493 5.14612 4.96764 479877 4.63886 4.48732| 4.343594.207164.07757 3.954371 Period 9 8.56602 8.16224 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 5.131664.94637 4.77158 4.60654 4.45057 4.30302 4.16333 Period 10 9.47130 8.98259 8.53020 8.11090 7.721737.36009 7.02358 6.71008 6.417666.14457 5.88923 5.650225.42624 5.216125.01877| 4.83323 4.65860 4.49409 433893 Period 11 10.36763 9.78685 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.937705.68694 5.45273 5.23371 5.028644836414.65601 4.48650 Period 12 11.25508 10.57534 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.160736.81369 6.49236 6.19437 5.91765 5.66029 5.42062 5.19711 4.98839 4.79322 4.6105014 Period 13 12.13374 11.34837 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.486907.10336 6.74987 6.42355 6.121815.84236 5.58315 5.34233 5.11828 4.90951 4.714714 Period 14 13.00370 12.10625 11.29607 10.56312 9.89864 9.294988.74547 8.24424 7.786157.36669 6.98187 6.62817 6.302496.00207 5.72443 5.46753 5.229305.008064.802284 Period 15 13.86505 12.84926 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.060697.60608 7.19087 6.81086 6.46238 6.14217 5.84737 5.57546 5.32419 5.09158 4.87586 Period 16 14.71787 13.57771 12.56110 11.65230 10.83777 10.105909.44665 8.85137 8.312567.823717.37916) 6.97399 6.60388 6.265065.95423 5.66850 5.40529 5.16235 4.93770 Period 1715.5622514.29187 13.1661212.16567 11.2740710.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.729096.37286 6.04716 5.74870 5.47461 5.222334.98966 Period 1816.3982714.99203 13.75351 12.65930 11.68959 10.8276010.05909 9.37189 8.75563 8.20141 7.701627.24967 6.83991 6.46742 6.12797 5.81785 5.53385 5.273165.03333 Period 19 17.2260115.678461432380 13.13394 12.08532 11.15812 10.33560 9.60360 8.95011 8.36492 7.839297.36578 6.93797 6.55037 6.19823 5.877465.58449 5.31624 5.07003 Period 2018.04555/16.35143 14.87747 13.59033 12.46221 11.4699210.59401 9.81815 9.12855 8.51356 7.96333 7.46944 7.02475 6.62313 6.25933 5.92884 5.62777 5.35275 5.100864 Period 25 22.0231619.5234617.41315 15.62208 14.0939412.78336 11.65358 10.67478 9.82258 9.07704 8.42174 7.84314 7.32998 6.87293 6.46415 6.097095.76623 5.46691 5.19515| Period 30 25.80771 22.3964619.60044 17.29203 15.3724513.7648312.4090411.25778 10.27365 9.42691 8.69379 8.05518 7.49565 7.00266 6.56598 6.17720 5.829395.516815.23466 Period 35 29.40858|24.99862 21.48722 18.66461 16.3741914 4982512.9476711.65457 10.56682 9.64416 8.85524 8.17550 7.58557 7.07005 6.61661 6.21534 5.85820 5.53862 5.25122| Period 40 32.8346927.35548 23.11477 19.79277 17.1590915.04630 13.3317111.92461 10.75736 9.77905 8.95105 8.24378| 7.63438 7.10504 6.64178 6.23350 5.871335.54815 5.25815 Period 45 36.0945129.4901624.5187120.72004 17.7740715.4558313.60552 12.108401088120 9.86281 9.00791 8.282527.660867.12322 6.65429 6.242145.877335.55232 5.26106| Period 50 39.19612 31.42361 25.72976 21.48218 18.2559315.7618613.80075 12.2334810.961689.91481 9.04165 8.30450 7.67524 7.132666.66051 6.24626 5.88006 5.55414 5.26228 Period 60 44.95504 34.76089 27.67556 22.62349 18.9292916.1614314.0391812.37655 11.04799 9.96716 9.07356 8.32405 7.68728 7.140116.66515 6.24915 5.881885.55529 5.2630014 Future Value of an Ordinary Annuity - 8% 1.000000 9% 1.00000 Future Value of an Ordinary Annuity 10% 11% 1294 13% 1.00000 1.000001 1.00000 1.00000 14% 1.000001 15% 1.000000 Periods 1% 294 3% 4% 5% 6% 7% Period 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1 Period 2.01000 2.02000 2.03000 2.04000 2.05000 2.06000 2.07000 2 Period 3.03010 3.06040 3.09090 3.12160 3.15250 3.18360 3.21490 2.08000 2.09000 2.10000 2.110001 2.12000 2.130001 2.140001 2.150001 3.246401 3.27810 3.31000 3.342101 3.37440 3.40690 3.43960 3.47250 3 4.50611 4.57313 4.64100 4.70973 4.77933 4.84980 4.92114 4.993381 5.86660 5.98471 6.10510 6.22780 6.352851 6.48027 6.61010 6.74238 7.335931 7.52333 7.71561 7.912861 8.11519 8.32271 8.53552 8.75374 8.922801 9.20043 9.48717 9.78327 10.08901 10.40466 10.73049 11.06680 10.636631 11.02847 11.43589 11.85943 12.29969 12.75726 13.23276 13.72682 12.487561 13.02104 13.57948 14.16397 14.77566| 15.41571 16.08535 16.78584 Period 4.06040 4.12161 4. 18363 4.24646 4.31013 4.37462 4.43994 4 Period 5.10101 5.20404 5.30914 5.41632 5.52563 5.63709 5.75074 5 Period 6.15202] 6.30812 6.46841 6.63298 6.80191 6.97532) 7.15329 6 Period 7.21354 7.43428 7.66246 7.89829 8.14201 8.39384 8.65402 7 Period 8.28567 8.58297 8.89234 9.21423 9.54911 9.89747 10.25980 8 Period 9.36853 9.75463 10.15911 10.58280 11.02656 11.49132 11.97799 9 Period 10.46221 10.94972 11.46388 12.00611 12.57789 13.18079 13.81645 10 Period 11.56683 12.16872 12.80780 13.48635 14.20679 14.97164 15.78360 11 Period 12.68250 13.4120914 19203 15.02581 15.91713 16.86994 17.88845 12 Period 13.80933 14.68033 15.61779 16.62684 17.71298 18.88214 20.14064 13 Period 14.94742 15.97394 17.08632 18.29191 19.59863 21.01507) 22.55049 14 Period 16.09690 17.29342 18.59891 20.02359 21.57856 23.27597 25.12902 15 14.48656 15.19293 15.93742 16.72201 17.548741 18.41975 19.337301 20.30372 16.64549 17.56029 18.53117 19.56143 20.65458 21.81432 23.04452 24 34928 18.97713 2014072 21.38428 22.713191 24.133131 25.65018 27.27075 29.00167 21.49530 22.95338 24.52271 26.21164 28.02911 29.98470 32.08865 34 35192 24.21492 26.01919 27.97498 30.094921 32.392601 34.88271 37.581071 40.504711 27.152111 29.36092 31.77248 34.40536 37.27971 40.41746 43.842411 47.580411 Darind 14705790 1283000l CAR 71 294531 72 85710l 35 672531 77 99905! 2n 2011 32 nanl 25 010721 20190051 12 753201 A6 A74731 Snoon! 55 74 7471 1 Present Value of $1 8917 Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% Period 1 0.99010 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 0.85470 0.84746 0. Period 20.98030 0.96117| 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.78315 0.76947 0.75614 0.74316 0.73051 0.71818 0. Period 3 0.97059 0.94232 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.69305 0.67497 0.65752 0.64066 0.62437 0.608630 Period 4 0.96098 0.92385 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 0.53365 0.51579 0. Period 5 0.951470.90573 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.54276 0.519370.49718 0.47611 0.45611 0.43711 0. Period 60.94205 0.88797 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.48032 0.45559 0.43233 0.41044 0.38984 0.37043 0 Period 7 0.93272 0.87056 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.42506 0.39964 0.37594 0.35383 0.33320 0.31393 0. Period 8 0.92348 0.85349 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.37616 0.35056 0.32690 0.30503 0.28478 0.26604 0. Period 9 0.91434 0.83676 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.33288 0.30751 0.28426 0.26295 0.24340 0.22546 0. Period 100.90529 0.82035 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.29459 0.26974 0.24718 0.22668 0.20804 0.19106 0. Period 110.89632 0.80426 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.26070 0.23662 0.21494 0.19542 0.17781 0.16192 0. Period 120.88745 0.78849 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 0.23071 0.20756 0.18691 0.16846 0.15197 0.13722 0. Period 130.87866 0.77303 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.20416 0.18207 0.16253 0.14523 0.12989 0.116290 Period 140.86996 0.75788 0.66112 0.57748 0.50507 0.44230 0.38782) 0.34046 0.29925 0.26333 0.23199 0.20462 0.18068 0.15971 0.14133 0.12520 0.11102 0.09855 0. Period 150.86135 0.74301 0.64186 0.55526 0.481021 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.15989 0.14010 0.12289 0.10793 0.09489 0.083520 Period 160.85282 0.72845 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.14150 0.12289 0.10686 0.09304 0.08110 0.070780 Period 17 0.84438 0.71416 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.12522 0.10780 0.09293 0.08021 0.06932 0.05998 0. Period 180.83602 0.70016 0.58739 0.49363 0.415521 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.11081 0.09456 0.08081 0.06914 0.05925 0.05083 0. Period 190.82774 0.68643 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 0.07027 0.05961 0.05064 0.04308 0. Period 200.819540.67297 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843] 0.14864 0.12403 0.10367 0.08678 0.07276 0.06110 0.05139 0.04328 0.03651 0. Period 250.77977 0.609530.47761 0.37512 0.29530 0.233000.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 0.01974 0.01596 0. Period 300.74192 0.55207 0.41199 0.30832 0.23138 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.02557 0.01963 0.01510 0.01165 0.00900 0.00697 0. Period 350.70591 0.50003 0.35538 0.25342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 0.00751 0.00555 0.00411 0.003050 Period 400.671650.45289 0.30656 0.20829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00753 0.00529 0.00373 0.00264 0.00187 0.00133 0. Period 450.63905 0.41020 0.26444 0.17120 0.111301 0.07265 0.04761 0.03133 0.02069 0.01372 0.00913 0.00610 0.00409 0.00275 0.00186 0.00126 0.00085 0.00058 0. Period 500.608040.37153 0.22811 0.14071 0.08720 0.05429 0.03395 0.02132 0.01345 0.00852 0.00542 0.00346 0.00222 0.00143 0.00092 0.00060 0.00039 0.00025 0 Period 600.550450.30478 0.16973 0.09506 0.05354 0.03031 0.01726 0.00988 0.00568 0.00328 0.00191 0.00111 0.00065 0.00039 0.00023 0.00014 0.00008 0.00005 0. Future Value of $1 % 13% 1.13000 14% 1.14000 15% 1.15000 16% 1.16000 17 1.170 1.276901 1.299601 1.32250 1.34560 1.368 Future Value of $1 Periods 1% 29 3% 4% 5% 6% 79 8% 9% 10% 11% 12% Period 1.010001.02000 1.03000 1.04000 1.05000 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1 Period 1.020101.040401.06090 1.08160 1.10250 1.12360 1.14490 1.16640 1.18810 1.21000 1.23210 1.25440 2 Period 1.030301.061211.09273 1.12486 1.15763 1.19102 1.22504 1.25971 1.29503 1.33100 1.36763 1.40493|| 1 3 Period 1.040601.08243 1.12551 1.16986 1.21551 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 4 Period 1.051011.104081. 15927 1.21665 1.27628 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234| 1.442901 1.48154 1.520881 1.56090 1.601 1.63047 1.68896 1.749011 1.81064 1.873 1.84244 1.92541 2.011361 2.10034 2.192 5 2.081951 2. 19497 2.31306 2.43640 2.565 2.35261 2.50227 2.66002 2.82622 3.001 2.65844 2.85259 3.059021 3.278411 3.511 3.00404 3.25195 3.51788 3.80296 4.108 3.39457 3.70722 4.04556 4.411441 4.806 Period 1.061521.126161.19405 1.26532 1.34010 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 6 Period 1.072141.148691.22987 1.31593 1.40710 1.50363 1.60578 1.71382 1.82804 1.94872 2.07616 2.21068|| 7 Period 1.082861.171661.26677| 1.36857 1.47746 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596|| 8 Period 1.093691.19509130477 1.42331 1.55133 1.68948 1.83846 1.99900 2.17189 2.35795 2.55804 2.77308 9 Period 1.104621.21899 1.34392 1.48024 1.62889 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 1 10 Period 1.115671.24337 1.38423 1.53945 1.71034 1.89830 2.10485 233164 2.58043 2.85312 3.15176 3.47855 11 Period 1.126831.268241.42576 1.60103 1.79586 2.01220 2.25219 2.51817 2.81266 3.13843 3.49845 3.89598 12 Period 1.138091.293611.46853 1.66507 1.88565 2.13293 2.40985 2.71962 3.06580 3.45227) 3.88328 436349 13 Period 1.149471.31948 1.51259 1.73168 1.97993 2.26090 2.57853 293719 3.34173 3.79750 4.31044 4.88711 14 Period 1.160971.345871.55797 1.80094 2.07893 2.39656 2.75903 3.17217 3.64248 4.17725 4.78459 5.47357|| 15 Dorind la 479col. 972701 41 4077001 - 400071 - Canal cual Chenol 3.83586 4.22623 4.65239 5.11726 5.623 4.33452 4.81790 5.350251 5.93603 6.580 4.898011 5.49241 6.152791 6.88579 7.698 5.53475 6.26135 7.075711 7.98752 9.007 6.25427) 7.13794 8.13706 9.26552) 10.538 JANA 207241 1 CAN : 2n9nl :4 670 In TAON Natale Enterprises, a major real estate developer, recently accepted a $10,000,000, 5-year, 2% note receivable in exchange for products sold. Interest is paid annually. The current market rate of interest is 6%. The note is not publicly traded. Future Vaue of $1 tabl Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Prepare the journal entry to record the sale. Ignore cost of goods sold. (Record debits first, then credits. Exclude explanations from any journal entries. Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answers to the nearest whole dollar.) C. Account Current Year