Answered step by step

Verified Expert Solution

Question

1 Approved Answer

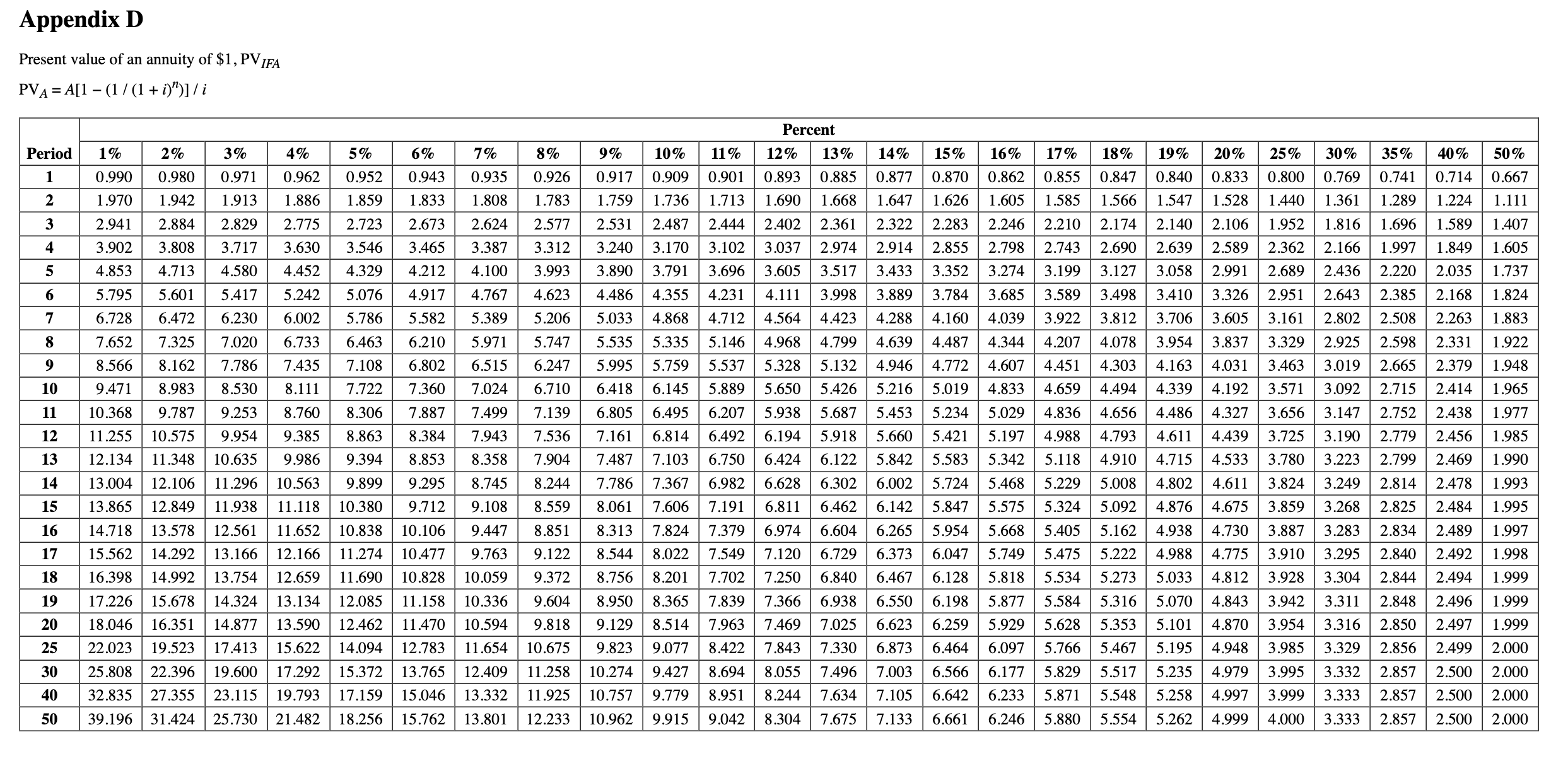

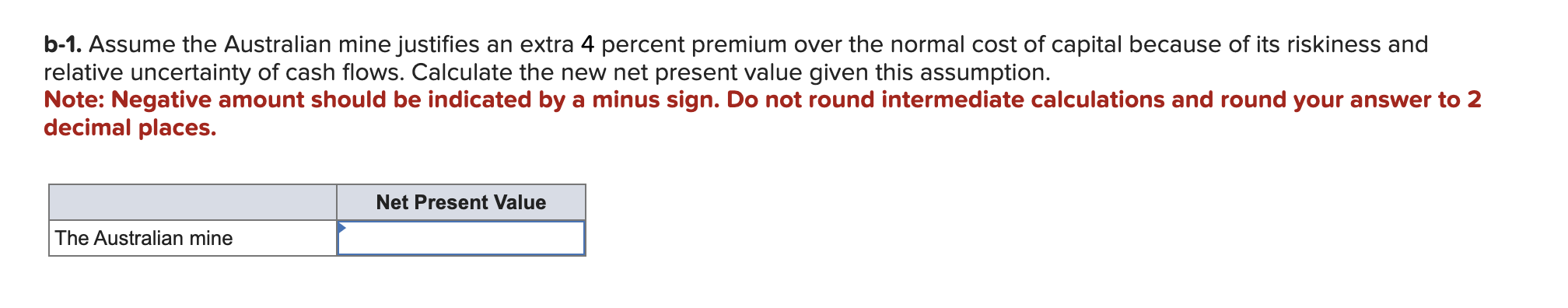

Present value of an annuity of $1,PVIFA PVA=A[1(1/(1+i)n)]/i b-1. Assume the Australian mine justifies an extra 4 percent premium over the normal cost of capital

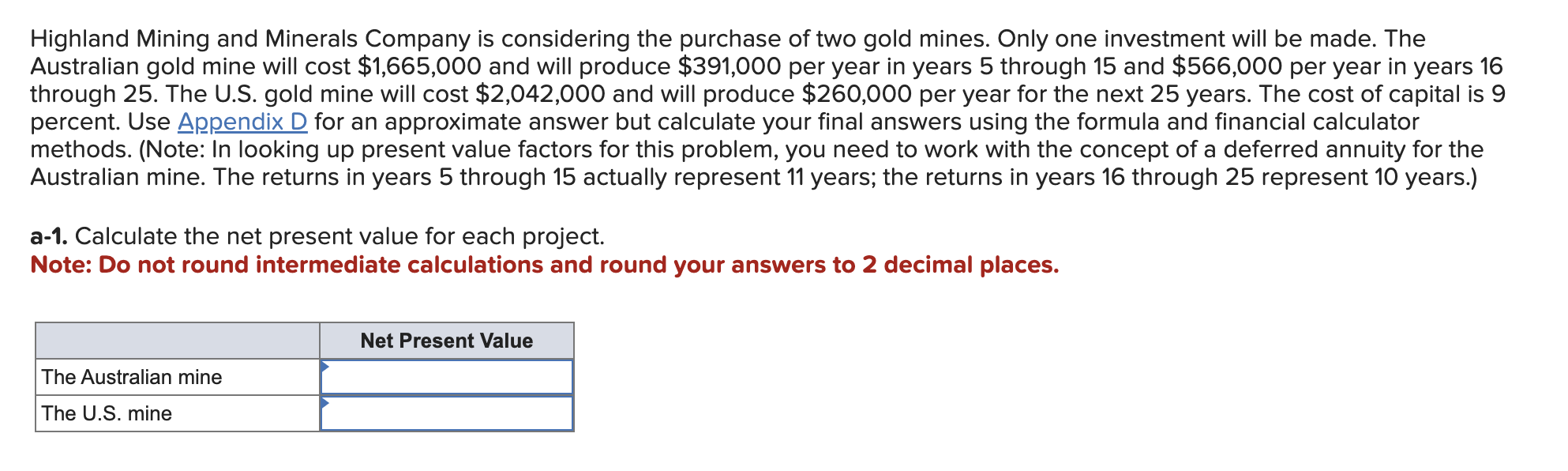

Present value of an annuity of $1,PVIFA PVA=A[1(1/(1+i)n)]/i b-1. Assume the Australian mine justifies an extra 4 percent premium over the normal cost of capital because of its riskiness and relative uncertainty of cash flows. Calculate the new net present value given this assumption. Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places. Highland Mining and Minerals Company is considering the purchase of two gold mines. Only one investment will be made. The Australian gold mine will cost $1,665,000 and will produce $391,000 per year in years 5 through 15 and $566,000 per year in years 16 through 25. The U.S. gold mine will cost $2,042,000 and will produce $260,000 per year for the next 25 years. The cost of capital is 9 percent. Use Appendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods. (Note: In looking up present value factors for this problem, you need to work with the concept of a deferred annuity for the Australian mine. The returns in years 5 through 15 actually represent 11 years; the returns in years 16 through 25 represent 10 years.) a-1. Calculate the net present value for each project. Note: Do not round intermediate calculations and round your answers to 2 decimal places

Present value of an annuity of $1,PVIFA PVA=A[1(1/(1+i)n)]/i b-1. Assume the Australian mine justifies an extra 4 percent premium over the normal cost of capital because of its riskiness and relative uncertainty of cash flows. Calculate the new net present value given this assumption. Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places. Highland Mining and Minerals Company is considering the purchase of two gold mines. Only one investment will be made. The Australian gold mine will cost $1,665,000 and will produce $391,000 per year in years 5 through 15 and $566,000 per year in years 16 through 25. The U.S. gold mine will cost $2,042,000 and will produce $260,000 per year for the next 25 years. The cost of capital is 9 percent. Use Appendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods. (Note: In looking up present value factors for this problem, you need to work with the concept of a deferred annuity for the Australian mine. The returns in years 5 through 15 actually represent 11 years; the returns in years 16 through 25 represent 10 years.) a-1. Calculate the net present value for each project. Note: Do not round intermediate calculations and round your answers to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started